Thread

How to calculate when you will double your money on an investment:

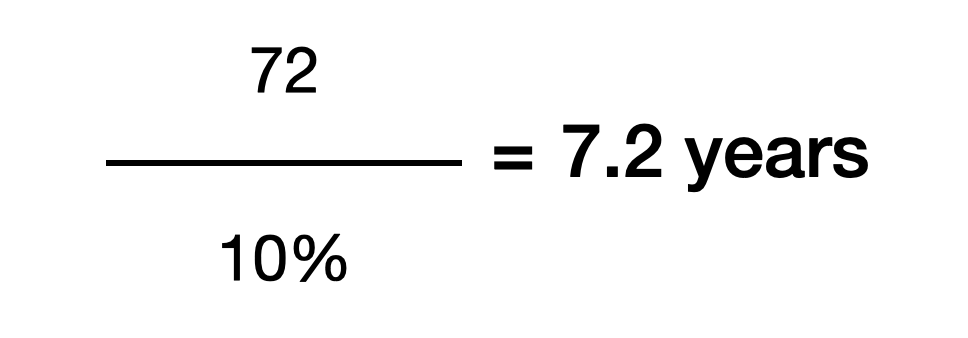

1/ The Rule of 72

You can use The Rule of 72 to calculate how many years it will take to double your money on an investment

The one thing you need to know to calculate this is:

The annualized rate of return on your investment

You can use The Rule of 72 to calculate how many years it will take to double your money on an investment

The one thing you need to know to calculate this is:

The annualized rate of return on your investment

Example:

Let’s say you’re looking at an investment that has an annualized return of 10%

How many years will it take to double your money?

You divide 72 by 10% which tells you that you will double your money in over 7 years:

Let’s say you’re looking at an investment that has an annualized return of 10%

How many years will it take to double your money?

You divide 72 by 10% which tells you that you will double your money in over 7 years:

2/ Let’s check the math on this

Let’s say you’ve got $100 to invest and your rate of return is 10% compounded

Here is how much you would have at the end of each year

Year 1: $110

Year 2: $121

Year 3: $133

Year 4: $146

Year 5: $161

Year 6: $177

Year 7: $195

Year 8: $214

Let’s say you’ve got $100 to invest and your rate of return is 10% compounded

Here is how much you would have at the end of each year

Year 1: $110

Year 2: $121

Year 3: $133

Year 4: $146

Year 5: $161

Year 6: $177

Year 7: $195

Year 8: $214

So the Rule of 72 was correct

In just over 7 years, you will double your investment of $100

There are a couple of observations I’d like to draw your attention to in the example above

In just over 7 years, you will double your investment of $100

There are a couple of observations I’d like to draw your attention to in the example above

3/ The rate of return matters

The rule of 72 implies that if you have a higher annual return

You will double your investment quicker

The rule of 72 implies that if you have a higher annual return

You will double your investment quicker

If the annual return in the example above was 20%, you would double your money in just over 3 years:

= 72 / 20% = 3.6 years

At 30%, you would double your money in just over 2 years:

= 72 / 30% = 2.4 years

= 72 / 20% = 3.6 years

At 30%, you would double your money in just over 2 years:

= 72 / 30% = 2.4 years

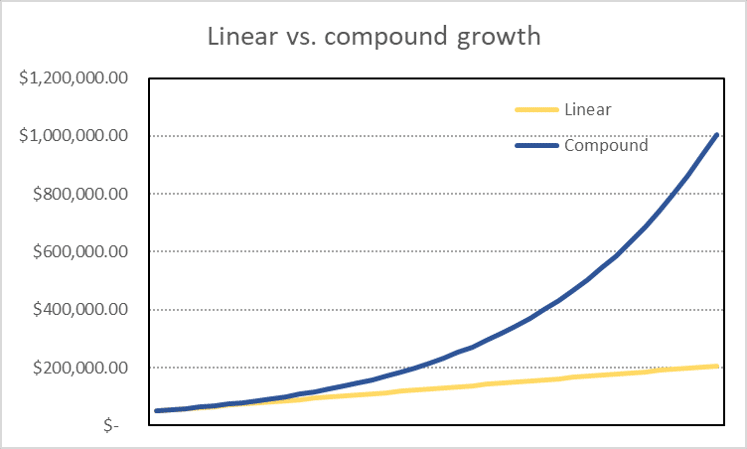

4/ Compounding accelerates at the end

If you pay close attention to how your investment changes in the example above

You will notice that the gaps start to get bigger at the end

Here is what I mean

If you pay close attention to how your investment changes in the example above

You will notice that the gaps start to get bigger at the end

Here is what I mean

In the later years, your investment increases by + $19

In the early years, your investment increased by +$11

Why is this?

In the early years, your investment increased by +$11

Why is this?

Because the magic of compounding happens at the end

In year 1, earning 10% on $110 is = $11

In year 7, earning 10% on $195 is = $19

In year 1, earning 10% on $110 is = $11

In year 7, earning 10% on $195 is = $19

Because your investment has grown in size over time

In the later years, the same percentage (%) return produces a larger $ number

This is why, when you see a graph of compounded growth, it looks like this:

In the later years, the same percentage (%) return produces a larger $ number

This is why, when you see a graph of compounded growth, it looks like this:

5/ Use it in practice

The next time, someone tells you to invest in something

1. Determine what the annual rate of return is

2. Use the rule of 72 to calculate how quickly you will double your money

3. Decide whether or not it’s a good investment for you

The next time, someone tells you to invest in something

1. Determine what the annual rate of return is

2. Use the rule of 72 to calculate how quickly you will double your money

3. Decide whether or not it’s a good investment for you

TL;DR:

1. Figure out: The annual rate of return

2. Use the Rule of 72 to calculate how long it will take to double

3. The higher the rate of return, the quicker it will happen

4. The magic of compounding occurs at the end

1. Figure out: The annual rate of return

2. Use the Rule of 72 to calculate how long it will take to double

3. The higher the rate of return, the quicker it will happen

4. The magic of compounding occurs at the end

Want to improve your understanding of investing and finance?

Sign up for the course I’m creating with @10Kdiver

10kdiver.com/courses/BIBO/

Sign up for the course I’m creating with @10Kdiver

10kdiver.com/courses/BIBO/

@10kdiver If you enjoyed this thread, retweet it so other people can benefit!

Follow @AliTheCFO

I tweet about:

• Finance

• Business Frameworks

• Personal Growth

Follow @AliTheCFO

I tweet about:

• Finance

• Business Frameworks

• Personal Growth

Mentions

See All

Misha @MishadaVinci

·

Jun 12, 2022

Great thread!