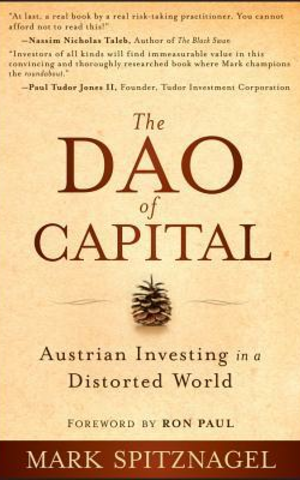

The DAO of Capital: Austrian Investing in a Distorted World

- Book

- Aug 16, 2013

- #Investment

<b>As today's preeminent doomsday investor Mark Spitznagel describes his <i>Daoist</i> and <i>roundabout</i> investment approach, "one gains by losing and loses by gaining." This is...

Show More

Number of Pages: 368

ISBN: 1118416678

ISBN-13: 9781118416679

Mentions

See All

Alexej Gerstmaier @AlexejGerstmaier

·

Apr 20, 2021

- Post

William Graham @williamgrahamiv

·

Jul 24, 2022

- Answered to What are the best books you’ve read on geopolitics, macroeconomics, and/or financial history?

- From Twitter