Thread

Today we published our Big Ideas 2022 report, available here:

www.ark-bigideas.com/2022/en/pages/download

Some highlights 🧵

www.ark-bigideas.com/2022/en/pages/download

Some highlights 🧵

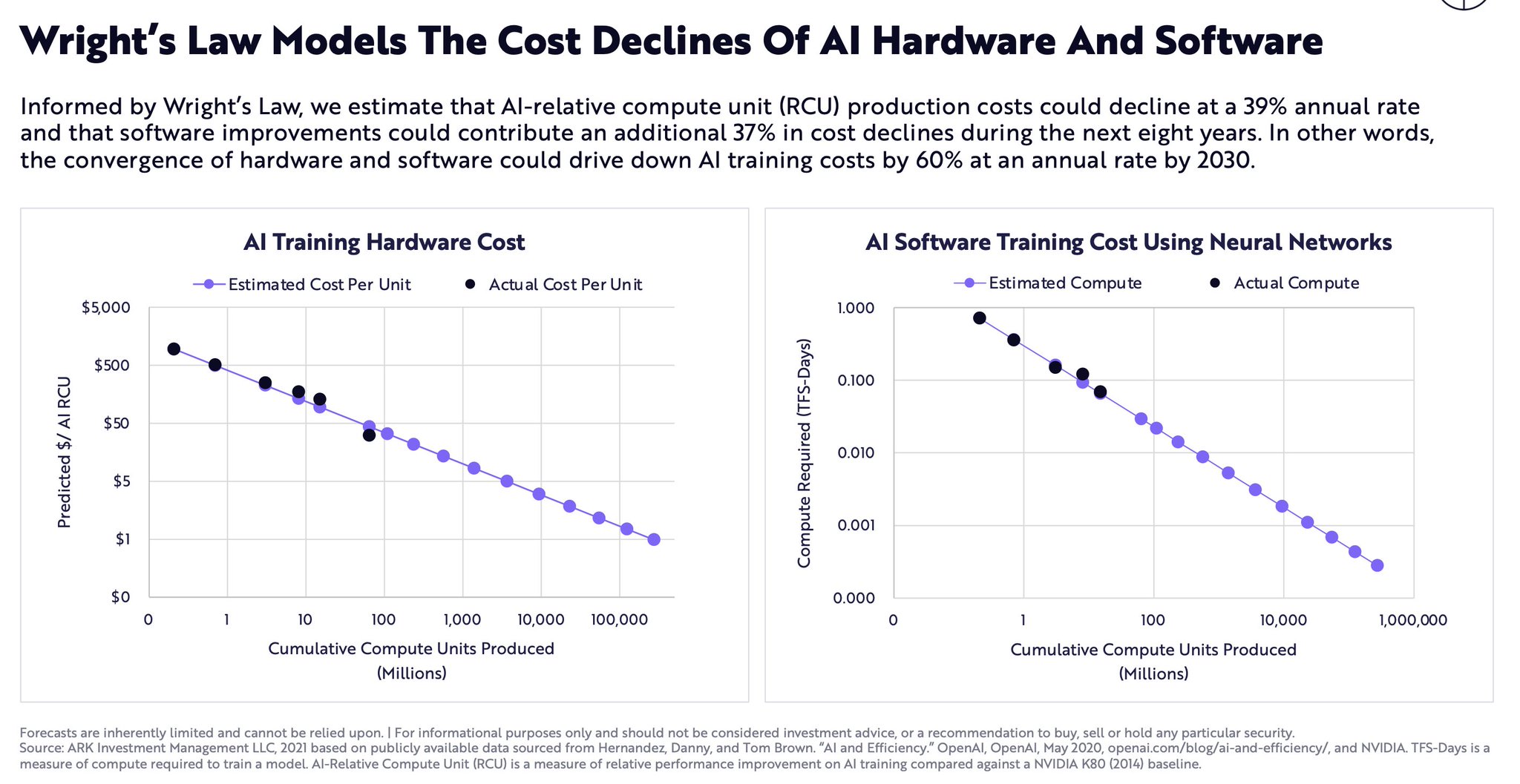

We forecast that the cost to train a neural network will halve every 9 months through 2030.

Roughly half of the anticipated cost declines will be due to compute hardware innovation and half due to software and model architecture improvements.

Roughly half of the anticipated cost declines will be due to compute hardware innovation and half due to software and model architecture improvements.

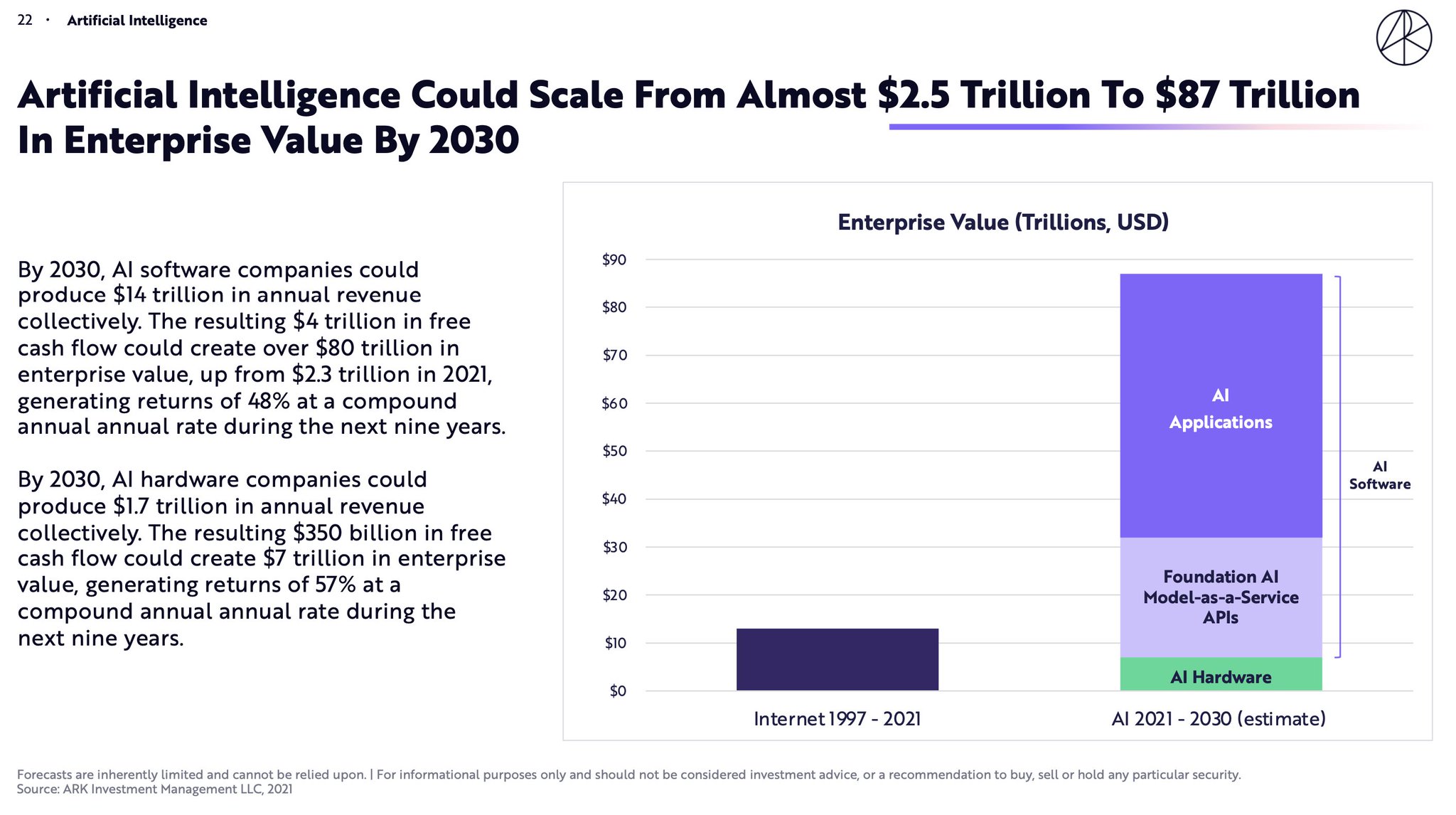

Based on these cost declines, an increasingly capable foundation-model-based AI as a service portion of the value chain could grow to be worth 10s of $trillions, and the software built atop could be worth multiples of that.

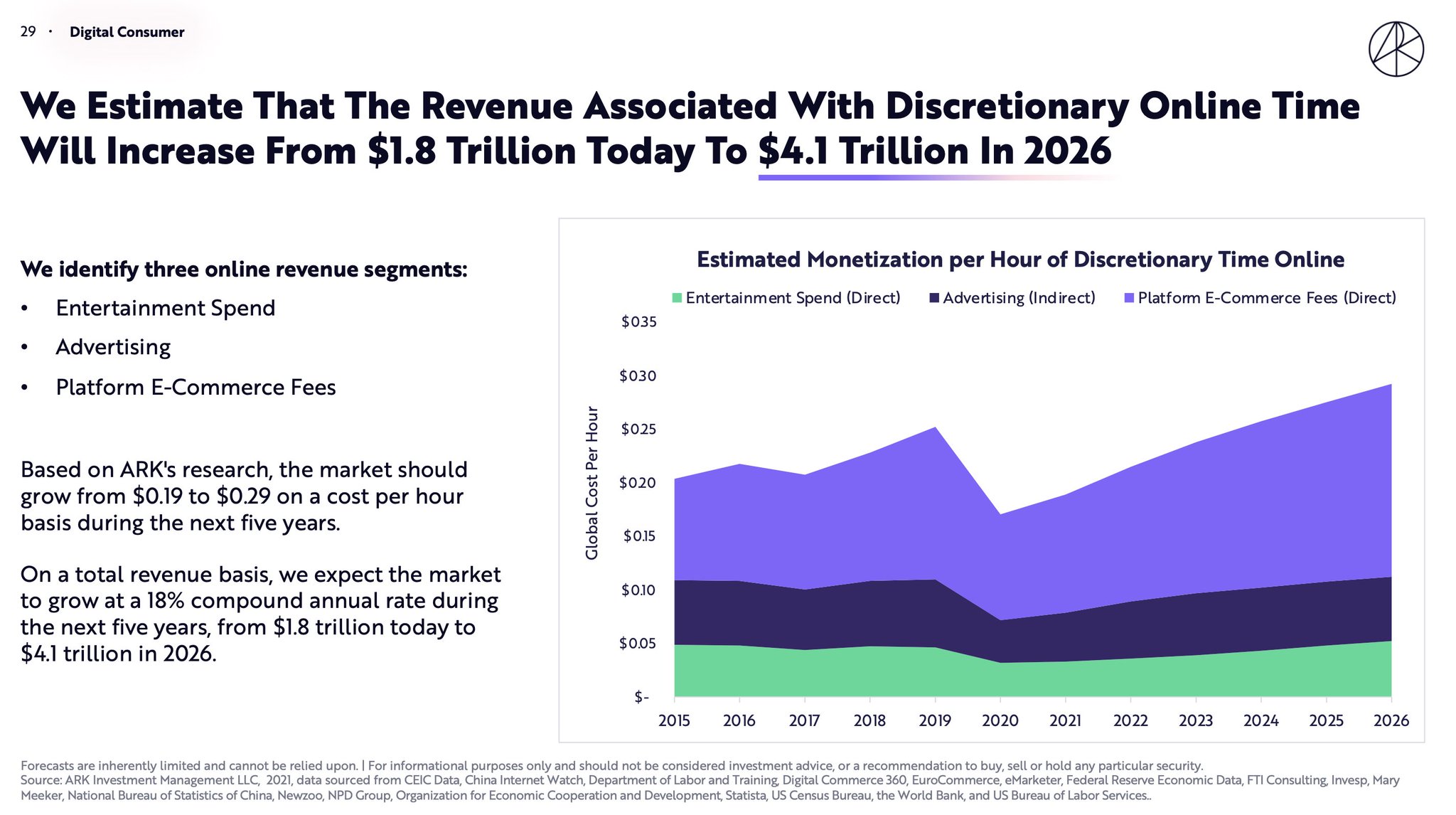

Online monetization rates, measured on a dollars-per hour basis, remain depressed.

People flooded online (and they ain’t coming back offline)

But advertising dollars, and even direct spend, have yet to catch up.

Monetization

People flooded online (and they ain’t coming back offline)

But advertising dollars, and even direct spend, have yet to catch up.

Monetization

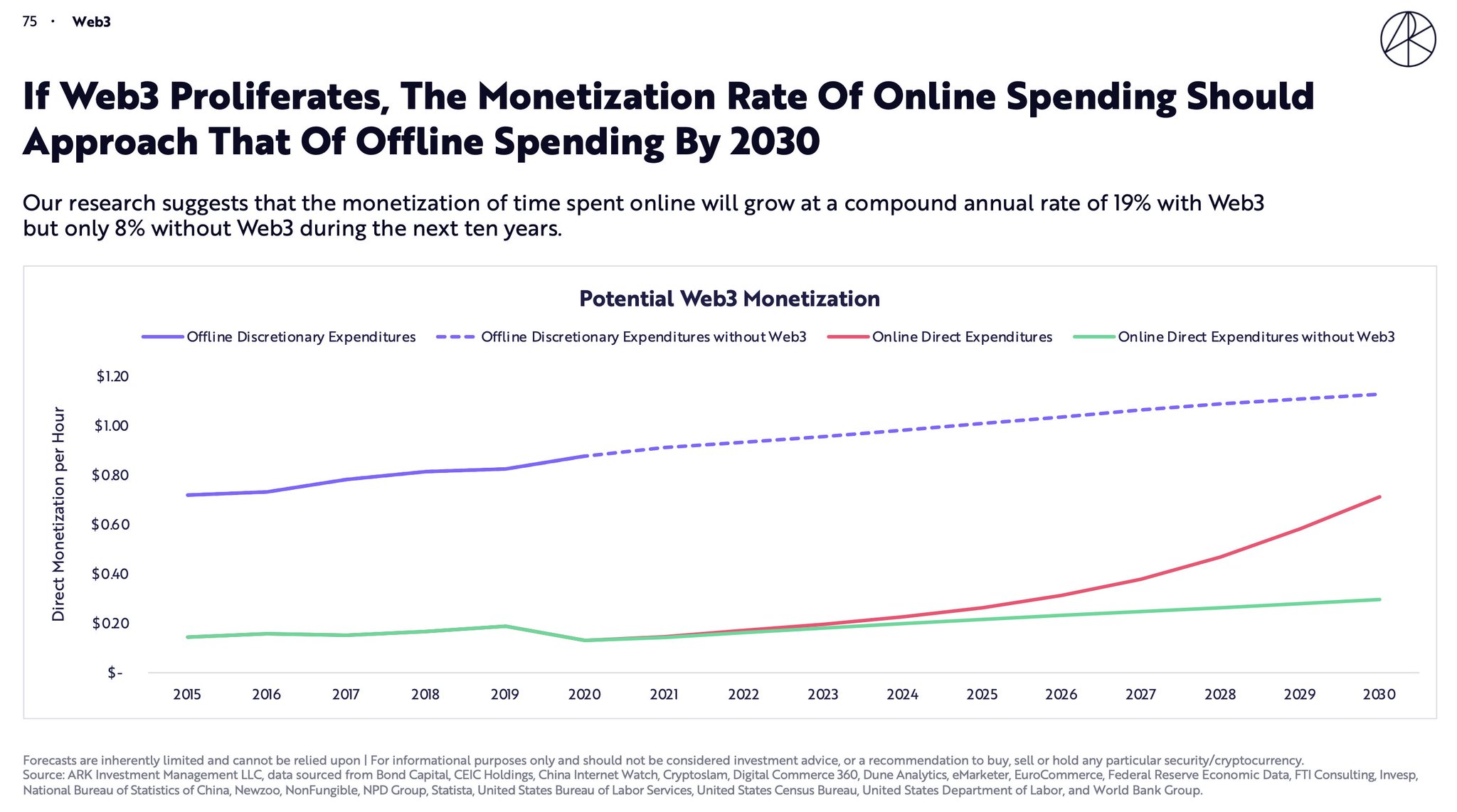

True digital ownership could change the trajectory.

As compared to digital spend,

Per discretionary hour offline we spend a lot more on physical discretionary stuff (that we actually own)

Web3 should shift digital monetization in that direction.

As compared to digital spend,

Per discretionary hour offline we spend a lot more on physical discretionary stuff (that we actually own)

Web3 should shift digital monetization in that direction.

This could confound macro-statistics.

We don’t assume that people have more discretionary money to spend; instead they shift it from owned physical goods to owned digital goods.

Traditional consumption statistics may have already plateaued

We don’t assume that people have more discretionary money to spend; instead they shift it from owned physical goods to owned digital goods.

