Thread

1/ @danielesesta announced today that $TIME is exiting the (3,3) space and pivoting toward the SPAC model

As a former investment banker, I've worked on SPAC transactions & pitches, and have friends who work in business dev. at such co's post de-SPAC

Herein lies my thoughts:

As a former investment banker, I've worked on SPAC transactions & pitches, and have friends who work in business dev. at such co's post de-SPAC

Herein lies my thoughts:

2/ The key questions that I think people want answered are (and what I will attempt to do) are:

- What is a SPAC?

- What are risks involved w/ this move?

- Will this move be healthy for the protocol?

- Are t-backed coins actually dying / was this necessary?

- What is a SPAC?

- What are risks involved w/ this move?

- Will this move be healthy for the protocol?

- Are t-backed coins actually dying / was this necessary?

3/ First, what is a SPAC?

A SPAC is not a difficult concept to understand, but it's a bit of a misnomer to spell it out ("Special Purpose Acquisition Company") as a method to explain itself.

It is more nuanced than just a way to deploy treasury w/ blank check dollars.

A SPAC is not a difficult concept to understand, but it's a bit of a misnomer to spell it out ("Special Purpose Acquisition Company") as a method to explain itself.

It is more nuanced than just a way to deploy treasury w/ blank check dollars.

4/ There are 2 sides to a SPAC transaction.

The vehicle (what $TIME proposes to be), which in capital markets, can technically be founded & run by anyone.

Typically though, it is led by 2 types:

- former C-suite executives w/ demonstrated track records in a specific industry

The vehicle (what $TIME proposes to be), which in capital markets, can technically be founded & run by anyone.

Typically though, it is led by 2 types:

- former C-suite executives w/ demonstrated track records in a specific industry

5/ - some carve-out of an existing buy-out group (type in "x" megafund + SPAC re: "Blackstone SPAC" or "Warburg Pincus SPAC" and you will se what I mean) led by financiers / private-equity moguls w/ 20+ years of experience - the focus here may be a bit more generalist

6/ Next, the founders of the SPAC put very little of their own capital in.

So far, so good - presumably the SPAC target for $TIMEE would be focused on Web3 / meta-verse, and @danielesesta and his team have build numerous successful products & protocols

So far, so good - presumably the SPAC target for $TIMEE would be focused on Web3 / meta-verse, and @danielesesta and his team have build numerous successful products & protocols

7/ In my estimation though, this is where the parallels stop.

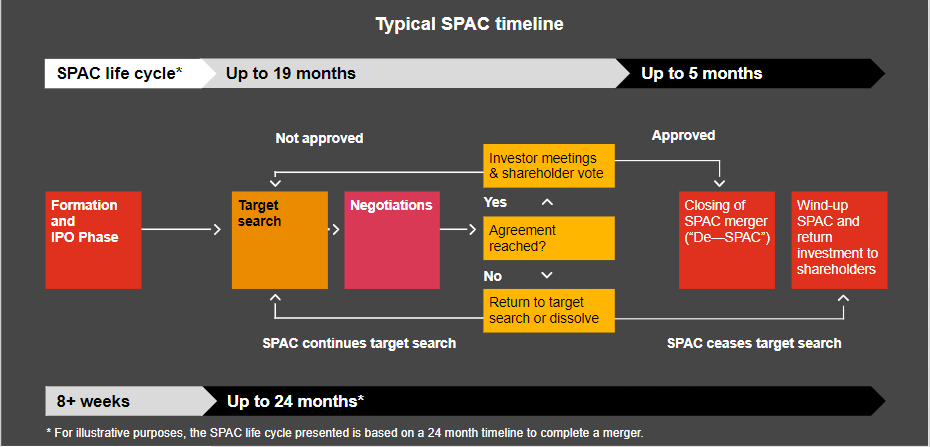

Below is a roadmap (Source: PWC) of what the SPAC life-cycle typically looks like.

A very important distinction - when SPACs IPO on the public market, proceeds are placed in a trust where...

Below is a roadmap (Source: PWC) of what the SPAC life-cycle typically looks like.

A very important distinction - when SPACs IPO on the public market, proceeds are placed in a trust where...

