Thread by Lewis Harland

- Tweet

- Apr 6, 2023

- #Blockchain #Cryptography

Thread

On Blockchain Valuations 🧵👇

The crypto industry is only just starting to articulate and understand the value captured by blockchains. The valuation lenses tend to also be fluid.

The crypto industry is only just starting to articulate and understand the value captured by blockchains. The valuation lenses tend to also be fluid.

Understanding crypto network valuations is to understand their crypto-native economics and their evolution. Just as valuation lenses evolve over time, so do the very systems that make up the ecosystem.

One under-researched area is gas markets where fees are paid by network users who want to transact. This also applies to scalability networks that provide alternative low-cost, high-speed rails for users.

Scalability blockchains have grown to become a $14B+ market.

Scalability blockchains have grown to become a $14B+ market.

So what has been driving this valuation?

One approach - value these scalability networks with respect to their gas contribution to their parent chain. Several scalability networks still ultimately rely on a parent chain like #Ethereum for the system to operate.

One approach - value these scalability networks with respect to their gas contribution to their parent chain. Several scalability networks still ultimately rely on a parent chain like #Ethereum for the system to operate.

More specifically, L2s and PoS Commit Chains could be valued as a function of their economic contribution (or block space demand) back to their parent chain.

Loose analogy = take @marqeta in Web 2 which needs the @CashApp to generate tokenized cards (pre-paid direct debits).

Loose analogy = take @marqeta in Web 2 which needs the @CashApp to generate tokenized cards (pre-paid direct debits).

Now replace Marqeta with a crypto network like @optimismFND that needs its Cash App - in this case #Ethereum.

h/t @finblueprint

Network valuation lens 1: Value a scaling network as a function of total gas contribution back to its parent chain.

h/t @finblueprint

Network valuation lens 1: Value a scaling network as a function of total gas contribution back to its parent chain.

