Thread

Someone asked me today what I look for in a 🌱seed project & how much is too little/too much to invest...it made me realize there just isnt enough info out there for the avg degen to consider if you want to angel/seed invest.

My take might not be popular: but its honest 🤷♀️

🧵👇

My take might not be popular: but its honest 🤷♀️

🧵👇

Rule #1: Try NOT do seeds/angel investments.

Why? Well, the honest trust is that $ETH will likely 3-5x ROI in the next 2yr by simply hodling

OR, u can give 💰 to a start-up that wont show ROI for >2 years + risks exploits, irrelevance, forking/copy-cats & lack of a value moat.

👇

Why? Well, the honest trust is that $ETH will likely 3-5x ROI in the next 2yr by simply hodling

OR, u can give 💰 to a start-up that wont show ROI for >2 years + risks exploits, irrelevance, forking/copy-cats & lack of a value moat.

👇

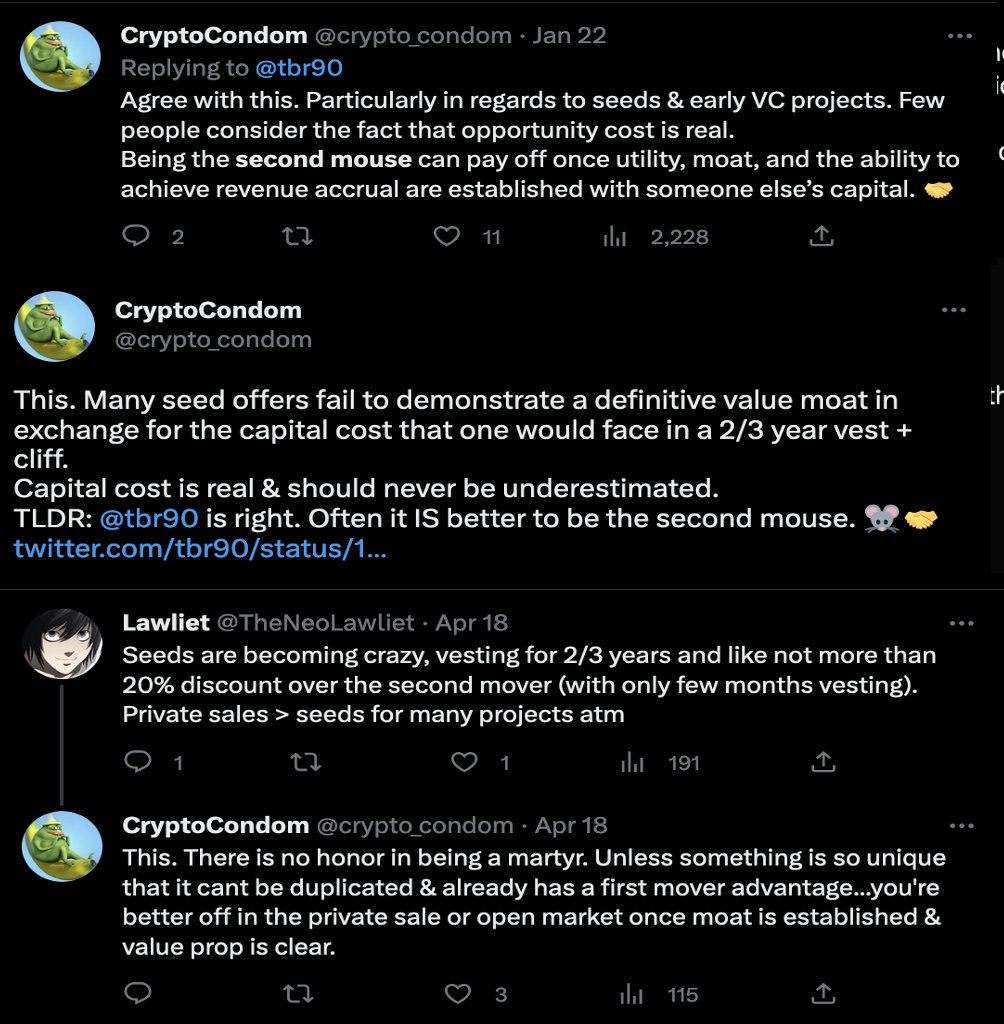

@tbr90 touched on this back in Jan when he noted it is often better to be the 2nd 🐭.

