Thread

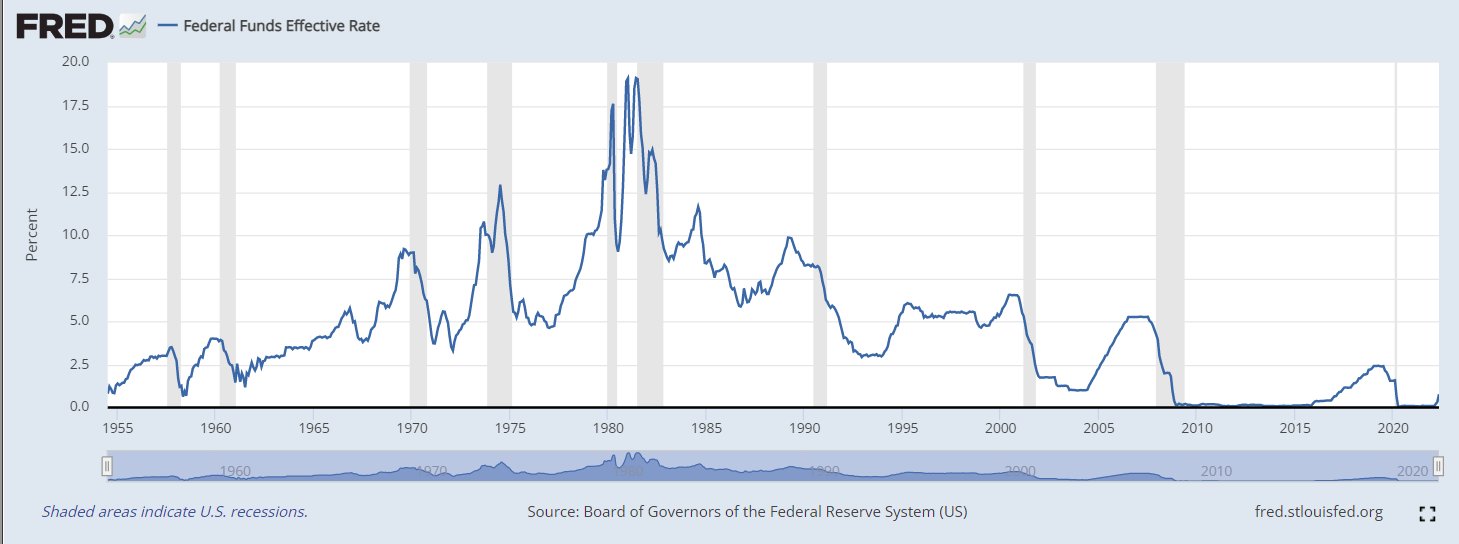

The Fed just announced that they are raising rates by 0.75% for the first time since 1994

This has HUGE implications for the future of the economy:

How did we get here?

This has HUGE implications for the future of the economy:

How did we get here?

As of last week, traders were nearly certain that the FED would be sticking to a 0.50% rate hike.

Even after the hot inflation print on Friday, Kalshi markets only moved their estimates of a 0.75% rate hike from 5% to 15%

Even after the hot inflation print on Friday, Kalshi markets only moved their estimates of a 0.75% rate hike from 5% to 15%

Federal Reserve Chair Jerome Powell also strongly suggested that a 0.5% rate hike was most likely.

After the last meeting, he drew a clear boundary by saying “Seventy-five basis points is not something the committee is actively considering,”

After the last meeting, he drew a clear boundary by saying “Seventy-five basis points is not something the committee is actively considering,”

A delayed reaction to Friday’s high inflation numbers created panic and market meltdowns early this week and manifested in a aggressive expectation of how strong the FED response would be.

Many expected Powell to change his tune after high inflation data.

Many expected Powell to change his tune after high inflation data.

Combine that with bank research reports forecasting 0.75% and an article that strongly hinted at leaked information, and many investors were all but certain that a surprise hike was coming

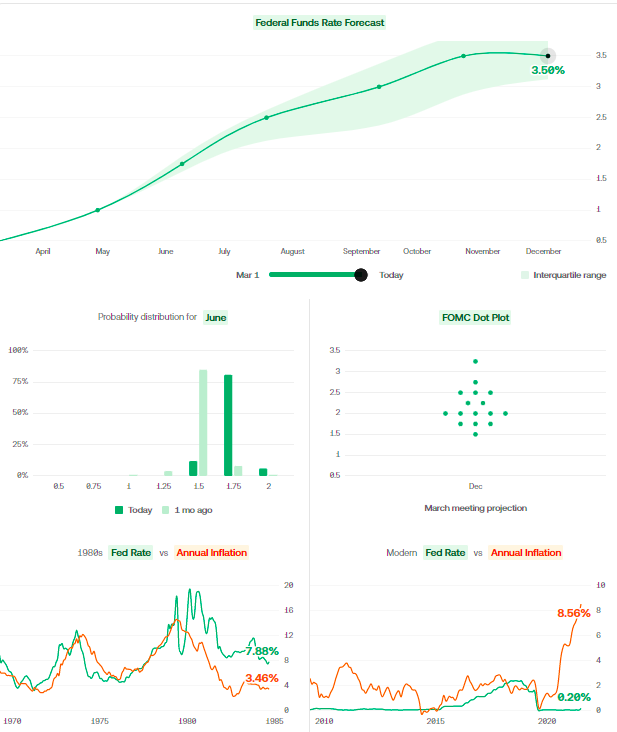

Over the last two days, Kalshi market expectations moved from a ~15% chance of a 0.75% rate hike to a ~85% (graph below) chance after the WSJ and other banks released statements forecasting a 0.75% hike.

