Thread

I've studied hundreds of cognitive biases to become a better Crypto investor.

Here are the 14 most important ones:

Here are the 14 most important ones:

Have you ever:

• Fomo'ed into a COIN at all time highs?

• Sell your bluechips for shitcoins?

• Lose 50% on a coin, and lose another 45% bc you didn't cut your losses?

That's cognitive biases working against ya.

They're "thinking" errors aka bugs in your brain.

• Fomo'ed into a COIN at all time highs?

• Sell your bluechips for shitcoins?

• Lose 50% on a coin, and lose another 45% bc you didn't cut your losses?

That's cognitive biases working against ya.

They're "thinking" errors aka bugs in your brain.

/1 Unit bias

People prefer to buy a “whole unit” of a token, rather than a fraction of it.

It's why meme coins exploded.

Don't overweigh the value of a token because it's "cheap."

Understanding how market caps work.

People prefer to buy a “whole unit” of a token, rather than a fraction of it.

It's why meme coins exploded.

Don't overweigh the value of a token because it's "cheap."

Understanding how market caps work.

/2 Anchoring bias

Over-reliance on the 1st piece of information you have.

You heard about Bitcoin at $1,000.

You missed out.

Then it GOES UP to $5,000.

You don't want to buy it anymore. It's "too expensive" in your head.

Evaluate it based on its POTENTIAL not its PAST.

Over-reliance on the 1st piece of information you have.

You heard about Bitcoin at $1,000.

You missed out.

Then it GOES UP to $5,000.

You don't want to buy it anymore. It's "too expensive" in your head.

Evaluate it based on its POTENTIAL not its PAST.

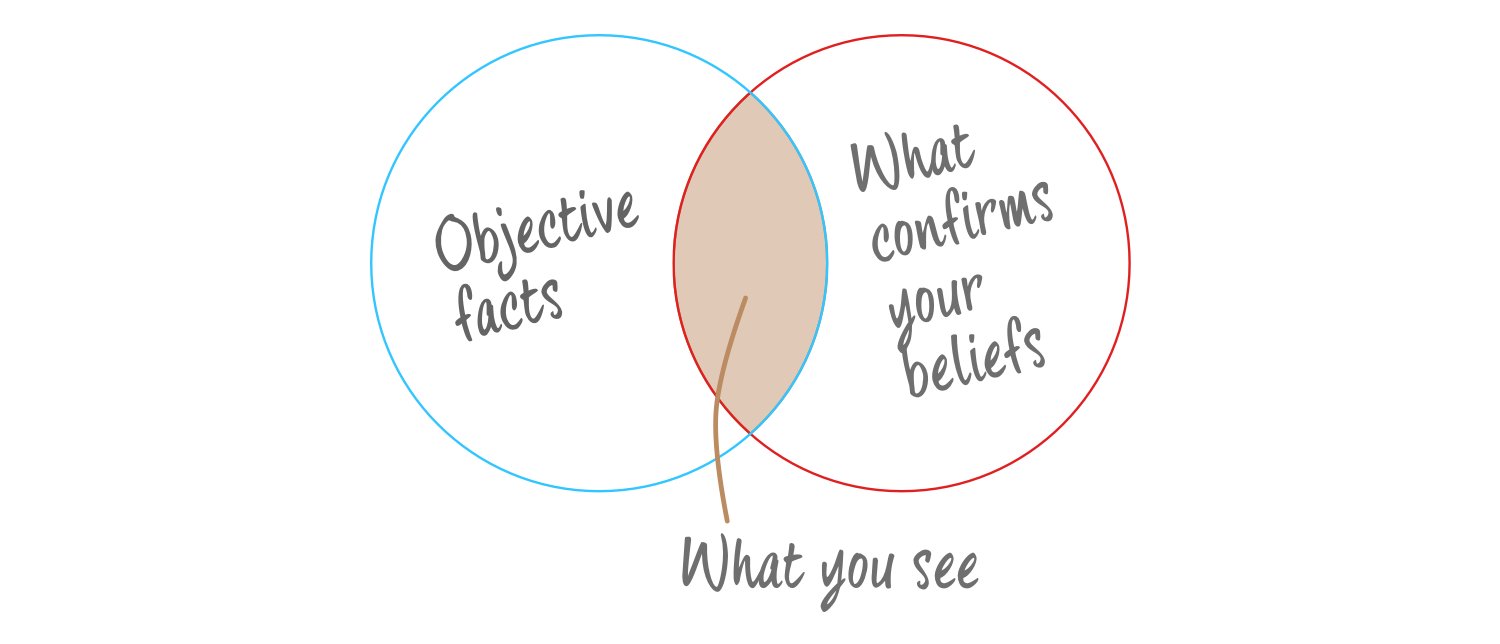

/3 Confirmation bias

You only seek out information that tells you what you want to hear.

