Thread by Sovereign Origin 🥕/21M

- Tweet

- Feb 22, 2022

- #Bitcoin

Thread

I present the #SuperHodl automated savings protocol using #bitcoin on @SovrynBTC 0% BTC-collateralized loans, lending pool and spot market products (not released yet).

Collateral ratio can be showed safe against backtesting.

Multiply your BTC over time!

Tagging @EdanYago

🧵👇

Collateral ratio can be showed safe against backtesting.

Multiply your BTC over time!

Tagging @EdanYago

🧵👇

Each data point here shows a different starting point in BTC's history, starting around 8 years ago and taking 50 steps in history incrementally, every time running a shorter and shorter period.

The blue line shows the BTC gains over that period.

The blue line shows the BTC gains over that period.

The algorithm takes your stash, 0%-loans USD against it, and splits it up in margin BTC buys & lending pool deposit. Then, as price changes (daily in current algo), it decides on paying back the loan to keep CR within a safe zone (price drops), or buying more BTC (rising price).

Here you can see the same gains in USD terms (end portfolio is fully in BTC, and shown is the gain factor value in USD terms.

Note the algorithm does NOT optimize for increasing your USD portfolio value but rather aims to stack BTC.

Hence, reduced gains @ the current price.

Note the algorithm does NOT optimize for increasing your USD portfolio value but rather aims to stack BTC.

Hence, reduced gains @ the current price.

At the end of the period, we use all our USD and whatever BTC needed to pay back the loan. So the "final value" is no longer including any margin; it's all yours for spending, or hodling in a regular way, or ....

maybe just keep SuperHodling. :-)

maybe just keep SuperHodling. :-)

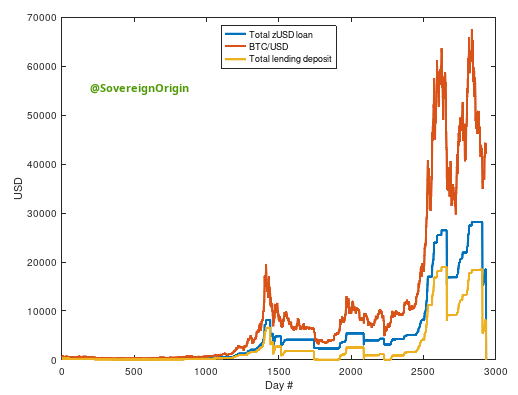

Example algorithm output for the longest duration SuperHodl for a 1-BTC start.

As you see, the lending deposit sometimes hits 0. At that point, further drops may cause liquidation. Historically however? Never got worse than those drops.

At the end, reset to 0 is loan repayment.

As you see, the lending deposit sometimes hits 0. At that point, further drops may cause liquidation. Historically however? Never got worse than those drops.

At the end, reset to 0 is loan repayment.

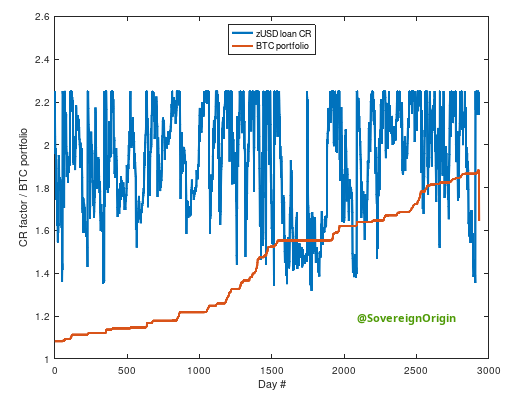

CR factor should remain above 1.1 (110%) at all times.

Here's the historical evolution the protocol maintains.

CR target is set to 225%, and never drops below 135%.

Here's the historical evolution the protocol maintains.

CR target is set to 225%, and never drops below 135%.

#HODL on!