The wisdom of the crowds was correct, In spite of what Jerome Powell said

The wisdom of the crowds was correct, In spite of what Jerome Powell said

This hike means the Fed is taking inflation seriously and is willing to pull out an interest rate bazooka to fight it, even if it means hurting the economy right after a quarter of negative GDP growth.

It also means they’re prioritizing effectiveness over consistent rhetoric - if they need to update their views, they’re willing to do so fast.

What does this mean for future rate hikes?

The FED is taking a strong approach to rate hikes, and a 0.75% hike could still come in July even after this aggressive one.

The FED is taking a strong approach to rate hikes, and a 0.75% hike could still come in July even after this aggressive one.

You can see real-time estimates of July’s Fed rates and how they’re changing post-print here.

kalshi.com/events/FED-22JUL?utm_source=twitter-06-15&utm_medium=thread&utm_campaign=growth-free&=1

kalshi.com/events/FED-22JUL?utm_source=twitter-06-15&utm_medium=thread&utm_campaign=growth-free&=1

Of course, when the Fed speaks, the rest of the economy listens.

Which begs the question - what else will be affected post Fed Decision?

We’ve built a dashboard to help you analyze all things Fed that you can look at here.

kalshi.com/forecasts/fed?utm_source=twitter-06-15&utm_medium=thread&utm_campaign=growth-free

Which begs the question - what else will be affected post Fed Decision?

We’ve built a dashboard to help you analyze all things Fed that you can look at here.

kalshi.com/forecasts/fed?utm_source=twitter-06-15&utm_medium=thread&utm_campaign=growth-free

First, the total number of projected rate hikes for the year. Investors update this based upon the Federal Reserve’s decision, their economic projections, and Federal Reserve members’ rhetoric

You can see real time forecasts for the interest rate trajectory for the whole year here.

kalshi.com/events/RATEHIKE-22/markets/RATEHIKE-22-C11?utm_source=twitter-06-15&utm_medium=thread&utm_...

kalshi.com/events/RATEHIKE-22/markets/RATEHIKE-22-C11?utm_source=twitter-06-15&utm_medium=thread&utm_...

Second, stock markets: Interest rates higher than expectations tend to drive markets down. You can see how estimates of various closing prices for the NASDAQ are changing in real-time in our markets.

kalshi.com/events/NASDAQ100D-22JUN15/markets/NASDAQ100D-22JUN15-B11350?utm_source=twitter-06-15&utm_m...

kalshi.com/events/NASDAQ100D-22JUN15/markets/NASDAQ100D-22JUN15-B11350?utm_source=twitter-06-15&utm_m...

Third, inflation data - more aggressive Fed responses decrease inflation expectations, and vice versa. You can see how our traders are updating their expectations for the next inflation print in real-time, here

kalshi.com/events/CPI-22JUN?utm_source=twitter-06-15&utm_medium=thread&utm_campaign=growth-free&=1

kalshi.com/events/CPI-22JUN?utm_source=twitter-06-15&utm_medium=thread&utm_campaign=growth-free&=1

Fourth - the likelihood of GDP falling even further. More aggressive Fed action tends to dampen the economy, which is why the Fed tends to raise rates slowly.

You can see how the market is changing their estimated likelihood of more negative GDP growth in real-time here

kalshi.com/events/GDPUSMIN-Q2Q42022/markets/GDPUSMIN-Q2Q42022-T0?utm_source=twitter-06-15&utm_medium=...

kalshi.com/events/GDPUSMIN-Q2Q42022/markets/GDPUSMIN-Q2Q42022-T0?utm_source=twitter-06-15&utm_medium=...

Fifth - Mortgage rates. Higher interest rates from the Fed = higher mortgage rates for everyday Americans.

Buying a house is about to get a lot harder.

Buying a house is about to get a lot harder.

You can see just how high the interest rate for buying homes is likely to get this year, and how that forecast has changed post Fed meeting, here.

kalshi.com/events/FRMMAX-22DEC29?utm_source=twitter-06-15&utm_medium=thread&utm_campaign=growth-free&...

kalshi.com/events/FRMMAX-22DEC29?utm_source=twitter-06-15&utm_medium=thread&utm_campaign=growth-free&...

Mentions

See All

Sahil Bloom @SahilBloom

·

Jun 15, 2022

Great thread!