Thread

We used to own the American dream, now we rent it.

Why it’s so hard to buy a home and what that means for us all 🧵

Why it’s so hard to buy a home and what that means for us all 🧵

Home ownership has always been a huge part of the American dream.

It’s tied closely to the values that are fundamental to all of us.

Family, property, community, independence, etc.

But starting a family with even a small home is becoming out of reach for most.

It’s tied closely to the values that are fundamental to all of us.

Family, property, community, independence, etc.

But starting a family with even a small home is becoming out of reach for most.

And when owning a home your only path toward generational wealth...it's a problem.

There are two primary issues:

1. Housing prices are up an inflation-adjusted 20% since the beginning of the pandemic

2. We are currently short about 4,000,000 homes

They're related.

There are two primary issues:

1. Housing prices are up an inflation-adjusted 20% since the beginning of the pandemic

2. We are currently short about 4,000,000 homes

They're related.

Between 2010 and 2020, we built fewer homes than any decade since the mid century.

At the beginning of the pandemic it got worse.

Huge shortages of construction workers and sky rocketing commodity prices kept inventory extremely low relative to demand.

At the beginning of the pandemic it got worse.

Huge shortages of construction workers and sky rocketing commodity prices kept inventory extremely low relative to demand.

And when everyone realized they could work from anywhere...

They left the cities looking for homes to buy, and with super low interest rates, why not.

This massive influx of demand strained the system even more than it already was.

People with property got richer.

They left the cities looking for homes to buy, and with super low interest rates, why not.

This massive influx of demand strained the system even more than it already was.

People with property got richer.

But that's not the whole story.

