Thread by The DeFi Edge

- Tweet

- Mar 28, 2022

- #DecentralizedFinance

Thread

Most people suck at building a Crypto Portfolio.

They're too aggressive & get wrecked.

or they playing it too safe and leaving $ on the table.

Here's how to build a solid Crypto Portfolio in 2022:

(+ my personal portfolio recommendation)

They're too aggressive & get wrecked.

or they playing it too safe and leaving $ on the table.

Here's how to build a solid Crypto Portfolio in 2022:

(+ my personal portfolio recommendation)

Portfolio Goals

Your goal is to

↓ Lower Risks

↑ Increase Rewards

(While sticking to YOUR risk tolerance, goals, and your timeline)

There's no perfect portfolio.

I'm going to include some theory + examples, and you have to think about what works for YOU.

Your goal is to

↓ Lower Risks

↑ Increase Rewards

(While sticking to YOUR risk tolerance, goals, and your timeline)

There's no perfect portfolio.

I'm going to include some theory + examples, and you have to think about what works for YOU.

Constructing a Team

Building a portfolio is kinda like constructing a sports team.

Imagine if your team was ONLY Goalies - too much defense and no offense!

Each position in your portfolio has a different role.

Some defend (stablecoins) and are scorers (higher risk)

Building a portfolio is kinda like constructing a sports team.

Imagine if your team was ONLY Goalies - too much defense and no offense!

Each position in your portfolio has a different role.

Some defend (stablecoins) and are scorers (higher risk)

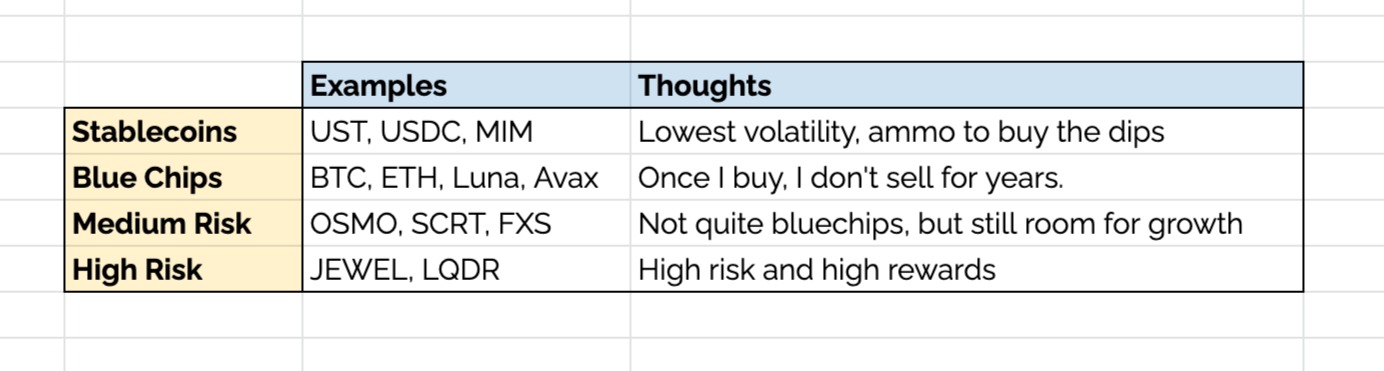

The Role of Each Class

Stablecoins: Preserves capital & serves as ammo to buy dips.

Blue chips: Long-term growth. Long-term hold.

Medium Risk: A nice balance.

High Risk: Your 10-100x plays. Make sure that you take profits.

Let us look at some sample portfolios:

Stablecoins: Preserves capital & serves as ammo to buy dips.

Blue chips: Long-term growth. Long-term hold.

Medium Risk: A nice balance.

High Risk: Your 10-100x plays. Make sure that you take profits.

Let us look at some sample portfolios:

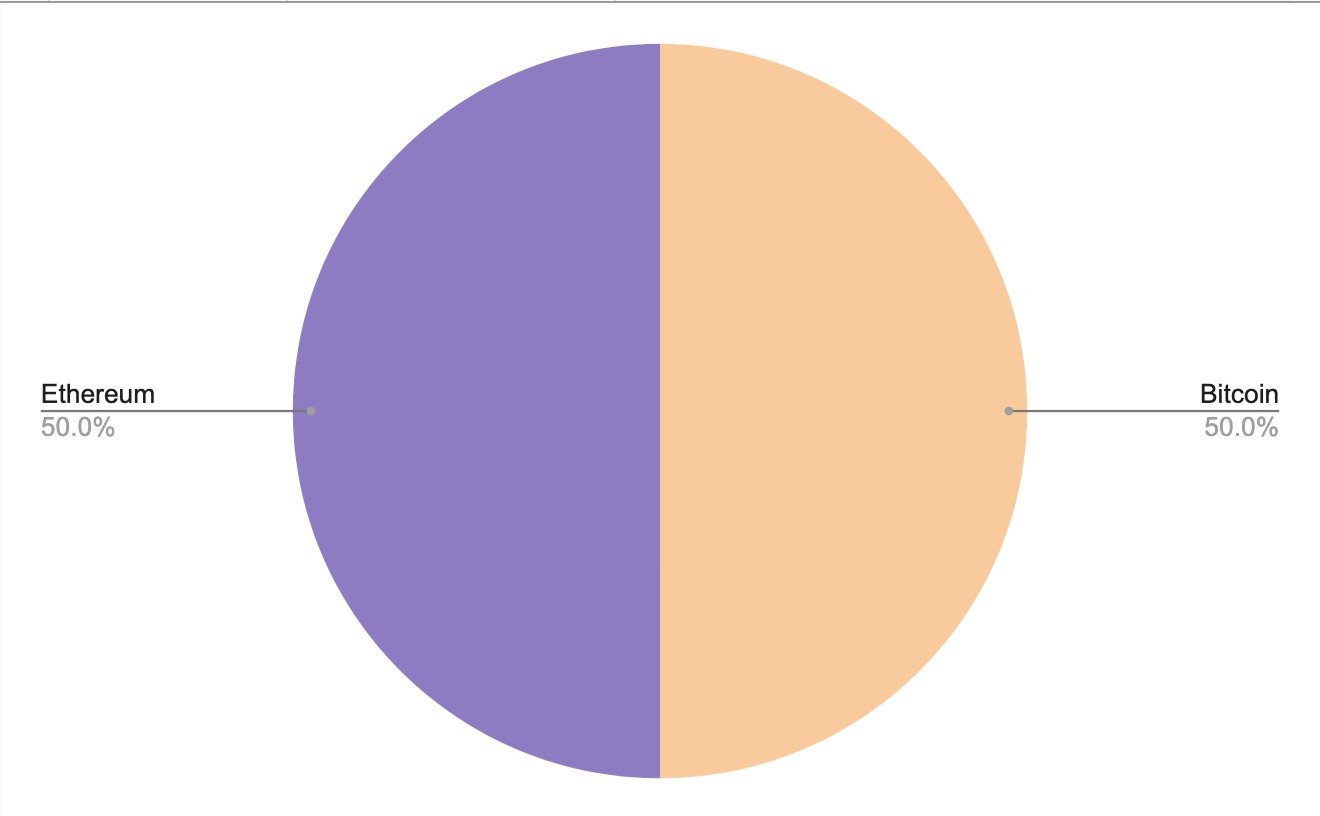

/1 The BTC / ETH Split

For people who want Crypto exposure, but don't want to go down the rabbit hole.

It's safe and simple.

For people who want Crypto exposure, but don't want to go down the rabbit hole.

It's safe and simple.