You only follow people that say good things about X coin.

You unfollow and block anyone that spreads “FUD.”

When you invest, seek and research the FUD to see if it's valid.

You only seek out information that tells you what you want to hear.

You only follow people that say good things about X coin.

You unfollow and block anyone that spreads “FUD.”

When you invest, seek and research the FUD to see if it's valid.

/4 Sunk cost bias

A cost that has occurred and can't be recovered.

We have a tendency to keep investing more money or OVER-committing because we're scared of losing our original investment.

A cost that has occurred and can't be recovered.

We have a tendency to keep investing more money or OVER-committing because we're scared of losing our original investment.

Sunk costs in real life

You've invested $10k into your friend's Frozen yogurt shop. It's doing horrible.

"I need another $5k for a milkshake machine"

You might be tempted to invest more to "save" your $10k.

Don't throw good money after the bad.

You've invested $10k into your friend's Frozen yogurt shop. It's doing horrible.

"I need another $5k for a milkshake machine"

You might be tempted to invest more to "save" your $10k.

Don't throw good money after the bad.

Sunk cost in Crypto

You're -70% on a coin.

You still have 30% left.

That's 70% is gone.

That 30% could be better off investing somewhere else, rather than hoping the original investment bounces back.

You're -70% on a coin.

You still have 30% left.

That's 70% is gone.

That 30% could be better off investing somewhere else, rather than hoping the original investment bounces back.

/5 Loss aversion

Losing money feels worse than gaining money.

Anyone that has been in Vegas knows what I'm talking about.

Winning +$100 does not feel the same as losing $100.

Losing is painful.

A study shows that the brain typically assigns 2.5x to a loss.

+250 = -$100

Losing money feels worse than gaining money.

Anyone that has been in Vegas knows what I'm talking about.

Winning +$100 does not feel the same as losing $100.

Losing is painful.

A study shows that the brain typically assigns 2.5x to a loss.

+250 = -$100

An example is when your investment is down 50% and there's more bad news.

You can close the trade and cut your losses.

Loss aversion means some ppl will PREFER to wait it out.

They're afraid of "losing" the money by selling.

You can close the trade and cut your losses.

Loss aversion means some ppl will PREFER to wait it out.

They're afraid of "losing" the money by selling.

Loss Aversion leading to risk avoidance

There has been a handful of rugs in DeFi.

I've seen some ppl vow to never invest in DeFi again!

Their loss aversion means they'll be missing out on life changing gains.

Weigh the risks vs rewards properly.

There has been a handful of rugs in DeFi.

I've seen some ppl vow to never invest in DeFi again!

Their loss aversion means they'll be missing out on life changing gains.

Weigh the risks vs rewards properly.

/6 Recency Bias

We overweight RECENT information and events.

"ETH's price is boring. I'm going to chase after low cap coins"

Then they get wrecked in bear markets.

You can beat recency bias by zooming out on the charts.

We overweight RECENT information and events.

"ETH's price is boring. I'm going to chase after low cap coins"

Then they get wrecked in bear markets.

You can beat recency bias by zooming out on the charts.

/7 Overconfidence Bias

We overestimate our own abilities.

We get lucky a few times, and think we're smarter than we really are.

The key to beating Overconfidence is solid risk management strategies

We overestimate our own abilities.

We get lucky a few times, and think we're smarter than we really are.

