Thread

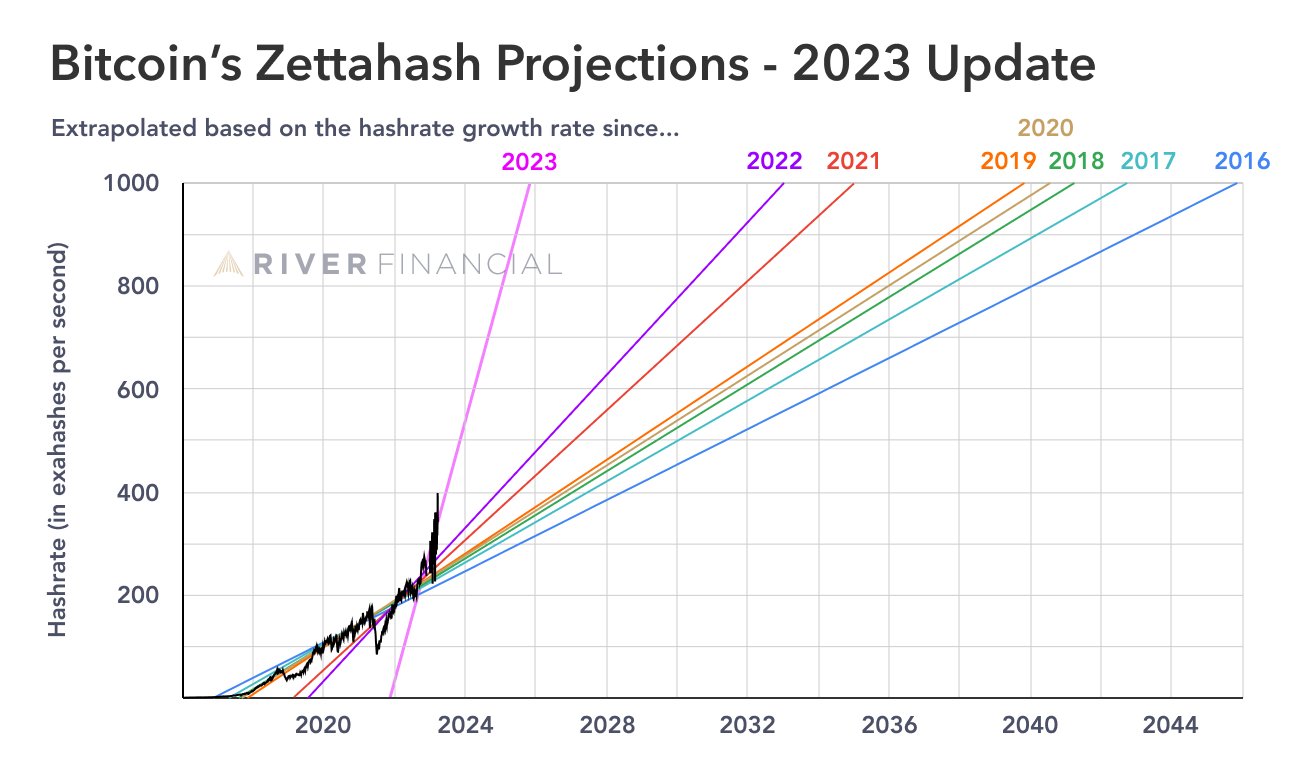

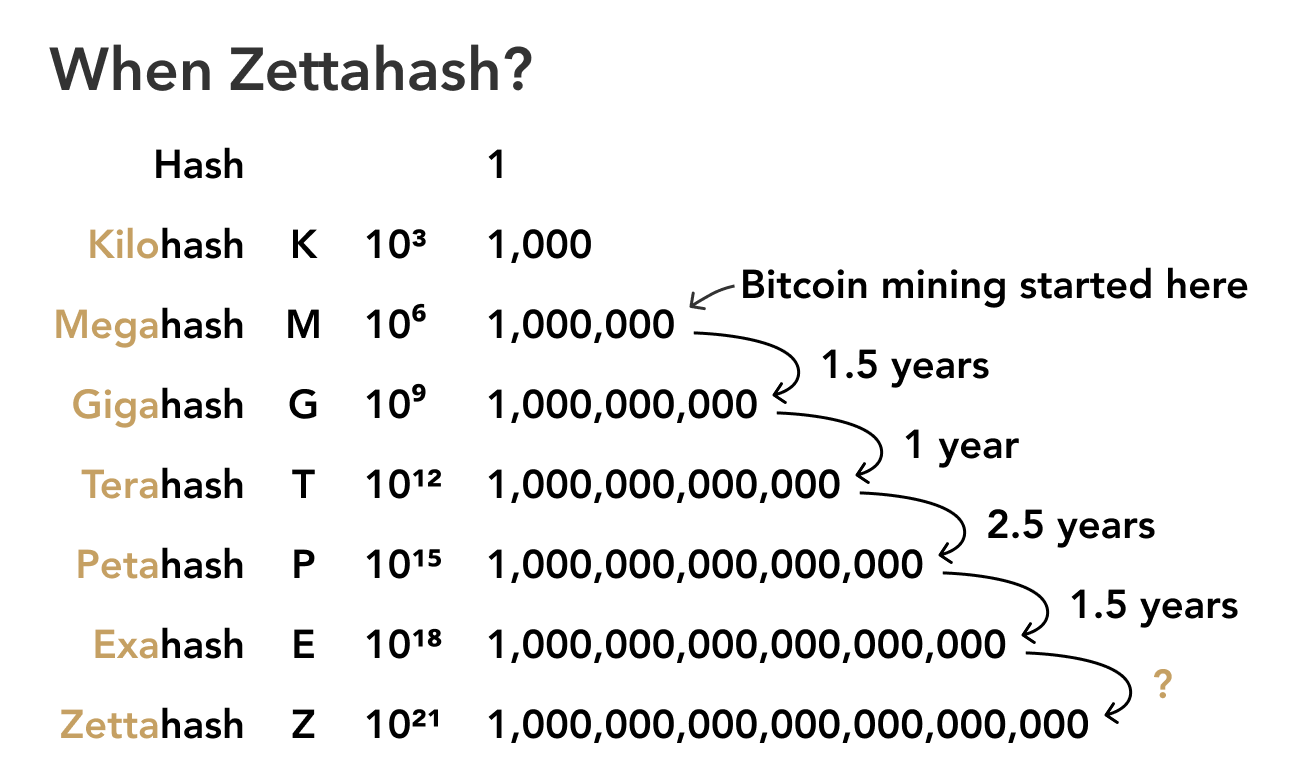

Bitcoin's hashrate touched 400 Exahash. At the current growth rate in 2023, we'd reach a Zettahash by the end of 2025.

I'm getting questions and concerns from people.

Where is the growth coming from? Is it nation-states? Secret mining operations? Did someone find some exploit?

I'm getting questions and concerns from people.

Where is the growth coming from? Is it nation-states? Secret mining operations? Did someone find some exploit?

Anyone can check to which pools the hashrate went. If you look at Waybackmachine for any pool data website, you get the following difference.

Before the "omg so centralized" alarmists show up, these pools consist of thousands of individual miners that can switch at any time.

Before the "omg so centralized" alarmists show up, these pools consist of thousands of individual miners that can switch at any time.

So we know that ~44 Exahash went to Foundry, ~29 to AntPool, ~8 to F2Pool, ~7 to Binance Pool, and -4 on Braiins Pool. Everything else are <1% changes.

We also know that Foundry has KYC, so the miners joining them are not "unknown" actors.

We also know that Foundry has KYC, so the miners joining them are not "unknown" actors.

I find it unlikely that the added hashrate would be mostly nation-states. Some people love to speculate about this, but the odds of such a thing happening and then remaining a secret are astronomically low. There are far too many people involved in running massive operations.

It is rumored that several large public miners have significant inventories of unused ASICs.

While Bitcoin's price was so low and as much inventory as possible was brought online last year, at some point maximum capacity of what the network could handle was reached.