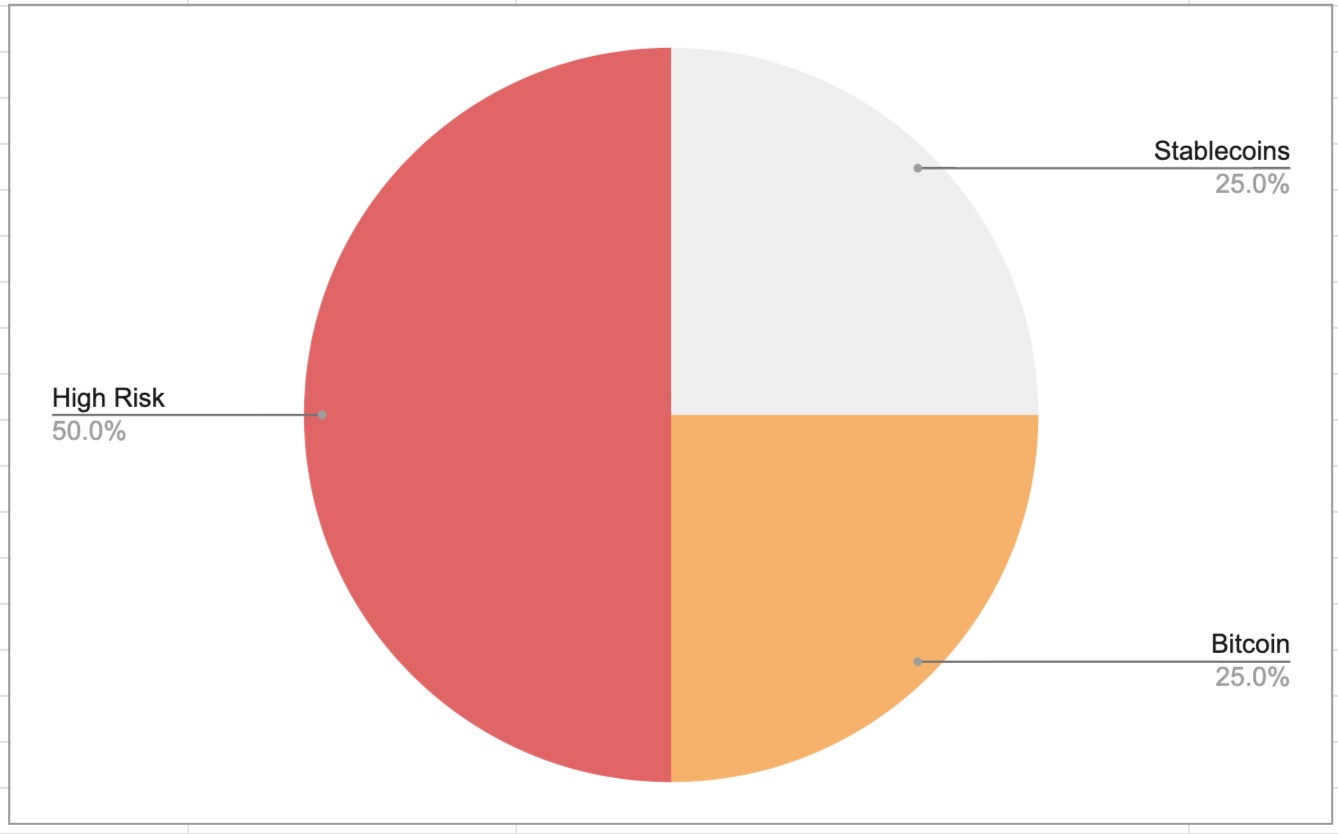

/2 The Barbell Strategy 🏋️

You go to both extremes of the risk curve while avoiding the middle.

• 50% safest assets.

• 50% high-risk plays.

• 0% medium risk.

Made famous by Nassim Taleb, though he'd throw a tantrum if he saw someone apply this to Crypto.

You go to both extremes of the risk curve while avoiding the middle.

• 50% safest assets.

• 50% high-risk plays.

• 0% medium risk.

Made famous by Nassim Taleb, though he'd throw a tantrum if he saw someone apply this to Crypto.