The key to beating Overconfidence is solid risk management strategies

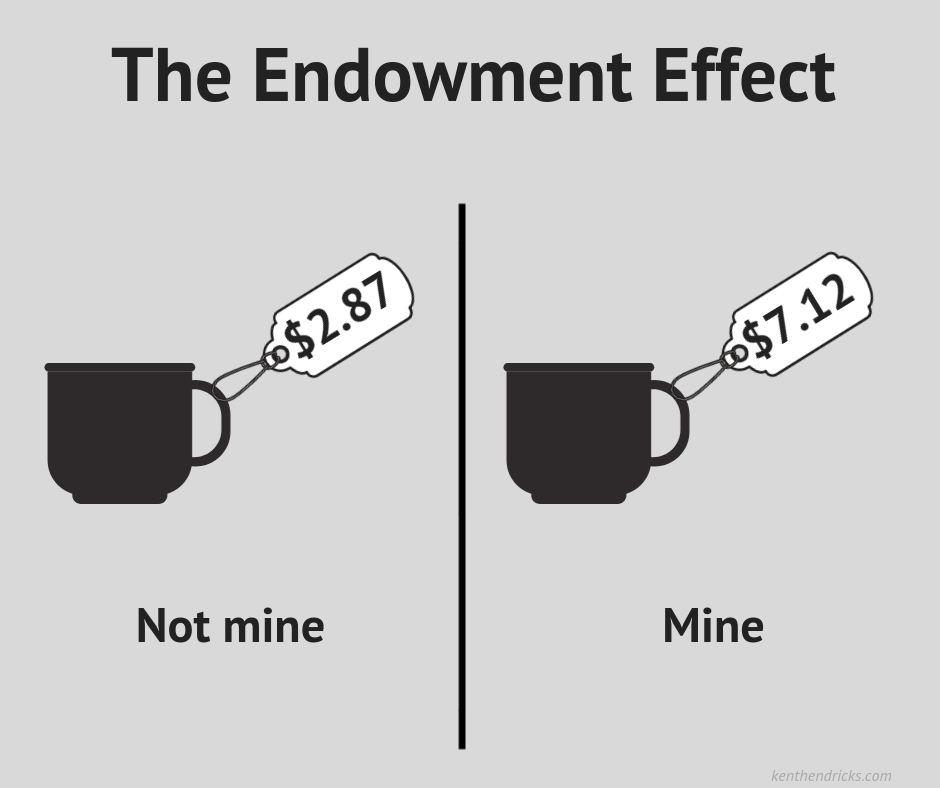

/8 Endowment Effect

You become emotionally attached to your bags.

We place a higher value on an investment because we own it.

I see this a lot with ETH maxis.

They made great gains with it, and become emotionally attached.

They ignore all other L1's.

You become emotionally attached to your bags.

We place a higher value on an investment because we own it.

I see this a lot with ETH maxis.

They made great gains with it, and become emotionally attached.

They ignore all other L1's.

How to Beat The Endowment Effect

Zero based decision making.

"If I didn't own this investment, would I invest in it today?

This keeps your decision more neutral.

Zero based decision making.

"If I didn't own this investment, would I invest in it today?

This keeps your decision more neutral.

/9 Survivorship Bias

Brad Pitt moved to LA and was a waiter before becoming a movie star.

Many people have followed his path hoping to do the same.

You don't hear about the THOUSANDS of other ppl who tried the same and failed.

Brad Pitt moved to LA and was a waiter before becoming a movie star.

Many people have followed his path hoping to do the same.

You don't hear about the THOUSANDS of other ppl who tried the same and failed.

Someone turned $8,000 of Shiba Inu into $5.7B.

You don't hear about the thousands of others who turned $8k into $500

The media prefers writing about the winners, and this skews your perception of the odds.

Plottwist: I am Brad Pitt

You don't hear about the thousands of others who turned $8k into $500

The media prefers writing about the winners, and this skews your perception of the odds.

Plottwist: I am Brad Pitt

/10 Narrative Bias

Humans love stories. It helps us make sense of the world.

Some coins explode BECAUSE of the story.

Remember GameStop last year?

It was a revolution against Wallstreet. Ppl invested for the NARRATIVE.

Humans love stories. It helps us make sense of the world.

Some coins explode BECAUSE of the story.

Remember GameStop last year?

It was a revolution against Wallstreet. Ppl invested for the NARRATIVE.

/11 Herd Mentality Bias

Investors’ tendency to follow and copy what other investors are doing.

They are largely influenced by emotion and instinct, rather than by their own independent analysis.

If you've ever felt FOMO, it could be because of herd mentality

Investors’ tendency to follow and copy what other investors are doing.

They are largely influenced by emotion and instinct, rather than by their own independent analysis.