8/ ...The SPAC has 2 years, at maximum, to identify and complete a merger w/ TargetCo. If the SPAC does not complete a merger during this time, IPO proceeds are returned to shareholders.

This hasn't been touched on, and indeterminate to how this could be executed w/ $TIME

This hasn't been touched on, and indeterminate to how this could be executed w/ $TIME

9/ Next, we need to discuss the type of TargetCo that would be interested in being a part of a SPAC transaction.

There can be poor actor incentives (which I will discuss later), but traditionally, SPACs are a much easier way of going public and obtaining liquidity vs an IPO.

There can be poor actor incentives (which I will discuss later), but traditionally, SPACs are a much easier way of going public and obtaining liquidity vs an IPO.

10/ And what do I mean by obtain liquidity?

Most founders attract top talent by issuing equity. These basis points don't have a fair market value attached to them until some sort of credible valuation is established, and/or otherwise usually take a long time (3+ years)...

Most founders attract top talent by issuing equity. These basis points don't have a fair market value attached to them until some sort of credible valuation is established, and/or otherwise usually take a long time (3+ years)...

11/ ...to fully vest. There is one clause common in the start-up world however, where upon 1 of 2 scenarios:

- an M&A sale (ex. Fitbit employee redeeming shares upon sale to Google), or

- going public

- an M&A sale (ex. Fitbit employee redeeming shares upon sale to Google), or

- going public

12/ ...Such shares vest fully, and early employees get to cash in. This goes for the founder too.

13/ And so, the paperwork, fees and timeline involved in going public via SPACing is significantly less so than going through an IPO.

How translatable is this in the web3 context?

If $TIME were to invest in a private, early seed business w/ high reputational risk...

How translatable is this in the web3 context?

If $TIME were to invest in a private, early seed business w/ high reputational risk...

14/ ... That's not a SPAC.

If $TIME were to purchase shares in something that already has a coin, that's not a SPAC.

These become weirdly structured incubators / hedge fund vehicle w/ no oversight & that are being publicly traded.

If $TIME were to purchase shares in something that already has a coin, that's not a SPAC.

These become weirdly structured incubators / hedge fund vehicle w/ no oversight & that are being publicly traded.

15/ This distinction may seem pedantic, or even myopic, but I can assure you that's not the case.

The motive of TargetCo is typically not only the #1 diligence item, but it is also completely reflective of the valuation that trickles down (if at all) to shareholders

The motive of TargetCo is typically not only the #1 diligence item, but it is also completely reflective of the valuation that trickles down (if at all) to shareholders

16/ Traditionally, SPAC companies have not been very blue-chip - usually distressed companies or niche industries. It has only been recently, starting in 2020, that SPACs saw more public domain, driven by a convergence of factors:

- excess cash sitting in private vehicles, and..

- excess cash sitting in private vehicles, and..

17/ ...

- regulatory changes that promoted SPAC use, and

- a proliferation of speculative companies seeking capital w/ large capital requirements and low assurances of revenue today

- regulatory changes that promoted SPAC use, and

- a proliferation of speculative companies seeking capital w/ large capital requirements and low assurances of revenue today

18/ A good example of a TargetCo that may seek SPAC capital is an electric vehicle company: great narrative, lots of capital needed to do R&D & for actual parts, and probably a very long time away from being profitable

SPAC investors willingly sign up for this speculation...

SPAC investors willingly sign up for this speculation...

19/ ...and as such, it is very common for successful SPACs who have de-SPACed (AKA unwound the shell structure post-reverse merger in becoming just 1 public entity) to trade off future revenue multiples four, even five years out, such as EV/2026 Revenue or EV/2027 Revenue

20/ Once there is some verbal handshake to move forward on a potential transaction (a nod of interest), both the SPAC shell & TargetCo will typically hire investment banks (my job) to provide guidance and work toward building a financial model that can provide...

21/ ...Some sophistication/credence in charting out what revenue could potentially be. A bit of an art more than a science, but some numbers to trade off of, and something that retail investors can reference.

So we know what a SPAC is now. What are the risks involved?

So we know what a SPAC is now. What are the risks involved?

