Thread

@besttrousers @jdcmedlock @balajis In the Fed transcripts from 2005 onward, I would say that Yellen was among the most level-headed members, mostly because she recognized that it wasn't a bubble and that higher prices did not necessitate a crisis. I don't think she was a voting member in 2007-2008.

1/

1/

@besttrousers @jdcmedlock @balajis Things might have gone better if she was. At the end of your link, she seems to, in hindsight, buy into the notion that the crisis was an inevitable result of her positions in 2004 and 2005 rather than a result of pro-cyclical monetary and regulatory decisions in 2008.

2/

2/

@besttrousers @jdcmedlock @balajis It's unfortunate if she has been won over to the dark side, because she was among the better members in 2004-5.

In your link, there is this, which is good.

3/

In your link, there is this, which is good.

3/

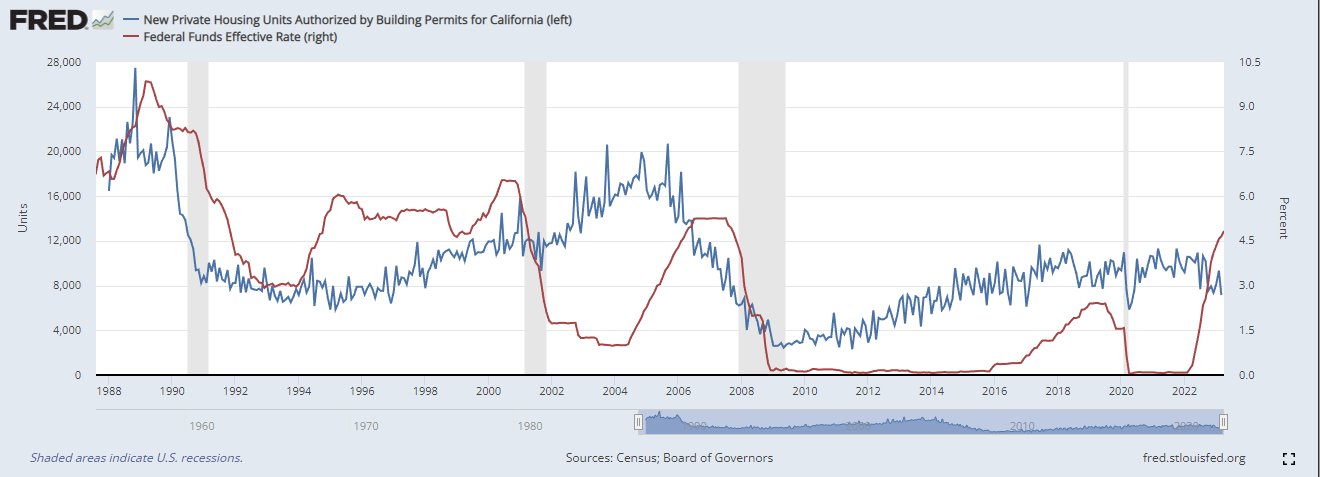

@besttrousers @jdcmedlock @balajis Unfortunately, when she wasn't a voting member, the committee voted for hikes and maintained austerity for YEARS after residential investment had started to decline in her district.

4/

fred.stlouisfed.org/graph/?g=134ps

4/

fred.stlouisfed.org/graph/?g=134ps

@besttrousers @jdcmedlock @balajis Even well into 2008, the Fed staff and members continued to see the falling rate of housing starts as a correction from oversupply.

Of course, the bubble-mongers don't have a problem with that. Crisis was inevitable. Policies that produced it don't deserve any blame.

5/

Of course, the bubble-mongers don't have a problem with that. Crisis was inevitable. Policies that produced it don't deserve any blame.

5/

@besttrousers @jdcmedlock @balajis Policies meant to avoid it are just delaying the inevitable and are unsustainable. They have their cake and they eat it. Which is why they will continue to be wrong about everything. That's great if they make million dollar bets with you, but not great if they're on the FOMC.

6/6

6/6