I have used the metaphor of the 2nd mouse in relation to seed investments several times since. The ref relates to a clip in Catch me if You Can w/Christopher Walken: www.youtube.com/watch?v=51lFmdChOA0

👇

I have used the metaphor of the 2nd mouse in relation to seed investments several times since. The ref relates to a clip in Catch me if You Can w/Christopher Walken: www.youtube.com/watch?v=51lFmdChOA0

👇

In general, 🌱seeds are NOT capital efficient.

Wen you invest, you are tying up capital for:

1) a cliff period where your funds are making NO yield

2) a vesting period where your funds trickle back to you at what (you hope) are outsized returns over years

👇

Wen you invest, you are tying up capital for:

1) a cliff period where your funds are making NO yield

2) a vesting period where your funds trickle back to you at what (you hope) are outsized returns over years

👇

Although I look at pitch decks on a daily basis, & I support teams whose projects are promising...it is EXTREMELY rare that I take a seed/angel position in a protocol.

Why is that Ser Condom?

Well, anon its because they're illiquid af.

👇

Why is that Ser Condom?

Well, anon its because they're illiquid af.

👇

In general, I allocate only 5% of my portfolio to early stage angel/seed investments & write off the capital on my PnL until unvesting.

Why? B/c there is an ugly trend among projects to require cliffs/vests that are ⌛️YEARS long. Sometimes longer than defi has even been around

👇

Why? B/c there is an ugly trend among projects to require cliffs/vests that are ⌛️YEARS long. Sometimes longer than defi has even been around

👇

Crypto moves at the speed of lightening: a lot of 💩 can happen in the 2-3 years it takes to reap your investment in a project.

Exploits, new tech making your investment obsolete, lack of a moat, poor execution, etc all add risk to your ROI. A 10x on a seed is NOT guaranteed.

👇

Exploits, new tech making your investment obsolete, lack of a moat, poor execution, etc all add risk to your ROI. A 10x on a seed is NOT guaranteed.

👇

IF you want to 🌱 an investment, know that smol size is OK. $10-20k is perfectly acceptable as a minimum investment for many SAFTs.

If you want a smaller investment, consider a group allo via someone like @blocmatesdotcom or exposure via a dao like @DigitsCapital.

👇

If you want a smaller investment, consider a group allo via someone like @blocmatesdotcom or exposure via a dao like @DigitsCapital.

👇

IF you decide to seed, make sure you clearly understand what you're investing in: tokens v equity.

Be sure to understand any warrant structure, cliff windows or vesting periods for your ROI.

Wen ever possible, have an attorney look over a SAFT bf you sign.

👇

Be sure to understand any warrant structure, cliff windows or vesting periods for your ROI.

Wen ever possible, have an attorney look over a SAFT bf you sign.

👇

Disclosure: This year, I have taken only 2 seeds: @tapioca_dao & @Dolomite_io. I am proud to have invested in both even tho I may have turned them down several times first🤣

I have no affiliation w/any entities mentioned & have never been paid to post. Opinions are my own. 🍌🤝

I have no affiliation w/any entities mentioned & have never been paid to post. Opinions are my own. 🍌🤝

Mentions

See All

The DeFi Edge @thedefiedge

·

May 14, 2023

Great post. It's something I wanted to do initially, but have cooled down on. Besides illiquidity, it's a HUGE timesink with the due diligence. Other options to get tokens without investing: 1) Advisory roles 2) Provide Dealflow if you have the distribution / network