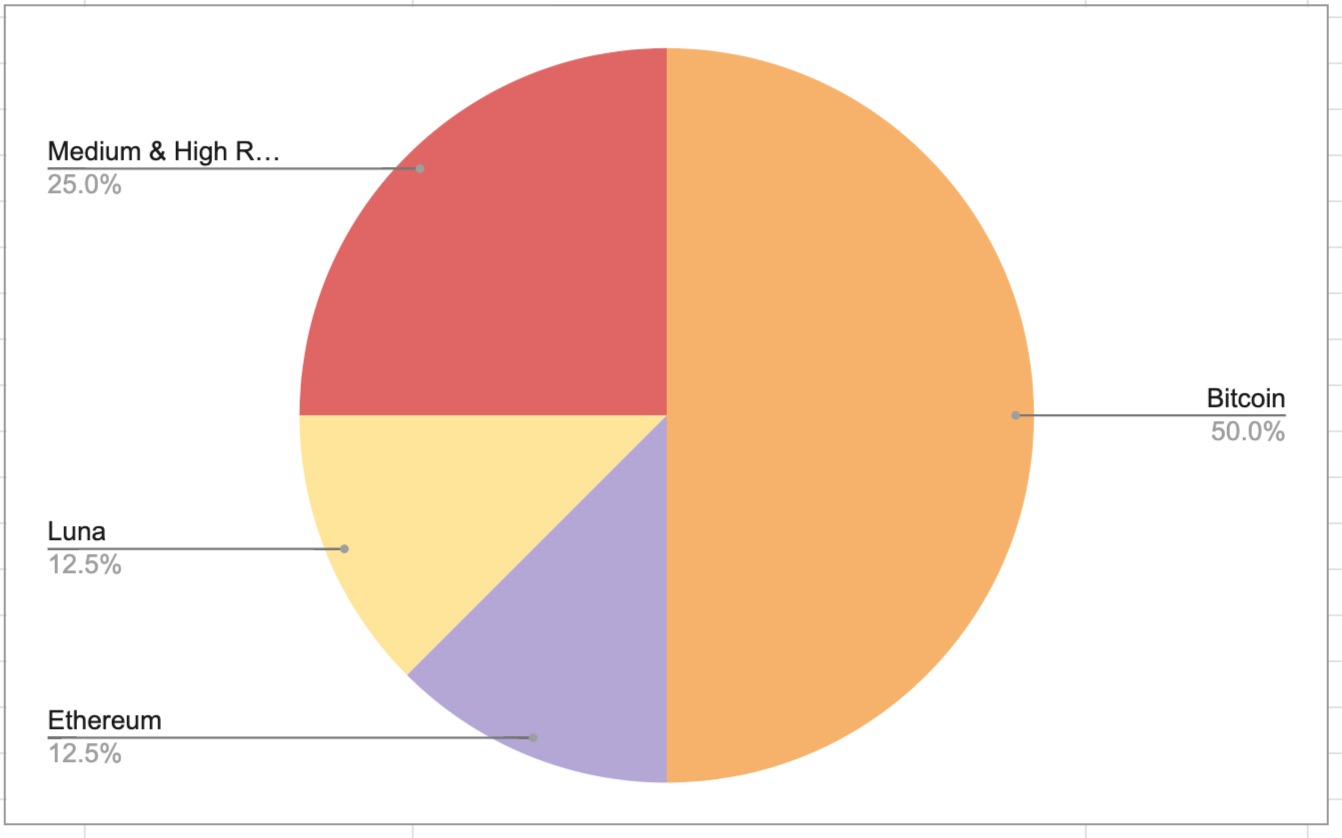

/3 The 50/25/25

• 50% BTC (or replace with ETH)

• 25% Low Risk

• 25% Medium Risk / Shitcoins

This is a solid portfolio.

It's on the safer side while giving you enough wiggle room to get your shitcoin fix.

• 50% BTC (or replace with ETH)

• 25% Low Risk

• 25% Medium Risk / Shitcoins

This is a solid portfolio.

It's on the safer side while giving you enough wiggle room to get your shitcoin fix.

/4 The Bitcoin Maxi

100% in Bitcoin and will not consider anything else.

• Wishes they were besties with Pomp

• Goes to work thinking "gotta stack some SATS!"

• Enjoys going to the Olive Garden for their Spaghetti & Meatballs.

100% in Bitcoin and will not consider anything else.

• Wishes they were besties with Pomp

• Goes to work thinking "gotta stack some SATS!"

• Enjoys going to the Olive Garden for their Spaghetti & Meatballs.

