Thread

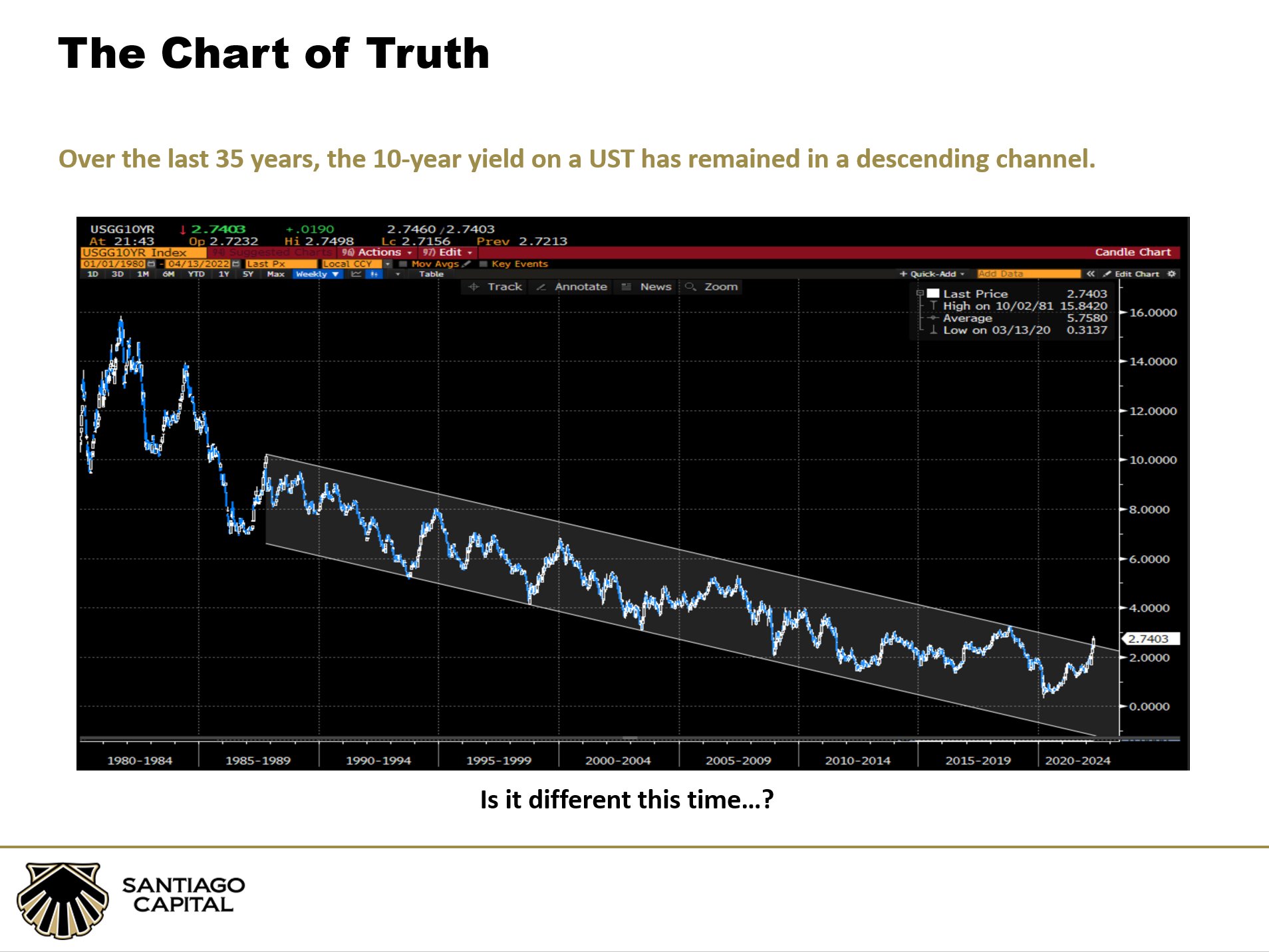

At this point most of those operating in, or following the world of global finance, have seen some version of this "Chart of Truth" (@RaoulGMI) where the US 10Yr yield has poked its head above the top of its 40 year channel.

Where it goes from here, I don't know...

Where it goes from here, I don't know...

What I do know is that this is not a uniquely American issue. The whole world is dealing with funding costs rising. Germany, Canada, Australia...for god's sake even Japanese rates are rising...