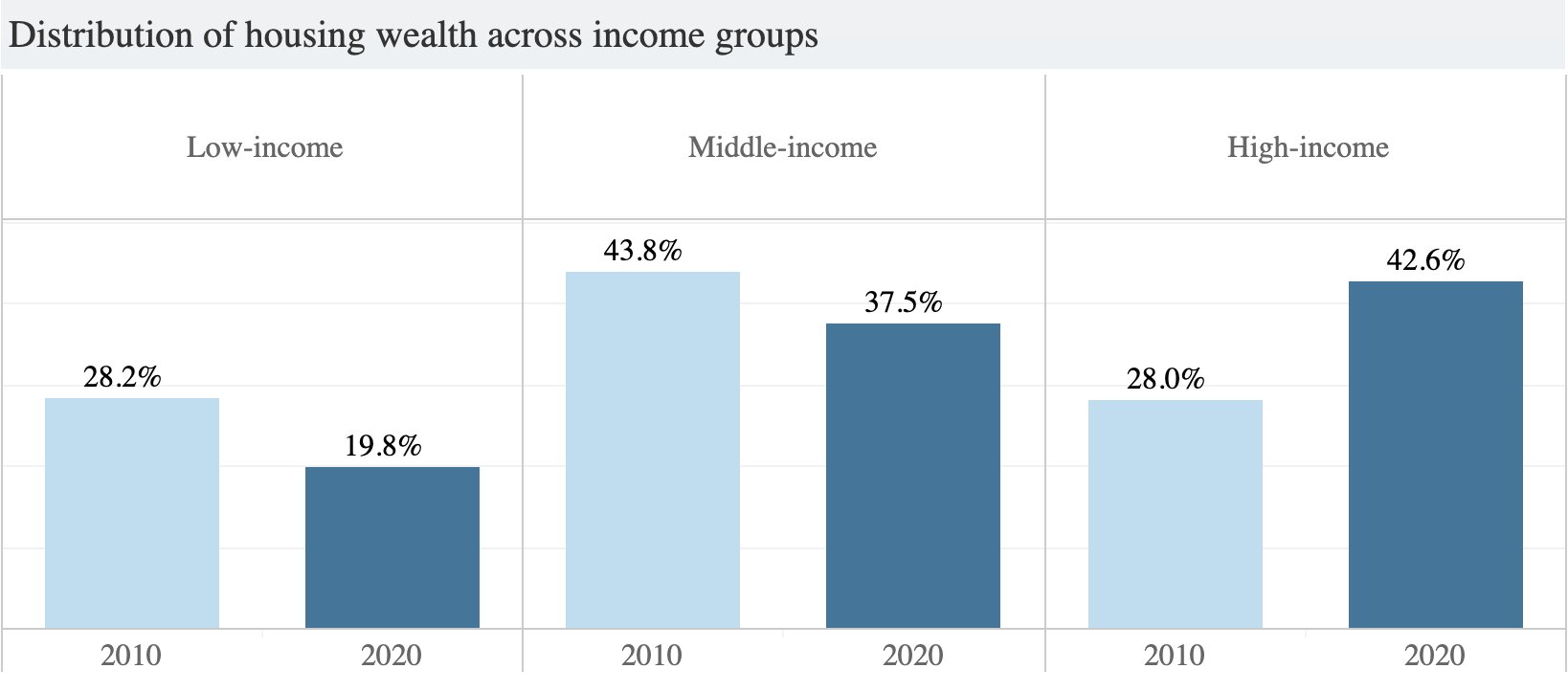

The gains from home ownership are not being spread evenly.

Between 2010 and 2020, the value of owner occupied housing grew from $16 trillion to $24.2 trillion.

That’s a lot of wealth creation! Great right?

Not so much.

The gains from home ownership are not being spread evenly.

Between 2010 and 2020, the value of owner occupied housing grew from $16 trillion to $24.2 trillion.

That’s a lot of wealth creation! Great right?

Not so much.

72% of that value went to high-income earners, with only 4% going to low income brackets.

The rich (home owners) get richer and everyone else (renters) doesn't.

The people who depend the most on home ownership for wealth creation, are the ones who are increasingly priced out.

The rich (home owners) get richer and everyone else (renters) doesn't.

The people who depend the most on home ownership for wealth creation, are the ones who are increasingly priced out.

This is going to get worse as mortgage rates spike.

“A borrower on a $500,000 mortgage at a 3.11% fixed rate would have faced a $2,138 monthly payment. Now, at a 4.16% rate, that soars to $2,433. That's an additional $106,400 over the course of the 30-year mortgage." - Fortune

“A borrower on a $500,000 mortgage at a 3.11% fixed rate would have faced a $2,138 monthly payment. Now, at a 4.16% rate, that soars to $2,433. That's an additional $106,400 over the course of the 30-year mortgage." - Fortune

So, without the ability to buy people are forced to rent much longer.

No ownership involved, no wealth creation.

But thanks to rising home prices, renting in any kind of desirable location is also becoming difficult.

No ownership involved, no wealth creation.

But thanks to rising home prices, renting in any kind of desirable location is also becoming difficult.

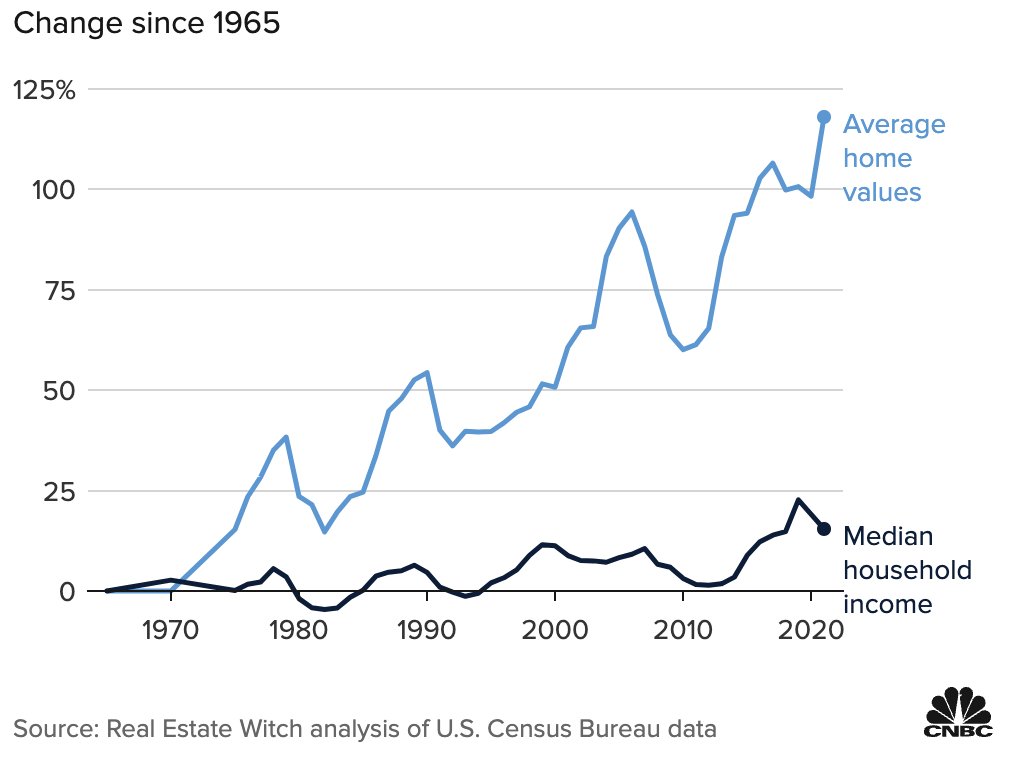

It’s the same story as usual.