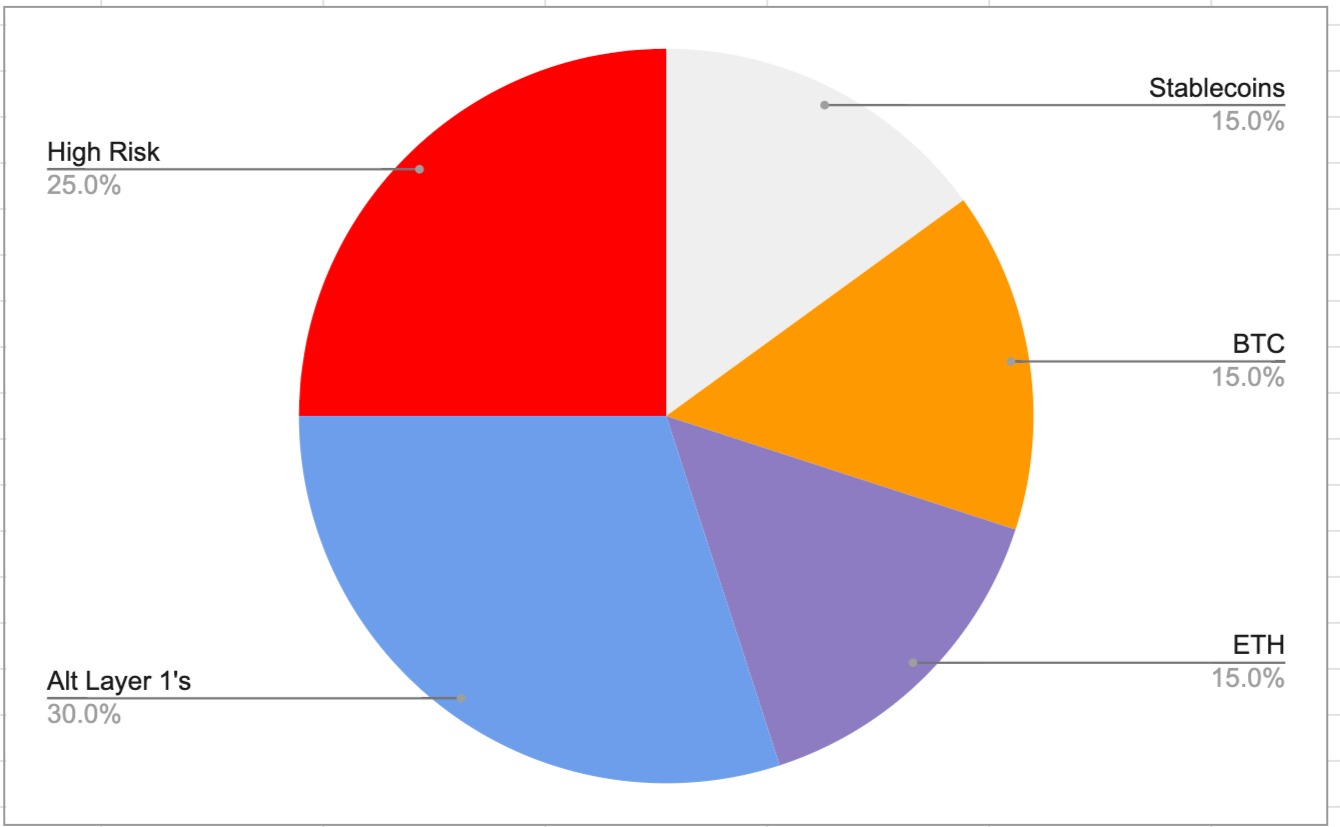

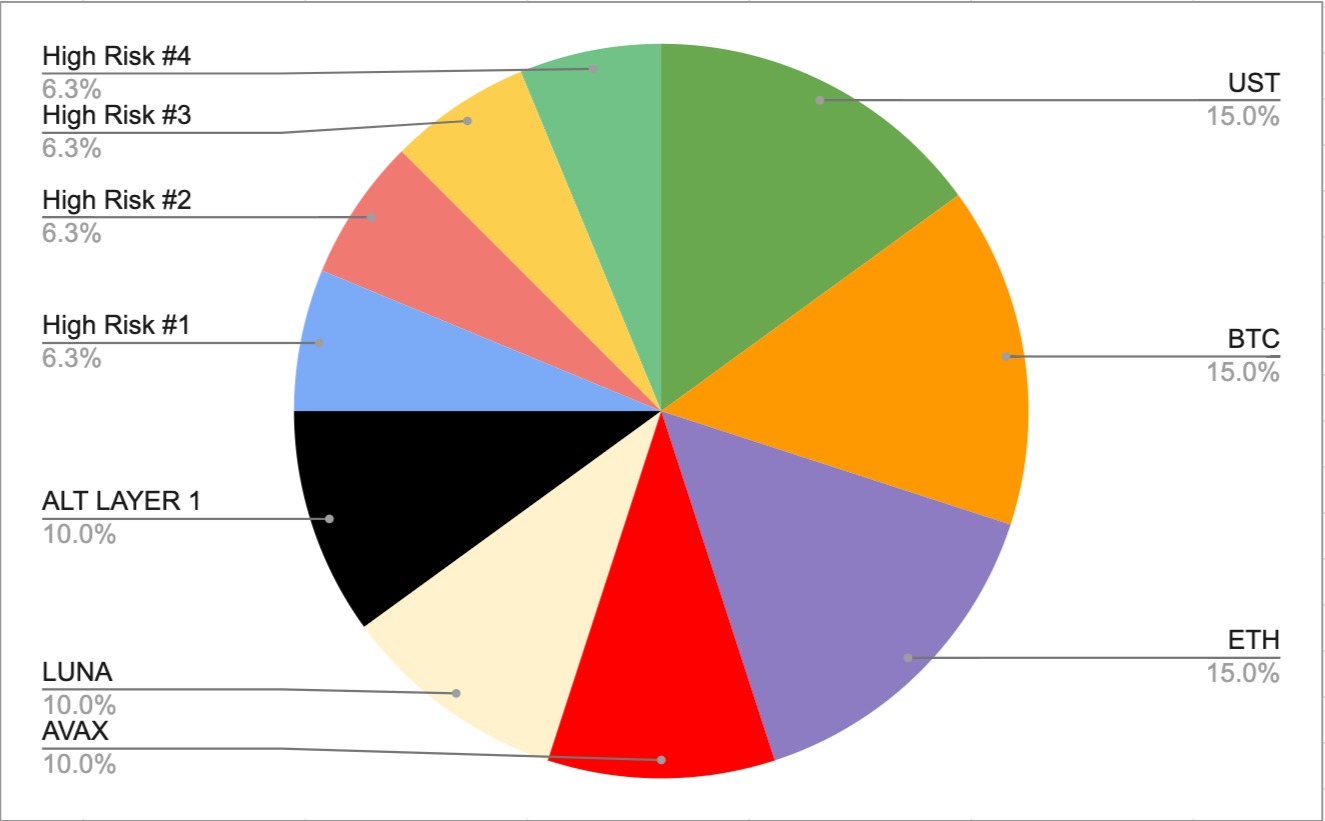

/5 The Edgelord (Mar 22')

It's hard to create a "1 size fits all" portfolio, but here's my best attempt.

• Stablecoins 15%

• ETH 15%

• BTC 15%

• Alt Layer 1s 30%:

• High Risk 25%

It's hard to create a "1 size fits all" portfolio, but here's my best attempt.

• Stablecoins 15%

• ETH 15%

• BTC 15%

• Alt Layer 1s 30%:

• High Risk 25%

The Reasoning Behind This Portfolio

• Alt Layer 1s are the best in terms of risk vs reward right now. Pick what you like. I like LUNA and AVAX.

• BTC & ETH are your safe-havens.

• Stables to buy the dip.

• There's enough % left over to get your trading fix in.

• Alt Layer 1s are the best in terms of risk vs reward right now. Pick what you like. I like LUNA and AVAX.

• BTC & ETH are your safe-havens.

• Stables to buy the dip.

• There's enough % left over to get your trading fix in.

Bull vs Bear Portfolios

When it's "altcoin season", there's more upside in rotating towards higher-risk plays.

So your bear & bull markets portfolios should look different.

The simplest way is to shift your stablecoin allocation depending on what season we're in.

When it's "altcoin season", there's more upside in rotating towards higher-risk plays.

So your bear & bull markets portfolios should look different.

The simplest way is to shift your stablecoin allocation depending on what season we're in.

