Thread

This is literal, verifiable, blatant fake news. Completely fraudulent academia. The de vries paper this is based on comes up with this estimate out of pure thin air. Any miner would tell you different

1. virtually all ASIC parts are recyclable. there's nothing toxic in them. they're not full of nasty stuff like cell phones. they dont have batteries. they are mostly made of aluminum. there's a financial incentive to recycle them obviously.

2. public miners disclose their depreciation schedules for accounting reasons. your average public miner depreciates them over 3 years. and that's not even realized depreciation, that's just expected. in practice it's longer.

3. 25% of the network consists of s9s, a miner that was released in **2016**. those are 6 year old machines, still going strong. because if you have sufficiently cheap electricity, it makes sense to run an s9. again, any miner will tell you this.

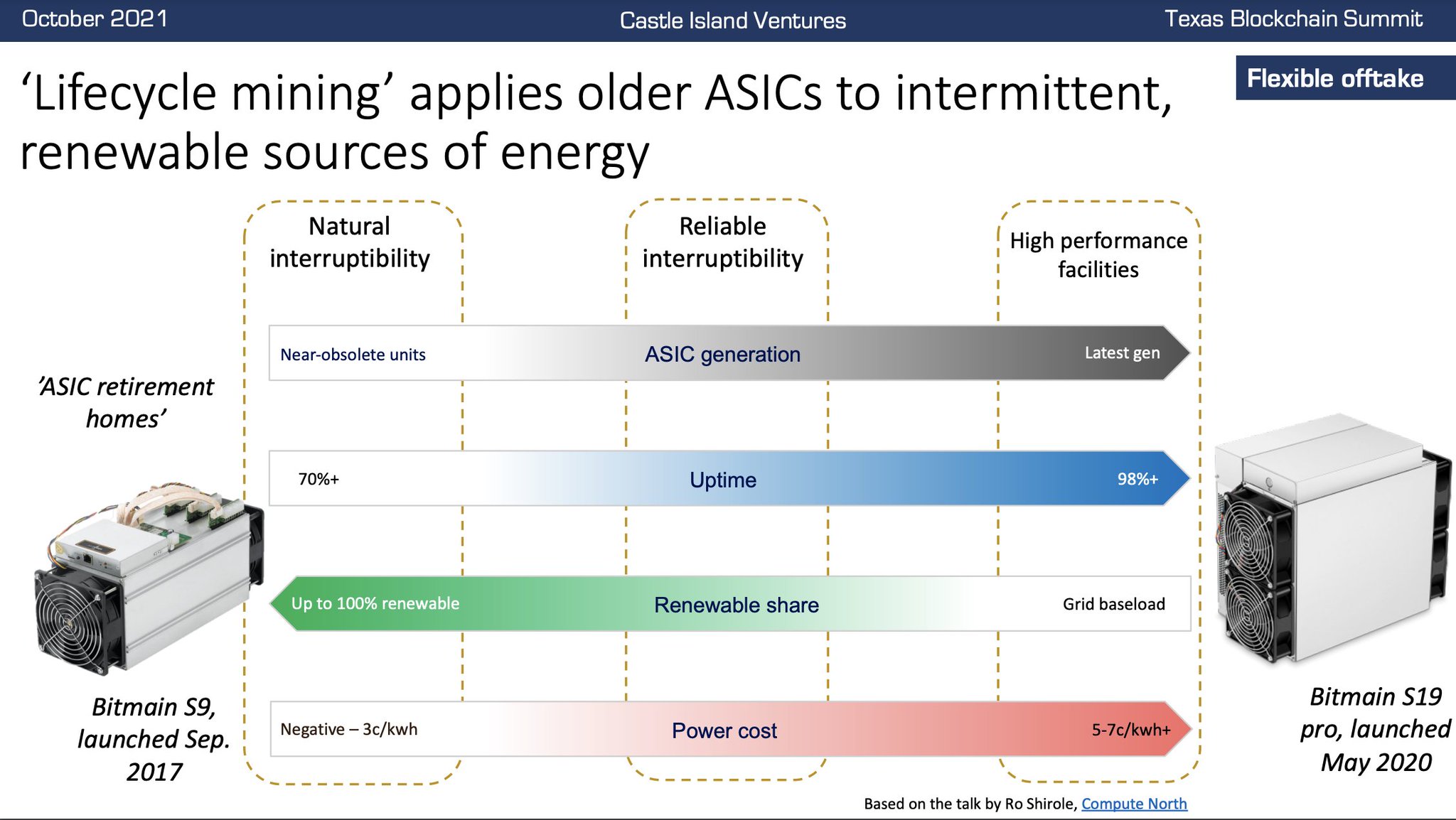

4. there is a vibrant secondary market for old ASICs. in practice, old miners have 'retirement homes' where they head to cheaper, more intermittent sources of energy. there's almost always a willing buyer for a miner, even if it's not a high end new machine.

5. the number of bitcoin mining ever produced is in the single digit millions. 1.5 billion smart phones are produced every year. bitcoin mining manufacturers are just not producing the kind of volume critics allege.