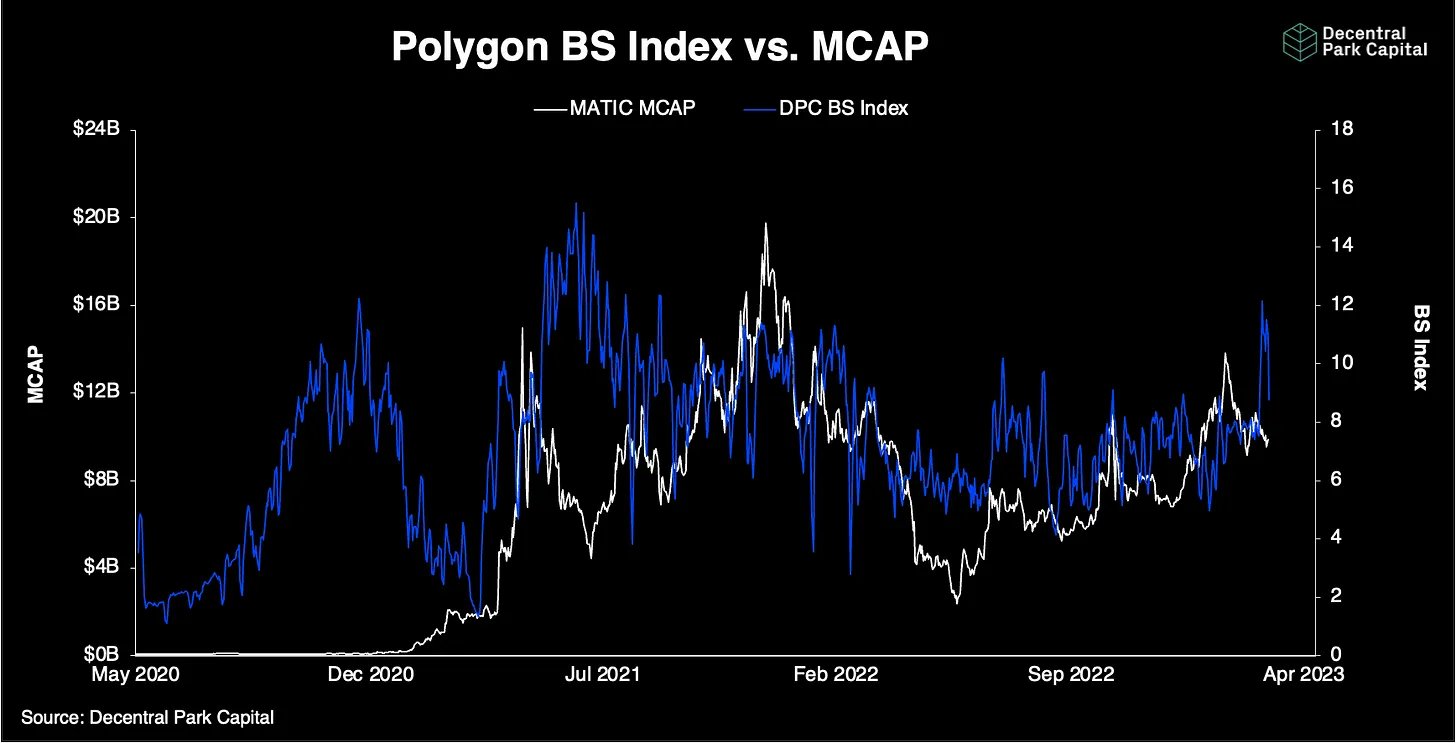

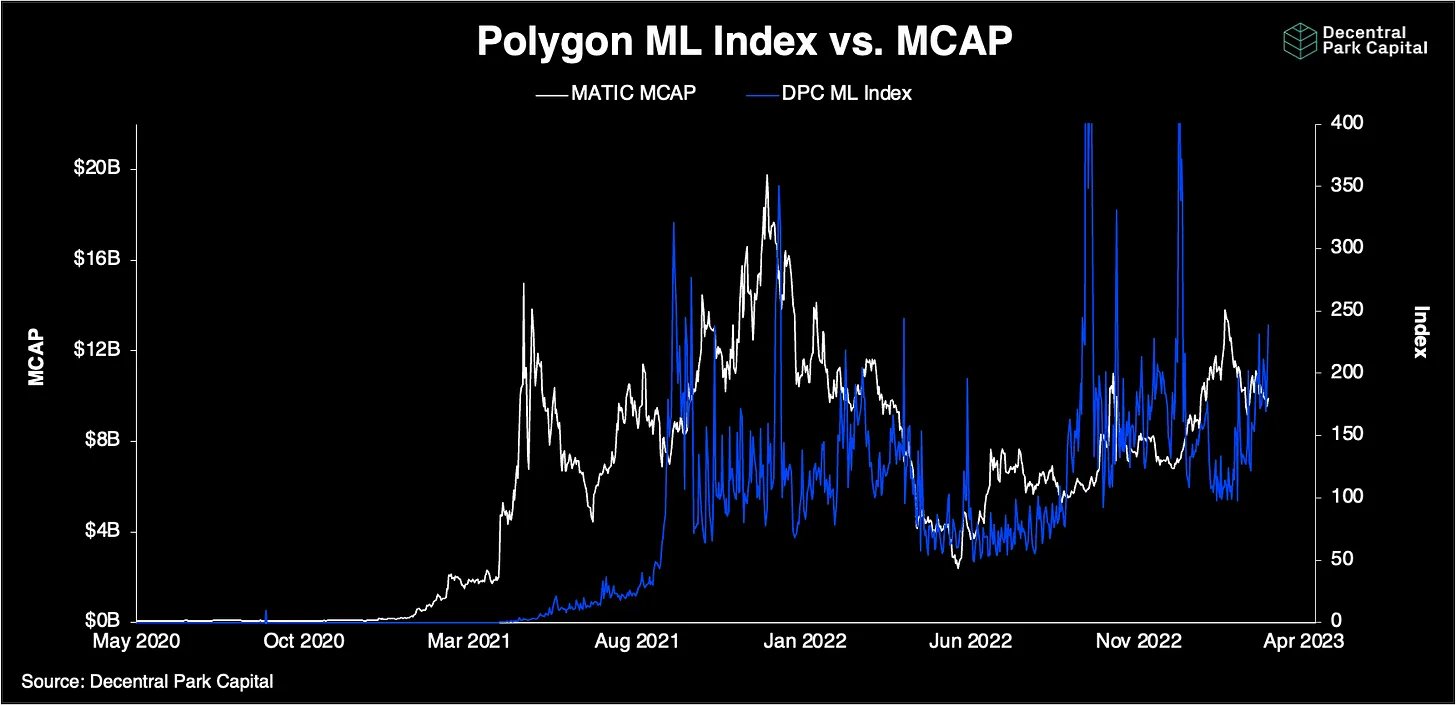

Take @0xPolygon - The value placed by the market appears to track the chain’s economic contribution (i.e. gas contribution dominance) quite well over time...

Starting in early 2021, the market was starting to value $MATIC in relation to @0xPolygon block space gas dominance for #Ethereum. But why then?

@CurveFinance, @AaveAave, @decentraland, and @SushiSwap launched in April and May 2021 and we began to see real utility within the @0xPolygon ecosystem...