Common Mistakes in Portfolio Construction

These are some of the most common mistakes that hurt gains:

/1 Most People are Too Aggressive

I have seen a lot of Crypto portfolios, and the most common mistake is that people are TOO aggressive.

These are some of the most common mistakes that hurt gains:

/1 Most People are Too Aggressive

I have seen a lot of Crypto portfolios, and the most common mistake is that people are TOO aggressive.

What causes this?

• Survivorship Bias. You hear about the guy who turned $5,000 into $5m and think you can do the same.

• Dunning–Kruger. You think you know more about DeFi than you actually do.

• Lack of Patience. You're not satisfied with life and want to escape it asap

• Survivorship Bias. You hear about the guy who turned $5,000 into $5m and think you can do the same.

• Dunning–Kruger. You think you know more about DeFi than you actually do.

• Lack of Patience. You're not satisfied with life and want to escape it asap

This has you doing risky behaviors such as using leverage or TOO many shitcoins.

• FOMO. Your favorite influencer says a coin will 100x. So you FOMO into it. No more cash so you sell blue chips for shitcoins.

Come up with a plan and STICK to it.

• FOMO. Your favorite influencer says a coin will 100x. So you FOMO into it. No more cash so you sell blue chips for shitcoins.

Come up with a plan and STICK to it.