While Bitcoin's price was so low and as much inventory as possible was brought online last year, at some point maximum capacity of what the network could handle was reached.

Now that the price has been rising again and some time has passed, more of this inventory has been able to go online.

The math looks something like this

The math looks something like this

In addition, the Hydro models have been around for a bit and are starting to get into the market, they have 250+ TH/s per machine, which adds tremendous hashrate, and they are estimated to have the highest average profitability at the moment. hashrateindex.com/rigs

The answer of where the hashrate comes from is likely nuanced. It could be a mix of:

- Unused inventory going online

- New models getting out there

- More facilities going live (can be a slow process)

- Crafty entrepreneurs finding cheap sources before regulators step in

- & More

- Unused inventory going online

- New models getting out there

- More facilities going live (can be a slow process)

- Crafty entrepreneurs finding cheap sources before regulators step in

- & More

I do not have a Soundcloud, I did write a report on what Bitcoin Mining could look like at one zettahash river.com/learn/files/river-bitcoin-mining-zettahash-report.pdf

And I went on a podcast about it

And I went on a podcast about it

Mentions

See All

Troy Cross @thetrocro

·

Mar 27, 2023

Great thread. Why is anyone surprised by this spike? Here is the big picture: 1. New machines are deployed at scale until it is not profitable to do so. (It's still profitable!) 2. Old machines will sit idle except where/when there's free power, a bull run, or spike in fees.…