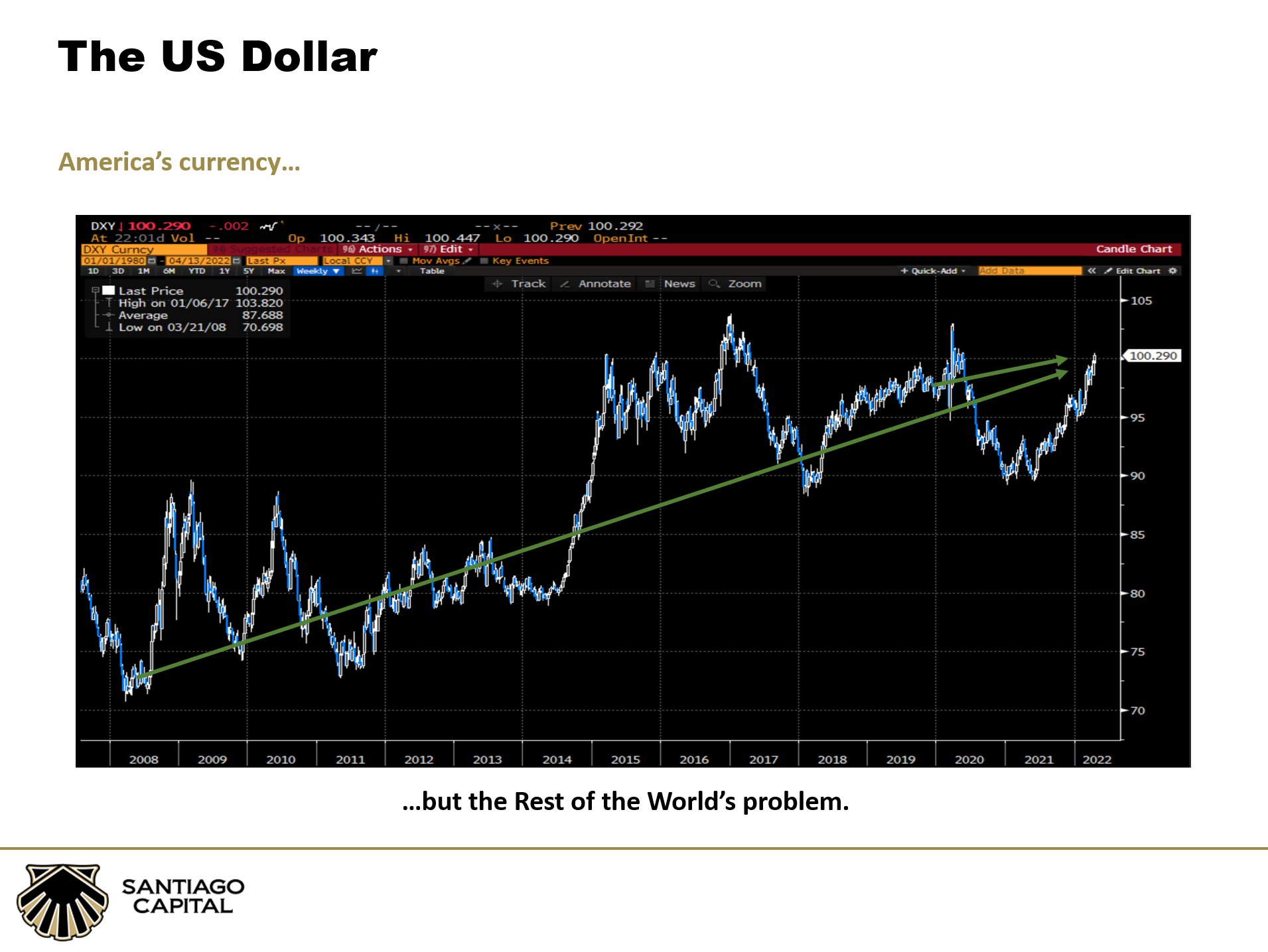

What I also know is that despite all the bailouts, all the stimulus, all the QE and all the helicopter money...the DXY is up 25% since 2008 and flat over the last 2 years.

Yes, the dollar is an absolutely horrible currency.

But all the others are even worse.

Yes, the dollar is an absolutely horrible currency.

But all the others are even worse.

And whether a rising dollar is the cause...

Or whether a rising dollar is the effect...

Its correlation with slowing global growth & global financial crisis is extremely clear.

