Thread

Determining a valuation for your crypto protocol/company is hard:

Here's how I started explaining the market environment to founders.

Bookmark this if your at Pre-Seed to Series A

🧵👇

Here's how I started explaining the market environment to founders.

Bookmark this if your at Pre-Seed to Series A

🧵👇

Brought to you by @NFTomics Venture Capital Investor/Occasional Threader.

Follow my substack: tokenthreads.substack.com

Follow my substack: tokenthreads.substack.com

{How do I value my project}

This is a question I often get asked by early-stage founders, and I understand.

> Low valuations impact cap tables for future fundraising rounds

> High valuations can put investors off or lead to 'down rounds' in the future

This is a question I often get asked by early-stage founders, and I understand.

> Low valuations impact cap tables for future fundraising rounds

> High valuations can put investors off or lead to 'down rounds' in the future

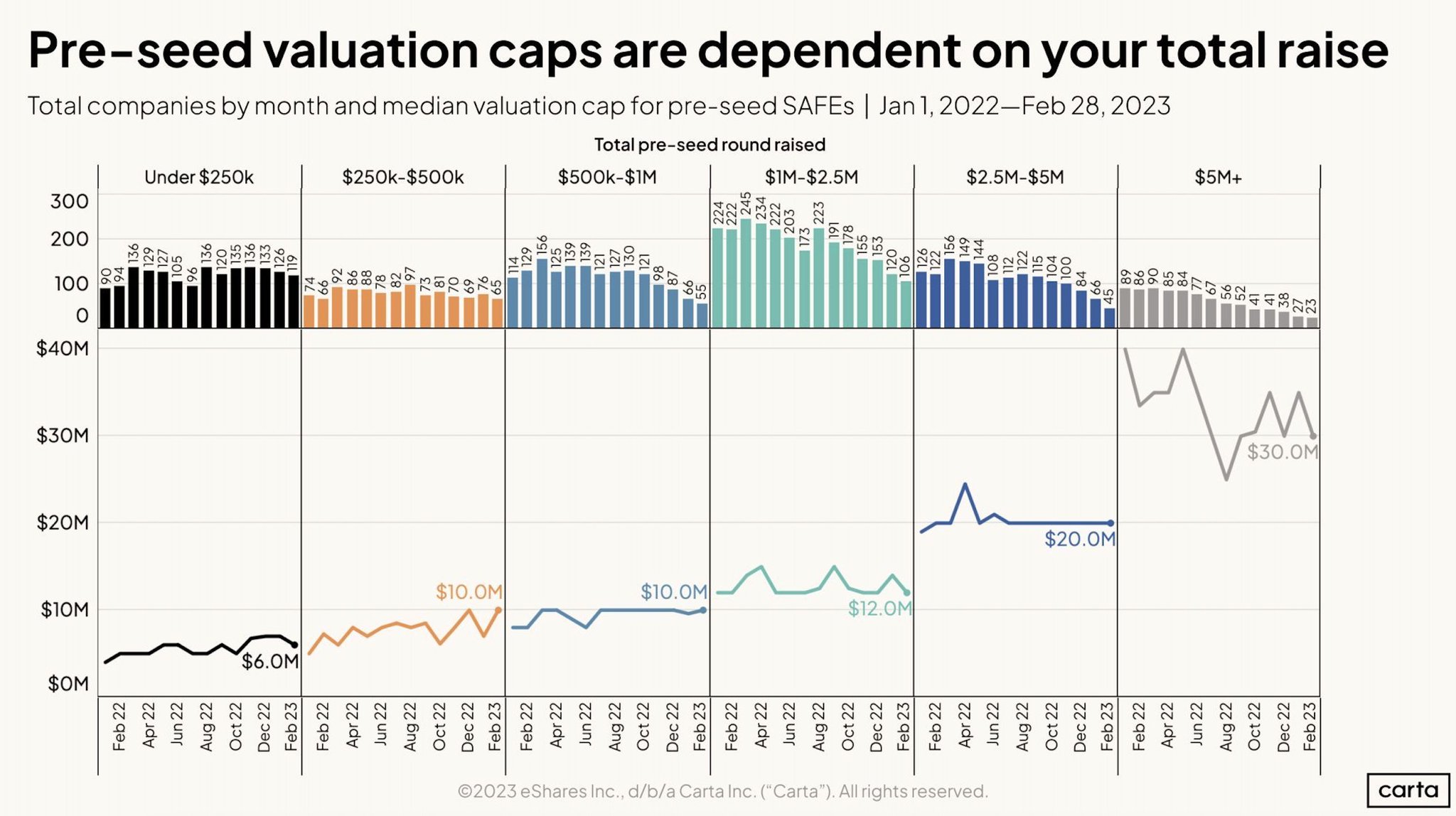

{Considerations Pre-Seed}

👉🏼 If you're super early to fundraising here is your guide

👉🏼 Remember it's typical to give away up to 20% of your project to VCs - quick math - you need $1m in funds - so you have to target a $5m valuation

👉🏼 If you're super early to fundraising here is your guide

👉🏼 Remember it's typical to give away up to 20% of your project to VCs - quick math - you need $1m in funds - so you have to target a $5m valuation

{Considerations Series A}

👉🏼 Cap table structure: Founding teams should have a minimum of 50% equity by their series A.

👉🏼 Modeling the dilution of future investment rounds vs how much $$ you'll need will help you view how much dilution you can afford to take on each round.

👉🏼 Cap table structure: Founding teams should have a minimum of 50% equity by their series A.

👉🏼 Modeling the dilution of future investment rounds vs how much $$ you'll need will help you view how much dilution you can afford to take on each round.

{Considerations Series A}

👉🏼 For your next round (Series A) with a robust capital allocation plan + data from burn over the last two years, you can take the target raise amount, apply an additional dilution range of 15% - 25%, and land on a valuation.

👉🏼 For your next round (Series A) with a robust capital allocation plan + data from burn over the last two years, you can take the target raise amount, apply an additional dilution range of 15% - 25%, and land on a valuation.

{Exit Considerations}

👉🏼 Calculating potential exit multiples in a specific sector or vertical can be done by researching enterprise value-to-revenue (EV/R) multiples.

👉🏼 EV/R is a measure of the value of a stock that compares a company's enterprise value to its revenue.

👉🏼 Calculating potential exit multiples in a specific sector or vertical can be done by researching enterprise value-to-revenue (EV/R) multiples.

👉🏼 EV/R is a measure of the value of a stock that compares a company's enterprise value to its revenue.

{Exit Considerations}

👉🏼Understanding these multiples allows a you to consider the exit potential of your start-up

👉🏼This help you think about how much equity you/ investors would need to achieve your target return.

(I'm comfortable w/ $3m & I own 10% so $30m exit @ 6x EV/R)

👉🏼Understanding these multiples allows a you to consider the exit potential of your start-up

👉🏼This help you think about how much equity you/ investors would need to achieve your target return.

(I'm comfortable w/ $3m & I own 10% so $30m exit @ 6x EV/R)

{Bonus Materials}

Footnote Sources: Peter Walker, LDN Anon

Bonus: Who to approach when trying to raise👇

Footnote Sources: Peter Walker, LDN Anon

Bonus: Who to approach when trying to raise👇

Mentions

See All

roxi @roxi_____

·

May 12, 2023

Great thread.