Thread

Okay, okay, enough with the jokes. Real talk: if you held $UST and yield farmed on @anchor_protocol, you took a risk, but were not stupid. Not everyone can be expected to know all the risks with all types of stablecoins, this is where the industry at large should be more helpful.

Anchor was not a ponzi.

There were some genuine sources of yield in Anchor from a) people paying interest when borrowing the UST you deposited and b) the staking yields their collateral generated. The remainder came from the Anchor yield reserve (real funds subsidized by TFL).

There were some genuine sources of yield in Anchor from a) people paying interest when borrowing the UST you deposited and b) the staking yields their collateral generated. The remainder came from the Anchor yield reserve (real funds subsidized by TFL).

There was nothing wrong with Anchor, they just paid more yield than what was sustainable as a growth strategy. Tons of businesses operate at a loss as a customer acquisition growth strategy.

So if you looked at the 20% APY, you were not duped by a ponzi. The yield didn’t come from new users joining (well, I guess you *can* argue that it kind of did because the real reason @terra_money had money to top up the Anchor yield reserve was because LUNA was mooning—

—from new users buying LUNA, which they did partly because they saw the growth and activity of UST). So maybe it was a little bit of a ponzi. Okay, yes, it was a bit of a ponzi.

But if @terra_money ran out of money to top up the Anchor yield reserve, all that should have happened should have been that the 20% APY should have been cut down to something substantially less! You shouldn’t have lost huge amounts of money. Anchor was overcollateralized.

The real reason UST is trading at 33 cents on the dollar right now and you’re down horrendous is because of the inherent unstable mechanism by which UST itself was synthesized and pegged at $1 via LUNA. The very real death spiral danger.

The danger was always that once UST depegs for whatever reason, people have to convert it to LUNA to be able to sell it at $1.

But that sounds like it’s only really a problem for LUNA, right?

But that sounds like it’s only really a problem for LUNA, right?