6. the infamous de vries estimate (he works for the dutch central bank) is based on a completely handwavy generalization of hardware depreciation. he has no actual mining expertise and clearly didnt consult any miners.

we're talking about a market for simple hardware which is made of a few components, with no batteries or other actually toxic materials, which literally print money if you can find cheap electricity, even if 'obsolete'. of course these don't get junked.

this is just one claim out of dozens in the thread, but it shows how the academia -> press -> pundit pipeline works. remember to tackle this stuff at the source: the fraudulent academia where it first emerges.

in case you're curious, this is where the 16 month estimate comes from. de vries 2019 and de vries & stoll 2021. (2021 is paywalled, see screenshot)

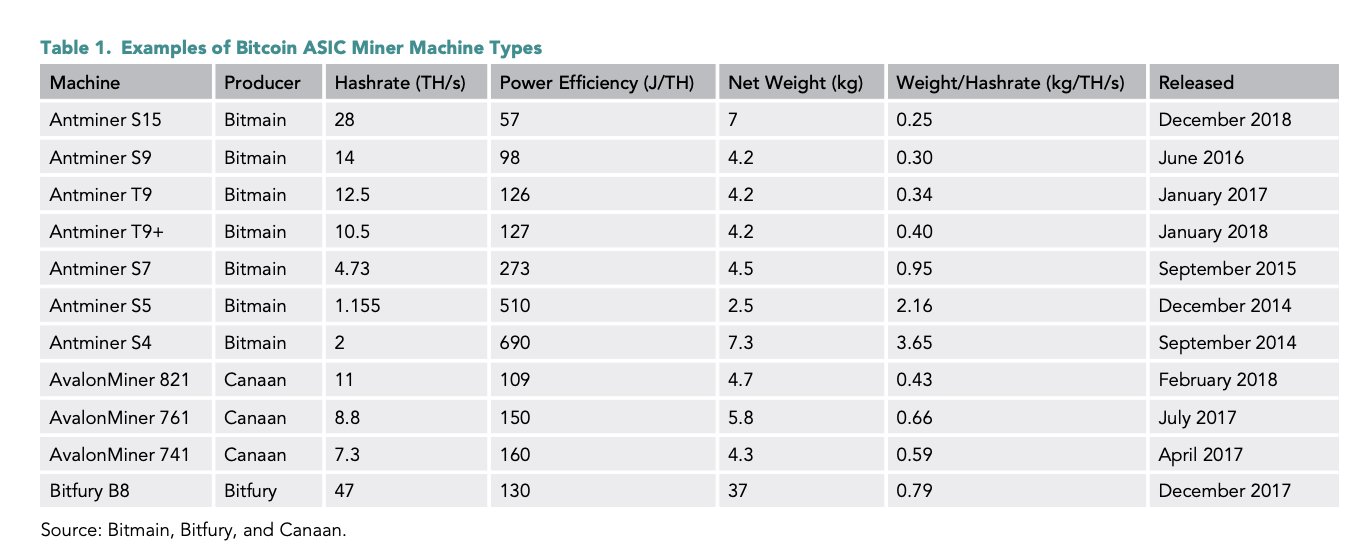

de vries's 1.5 year depreciation estimate is _completely_ baseless for 2 reasons. 1) he assumes that when a new vintage of ASICs is released, **all prior ASICs become immediately defunct**. this is obviously false. they just become less economical, but still run w/ cheap energy

new ASIC vintages don't mean all prior ASICs are immediately discarded. it just means that older ASICs have lower breakeven energy costs. however, some providers will always have 0 or near-0 priced energy, so older ASICs are almost always economical for some.

second, and perhaps more egregiously, De Vries applies a completely general, and non specific law – Koomey's law – to Bitcoin hardware, naively assuming that because computer hardware generally becomes more efficient, Bitcoin ASICs _must_ be thrown out every 18 mo.

forget about the fact that Koomey's law was revised to 2.6 years (from 1.5) for hardware after 2000, and the fact that newer vintages don't doom older hardware. de vries defines Bitcoin economics based on random, general observations around computing

en.wikipedia.org/wiki/Koomey%27s_law

en.wikipedia.org/wiki/Koomey%27s_law

De Vries is completely wrong about new mining vintages "obsoleting" prior generations. Yes they are more efficient, but that doesn't mean that older hardware is junked. that would be insane. there is a distinct lifecycle to hardware, which ends with recycling.

some references:

Galaxy calls a 3-year depreciation on ASICs reasonable yet conservative. in practice, it's normally too steep

docsend.com/view/nk6szu7i8e6tv45m

Galaxy calls a 3-year depreciation on ASICs reasonable yet conservative. in practice, it's normally too steep

docsend.com/view/nk6szu7i8e6tv45m

Lifecycle mining is the term for what happens to miners in retirement. They go to lower-power producers. Compute North's Ro Shirole covered it in a talk at a Miami mining conference. I made a slide about it in my talk in austin

www.youtube.com/watch?v=NkpTX4XvnHY&t=18440s

www.youtube.com/watch?v=NkpTX4XvnHY&t=18440s

ASIC prices also debunk the de vries idea that non-new vintages are instantly junked. they have an economic value, obviously they aren't trashed. literally just look at ASIC prices. even s9s are worth something

data.hashrateindex.com/asic-index-data

data.hashrateindex.com/asic-index-data

once you've understood what actual miners know, it's obvious that this 1.5y depreciation-and-full-write off schedule is massively flawed, to the point of being flat earth tier. not a single ounce of actual market research went into the estimate. it's just a naked assertion

but because it was written in a (paywalled) aCaDeMiC pUbLiCaTiOn it gets cited over and over in the press.

the author literally works for the dutch central bank, and has published flawed work on mining elsewhere. this is just one component of his paid opposition research.

the author literally works for the dutch central bank, and has published flawed work on mining elsewhere. this is just one component of his paid opposition research.

these people hate us, because Bitcoin is a threat to their way of life. they demand surveillance money. so they come up with completely made up, junk science to discredit us. but their stooges like de vries come up with paper thin 'academia', so they are pretty easy to debunk.