Thread

1/ There were a lot of words spoken about $UST / $Luna / #Terra collapse, but can we evaluate the total damage to the DeFi space?

2/ Besides the complete wipe of ~$50b chain a lot of protocols outside #terra were affected as well.

3/ First of all people started removing their money from any risky assets which caused temporary or complete depeg or heavy imbalances in the liquidity pools of most of the algo / pegged tokens.

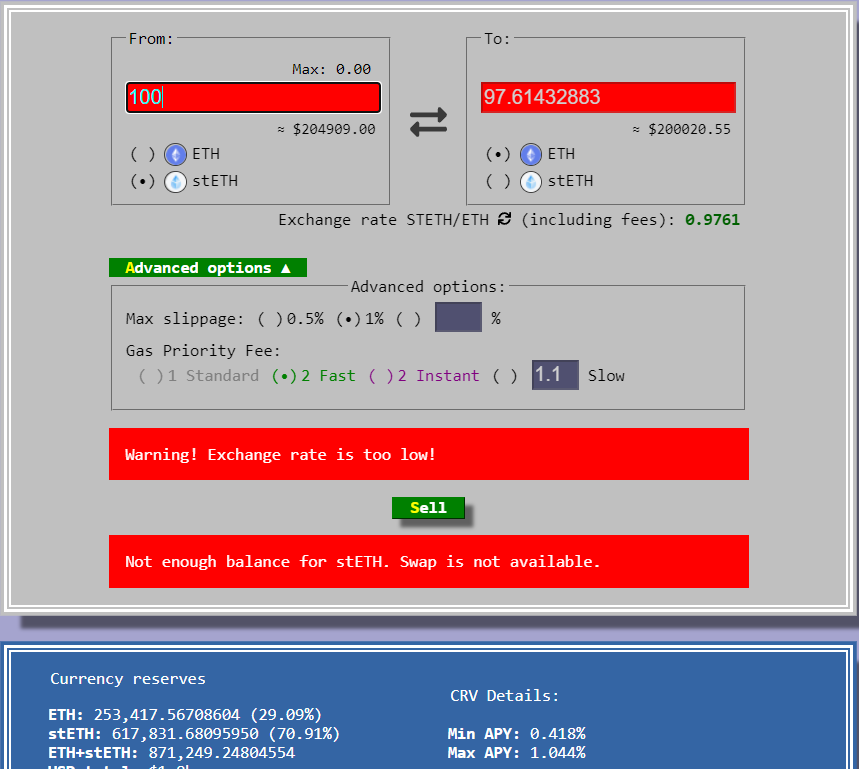

4/ $stETH

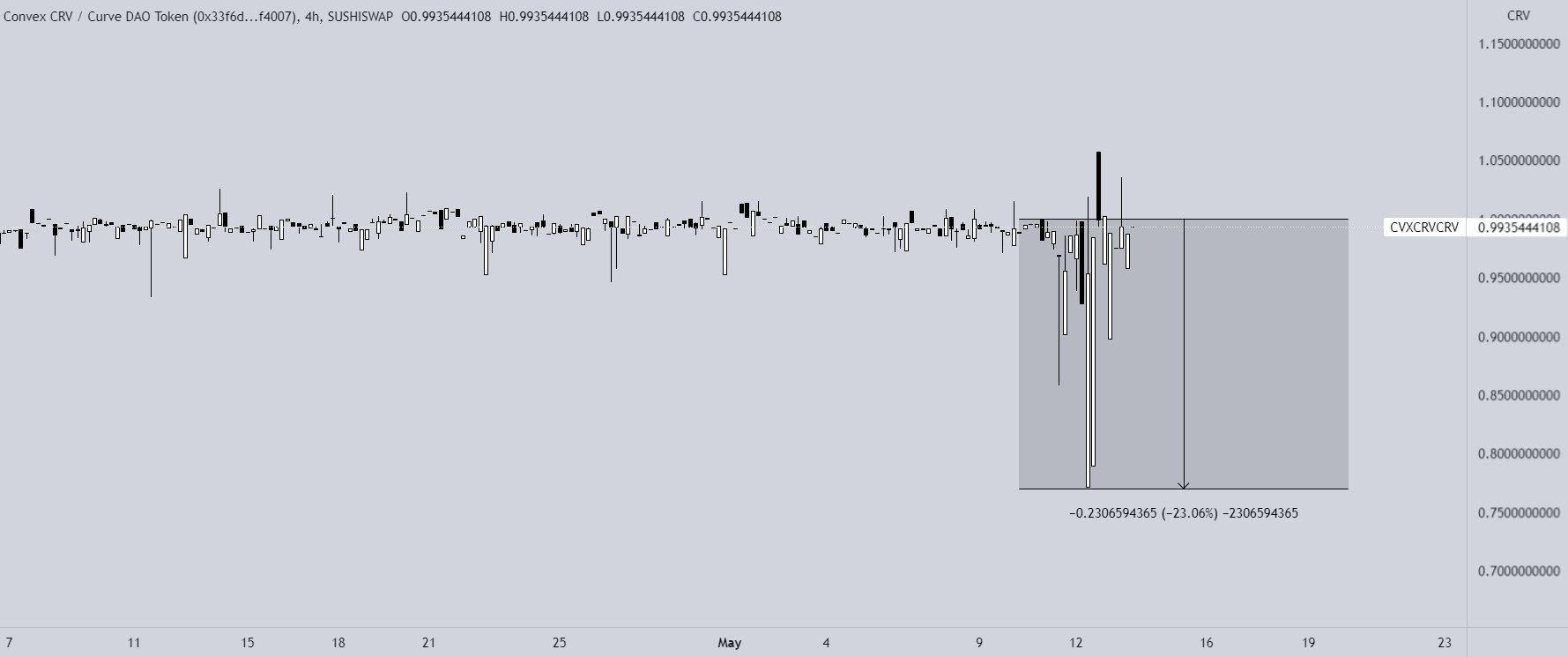

5/ $cvxcrv

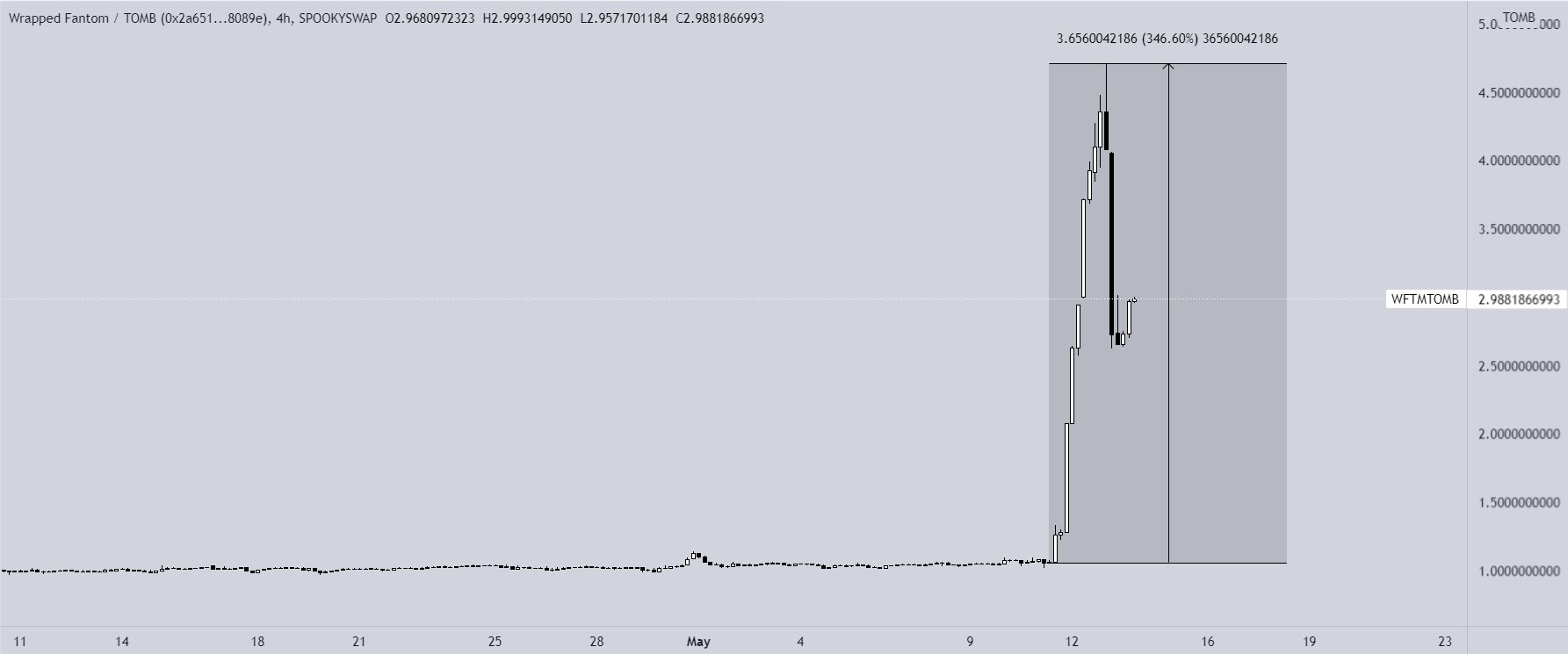

6/ $tomb

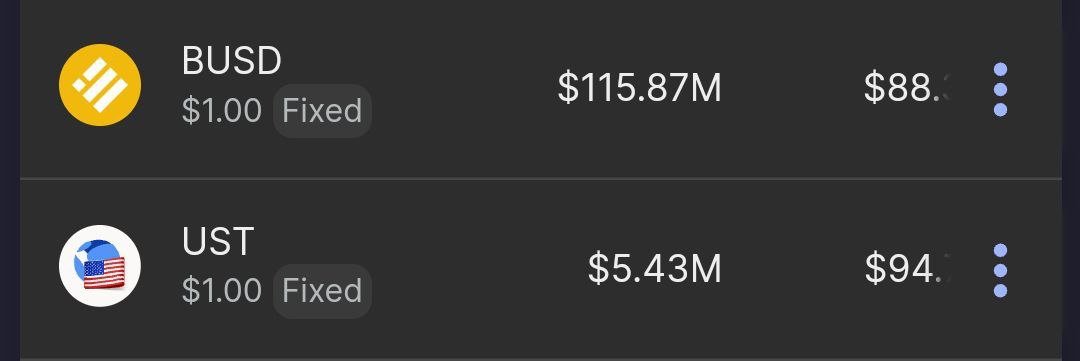

7/ Fixed Forex stablecoins

8/ People even started selling $usdt in panic

9/ And many others. But this was investors' decision to abandon these projects, you can not really blame anyone. Unfortunately, there were many projects which suffered huge losses during #terra collapse due to other factors.

10/ @venusprotocol suffered a $13.5m loss because Chainlink oracle stopped updating the price of Luna below $0.1 while the market price was $0.01. This allowed users to lend $Luna and borrow against it 10x more assets than possible under normal conditions.

11/ The same issue happened to @Blizzfinance on #Avalanche. According to @DefiLlama TVL in the protocol went from ~$10m to $0.