This speaks to a network's active user base (which we'll come onto later).

This speaks to a network's active user base (which we'll come onto later).

Network valuation lens 2: a revisit of Metcalfe’s law

An alternative (but complimentary) valuation framework is Metcalfe’s law where the value of the PoS or L2 network is proportional to the square number of active nodes (users) within that respective network...

An alternative (but complimentary) valuation framework is Metcalfe’s law where the value of the PoS or L2 network is proportional to the square number of active nodes (users) within that respective network...

Metcalfe's Law valuation models have been applied to networks for several years now including higher up the stack to secondary protocols like Oracle networks.

static1.squarespace.com/static/5d580747908cdc0001e6792d/t/5f3bba7fe0cc631d15da5c04/1597749887865/rese...

static1.squarespace.com/static/5d580747908cdc0001e6792d/t/5f3bba7fe0cc631d15da5c04/1597749887865/rese...

Side note - secondary + application networks may warrant specific valuation models depending on their use case. An oracle network will likely have different value drivers those for a lending network...

decentralparkcapital.substack.com/p/oracle-network-valuations-the-vspt-fad

decentralparkcapital.substack.com/p/oracle-network-valuations-the-vspt-fad

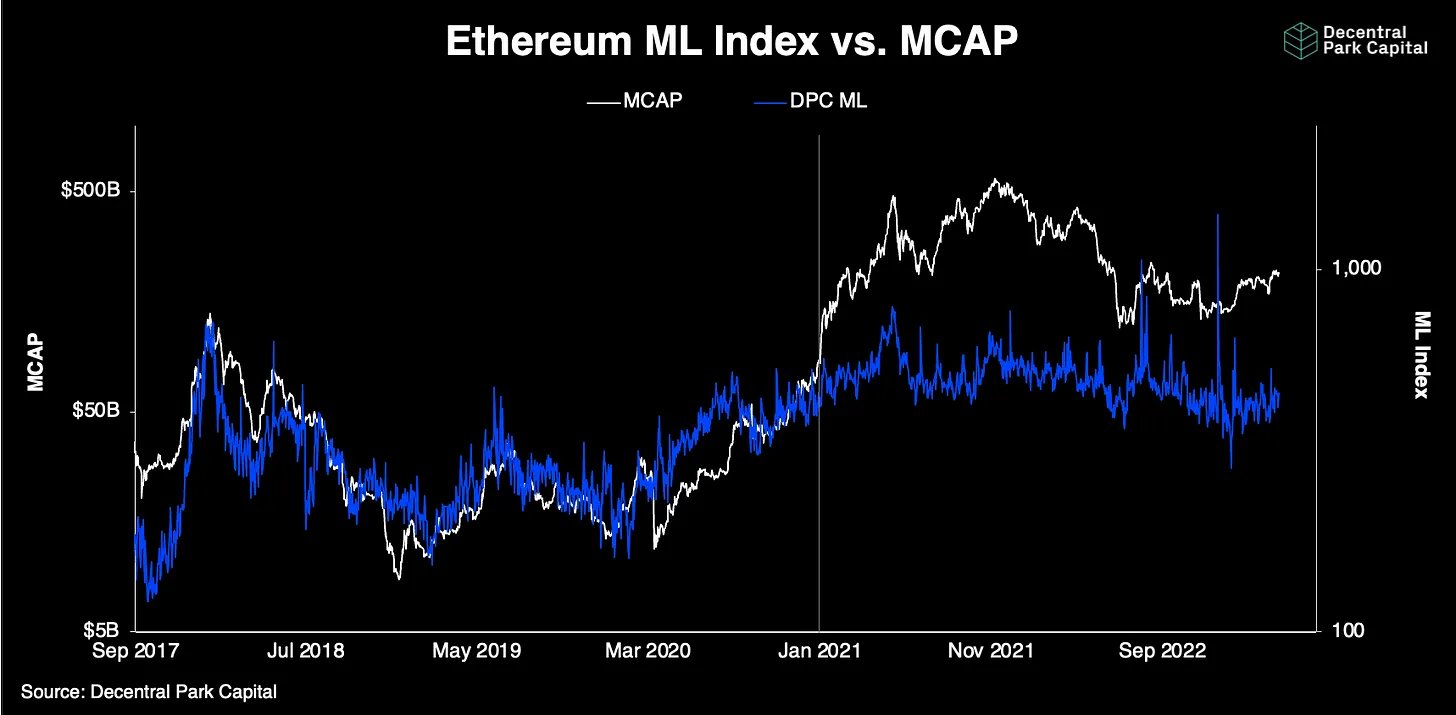

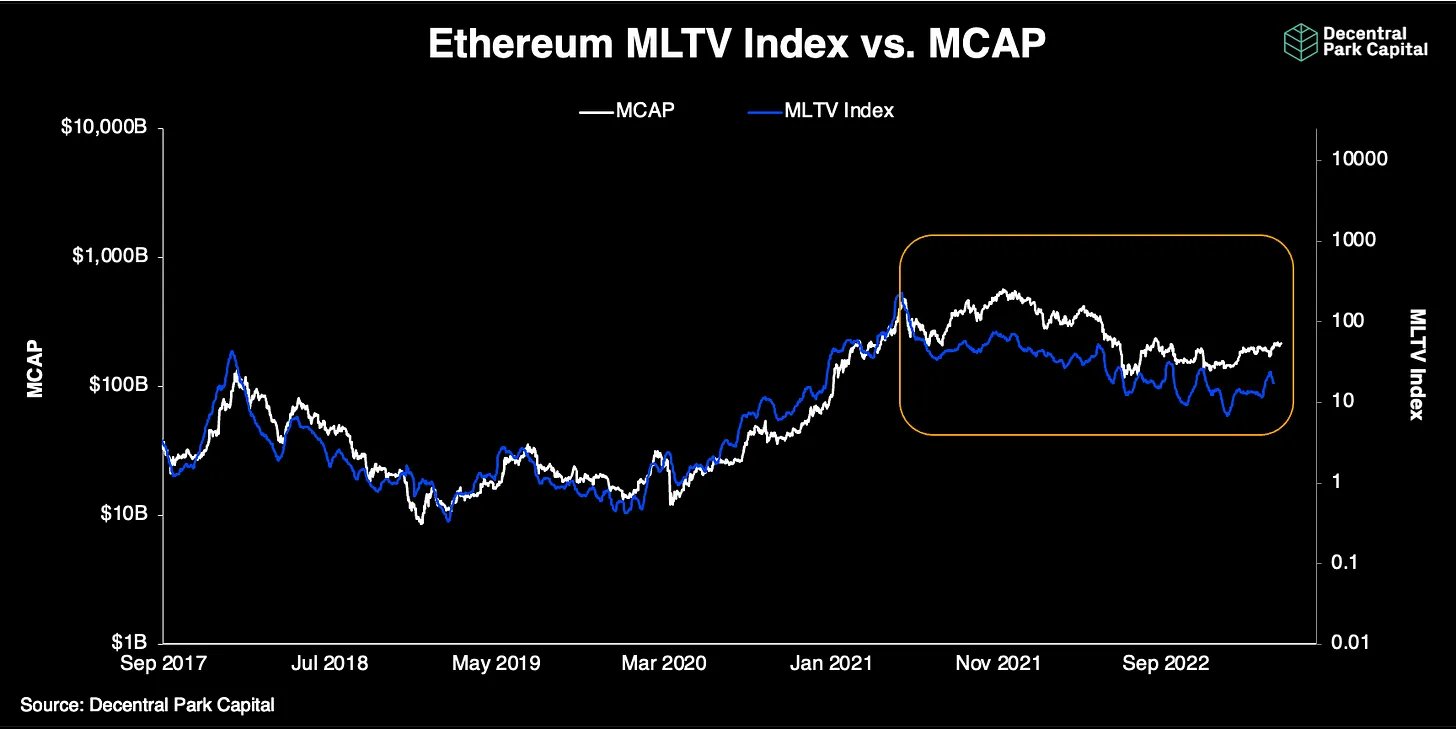

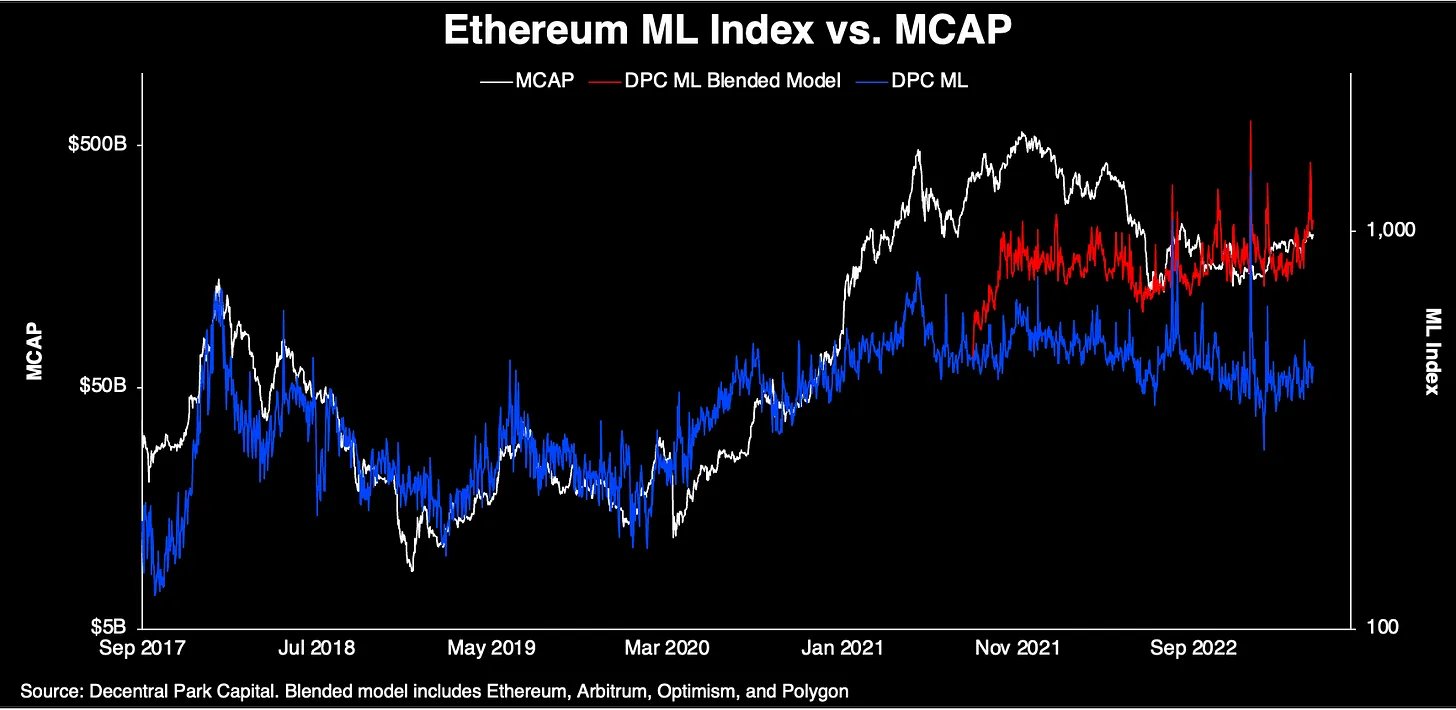

The market seemed to have priced L1s according to its active user base rather well. For $ETH it seems that something happened in early 2021 causing divergences...

Tweaks in Metcalfe's Law have been put forward such GMI's index where the *value of transactions* is an equal input into the model...

h/t @RaoulGMI

h/t @RaoulGMI

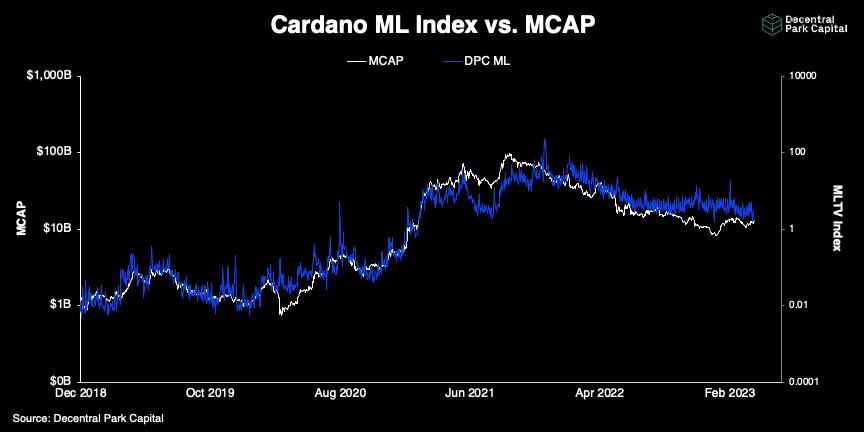

And if we compare to other networks like @Cardano, we don't get the same result (if anything it's reversed)...

So why the divergence still? I think we need to look at the key *structural* change for Ethereum that began to emerge in 2021 - scalability networks...

These networks ported over utility for lower-value users in early 2021 from Ethereum to sister networks.

These networks ported over utility for lower-value users in early 2021 from Ethereum to sister networks.

A revised Metcalfe's Law model that incorporates the active user base of these scalability networks like @0xPolygon and @optimismFND may therefore be necessary. Ethereum still captures their active user base value indirectly as their parent chain...

$ETH appears to track this 'blended' index more recently. $ETH is trading in line right where this revised index places 'fair value' - again purely through the lens of ML.