Traditional consumption statistics may have already plateaued

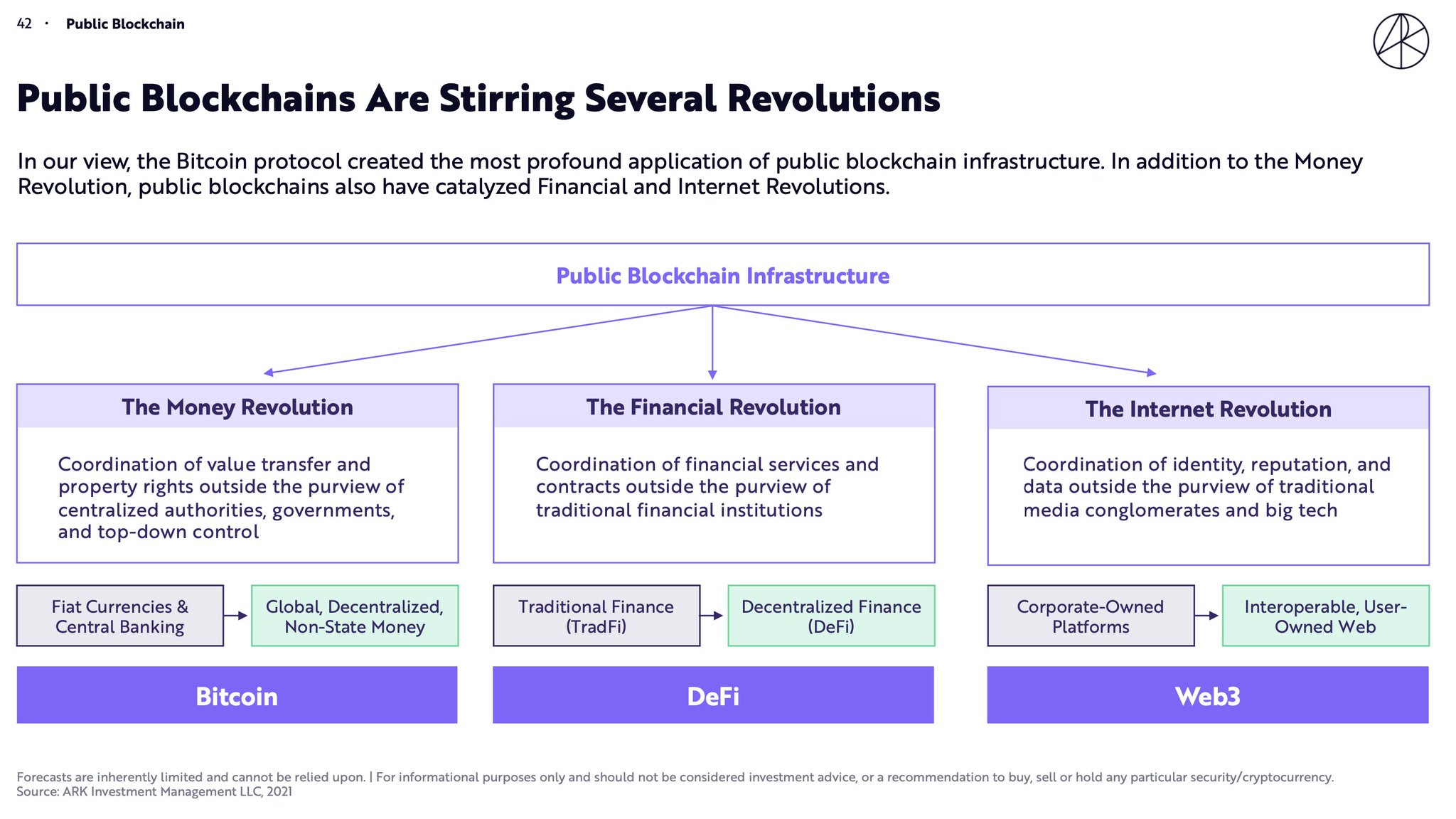

While many (with heavily vested interests) want to define all things blockchain as web3

We believe that web3 is best understood as just 1 of 3 revolutions that the innovation of bitcoin has catalyzed:

The Money Revolution

The Financial Revolution

And the Internet Revolution

We believe that web3 is best understood as just 1 of 3 revolutions that the innovation of bitcoin has catalyzed:

The Money Revolution

The Financial Revolution

And the Internet Revolution

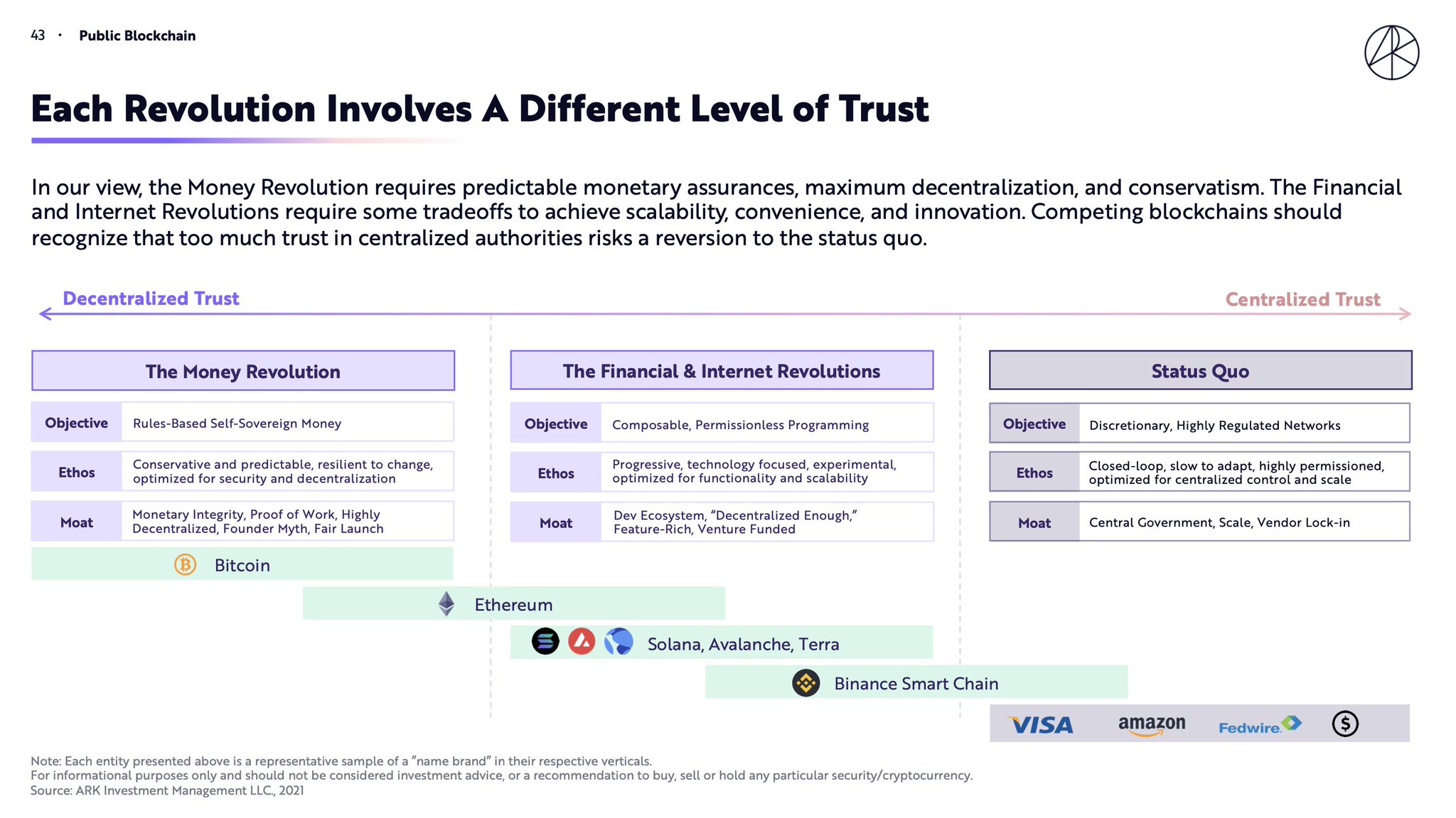

The decentralization requirements for each of these revolutions differs

Moving from left to right on this chart, blockchain robustness becomes less important

Displacing money requires assurances that could last centuries; digitizing ownership of mostly disposable media, less so

Moving from left to right on this chart, blockchain robustness becomes less important

Displacing money requires assurances that could last centuries; digitizing ownership of mostly disposable media, less so

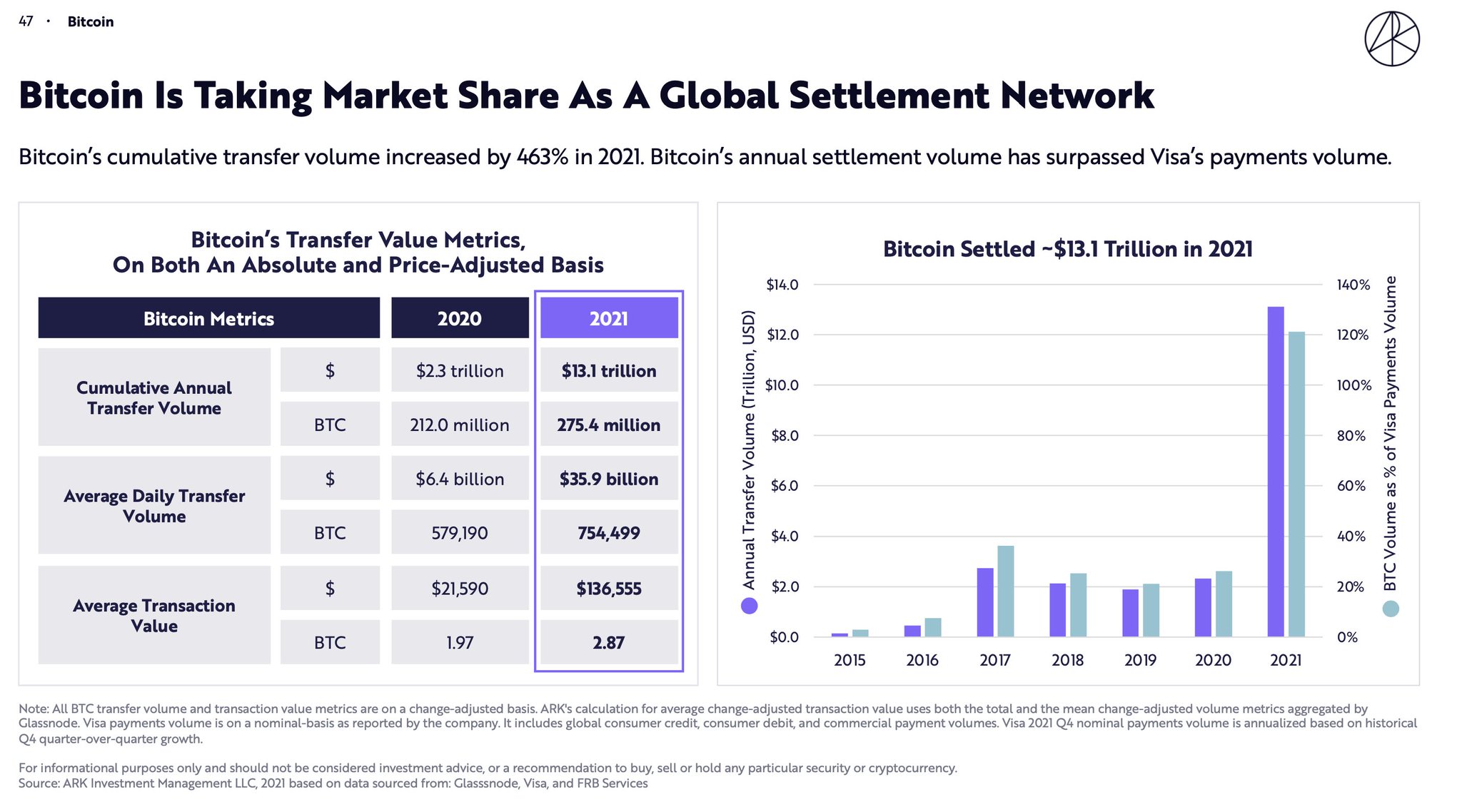

There is plenty of evidence that money displacement has already begun

Bitcoin’s transaction value has surpassed Visa’s

Bitcoin’s transaction value has surpassed Visa’s

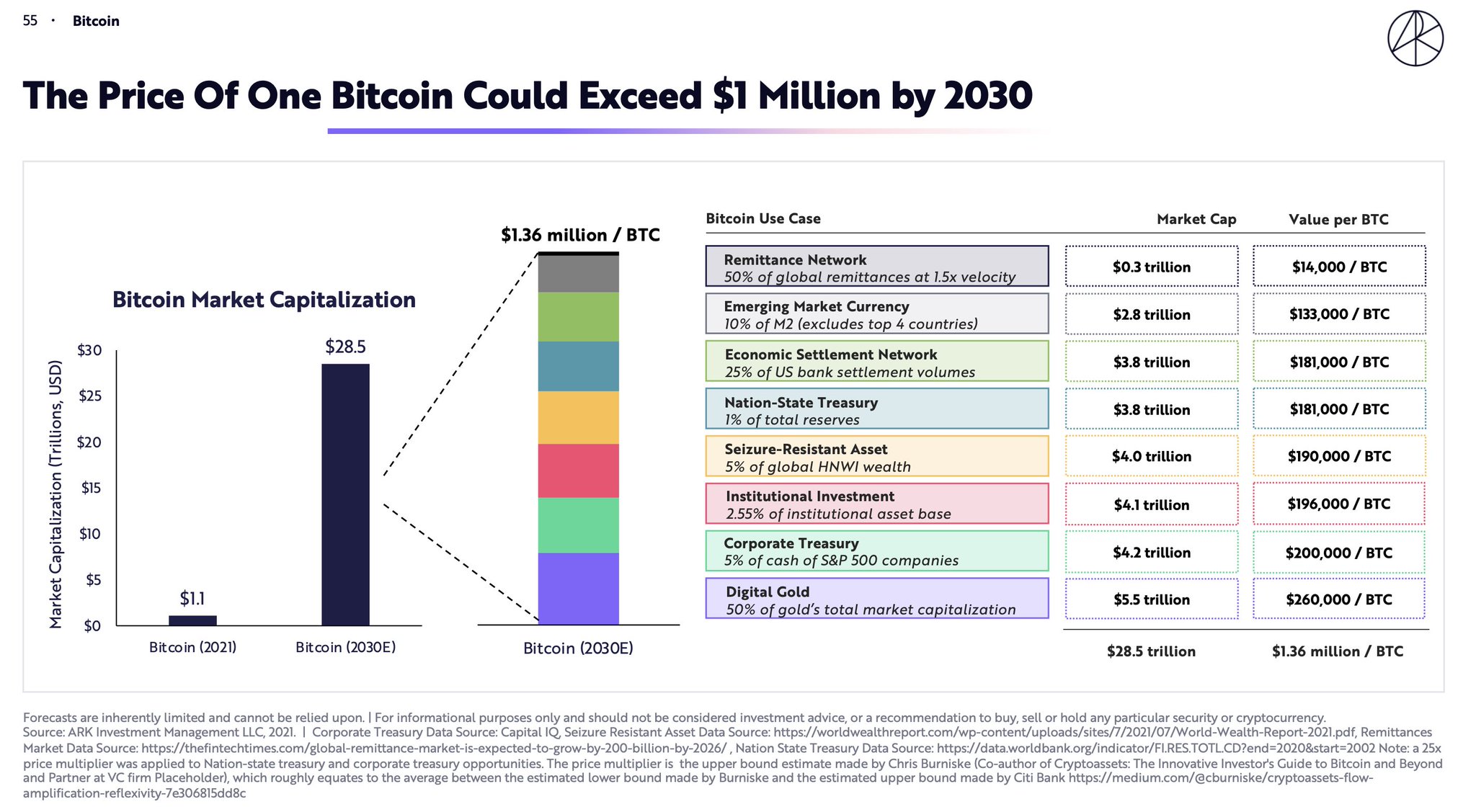

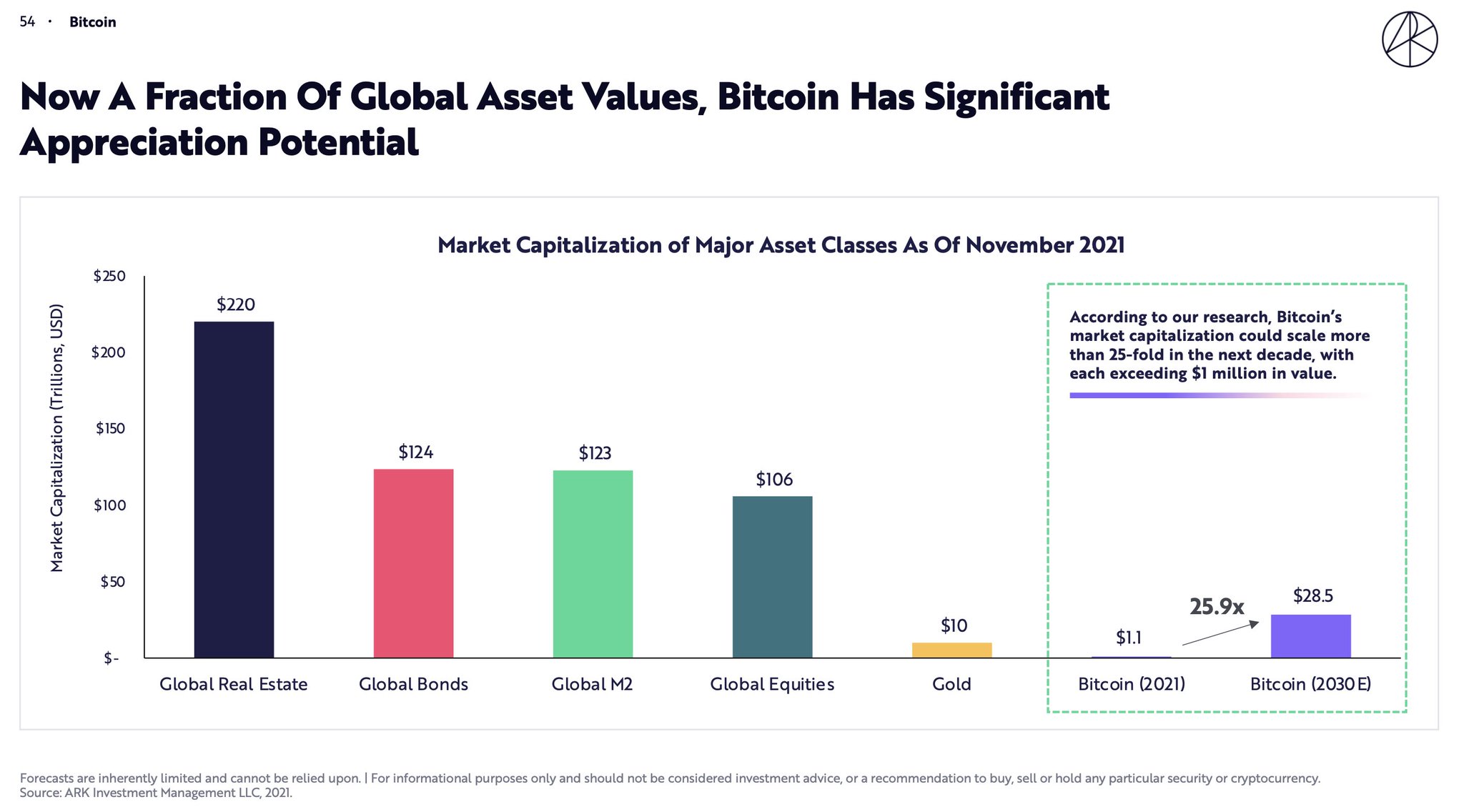

The rewards for displacing money could be dramatic

$1m per coin by 2030 is a reasonable expectation given the adoption rates we have modeled