22/ Let's go through them.

1. Illiquidity risk. A study published in the Yale Journal of Regulation found that the average rate of redemption per deal was 58%. Additionally, in more than 1/3 of SPACs, over 90% of investors pulled out.

1. Illiquidity risk. A study published in the Yale Journal of Regulation found that the average rate of redemption per deal was 58%. Additionally, in more than 1/3 of SPACs, over 90% of investors pulled out.

2. Structural risk. The sponsor targets a fundraising goal and w/ that structure in place, offers investors x # of shares at a par value of $10/shr as well as warrants that allow them to buy shares in the future at some price (typically $11.50/shr). This represents...

23/ ...a very clear path to profitability moving forward. Specifically, warrants are critical in aligning risk between the Sponsor and investors. Often, SPAC investors may not be looking for high-returns but like the SPAC structure on a levered basis to get higher-than-Rf returns

24/ This structure allows for return profiles to match risk tolerance, and is completely devoid in the fundraising vehicle that $TIME is branding itself as.

3. Funding risk. Often, SPACs will raise PIPEs (private investment in public vehicles) to validate their investment thesis

3. Funding risk. Often, SPACs will raise PIPEs (private investment in public vehicles) to validate their investment thesis

25/ ... to both bridge committed financing and have a large institutional name effectively providing a vote of confidence. PIPEs typically are locked up for 6 months+ and cannot think of one SPAC that has been successful w/o this.

26/ 4. Accountability risk. What are the backgrounds and the profiles of the $TIME team that are supposed to drive forward what is typically an intensely complex transaction? Seasoned operating executives and board members w/ demonstrated experience in governance are essential...

27/ ...and backgrounds and names are fully exposed in the public domain.

And to me, most importantly:

5. Alignment risk. I am saying this w/ my experience in having overseen these transactions - parties involved in a SPAC are usually misaligned...

And to me, most importantly:

5. Alignment risk. I am saying this w/ my experience in having overseen these transactions - parties involved in a SPAC are usually misaligned...

28/ ...SPAC tools are seen by many as an easy "get-rich" scheme for Sponsors and Underwriters.

Underwriters get chunky fees (usually the bank with the most "constructive" view are selected) and the Sponsor can typically exit in a very short-time frame post de-SPAC w/ $$ in-hand

Underwriters get chunky fees (usually the bank with the most "constructive" view are selected) and the Sponsor can typically exit in a very short-time frame post de-SPAC w/ $$ in-hand

29/ "Goldman Sachs noted in September 2021 that of the 172 SPACs that had closed a deal since the start of 2020, the median SPAC had outperformed the Russell 3000 index from its IPO to deal announcement; but in the 6 months after deal closure, the median SPAC had..."

30/ ..."underperformed the Russell 3000 index by 42 percentage points.

According to a strategist from Renaissance Capital, "as many as 70% of SPACs that had their IPO in 2021 were trading below their $10 offer price as of Sept. 15, 2021."

Frothy valuations have re-traded...

According to a strategist from Renaissance Capital, "as many as 70% of SPACs that had their IPO in 2021 were trading below their $10 offer price as of Sept. 15, 2021."

Frothy valuations have re-traded...

31/ ...at even frothier valuations driven by immense popularity (not too different from a shitcoin getting pumped), with large volatility and over-optimistic projections being covered up.

Here is an article by FTI Consulting that details this: www.fticonsulting.com/insights/fti-journal/why-have-spac-valuations-skyrocketed

Here is an article by FTI Consulting that details this: www.fticonsulting.com/insights/fti-journal/why-have-spac-valuations-skyrocketed

32/

6. Sizing risk. I use this source (spactrack.net/activespacs/) to look at the most active SPACs by market cap. The largest is $1.3bn.

The treasury as it stands using the $TIME website is near ~$1bn. The median SPAC, I would estimate, is closer to $250-400mm. What returns...

6. Sizing risk. I use this source (spactrack.net/activespacs/) to look at the most active SPACs by market cap. The largest is $1.3bn.

The treasury as it stands using the $TIME website is near ~$1bn. The median SPAC, I would estimate, is closer to $250-400mm. What returns...