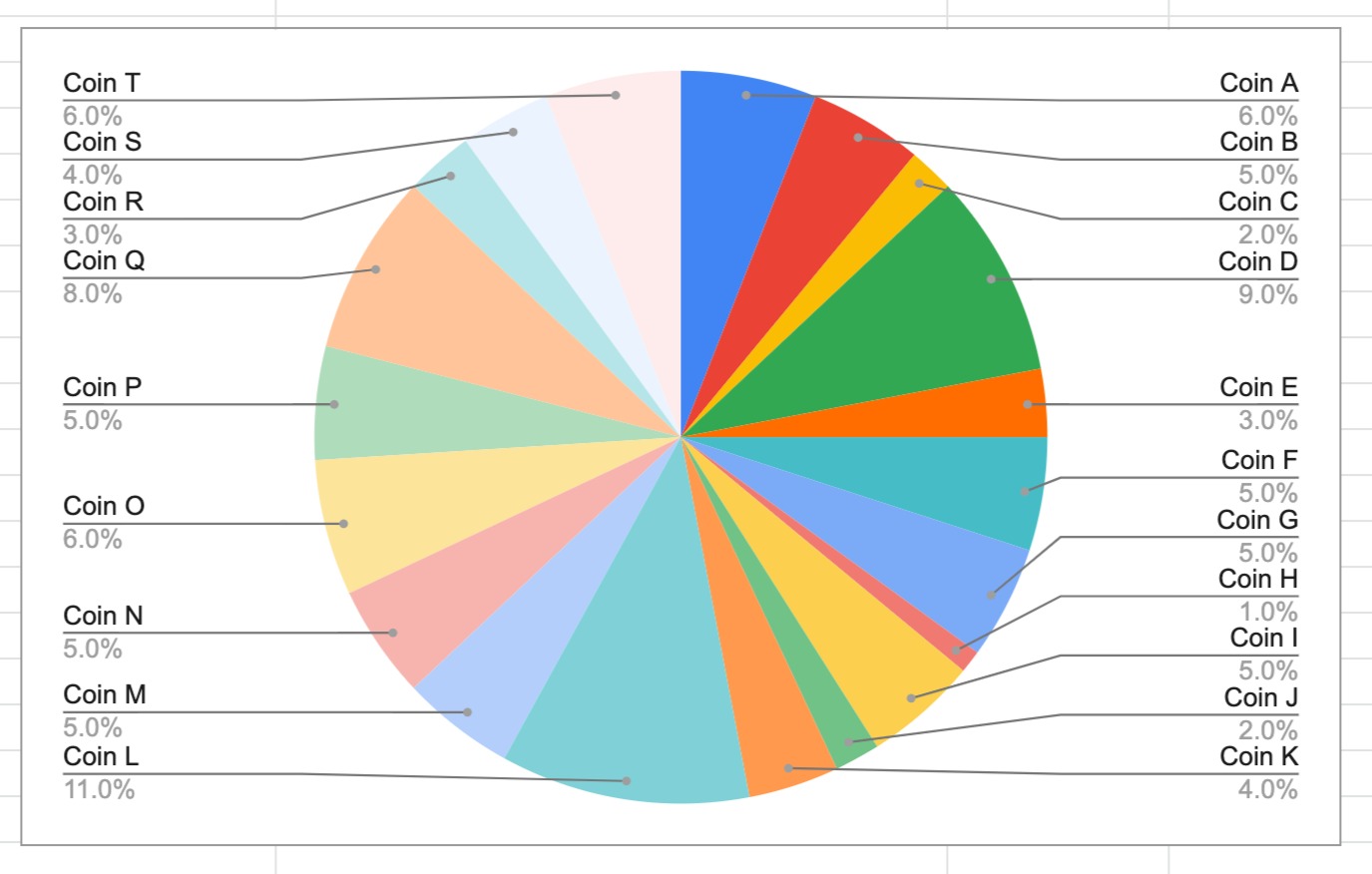

/2 Your Portfolio is TOO diversified

Diversity is good, but there's a limit.

It's hard to stay on top of all these projects.

Plus you're not gaining as much value if a coin moons.

Diversity is good, but there's a limit.

It's hard to stay on top of all these projects.

Plus you're not gaining as much value if a coin moons.

/3 Not Rebalancing

Rebalancing means buying & selling assets to maintain the % allocation.

Imagine if your shitcoin moons and is now 20% of your portfolio.

The target is ~5% max.

You need to take profits and rebalance before it's too late.

Easier said than done.

Rebalancing means buying & selling assets to maintain the % allocation.

Imagine if your shitcoin moons and is now 20% of your portfolio.

The target is ~5% max.

You need to take profits and rebalance before it's too late.

Easier said than done.

"Ser, when do you rebalance?"

It depends.

There's not too much rebalancing going on in bear markets. I'll check my portfolio once a week.

But in alt season when everything's going parabolic? I'll check my portfolio and rebalance it more often.

It depends.

There's not too much rebalancing going on in bear markets. I'll check my portfolio once a week.

But in alt season when everything's going parabolic? I'll check my portfolio and rebalance it more often.

More Ideas on Building a Portfolio

/1 Diversifying Use Cases

Think about what your long-term vision of Crypto is, and try to get exposure among different sectors.

It's kinda like how in the stock market you can have money in Healthcare and some in Tech.

/1 Diversifying Use Cases

Think about what your long-term vision of Crypto is, and try to get exposure among different sectors.

It's kinda like how in the stock market you can have money in Healthcare and some in Tech.