$1m per coin by 2030 is a reasonable expectation given the adoption rates we have modeled

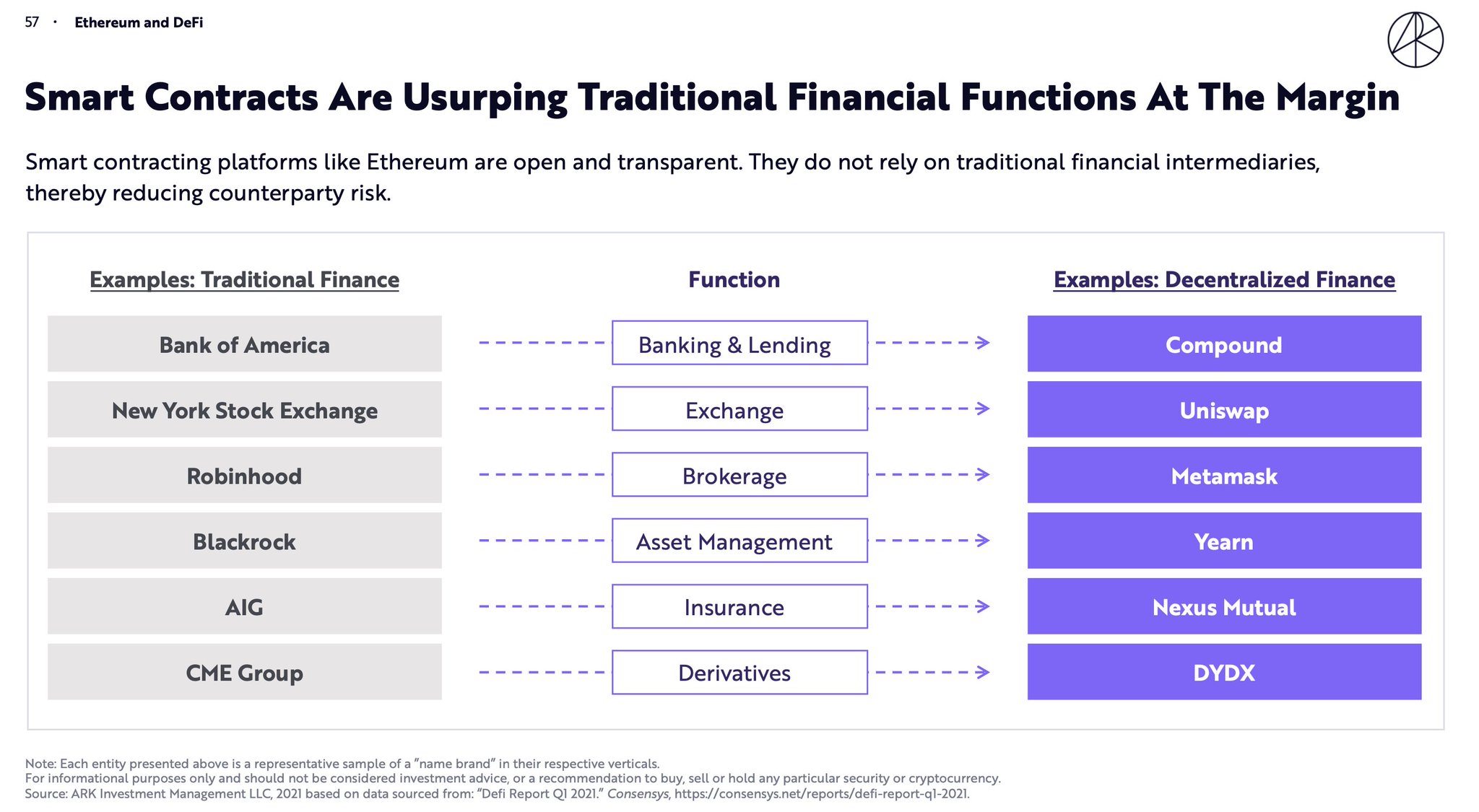

Of course there are a raft of synthetic dollars arising that could compete for some of Bitcoin’s money functionality.

Synthetic dollars could grease onboarding into DeFi—the Financial Revotion—which is still in its earliest stages

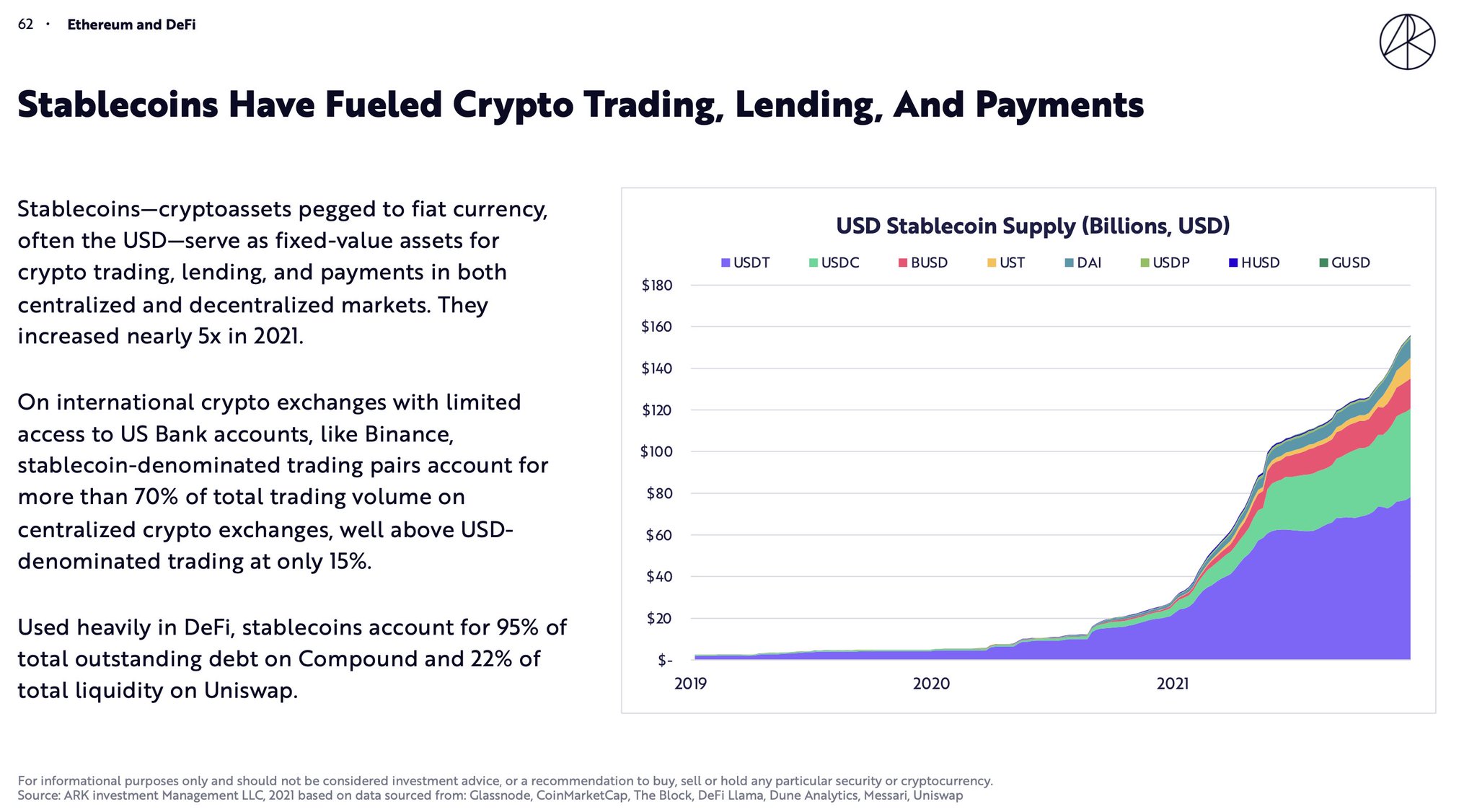

Over time DeFi could displace many of the regulated rent-extracting backend entities in financial service

Lots of uncertainty between here and there tho

Over time DeFi could displace many of the regulated rent-extracting backend entities in financial service

Lots of uncertainty between here and there tho

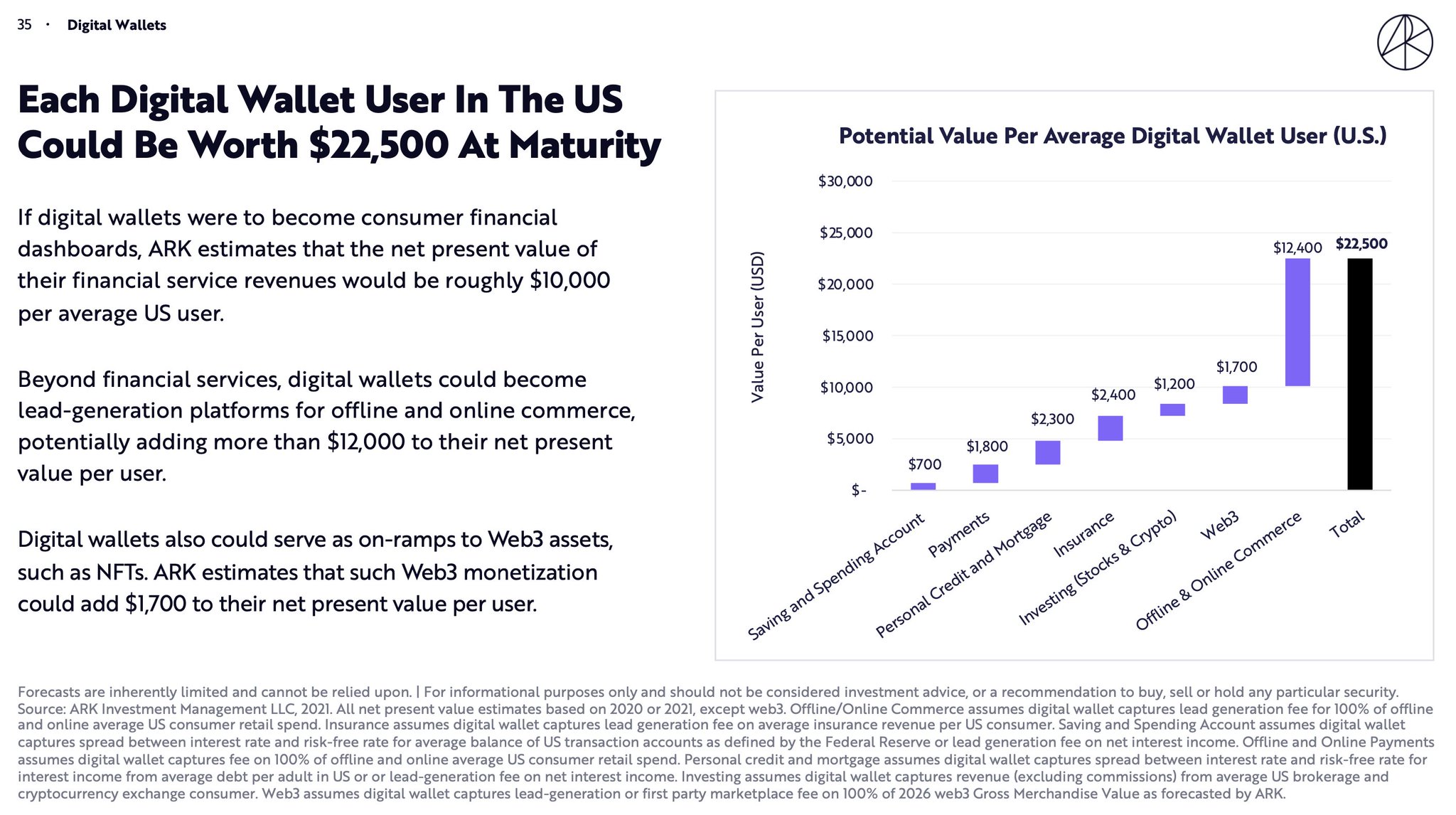

Solving UI/UX for all blockchain experiences remains a dramatic friction point.

Digital wallets are strategically positioned to win and should be able to command meaningful economic value if and as they do so.

Digital wallets are strategically positioned to win and should be able to command meaningful economic value if and as they do so.

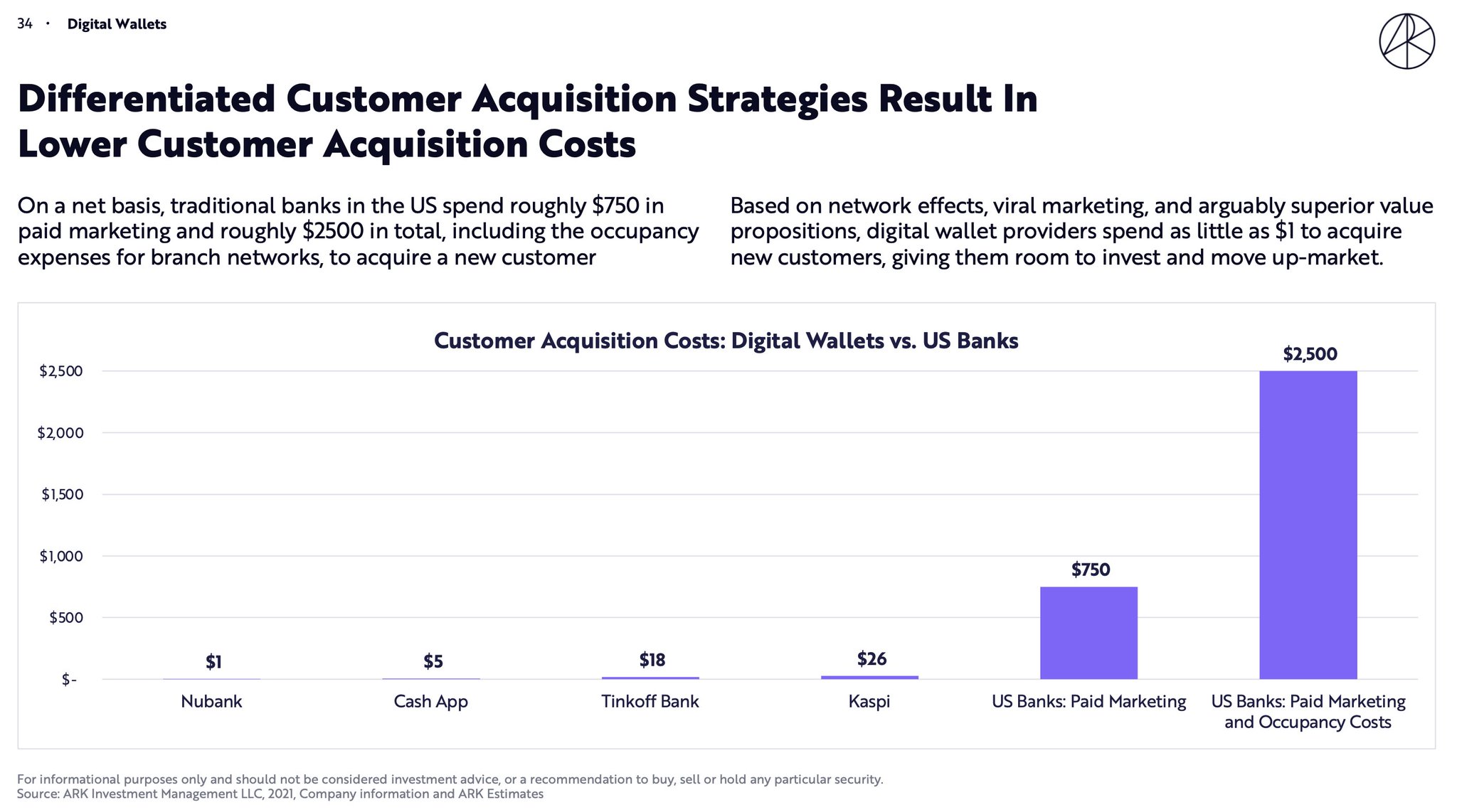

With the right go-to-market, digital wallets can accrue customers at radically low costs and so price their products humanely and service near-anyone, no matter their wealth.