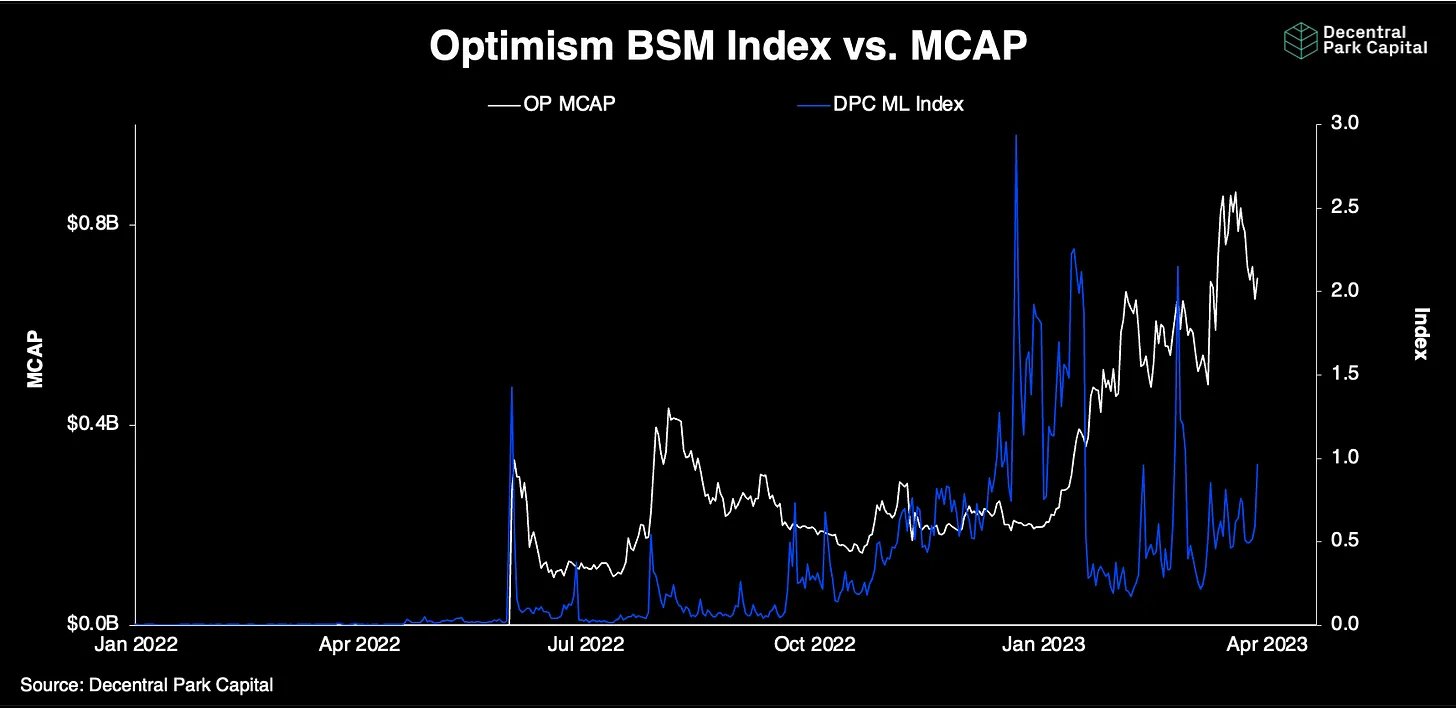

Analyzing the individual scaling network can also illustrate the close tie between a network’s network valuation and its active user set but it can be noisy...

Others appear to diverge completely from their index in 2023. Maybe more nascent networks need to time to mature to become a more reliable model.