33/ ...are going to be able to executed on w/ such a large amount of dry powder? A good rate of return on the private spectrum in modern capital markets is 20%. The S&P runs probably ~10%.

Stablecoin yield is 15-20%.

When treasury management goes from a slow fee generating...

Stablecoin yield is 15-20%.

When treasury management goes from a slow fee generating...

34/ ...model to what is being proposed - a "SPAC" - this completely changes the return thresholds and limitations that investors believed they were receiving

35/ "Will this move be healthy for the protocol?"

In summation, I find it very difficult to see how this is successful. Not only is this not what $TIME shareholders signed up for when they purchased supply (a perpetually rebasing coin w/ large yields above a t-backed price)..

In summation, I find it very difficult to see how this is successful. Not only is this not what $TIME shareholders signed up for when they purchased supply (a perpetually rebasing coin w/ large yields above a t-backed price)..

36/ ...Within Web3, SPACs are not a compatible idea in either need or origin. The "DAO" part of Wonderland is supposed to reflect democratized voting toward treasury deployment, and yet it hardly seems feasible to have investors now put on their researcher hats after-the-fact

37/ Next, a call to completely discontinue yields is admitting to a lack of foresight.

If previous yields (~80k%+) were based on rosy projections and a forever-continuing bull market, that this represents a failure to reasonably chart out market conditions.

If previous yields (~80k%+) were based on rosy projections and a forever-continuing bull market, that this represents a failure to reasonably chart out market conditions.

38/ Is @danielesesta a brilliant developer w/ a large vision for blockchain-driven technologies and protocols? Yes, he is a visionary.

But we cannot acquit every move as being correct, just as we cannot believe everything a F500 CEO says.

But we cannot acquit every move as being correct, just as we cannot believe everything a F500 CEO says.

39/ This move also strikes me as being a knee-touch reaction to falling market conditions and t-backed coins falling consequentially as leverage continues to unwind and new capital throttles out - which leads into the next query: "are t-backed coins dying?"

My sentiment is no.

My sentiment is no.

40/ Of course, nominal prices are falling - and they do in a vacuum as an inflationary token - but real prices (price divided by a moving index) are falling much slower than it appears. This becomes even more true w/ high-yield protocols (as I write this, $TIME's INDEX is 10.77)

41/ Furthermore, the goal of t-backed coins has always been a vision by @ohmzeus to supply protocol-owned liquidity to avoid mercenary capital and create a foundation for upcoming instruments to not overpay in capital-seeking.

If $TIME seeks to move away from this model, then..

If $TIME seeks to move away from this model, then..

42/ ... Their mission statement and advertising as a "decentralized reserve currency protocol" has never been true.

$TIME's white paper says on pg.1:"...we believe this system can be used to optimize for stability and consistency so that TIME can function as a global...

$TIME's white paper says on pg.1:"...we believe this system can be used to optimize for stability and consistency so that TIME can function as a global...

43/ (cont.) "...unit of account and medium-of-exchange currency.....we intend to achieve price flatness for a representative basket of goods w/o the use of fiat currency."

44/ My proposal would be to cease this transition (in fact, @Magnet_DAO already exists in this capacity via an incubator model w/ almost no premium associated to treasury, as is correct given that no funds have been meaningfully deployed yet) or to at least desist calling this...

45/ ...a SPAC. This is not a SPAC.

The foremost conditions for something to be a SPAC is 1) devising a multi-layered share structure for valuation alignment, and 2) the act of merging and becoming an entirely different company that investors knowingly participate in, from Day 1

The foremost conditions for something to be a SPAC is 1) devising a multi-layered share structure for valuation alignment, and 2) the act of merging and becoming an entirely different company that investors knowingly participate in, from Day 1

46/ If the @Wonderland_fi team is concerned about falling treasury multiples and lackluster share performance, I suggest looking for a) purchasing instruments for treasury w/ low correlation to conventional BTC/ETH, and/or b) look for alternative...

47/ ...strategies to buy back shares, whilst lowering, or zeroing, staking yields temporarily while market conditions continue to be volatile - this could come in the format of seeking a loan from institutional capital w/ payment-in-kind perhaps