The bank down the street--meanwhile--is locking multiple thousands in costs per customer acquired...

The bank down the street--meanwhile--is locking multiple thousands in costs per customer acquired...

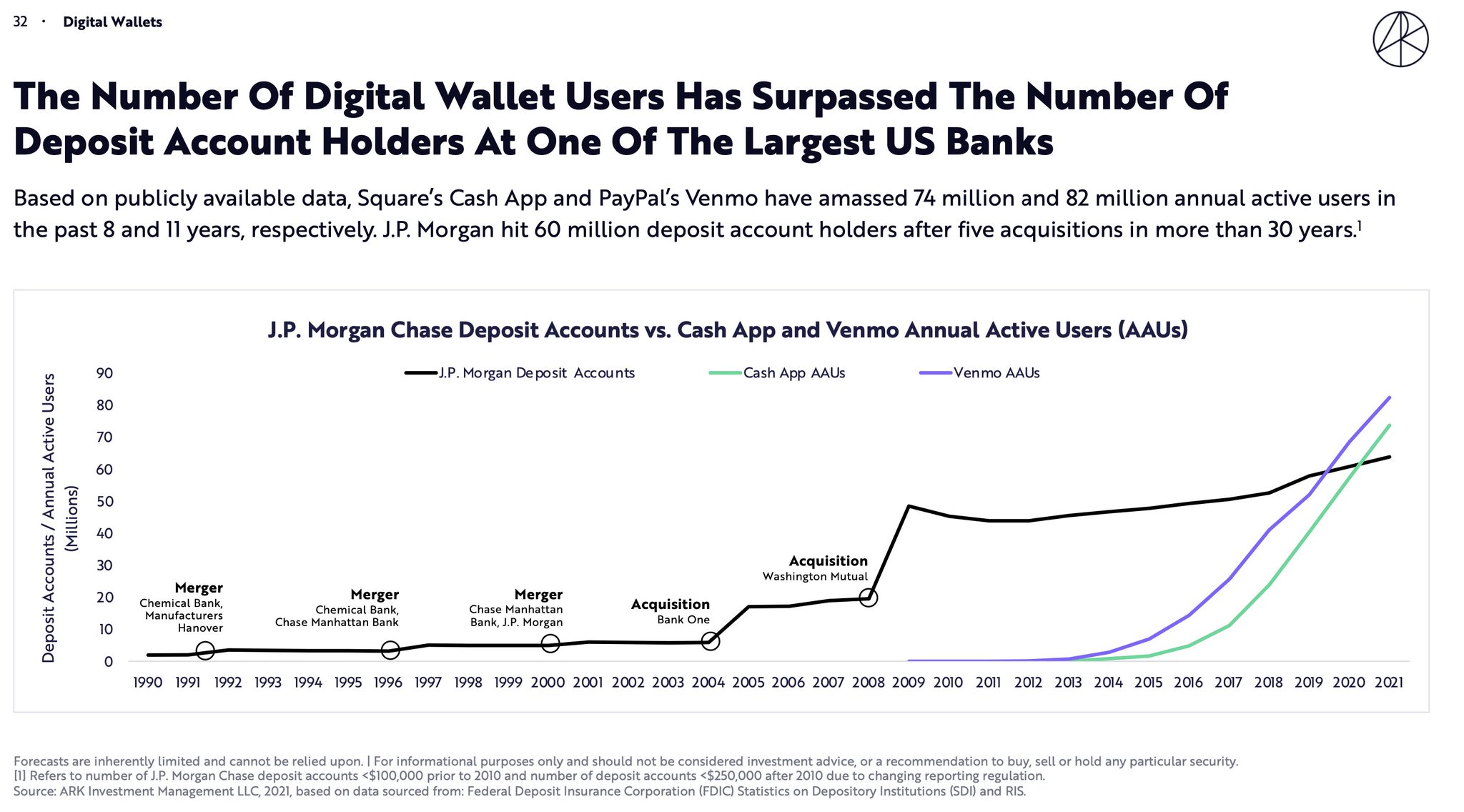

No wonder that the two largest customer facing financial institutions in the US are both now digital wallets

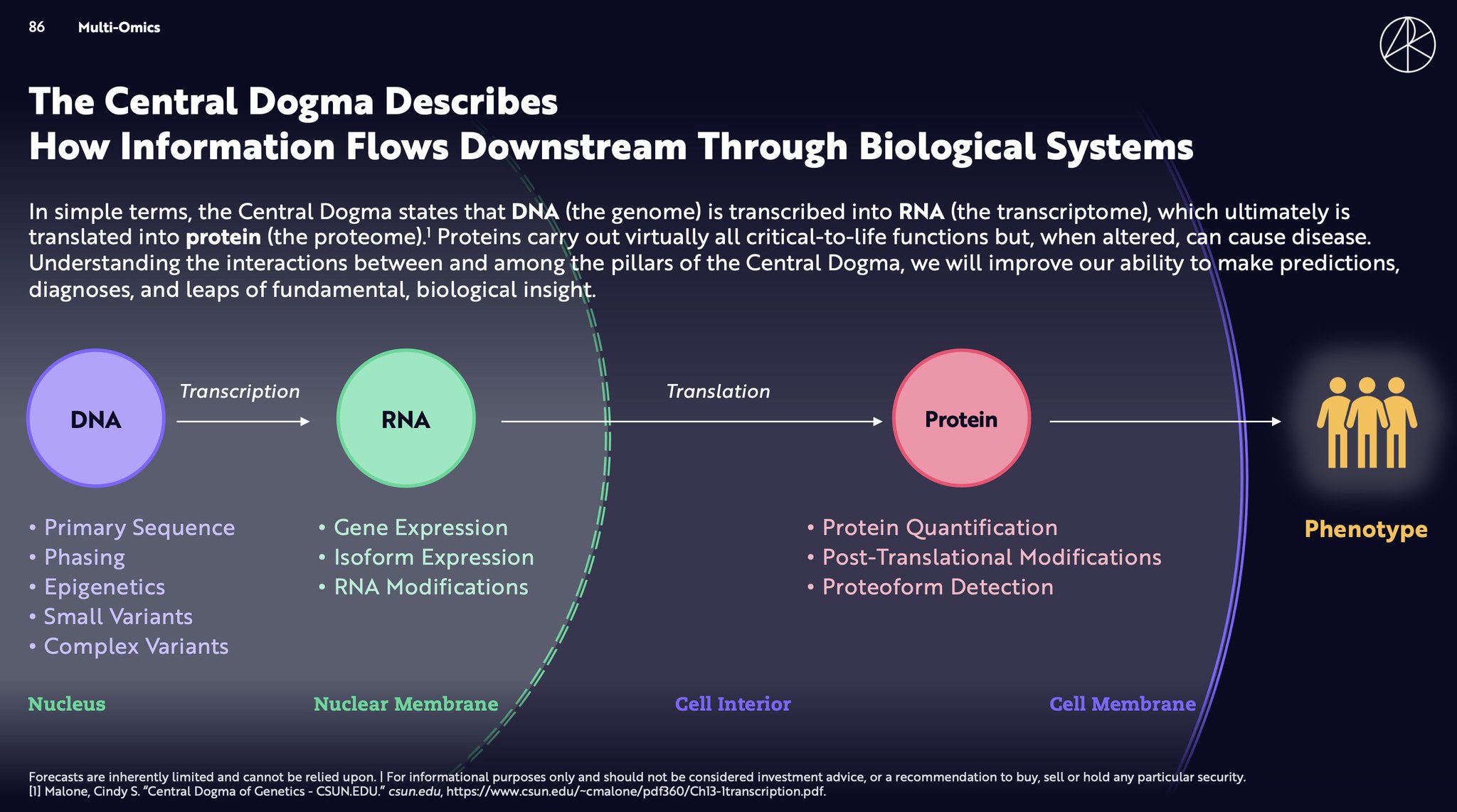

In genomics, convergences have never been more apparent

As we combine genomic, epigenomic, transcriptomic and proteomic data with phenotypic digital health information (with digital wallets the natural holders)

All parsed and interpreted by AI

As we combine genomic, epigenomic, transcriptomic and proteomic data with phenotypic digital health information (with digital wallets the natural holders)

All parsed and interpreted by AI

Insights in one of these information layers feeds back into understanding information already gathered in others.

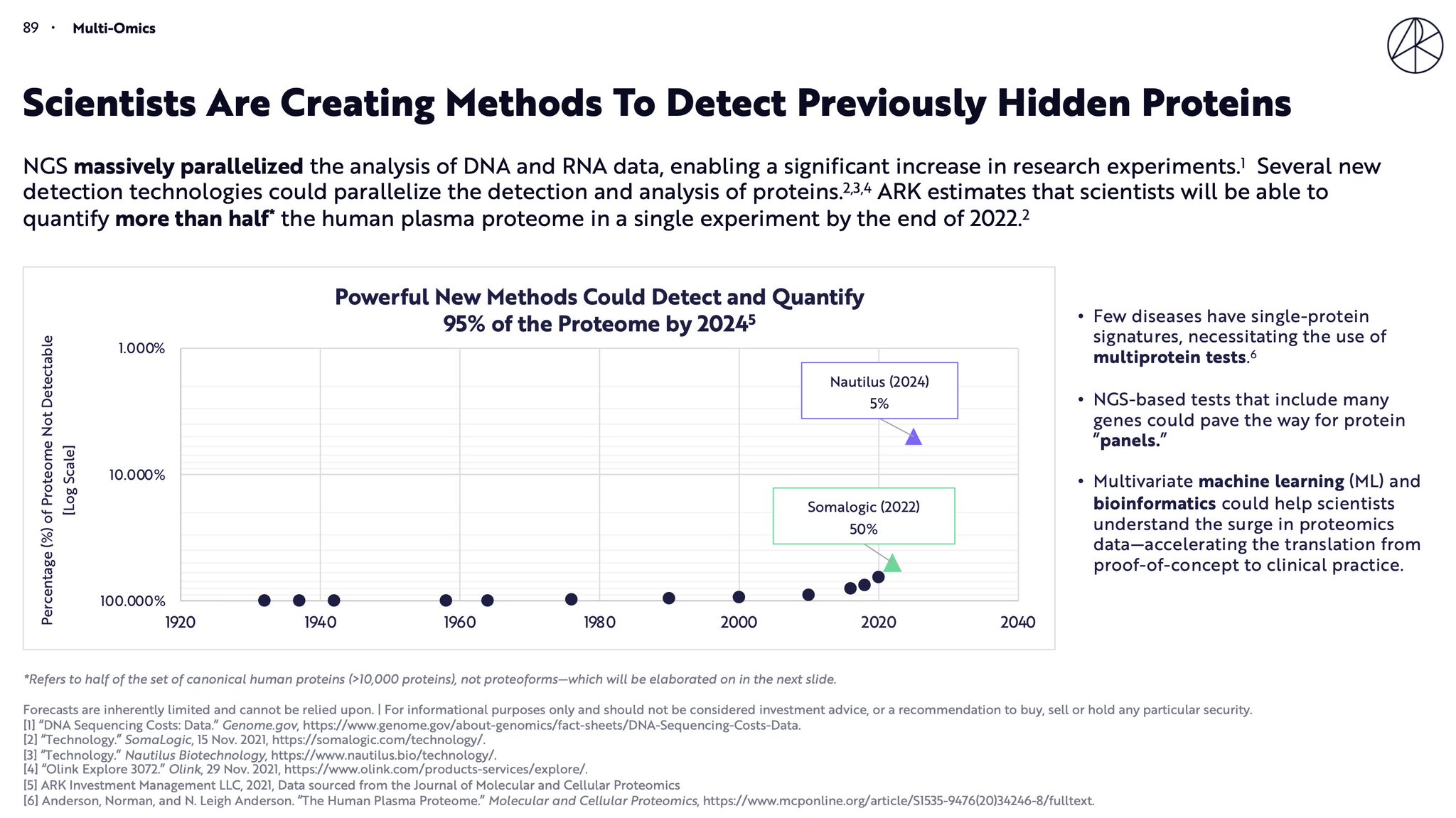

Advancements in proteomics are most notable: 95% of the proteome should be measurable within the next few years (up from a ~third in 2020)

Advancements in proteomics are most notable: 95% of the proteome should be measurable within the next few years (up from a ~third in 2020)

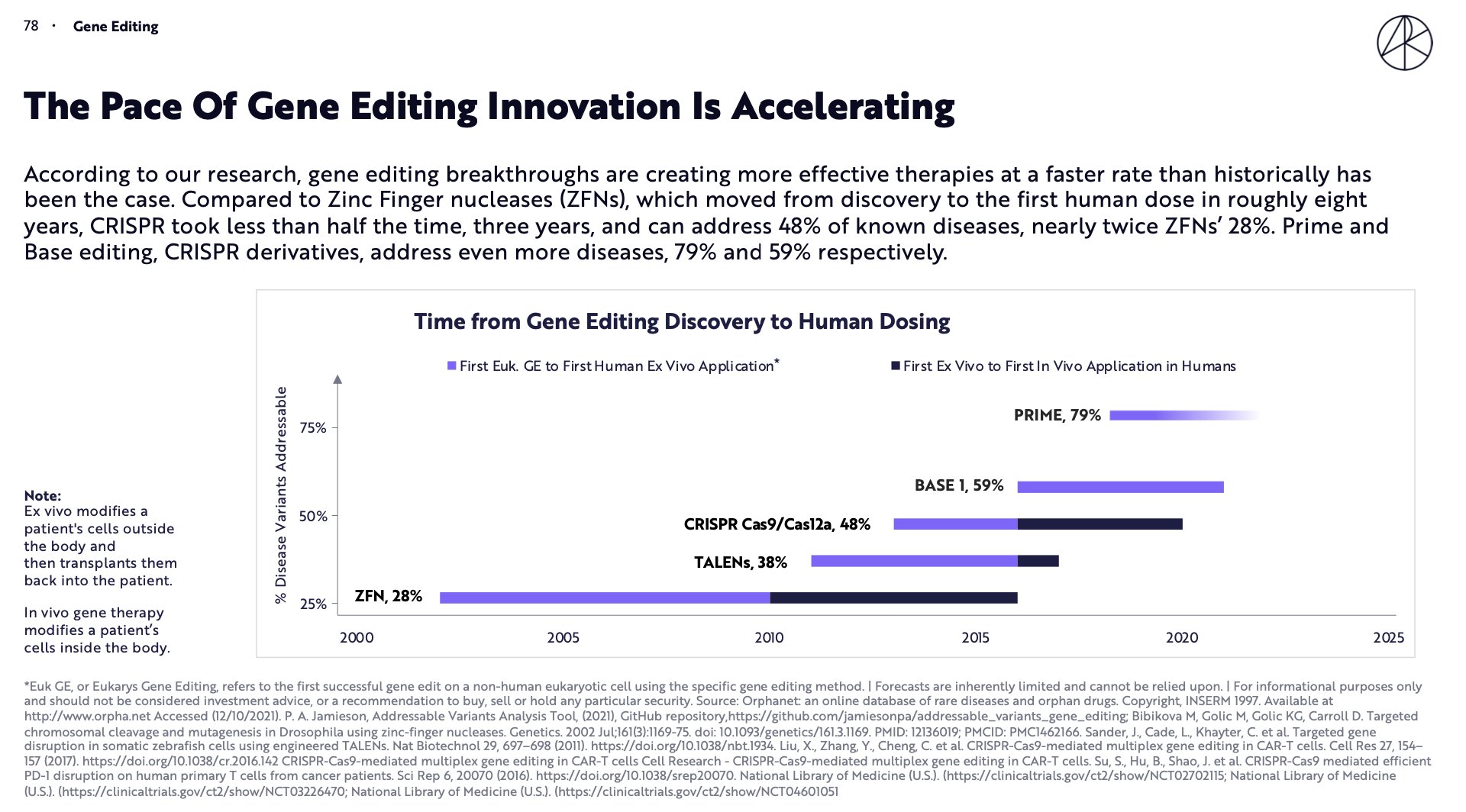

On the gene editing side, genomic insights are being deployed against real diseases.