The price of the asset is rising at a rate many multiples faster than incomes.

And that growth is being passed on to renters as purchasers buy for higher prices.

The price of the asset is rising at a rate many multiples faster than incomes.

And that growth is being passed on to renters as purchasers buy for higher prices.

How much are renters feeling the pain from skyrocketing home prices?

In Austin, rent rose 40% last year.

Here’s how that would play out:

In Austin, rent rose 40% last year.

Here’s how that would play out:

If you signed a lease in Austin last year for $1k/month, it would be $1.4k/month this year.

But because the reason is rising home prices in the area...

Every rental unit in the area will have a similar increase.

Suddenly you’re priced out of your home AND your city.

But because the reason is rising home prices in the area...

Every rental unit in the area will have a similar increase.

Suddenly you’re priced out of your home AND your city.

A lot of fingers are being pointed at institutional investors for this.

And it’s true that large funds are buying more single family homes than ever.

Nearly 20% of homes sold in 2021 where bought by investors (in some areas as high as 30%).

That number was 6% in 2000.

And it’s true that large funds are buying more single family homes than ever.

Nearly 20% of homes sold in 2021 where bought by investors (in some areas as high as 30%).

That number was 6% in 2000.

For sellers, investors are more attractive than individual buyers.

They offer all cash, and mostly purchase without ever looking at the property.

Cash strapped young families just can’t compete.

So yes, investors are making the housing shortage issue worse.

They offer all cash, and mostly purchase without ever looking at the property.

Cash strapped young families just can’t compete.

So yes, investors are making the housing shortage issue worse.

Would be starter homes are turned into rental properties.

But to be fair to investors, they’re doing their job.

As capital allocators, they want to seek the best risk adjusted returns.

As people start to settle down later in life, demand for rental units has increased.

But to be fair to investors, they’re doing their job.

As capital allocators, they want to seek the best risk adjusted returns.

As people start to settle down later in life, demand for rental units has increased.

Investors saw this trend and are capitalizing on it.

It’s the job of regulators and legislators to do something if it's harmful.

The can say "Hey this is negatively impacting Americans and here’s a policy to make everyone happy."

(just kidding no policy ever does that).

It’s the job of regulators and legislators to do something if it's harmful.

The can say "Hey this is negatively impacting Americans and here’s a policy to make everyone happy."

(just kidding no policy ever does that).

All of the points above manifest in three major issues that I’m focused on:

1. Access to one of the primary wealth creation engines in the US (real estate) is harder than ever

2. There are not nearly enough homes to meet demand

3. Ownership aside, even renting is too expensive

1. Access to one of the primary wealth creation engines in the US (real estate) is harder than ever

2. There are not nearly enough homes to meet demand

3. Ownership aside, even renting is too expensive

Number one is a problem that I’m seeing a lot of creative people try to solve for.

Primarily by allowing anyone to participate in the asset class without owning a home or having millions of dollars.

More on this next week.

Primarily by allowing anyone to participate in the asset class without owning a home or having millions of dollars.

More on this next week.

For number two and three:

We need to make it easier to build more affordable housing in more parts of the country, especially single family homes.

As people move out of the cities, local governments need to rethink their zoning policies to pave the way for more construction.

We need to make it easier to build more affordable housing in more parts of the country, especially single family homes.

As people move out of the cities, local governments need to rethink their zoning policies to pave the way for more construction.

Every American who works hard to earn a living should be able to afford a home.

But to even get there, rents need to go down and allow people to save.

Until then, housing will continue to be one of our country’s biggest crises, with huge impacts on the rest of the economy.

But to even get there, rents need to go down and allow people to save.

Until then, housing will continue to be one of our country’s biggest crises, with huge impacts on the rest of the economy.

@kairyssdal Let's talk this over on the pod

Mentions

There are no mentions of this content so far.