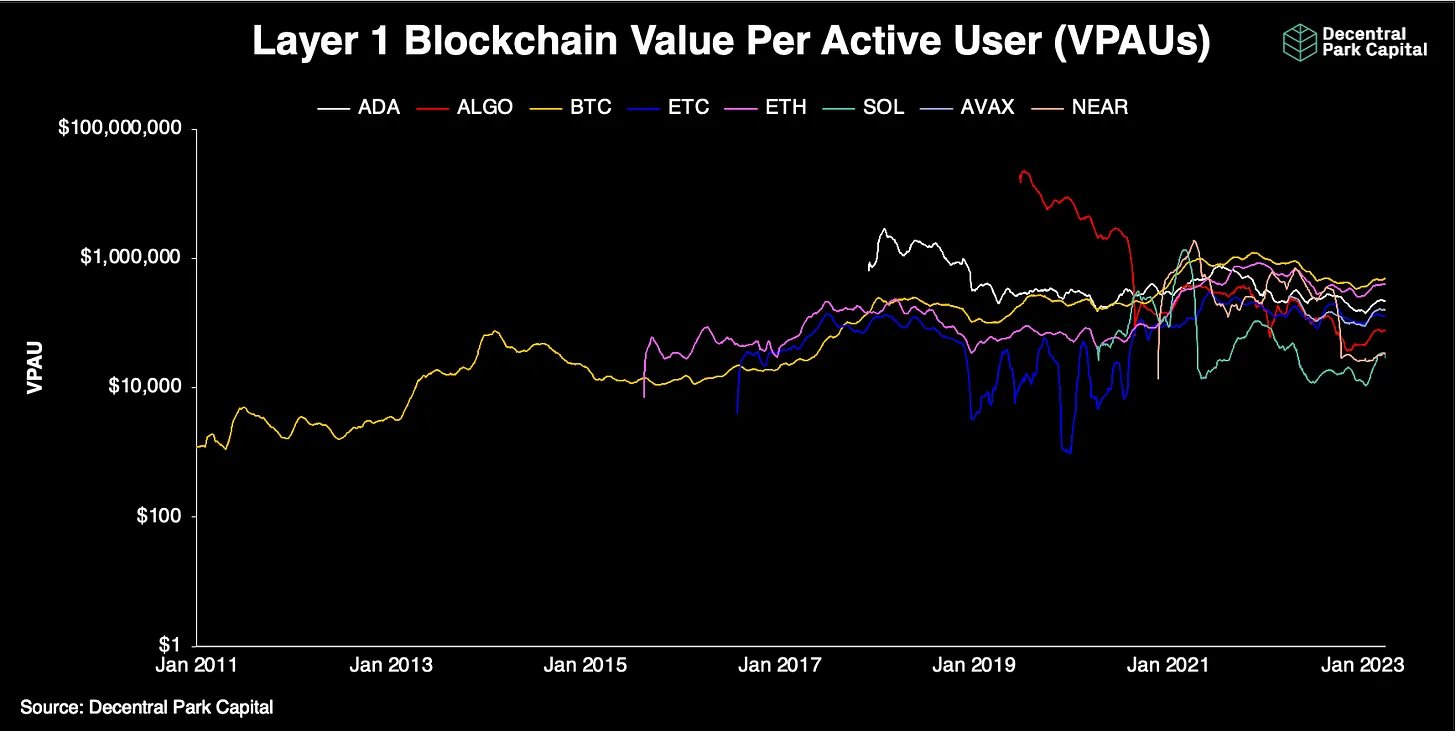

Valuation Lens 3: Value Per Active User (VPAs): analyzing the market value placed on each user for a crypto network.

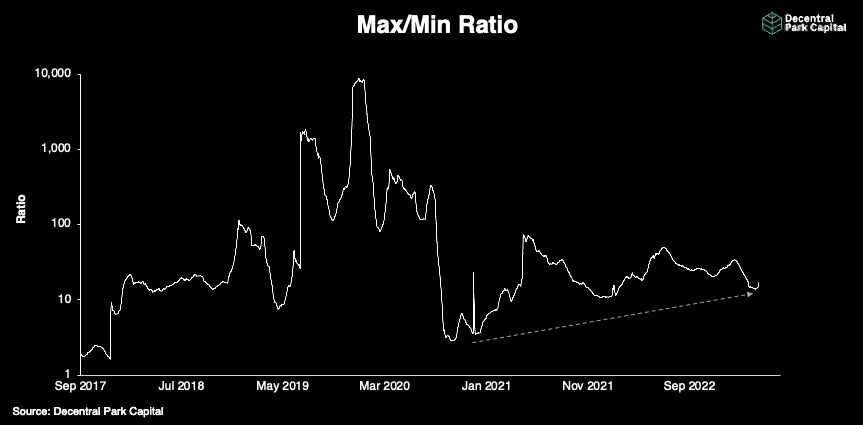

We can also see investors value each active user the same across L1s (e.g. Dec-Jan 2021) only to then become more partial as the bull market develops.

The % gap between the maximum and minimum value also appears to have increased since Jan 2021 with no ‘golden ratio’ being applied across the board. Investors have become more partial across the board.