Gene editing capability velocity is accelerating, and the % of genetic diseases accessible with our new molecular tools is expanding

Gene editing capability velocity is accelerating, and the % of genetic diseases accessible with our new molecular tools is expanding

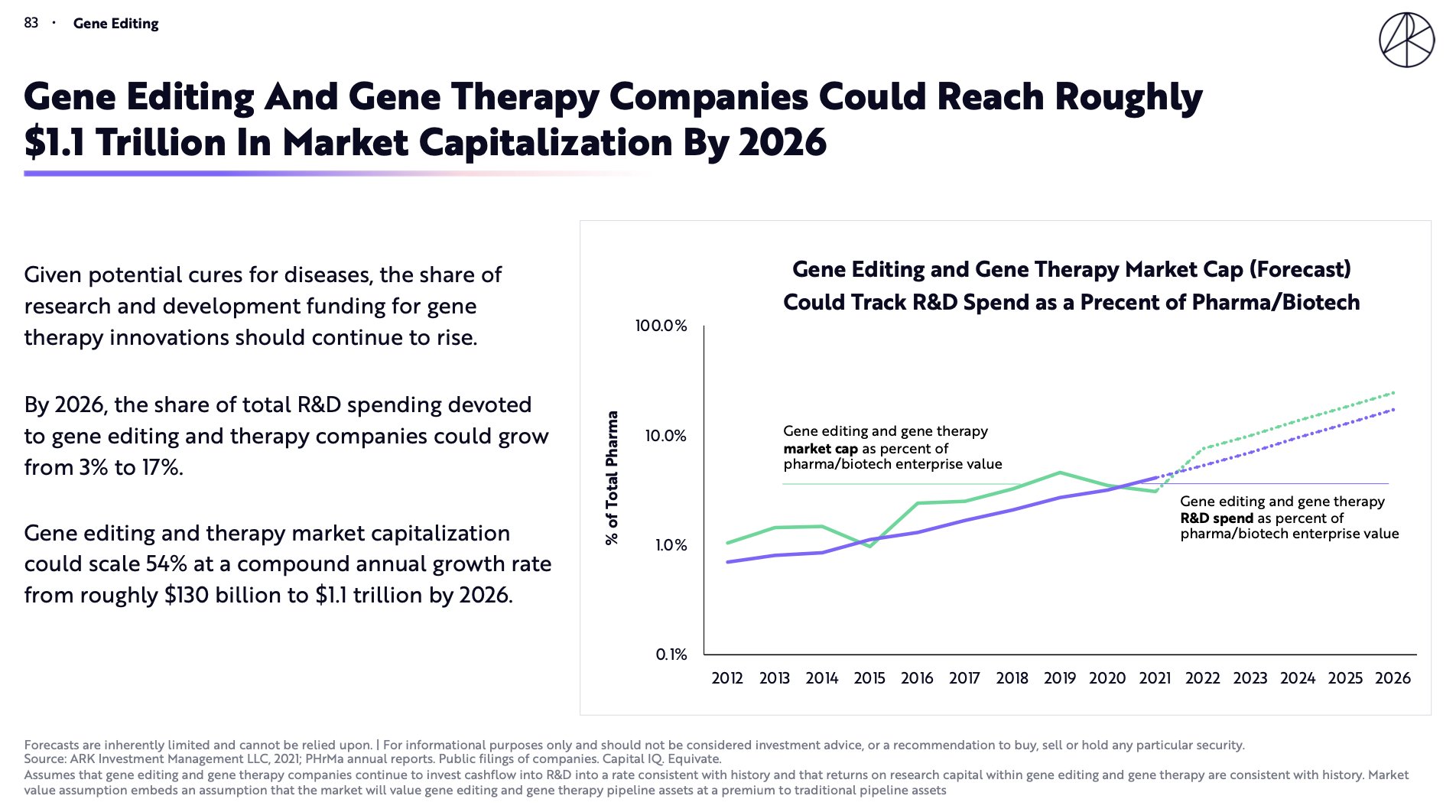

Given the economic value of curing disease (rather than managing symptoms) and consequent high returns on R&D, gene editing should continue to take share of overall R&D spend, and enterprise value should follow.

We believe $1 trillion in market cap by 2026 is possible.

We believe $1 trillion in market cap by 2026 is possible.

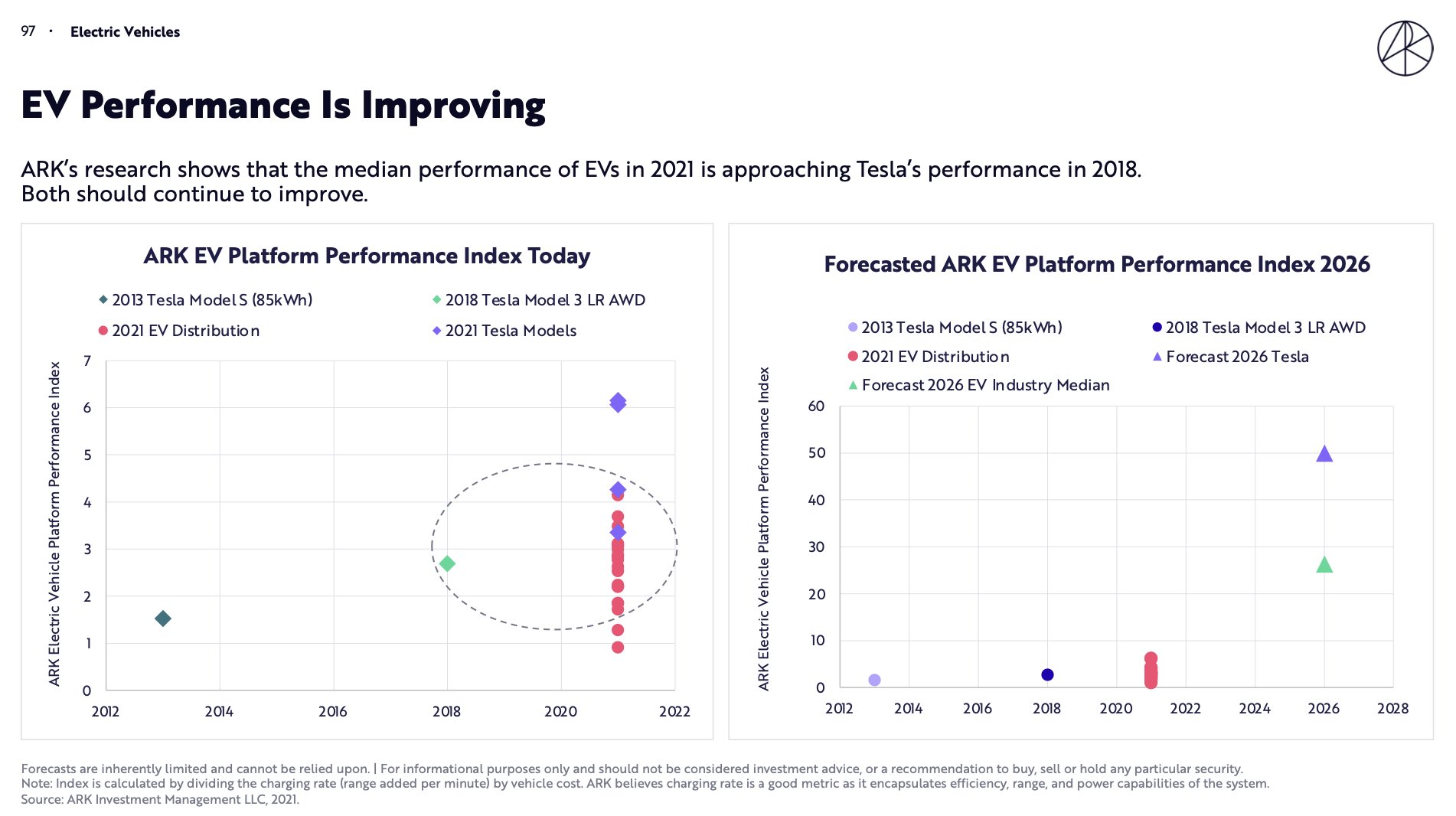

In electric vehicles we expect accelerating technological improvements, if you are not planning for an 8-fold improvement in cost per unit performance (as we measure it) by 2026

Then you are planning to fall behind

Then you are planning to fall behind

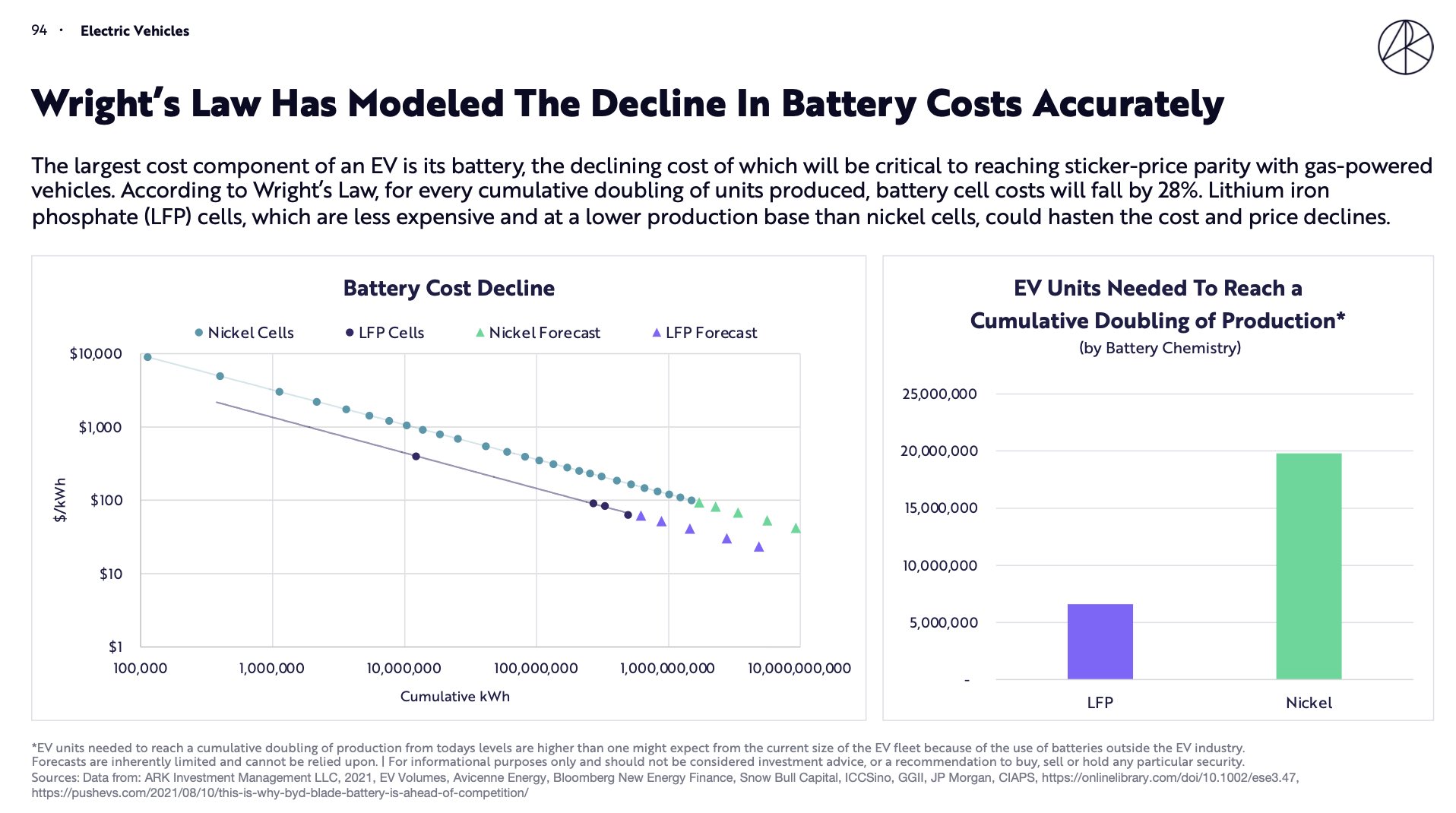

We expect marginal production growth to accrue to lower-cost LFPs, particularly as autonomous enables purpose-specific form factors.

The entire industry seems to be underwriting a future in which robotaxi does not change pricing-structure, unit-volumes.

Best of luck with that.

The entire industry seems to be underwriting a future in which robotaxi does not change pricing-structure, unit-volumes.

Best of luck with that.

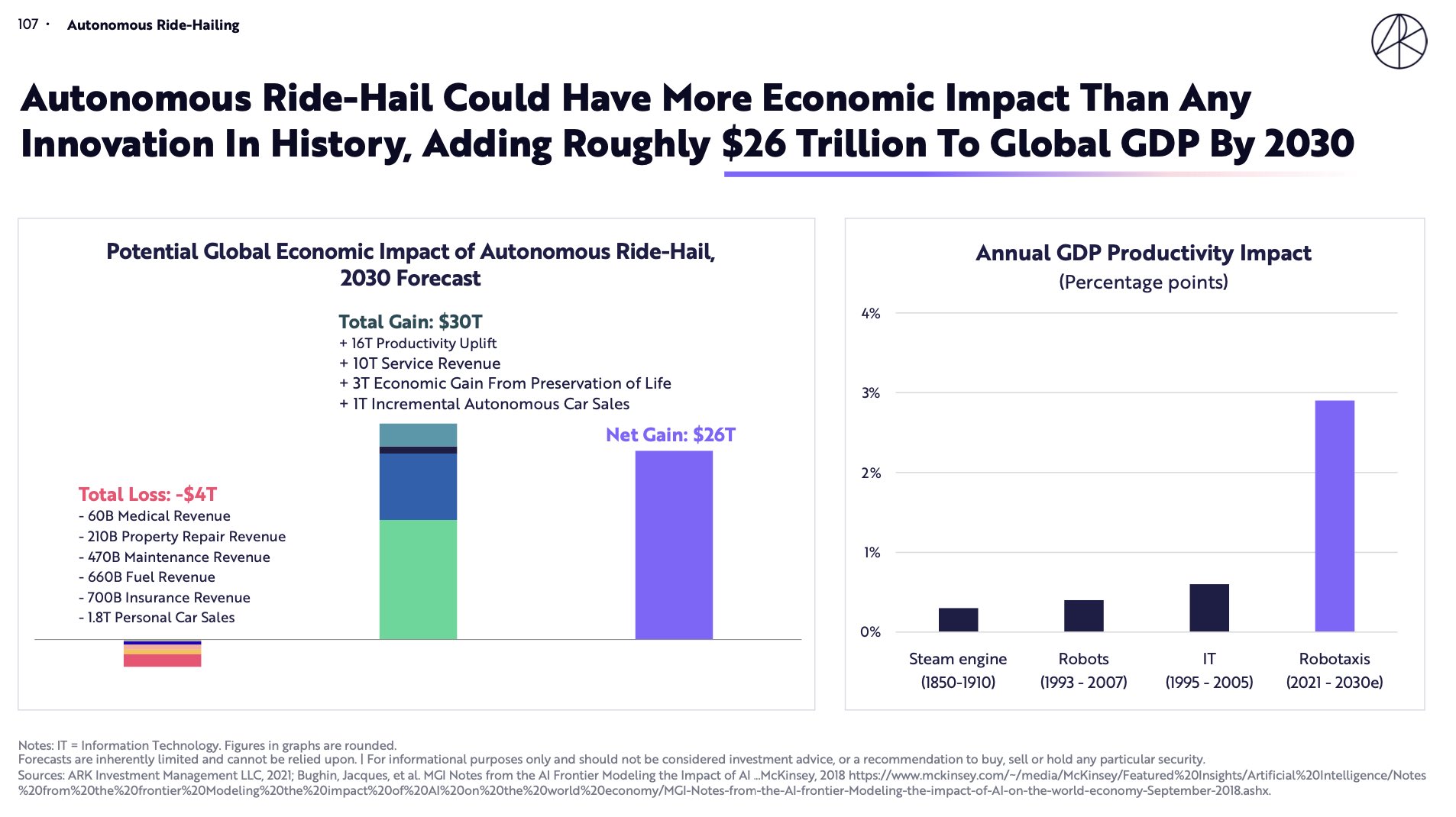

Robotaxi itself could prove to be the most economically productive innovation in history.

