Thread

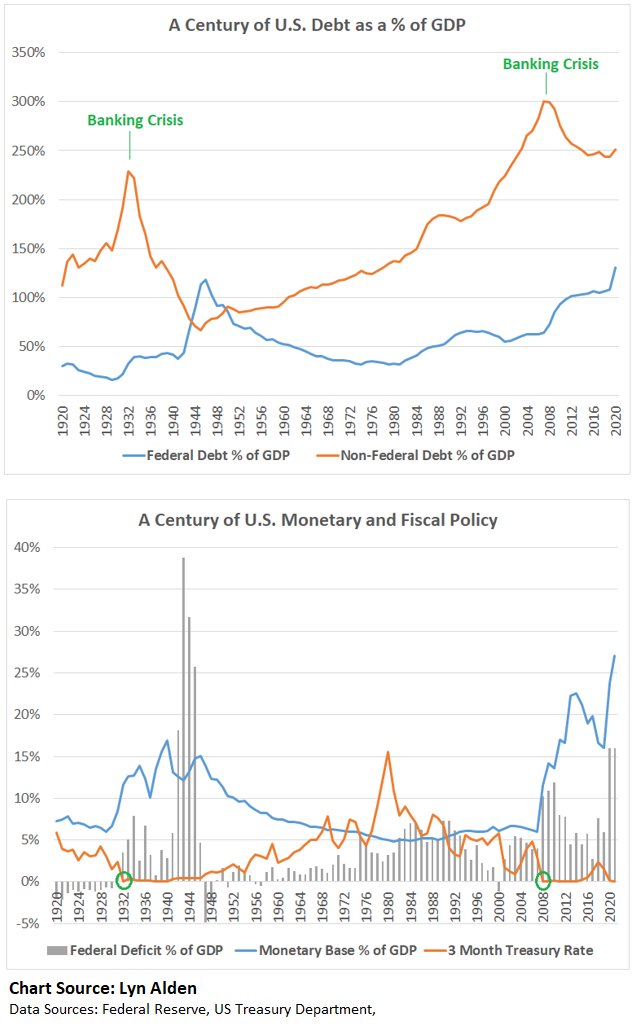

The modern financial system is based on the premise of constant (and relatively smooth) growth indefinitely, including persistent credit growth.

War and commodity shortages threaten the whole model.

🧵

War and commodity shortages threaten the whole model.

🧵

A low-leverage system can take shocks. For example, a solid business with little/no debt can have its cash flows go up and down based on economic conditions, without blowing up.

Up years are fun, down years aren't, but it's okay either way.

Up years are fun, down years aren't, but it's okay either way.

A high-leverage system can't take shocks. If businesses, households, and sovereigns are all highly-levered, it requires constant growth to avoid a systemic meltdown.

A lack of sufficient commodities makes it very, very hard to grow.

A lack of sufficient commodities makes it very, very hard to grow.

Households and companies then have trouble serving their debts, and those creditors then have trouble paying their own debts, etc.

Employment slows, tax revenue falls, sovereign deficits widen and get monetized by the central bank, etc.

Employment slows, tax revenue falls, sovereign deficits widen and get monetized by the central bank, etc.

In a low-leverage system, high commodity prices can result in recessionary conditions, higher interest rates, and thus less demand. The demand side shrinks to match the tight supply side.

Meanwhile, new capital is incentivized to come in and bring new commodity supply to market.

Meanwhile, new capital is incentivized to come in and bring new commodity supply to market.

But such a high-leverage system blows up if it encounters those recessionary and/or high rate conditions.

The result is usually currency devaluation, stagflation, like an emerging market recession rather than a typical developed market recession.

The result is usually currency devaluation, stagflation, like an emerging market recession rather than a typical developed market recession.

Besides financial leverage, one must also consider social leverage.

In times of relative political unity and a strong social contract, people are willing to go through hardship and sacrifice, viewing it as being in this together.

In times of relative political unity and a strong social contract, people are willing to go through hardship and sacrifice, viewing it as being in this together.

But in times of unusually high wealth concentration, strong political polarization, culture wars, and decaying institutions, people have a much lower threshold for hitting a breaking point, protesting, becoming extreme, etc.

When the pandemic hit in 2020, governments printed trillions of dollars. Investors were shocked, but historians were not really.

Governments did so because they were so financially and socially leveraged, that they couldn't just take a shock and move on. Too leveraged for that.

Governments did so because they were so financially and socially leveraged, that they couldn't just take a shock and move on. Too leveraged for that.

Similarly, the system is not well-prepared for commodity shocks, either shortages or price spikes, nor is it prepared for any degree of deglobalization and a shift from supply chain efficiency towards supply chain resiliency.

www.lynalden.com/march-2022-newsletter/

www.lynalden.com/march-2022-newsletter/

10, 20, or 30-year backtests during structural globalization and disinflation are not very informative here, yet people still use these shorter-term models.

These are 50-80 year types of disruptions. Long-term debt cycle stuff.

These are 50-80 year types of disruptions. Long-term debt cycle stuff.