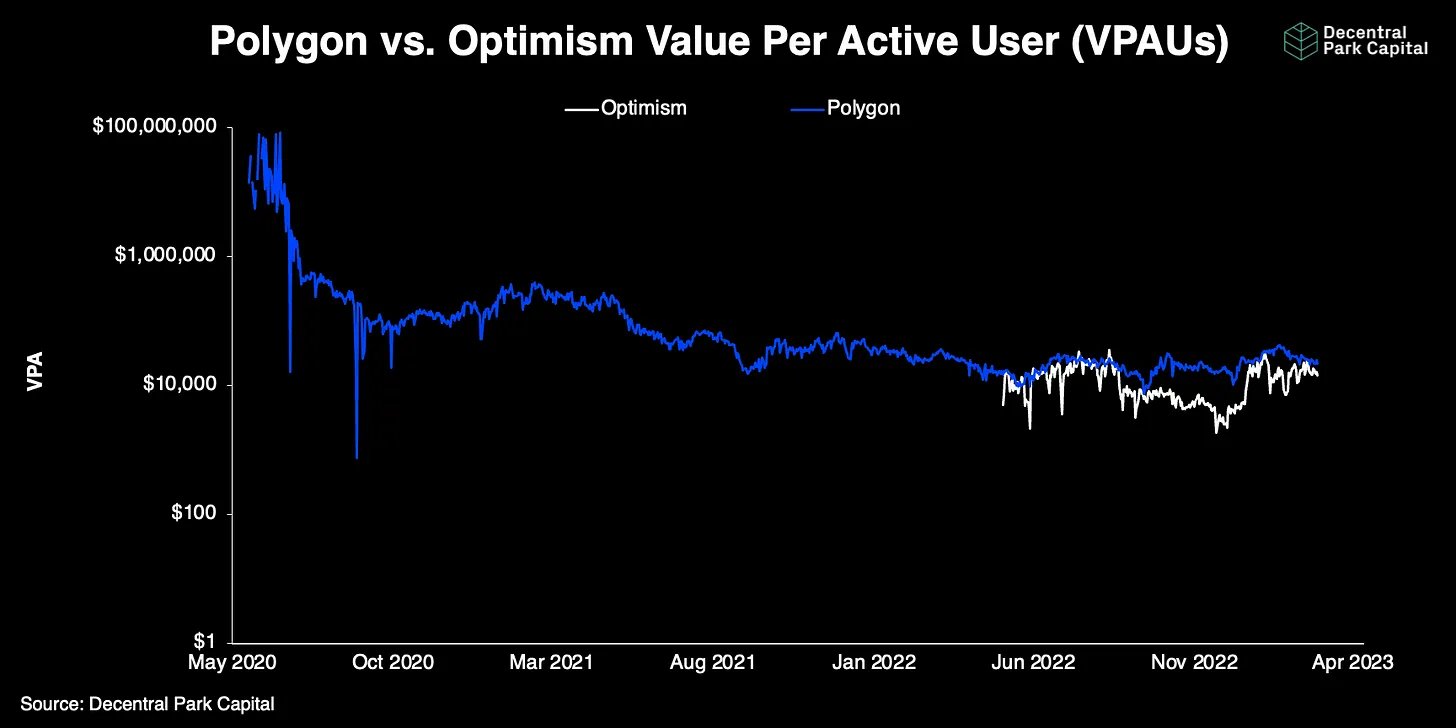

Scaling networks like Optimism and Polygon are priced generally the same now on a per active user basis ($20k/user) although we do see some variability.

Working hypothesis for declining in trends for an *individual* network: as networks mature and grow, a lower value is placed on each additional active network user in the total set.

The first 1m users are more valuable when the network only has 2m users than when the network has 200m users.

I think understanding network valuation doesn’t require one measure but several: both crypto-native measures (e.g. gas economics, on-chain transaction volumes) and well as more generalized measures (e.g. Metcalfe’s Law).

Over time, investors may also place a greater emphasis on certain measures over others as well as add new ones to the repertoire...

Time will tell.

Time will tell.

The ever-evolving nature of crypto networks and the industry may drive an evolving set of valuation lenses which makes it all the more demanding but exciting to analyze!

Read the full analysis here 👇

decentralparkcapital.substack.com/p/on-blockchain-valuations

Read the full analysis here 👇

decentralparkcapital.substack.com/p/on-blockchain-valuations

And further coverage from @SceniusCapital here👇

sceniuscapital.substack.com/p/scenius-insights-on-blockchain-valuations

@bennypjacobs @DinchThe

sceniuscapital.substack.com/p/scenius-insights-on-blockchain-valuations

@bennypjacobs @DinchThe

You can also find the link to Decentral Park Capital's research hub below 👇

decentralparkcapital.substack.com/

decentralparkcapital.substack.com/

Mentions

See All

Raoul Pal @RaoulPal

·

Apr 6, 2023

Great thread. Thanks! v interesting.