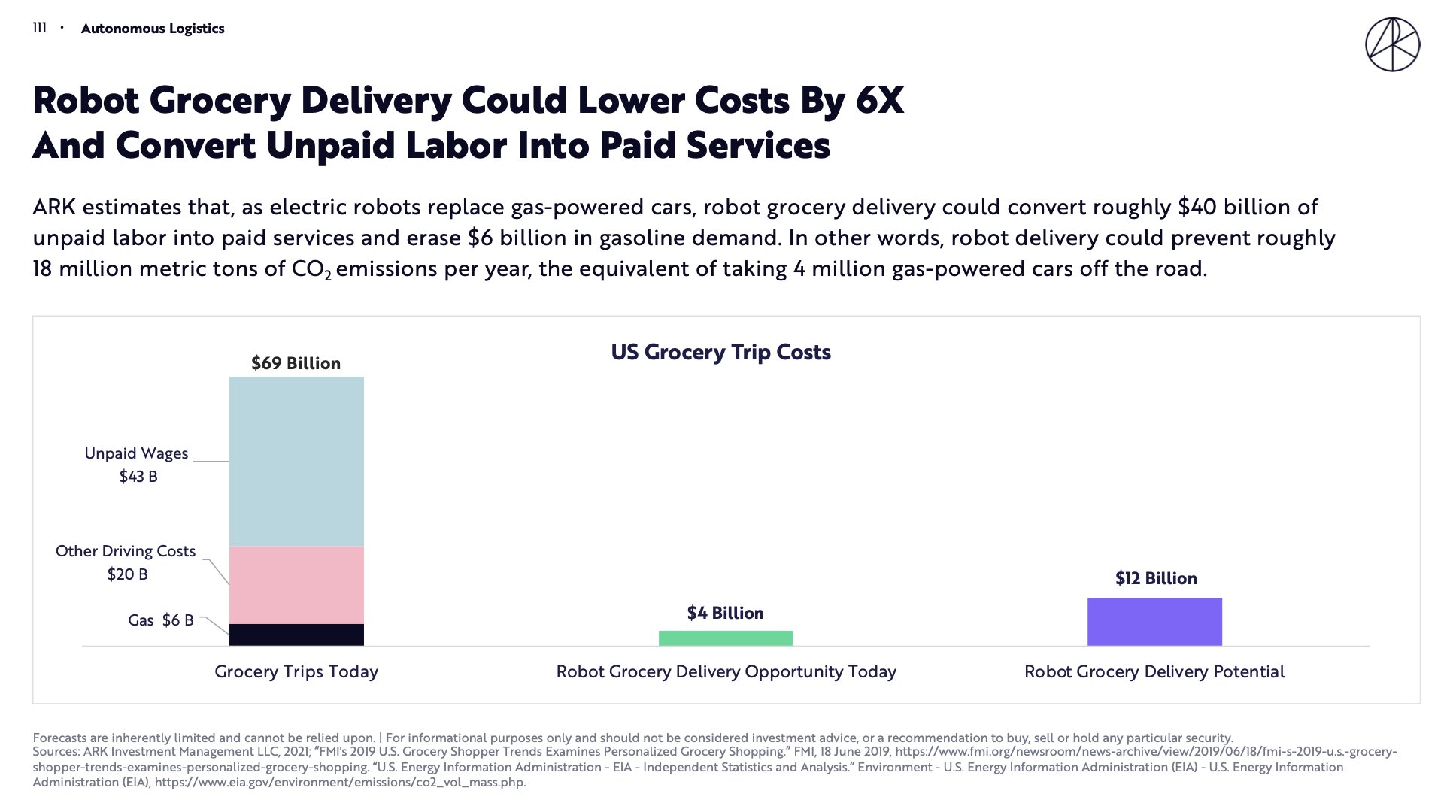

Convert all of our unpaid urban driving miles into a radically economic service that we will pay for on convenience alone.

A giant pool of non-market activity becomes economic production.

Convert all of our unpaid urban driving miles into a radically economic service that we will pay for on convenience alone.

A giant pool of non-market activity becomes economic production.

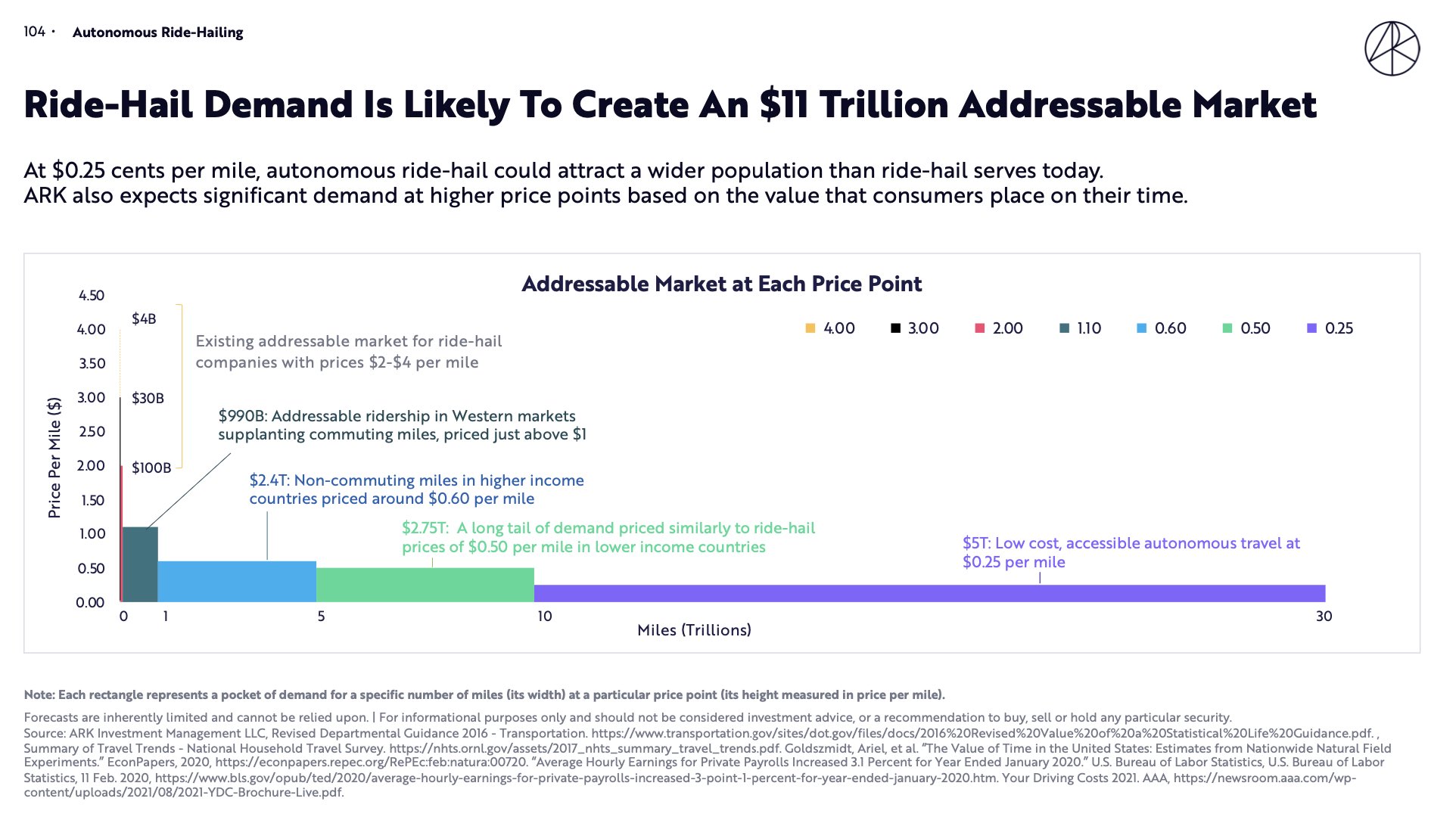

Even a robotaxi service of $1 per mile (down from $2) increases the addressable ride-hail market from $100 billion annually to roughly $1 trillion.

There should be massive demand elasticity as you move down price-point.

There should be massive demand elasticity as you move down price-point.

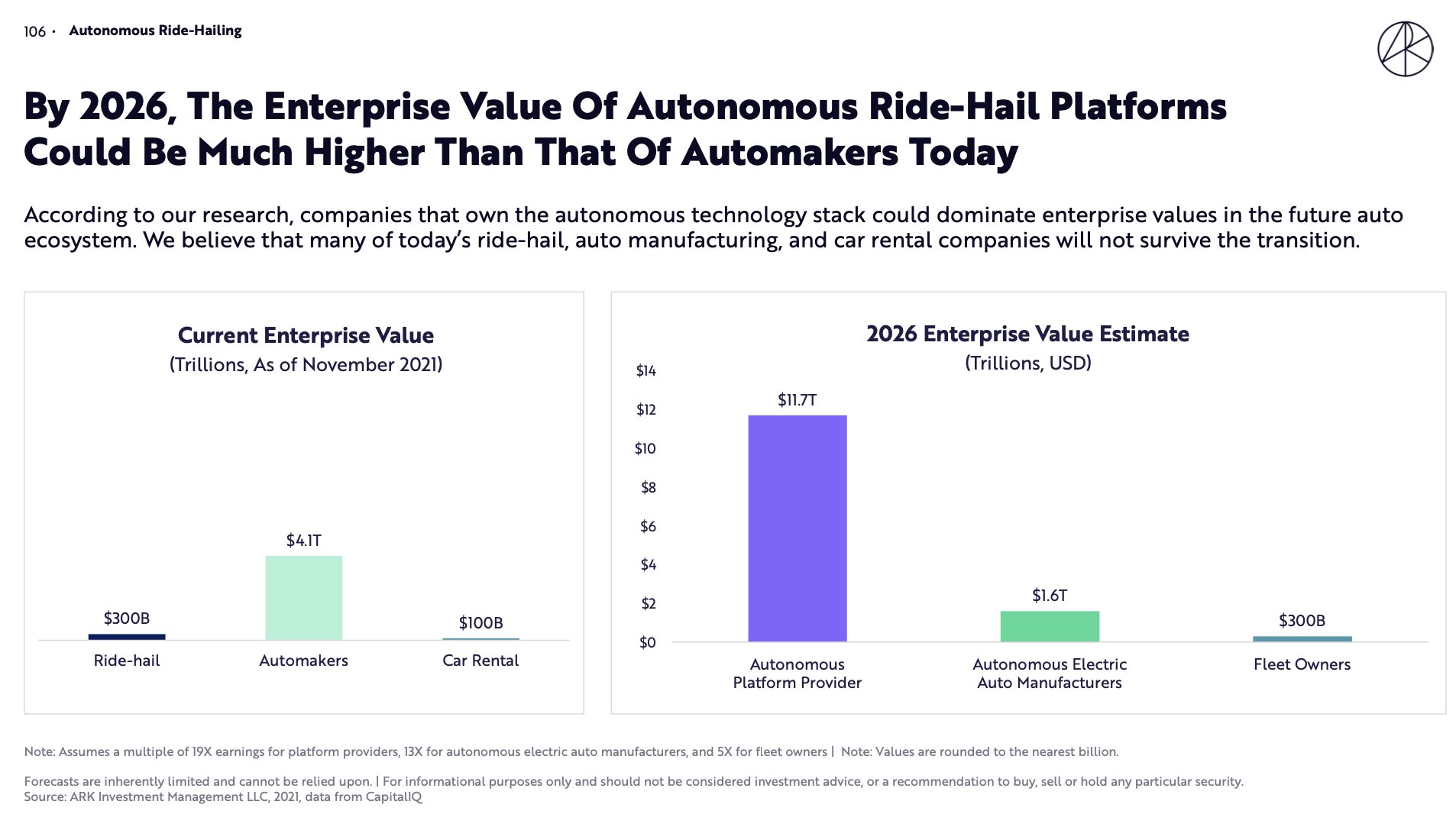

This may not bode well for pure-play manufacturers however.

City-only robotaxis could accomodate 10x the mileage and cost a relative pittance to manufacture.

Suppressed units at lower prices is not recipe for industry success unless you can occupy the robotaxi software layer.

City-only robotaxis could accomodate 10x the mileage and cost a relative pittance to manufacture.

Suppressed units at lower prices is not recipe for industry success unless you can occupy the robotaxi software layer.

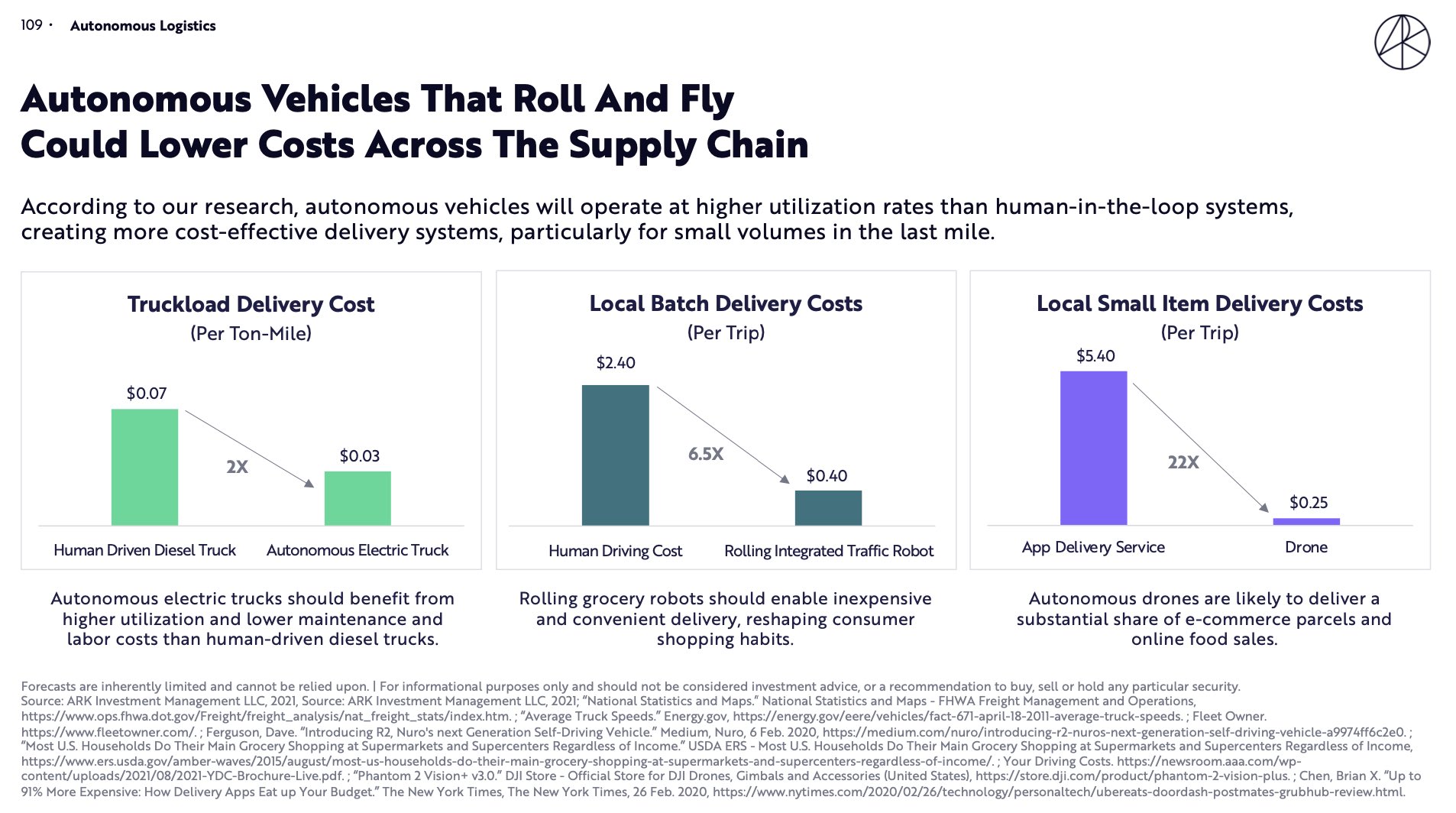

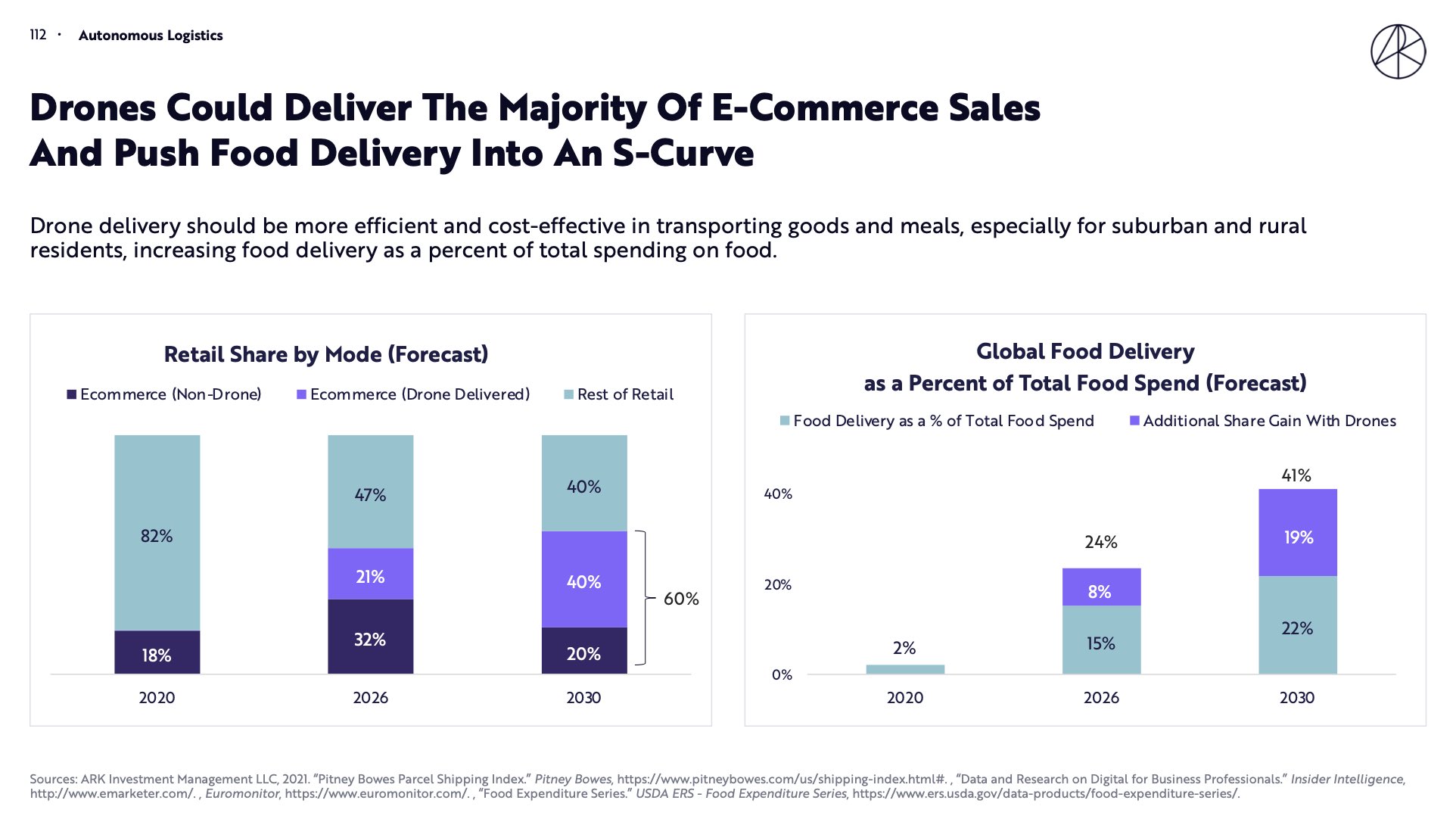

The cost of moving people around is going to fall as is the cost of moving things around.