12/ @groprotocol was exposed to $UST in one of their farming strategies. Team was continuously monitoring the situation, but failed to take necessary actions to prevent huge losses.

13/ They have fallen into the trap of over-reliance on the size of Terra, reputable funds behind and others.

14/ Don't know what is this protocol, but they have lost all the TVL as well

15/ A lot of lending protocols acquired little to huge bad debt due to extreme market volatility and chain congestion. But there is one protocol which did the worst possible thing to themselves and their investors.

16/ @kava_platform hardcoded $ust to $1. Users were able to mint $USDX (native stablecoin from the Kava chain) against UST at 99% LTV without risk of liquidation. After that $USDX was sold for other assets on Kava Swap.

17/ I like @kava_platform, I think this is a promising US based project within the Cosmos ecosystem with IBC transfers implemented, but they have made a horrible mistake.

18/ Own protocol and own stablecoin already have risks involved, why would put on top of that all the risks associated with other stablecoin from another chain? Of course $usdx lost the peg as it was minted against 0 value $ust and dumped on the market right away.

19/ It took several days for the team to change $ust hardpeg to oracle price (which was also much higher than market price, so people were still arbing but with less profit) and then to restirct minting $USDX against $UST.

20/ Protocol has lost ~$300m in TVL or ~50% in a few days. In addition to $USDX collapse and investors faith.

21/ Probably this is one of the worst weeks in crypto history so far. And a lot of people are accountable for that besides Do Kwon and the team. A lot of crypto influencers were promoting Terra heavily and building their wealth and audience around it.

22/ I don't want to call their names, everyone knows them and people will eventually forget about it. But I want to thank those who were trying to warn the community about the risks @FreddieRaynolds @0xHamz @Galois_Capital @JackNiewold and many others.

23/ In my turn I regret that I was too delicate in wordings in my thread about $UST as I didn't want to get a lot of hate from the Terra c̵u̵l̵t̵ community.

24/ This week gave us a lesson that there are even more risks involved in DeFi and you might be indirectly affected by events happening on other chains / protocols.

25/ If you liked this thread, I would love it if you could share it by retweeting the first tweet:

Thank you and stay safe!

Thank you and stay safe!