If you've ever felt FOMO, it could be because of herd mentality

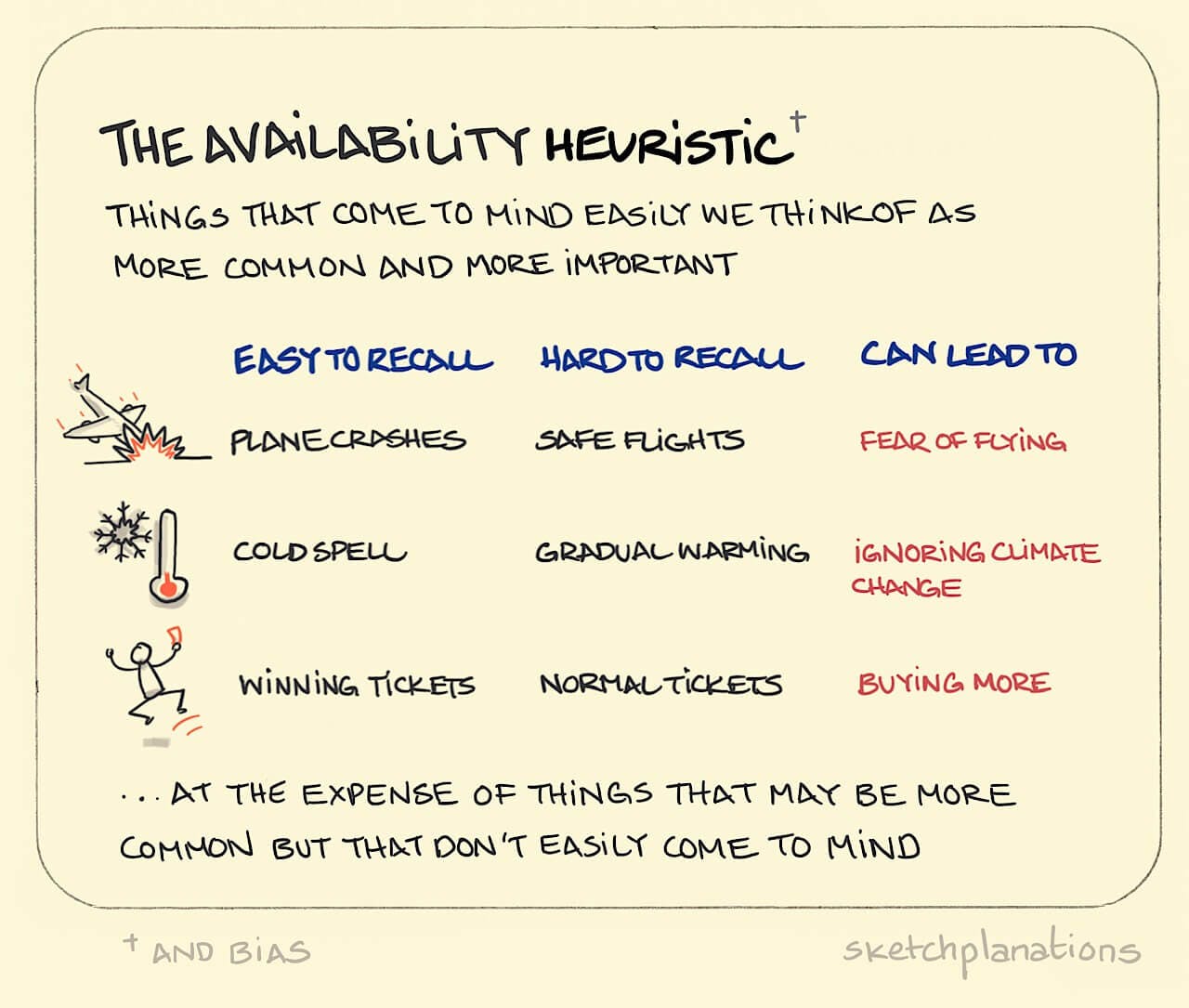

/12 Availability Heuristic

You make judgments based on how easy it is to remember information.

After major airplane crashes, there's usually a fear of flying.

However,

• 1 in 9,821 die in a plane crash

• 1 out of 114 die in a car accident

Planes are much safer

You make judgments based on how easy it is to remember information.

After major airplane crashes, there's usually a fear of flying.

However,

• 1 in 9,821 die in a plane crash

• 1 out of 114 die in a car accident

Planes are much safer

In Crypto, the availability bias presents itself in marketing.

A coin might be pumping because it has great marketing.

Marketing is important, but make sure that it isn't masking a terrible project.

A coin might be pumping because it has great marketing.

Marketing is important, but make sure that it isn't masking a terrible project.