For parcels to individual households we believe a 20x reduction in the cost of delivery is achievable.

For parcels to individual households we believe a 20x reduction in the cost of delivery is achievable.

The biggest structural demand shift from this capability, at the consumer level, will probably occur in the food space where delivery can become much less expensive *and* more predictable and groceries can be every day of the week on-demand

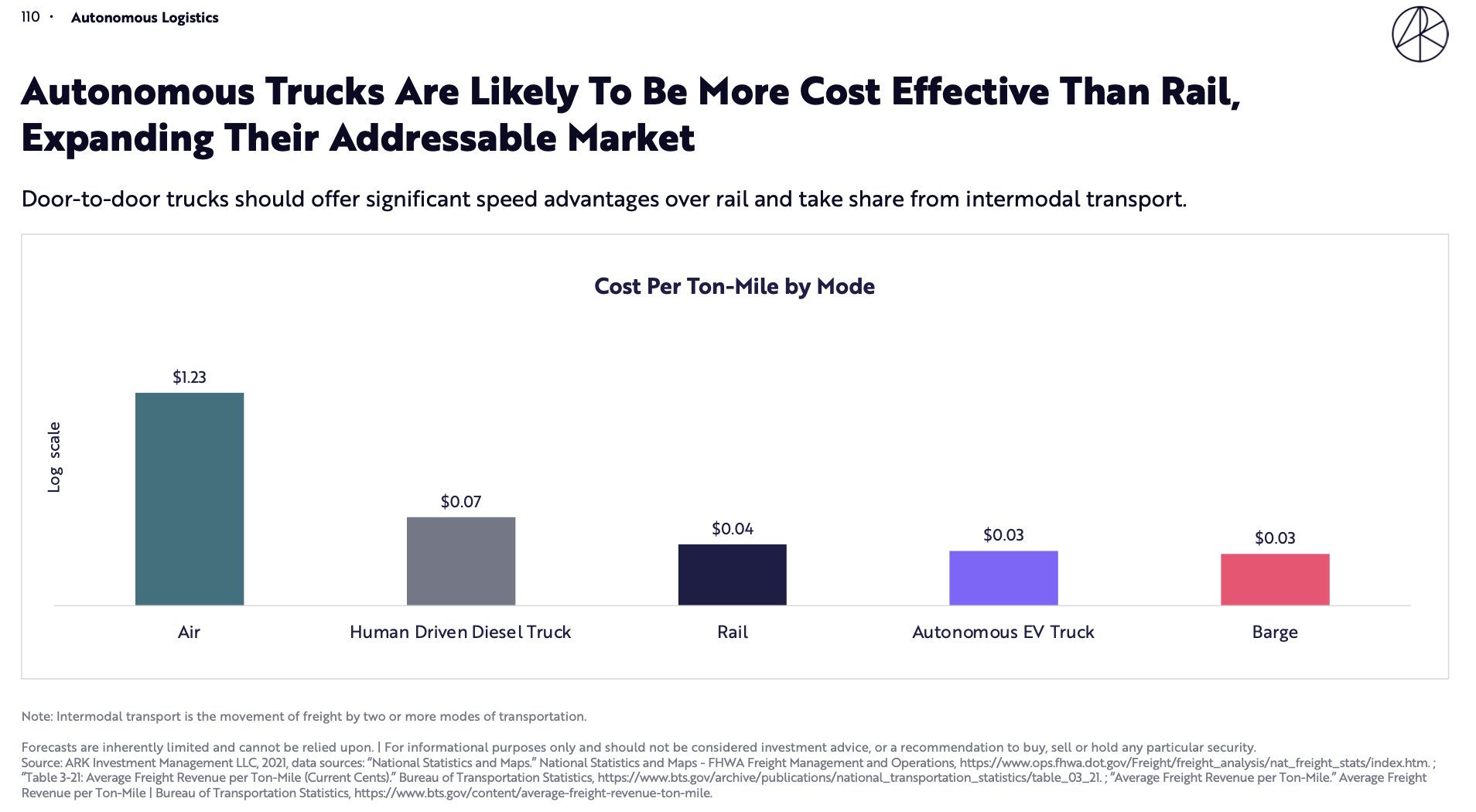

The biggest market opportunity, however, is in trucks where autonomous capabilities could allow them to displace freight rail.

The way in which things are built should transform as well.

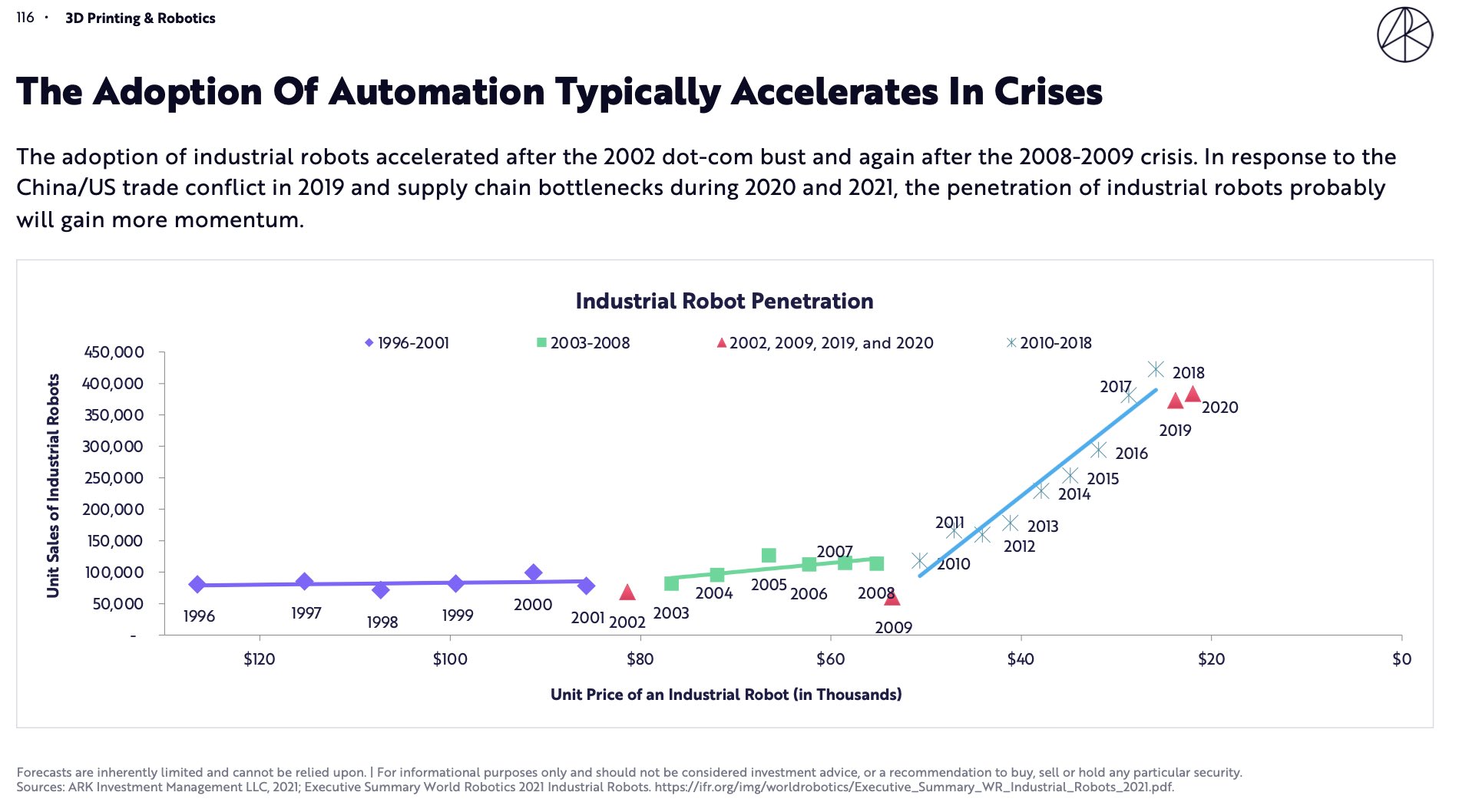

Robot prices continue to fall.

Contingent upon continued developments in AI, software defined robots easily backwards compatible with existing business processes, could radically expand the market.

We are still early

Robot prices continue to fall.

Contingent upon continued developments in AI, software defined robots easily backwards compatible with existing business processes, could radically expand the market.

We are still early

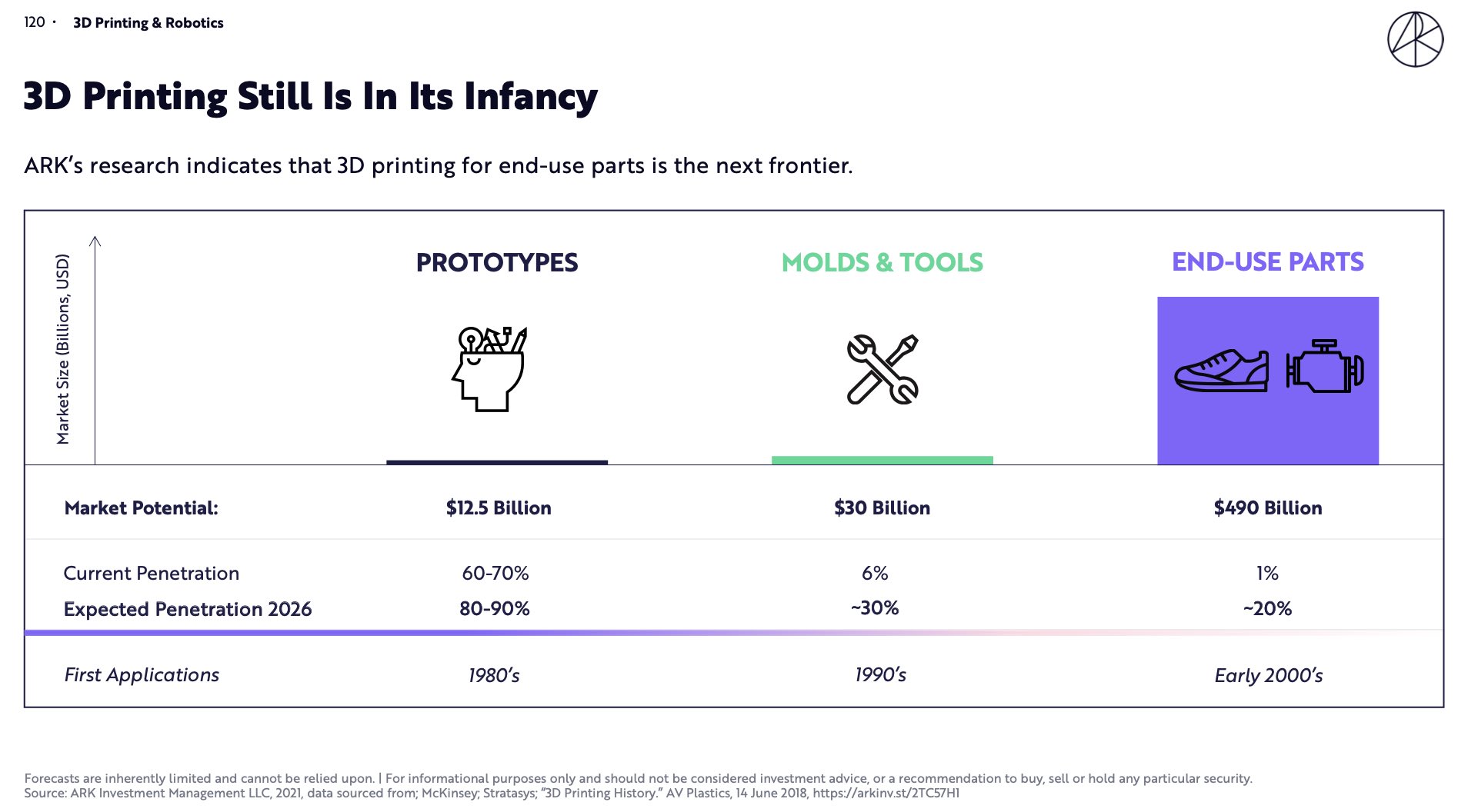

Also still early: 3D printing, which is beginning to find its way into end-use applications, and should be catalyzed and enabled by the form factor diversification emerging from autonomous electric capabilities.

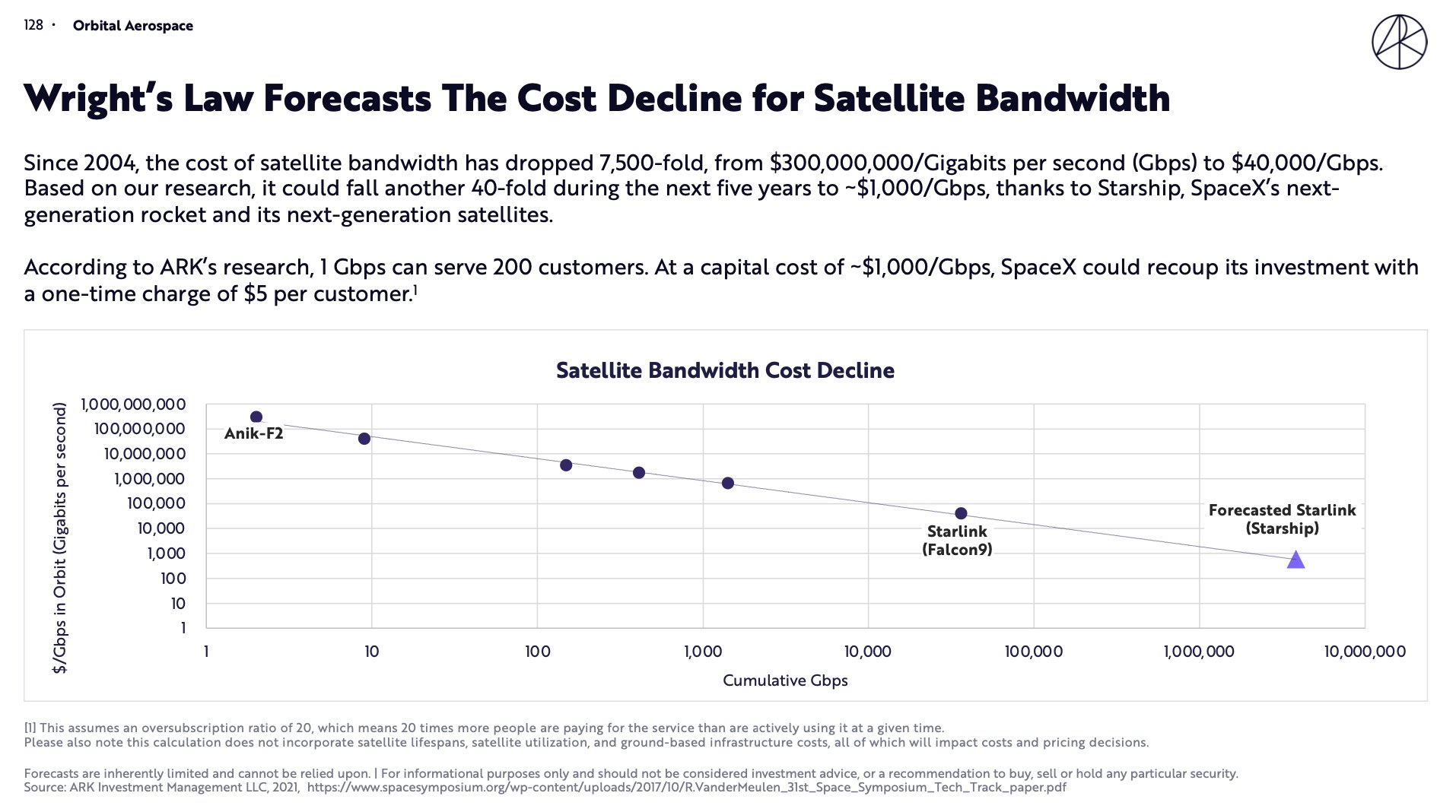

Orbital aerospace has perhaps the most impressive cost decline of any technology we have studied.