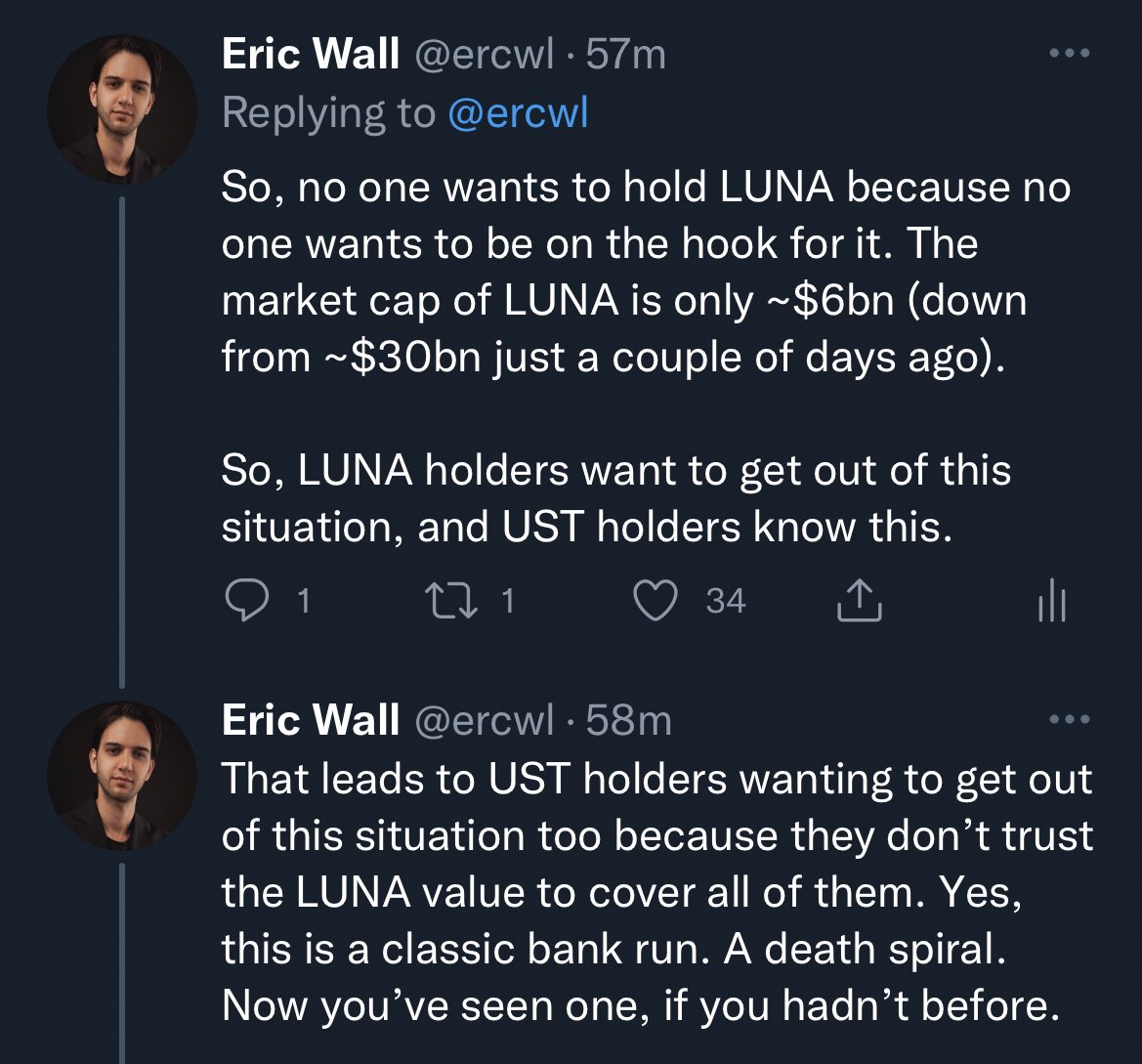

Well, unfortunately no. If the system has $17B of UST and $40B of LUNA (which it did), things feel safe. But once people are realizing that LUNA holders are going to be on the hook for bringing UST back to peg, LUNA holders become skittish and would rather escape for a while.

$40B market cap LUNA is a mirage. That’s not a $40B buffer that UST will have the benefit of slowly chewing through to stabilize.

$40B can become $10B in the flash of a day (which it did) because market cap is just a number decided by supply and the top bids in the orderbooks.

$40B can become $10B in the flash of a day (which it did) because market cap is just a number decided by supply and the top bids in the orderbooks.

The market cap can vanish in an instant if people are running for the door. And so, if you have $17B of UST and a shrinking LUNA market cap that now looks unlikely to be able to carry the UST holders out the door safely, you get a bank run. Death spiral.

Now, the way the LUNA system works is that you never actually run out of LUNA. The system is always going to try to print enough LUNA for you if you burn your UST so that you can exit with $1 (although a spread fee is added during high vol to try to slow the bank run down).

The mechanism doesn’t work. It’s impossible to stabilize the system once no one longer wants to hold UST anymore because they realize the depegging risks are no longer worth the 20% Anchor yield (which TFL can probably no longer even afford to top up any longer).

Meanwhile the LUNA is being printed to in vain cover the value speed to UST holders and the LUNA supply algorithmically explodes from the hundreds of millions into the tens of billions as the price plummets to 0.

The death spiral dynamic is pernicious and catastrophic. The $3B bitcoin reserve was still nowhere near to resist it—in fact, it could be argued that it even gave UST exiters a reason to try to run out the door as early as possible while there was any BTC liquidity cushion left.

The dangers of this algostable was downplayed by our most notable industry participants. People were not being upfront with you or did not care enough to entertain the uncomfortable idea themselves. Let’s learn from this and not make this tweet reality:

I’m sorry for all the UST holders who were trying to leverage the subsidized Anchor yields to harvest the 20% APY. In a highly inflationary environment where tradfi interest rates are low and S&P500 looks scary, I understand the decision.

Arrogant LUNA 🌕 shills can suck a D tho

Arrogant LUNA 🌕 shills can suck a D tho