Crypto Sector Examples:

• BTC

• ETH

• ETH Layer 2s

• Alt Layer 1s

• Layer 0s

• Privacy Coins

• GameFi

• Stablecoins

• Metaverse

• Farming as a Service

• Derivatives

• and more

• BTC

• ETH

• ETH Layer 2s

• Alt Layer 1s

• Layer 0s

• Privacy Coins

• GameFi

• Stablecoins

• Metaverse

• Farming as a Service

• Derivatives

• and more

/2 Investment vs. a Trade

I'm willing to hold certain tokens like BTC and ETH for several years.

Some of the higher risk plays I do are trades- I might hold them for only a few weeks or a few months.

I'll exit and stay based on narratives, trends, and the metagame.

I'm willing to hold certain tokens like BTC and ETH for several years.

Some of the higher risk plays I do are trades- I might hold them for only a few weeks or a few months.

I'll exit and stay based on narratives, trends, and the metagame.

/3 Earn Yield on Everything

You should be trying to optimize yield on everything through staking and DeFi.

Make sure you understand the risks involved.

• Stake your blue chips.

• Earn yield with Liquidity Pairs.

You should be trying to optimize yield on everything through staking and DeFi.

Make sure you understand the risks involved.

• Stake your blue chips.

• Earn yield with Liquidity Pairs.

/4 Balance with your Non-Crypto Assets

I know most younger people are all in with Crypto.

As much as I love Crypto, that's risky.

Figure out your optimal balance across all of your asset classes:

• Cash

• Crypto

• Stocks

• Real Estate

• Physical Gold (sike!!!)

I know most younger people are all in with Crypto.

As much as I love Crypto, that's risky.

Figure out your optimal balance across all of your asset classes:

• Cash

• Crypto

• Stocks

• Real Estate

• Physical Gold (sike!!!)

/5 Understanding Your Risk Tolerance

• How did you feel in the past 2 months?

• How would you feel if your portfolio went -95%?

• How many assets do you have OUTSIDE of Crypto?

• What's your earning power?

Create your portfolio to fit your risk tolerance.

• How did you feel in the past 2 months?

• How would you feel if your portfolio went -95%?

• How many assets do you have OUTSIDE of Crypto?

• What's your earning power?

Create your portfolio to fit your risk tolerance.

I have a high-risk tolerance.

If Crypto went to -90%, I'd still be fine. I know this because I went through 2017.

The problem is when someone has a LOW-risk tolerance, and they are too heavy in high-risk plays.

This is what causes panic selling.

If Crypto went to -90%, I'd still be fine. I know this because I went through 2017.

The problem is when someone has a LOW-risk tolerance, and they are too heavy in high-risk plays.

This is what causes panic selling.

"Ser, how do you track your portfolio"

I use a combination of custom spreadsheets + @zapper_fi.

You can use portfolio trackers like @coinstats if you want.

Coming up with your own spreadsheet solution is the best.

I use a combination of custom spreadsheets + @zapper_fi.

You can use portfolio trackers like @coinstats if you want.

Coming up with your own spreadsheet solution is the best.

Disclaimer and Transparency

None of this is financial advice, it's meant for educational purposes only.

You should assume that I own many of the coins mentioned.

My portfolio recommendation is for now and that might change. The industry changes and I keep learning/adapting.

None of this is financial advice, it's meant for educational purposes only.

You should assume that I own many of the coins mentioned.

My portfolio recommendation is for now and that might change. The industry changes and I keep learning/adapting.

Key Takeaways:

• Understand your risk tolerance, goals, and time horizon

• Most portfolios are too aggressive or contain too many coins

• Get exposure to the asset classes that you believe in long term

• Look at the sample portfolios and see what resonates with you

• Understand your risk tolerance, goals, and time horizon

• Most portfolios are too aggressive or contain too many coins

• Get exposure to the asset classes that you believe in long term

• Look at the sample portfolios and see what resonates with you

Whew, that was a banger!

1. Quote retweet the 1st tweet below and let me know what your portfolio looks like!

2. I wrote threads on DeFi 1-3x a week.

Make sure you follow me @thedefiedge so you don't miss them.

1. Quote retweet the 1st tweet below and let me know what your portfolio looks like!

2. I wrote threads on DeFi 1-3x a week.

Make sure you follow me @thedefiedge so you don't miss them.

If you're interested in getting tips like this on a weekly basis, subscribe to my email list below.

It's 100% free.

Subscribe -> TheDeFiEdge.com

It's 100% free.

Subscribe -> TheDeFiEdge.com