The cost of lofting a gigabit-per-second in to orbit has from $300,000,000 in 2004 to $1,000 today and we expect $40 by within the next 5 years.

The cost of lofting a gigabit-per-second in to orbit has from $300,000,000 in 2004 to $1,000 today and we expect $40 by within the next 5 years.

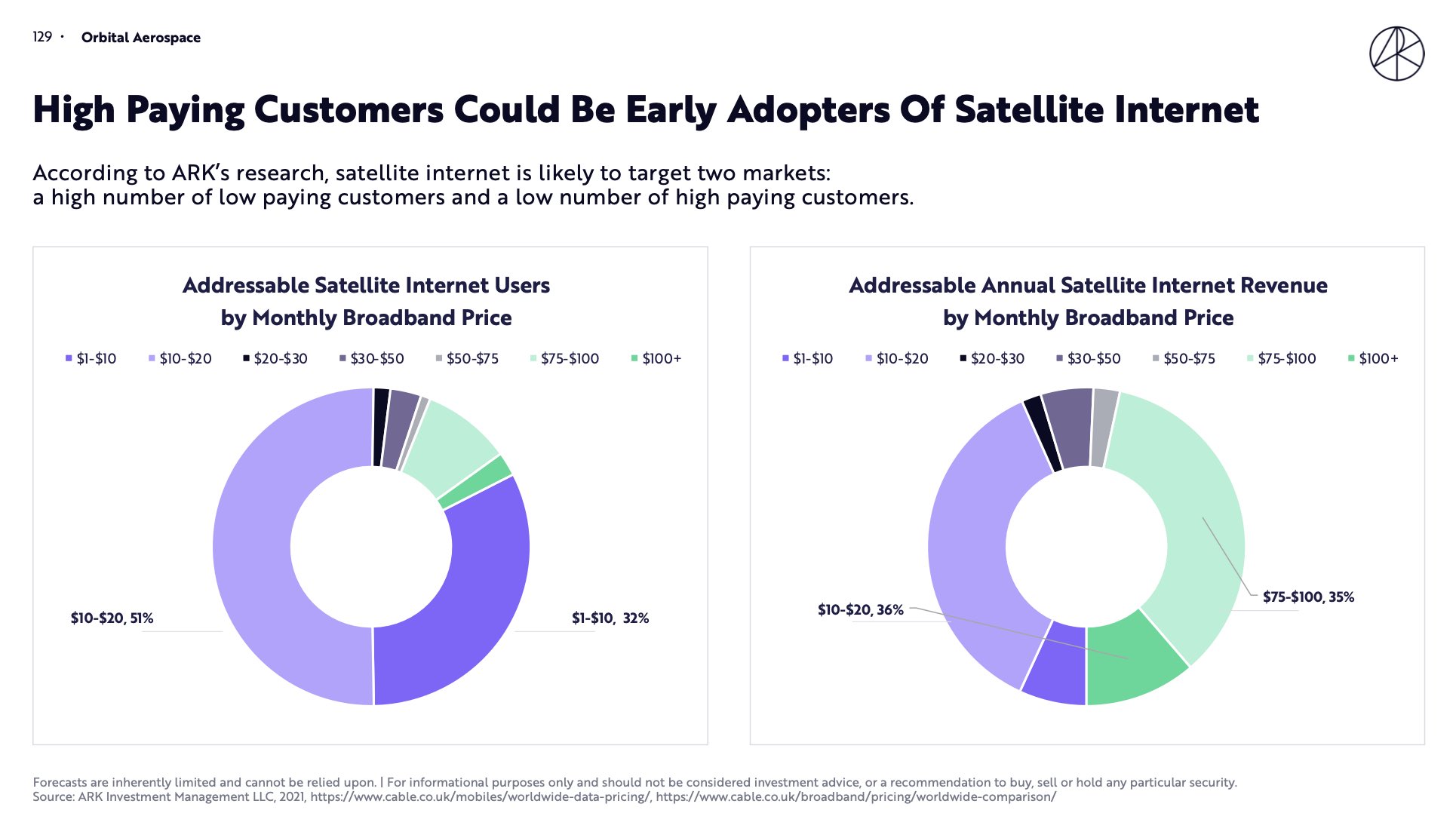

The market in developed markets for LEO satellite internet is large enough that the rest of the world will be able to sign on for relatively low cost.

The competitive pressure this puts on local internet monopolies (and the governments that control them) could prove interesting.

The competitive pressure this puts on local internet monopolies (and the governments that control them) could prove interesting.

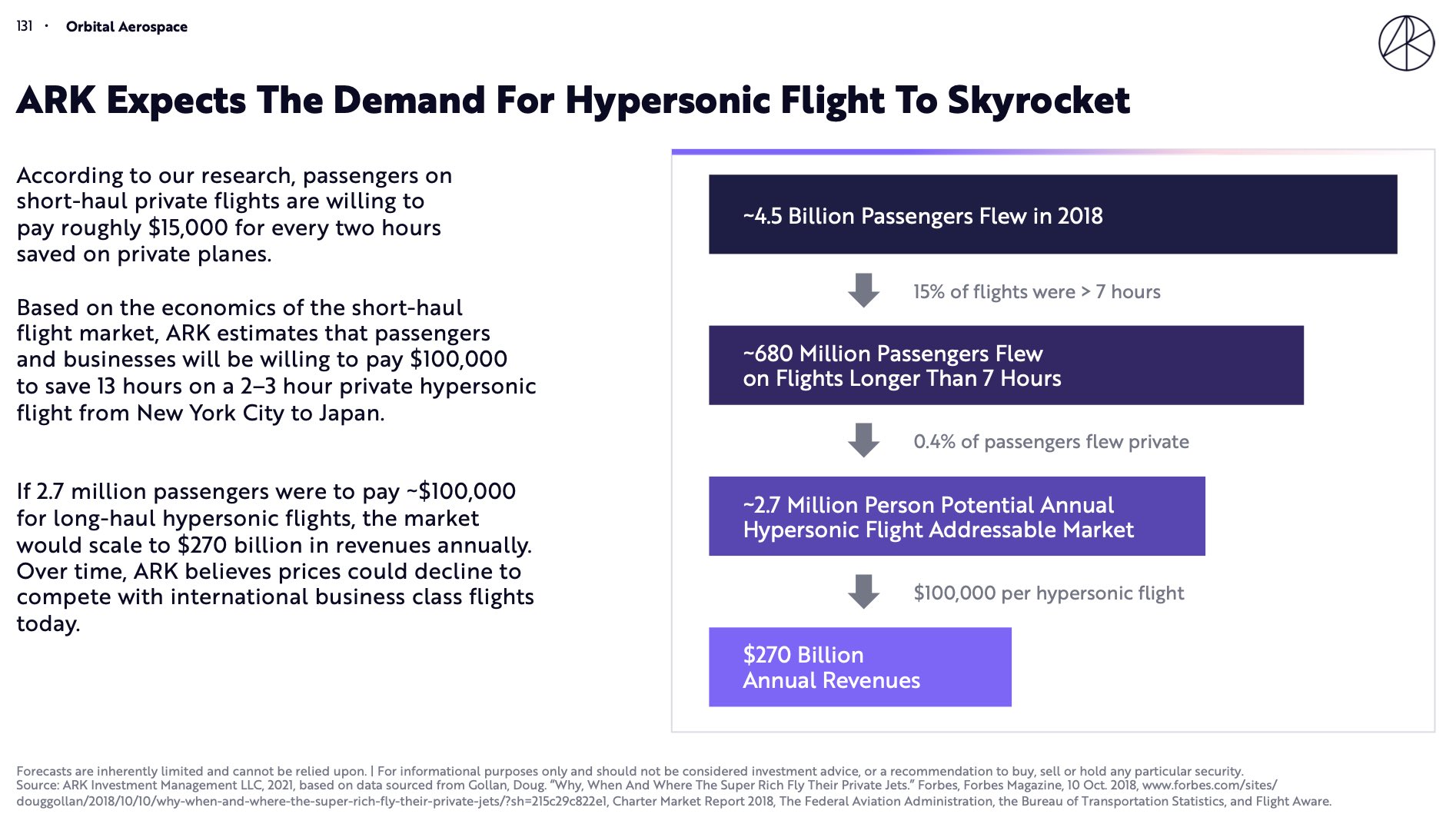

There is a larger market potentially available for rocket technology in hypersonic travel. Though the engineering and infrastructural hurdles remain daunting.

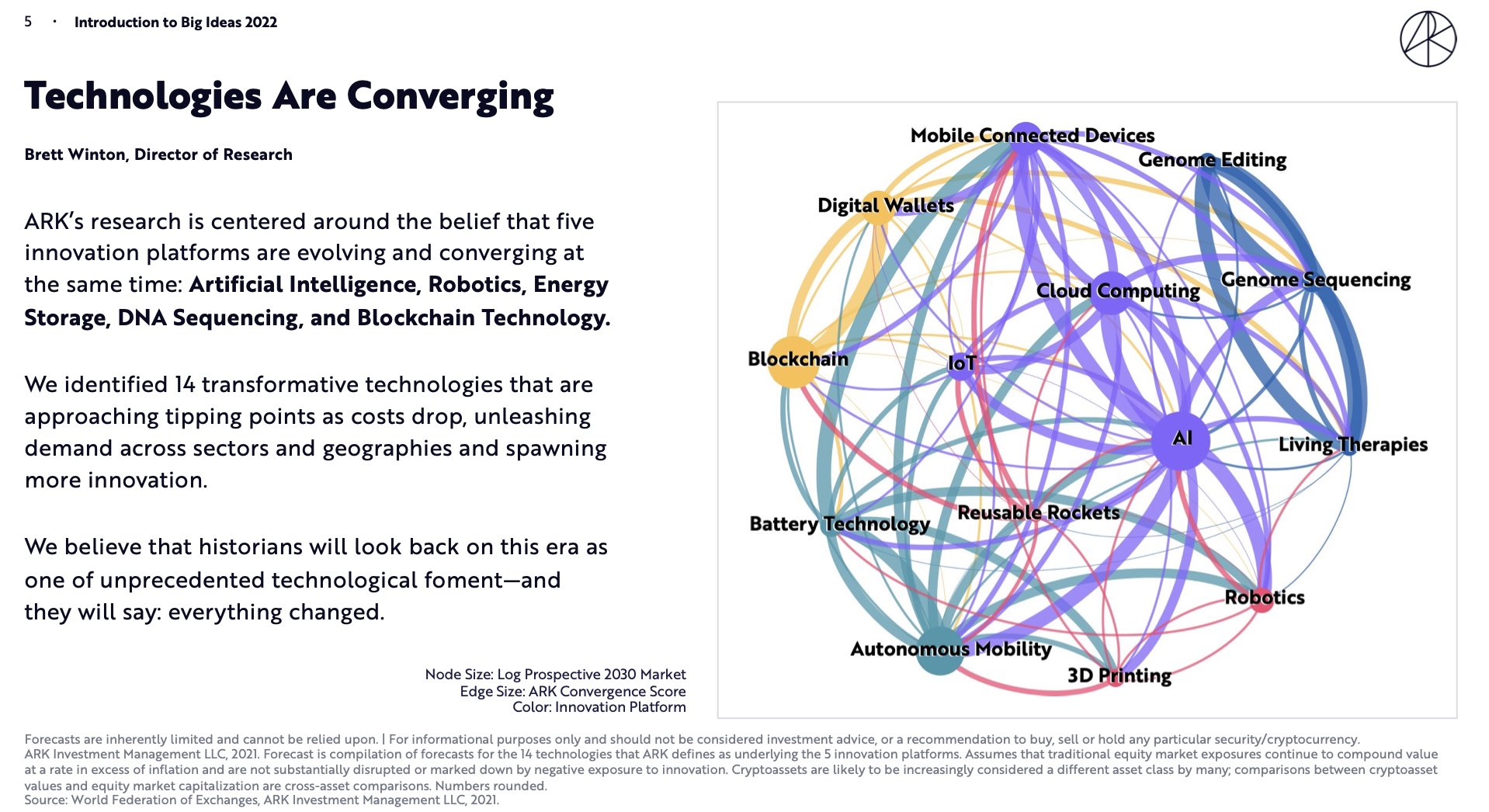

Across all technology platforms convergence is increasing.

AI drives robotaxis

Battery advances enable augmented reality

Digital health feeds back into genomic understanding

Blockchains and digital wallets weave the entire connected world into the same digital economic system

AI drives robotaxis

Battery advances enable augmented reality

Digital health feeds back into genomic understanding

Blockchains and digital wallets weave the entire connected world into the same digital economic system

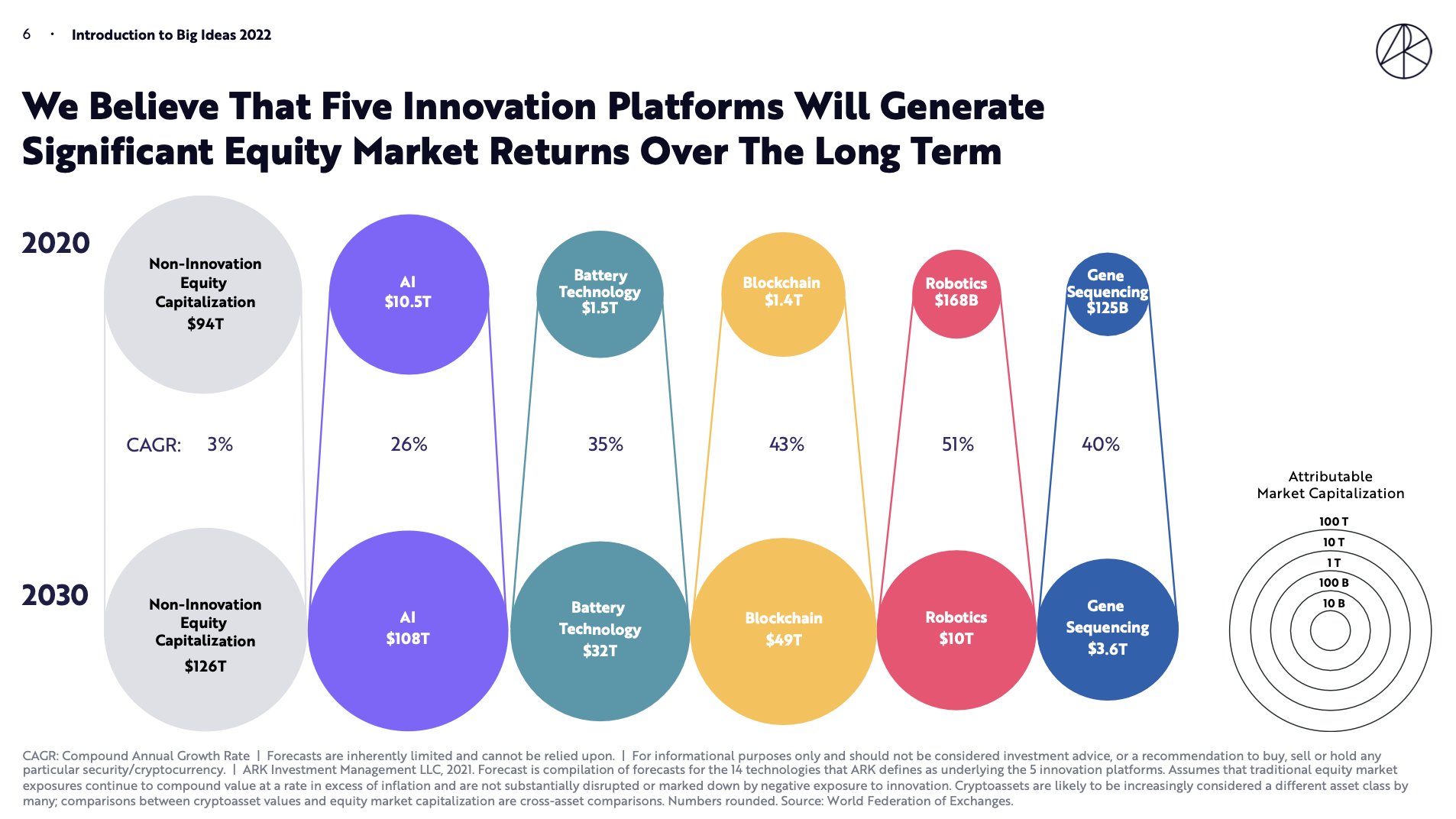

At an aggregate level our forecasts suggest that innovation platforms will occupy more than half of equity market capitalization up from a bit more than 10% today.

(And this assumes that incumbents will not be placed into severe distress; that bubble on the left could shrink)

(And this assumes that incumbents will not be placed into severe distress; that bubble on the left could shrink)

@threadreaderapp unroll