/13 Outcome Bias

Outcome bias is an error made in evaluating the quality of a decision when the outcome of that decision is already known

Outcome bias is an error made in evaluating the quality of a decision when the outcome of that decision is already known

Imagine going all in with AA vs. JJ in Poker, and losing.

You made a GREAT decision but it let to a BAD outcome.

(AA has 80% chance of winning in this case)

You invest $10k into a shitcoin that is now worth $100k.

That had a great outcome, but it was a poor decision.

You made a GREAT decision but it let to a BAD outcome.

(AA has 80% chance of winning in this case)

You invest $10k into a shitcoin that is now worth $100k.

That had a great outcome, but it was a poor decision.

Another angle of Outcome Bias

Imagine if the scenario was replayed a thousand times.

You have to account for variance.

You can do everything right and the outcome STILL won't be right.

That's life.

But you should always make the decision with the best ODDS and PROBABILITY.

Imagine if the scenario was replayed a thousand times.

You have to account for variance.

You can do everything right and the outcome STILL won't be right.

That's life.

But you should always make the decision with the best ODDS and PROBABILITY.

/14 Authority Bias

This is our natural tendency to follow the leader.

Once we believe someone is an expert, we trust everything they say.

"They're the expert, they must be right!"

• Experts can be wrong

• Experts can have ulterior motives

This is our natural tendency to follow the leader.

Once we believe someone is an expert, we trust everything they say.

"They're the expert, they must be right!"

• Experts can be wrong

• Experts can have ulterior motives

How do you stop Cognitive Biases?

Well, you're already doing a great job. At least you're aware of them!

Here are some strategies I use to lower the damage of cognitive biases.

Well, you're already doing a great job. At least you're aware of them!

Here are some strategies I use to lower the damage of cognitive biases.

Call Them Out

My friend bought $100 non-refundable tickets to see a show.

He had the chance to do a consulting gig that night for $500.

He didn't want to lose the $100 he spent.

I told him that the sunk cost bias was affecting his decision making.

(I'm fun at parties btw)

My friend bought $100 non-refundable tickets to see a show.

He had the chance to do a consulting gig that night for $500.

He didn't want to lose the $100 he spent.

I told him that the sunk cost bias was affecting his decision making.

(I'm fun at parties btw)

Develop a Cognitive Bias checklist

Whenever I'm making an investment decision, I go through my cognitive biases checklist.

This keeps me aware of my own thinking flaws.

Whenever I'm making an investment decision, I go through my cognitive biases checklist.

This keeps me aware of my own thinking flaws.

Consider creating your own Systems for investing

Formulas can help keep your emotions in check.

Formulas can help keep your emotions in check.

Keep a trading log.

I keep a Google Spreadsheet that contains all my trades.

Besides the financial data, I also write about some of my thesis.

If I exited early, I will write down any issues I faced.

BTW, it's in my plans for me to create a free template for you.

I keep a Google Spreadsheet that contains all my trades.

Besides the financial data, I also write about some of my thesis.

If I exited early, I will write down any issues I faced.

BTW, it's in my plans for me to create a free template for you.

Use Cognitive Biases to Your ADVANTAGE

Understanding cognitive biases mean you can profit from others.

A coin that has a good narrative + charismatic leader + marketing (availability bias) + herd mentality

The more cultish, the more profit potential.

Understanding cognitive biases mean you can profit from others.

A coin that has a good narrative + charismatic leader + marketing (availability bias) + herd mentality

The more cultish, the more profit potential.

Just make sure you take profits along the way.

Here are some additional resources if you want to study cognitive biases more.

It's well worth the effort.

@farnamstreet

@sahilbloom

Books:

• The Art of Thinking Clearly

• Thinking Fast & Slow

• Thinking in Bets

It's well worth the effort.

@farnamstreet

@sahilbloom

Books:

• The Art of Thinking Clearly

• Thinking Fast & Slow

• Thinking in Bets

If you liked this thread, you’ll also like my weekly newsletter.

My goal is to teach you how to become a better investor rather than "this coin will 100x next week 🤯🤯🤯"

Subscribe below, it's free.

TheDeFiEdge.com

My goal is to teach you how to become a better investor rather than "this coin will 100x next week 🤯🤯🤯"

Subscribe below, it's free.

TheDeFiEdge.com

Mentions

See All

Sahil Bloom @SahilBloom

·

Feb 8, 2022

Great thread.