Will it be different this time?

Maybe.

Or Maybe not.

Do you really want to bet everything on Maybe?

Or whether a rising dollar is the effect...

Its correlation with slowing global growth & global financial crisis is extremely clear.

Will it be different this time?

Maybe.

Or Maybe not.

Do you really want to bet everything on Maybe?

Bc systematic devaluation of dollar vs other fiat didn't just start in 2008. It goes back to 1980s & the Plaza Accord. This was followed by Greenspan's relentless rate cuts. And yet, the DXY is STILL breaking above its 20 yr resistance line.

Make no mistake, this is a problem...

Make no mistake, this is a problem...

We can see further evidence when we take a look at the Yen. It's now broken through its 40yr resistance line. (rising chart is weakening) And there is now little resistance on technical basis. IMO this is biggest deal in global finance that is (so far) being mostly overlooked.

This becomes a little more clear if look at the long term chart of Yen futures rather than the currency cross with the dollar.

Pretend this was a 2 year chart of ARKK rather than a 40yr chart of Yen. You want to buy this?

Well, maybe. But do you want to bet everything on it?

Pretend this was a 2 year chart of ARKK rather than a 40yr chart of Yen. You want to buy this?

Well, maybe. But do you want to bet everything on it?

What is happening is the BOJ is sacrificing its currency to save its bond market.

This is exactly what some are saying FED will have to do. And I agree. At some pt it probably will.

But more important pt is it's happening on periphery FIRST. And this will send DXY even higher.

This is exactly what some are saying FED will have to do. And I agree. At some pt it probably will.

But more important pt is it's happening on periphery FIRST. And this will send DXY even higher.

Why else important?

Bc making Japanese goods more competitive with China. Last few times Yen fell significantly it eventually led to Yuan weakness. I know this reaction doesn't look significant but must remember Yuan is pegged/managed currency. And it still weakened anyway...

Bc making Japanese goods more competitive with China. Last few times Yen fell significantly it eventually led to Yuan weakness. I know this reaction doesn't look significant but must remember Yuan is pegged/managed currency. And it still weakened anyway...

Why would China want to let its currency fall?

Bc dealing with slowing economy & credit crunch in their real estate market. And may need to export the deflationary pressures to the rest of the world. To understand why else may have to weaken must first understand how we got here.

Bc dealing with slowing economy & credit crunch in their real estate market. And may need to export the deflationary pressures to the rest of the world. To understand why else may have to weaken must first understand how we got here.

As long as capital keeps flowing in, can use Foreign Currency reserves to peg currency level while extending credit in yuan. But what happens when foreign capital stops flowing in? Or worse, what happens when foreign capital starts to leave?

Well...we could very soon find out.

Well...we could very soon find out.

Because it is starting to happen.

Foreign investors are starting to do just that.

But why are they starting to do this now?

Foreign investors are starting to do just that.

But why are they starting to do this now?

Not only is China dealing with a deflating Real Estate market, other markets are now shut down due to recent Covid outbreaks. This is not only leading to economic pressures but social pressures as well. So the political risk of capital allocated to China is rising.

Foreign investors used to get compensated for taking on the extra level of risk. But that risk premium is now gone. Investors now get paid more to hold the most liquid security on the planet rather than holding the bond of a country with the problems mentioned above.

And there is a very clear correlation between yield differentials and foreign bond flows to China.

Do you think it's different this time?

Maybe.

But do you want to be it all on Maybe?

Do you think it's different this time?

Maybe.

But do you want to be it all on Maybe?

Because this is now reality.

Foreign capital leaving China is now at its highest level since the height of the Pandemic.

And if you understand how the rise of passive (@profplum99) effects capital flows, you will understand how hard it will be to reverse this.

Foreign capital leaving China is now at its highest level since the height of the Pandemic.

And if you understand how the rise of passive (@profplum99) effects capital flows, you will understand how hard it will be to reverse this.

This chart from @Bellehos shows how the Yuan could explode higher once the resistance level is broken.

CNY Dollar cross might be most important financial ratio in world. If explodes to upside, all bets are off. The HKD peg that @Jkylebass has focused on will go as well. And very possible that every other currency peg in the world would follow.

Buckle Up...

www.youtube.com/watch?v=xxzy3sLs4Bs

Buckle Up...

www.youtube.com/watch?v=xxzy3sLs4Bs