Thread

If you don't understand debt, you'll never be truly wealthy.

Here's what you need to know about how the rich use debt:

Here's what you need to know about how the rich use debt:

We were taught a bunch of lies about debt. That it's:

• bad

• irresponsible

• dangerous

• even predatory

All those things CAN be true, but when you actually understand debt it's like a lever that can lift the world. Here's one example:

• bad

• irresponsible

• dangerous

• even predatory

All those things CAN be true, but when you actually understand debt it's like a lever that can lift the world. Here's one example:

Avoid taxes, take loans.

The rich: ie Musk, Ellison, Gates, all borrow against their stock to get $ and avoid capital gains tax.

They're called Securities-based Loans or stock collateralization.

IF you hold sizable shares of a listed company, you can often do the same.

The rich: ie Musk, Ellison, Gates, all borrow against their stock to get $ and avoid capital gains tax.

They're called Securities-based Loans or stock collateralization.

IF you hold sizable shares of a listed company, you can often do the same.

Musk for instance has an evergreen credit facility for $90Billion+.

The rich like debt, because you can't get taxed as income or as capital gains on a loan.

So they essentially create loans to themselves through their brokerage accounts:

How's it work?

The rich like debt, because you can't get taxed as income or as capital gains on a loan.

So they essentially create loans to themselves through their brokerage accounts:

How's it work?

Let's say Musk has 175 million Tesla shares with Merrill Lynch.

He calls up his banker & pledges (puts up as collateral aka the bank could take them if he defaults) 88.3 million Tesla shares.

That's 36% of his stake which gives him $94 billion.

Now he has $94B to spend.

He calls up his banker & pledges (puts up as collateral aka the bank could take them if he defaults) 88.3 million Tesla shares.

That's 36% of his stake which gives him $94 billion.

Now he has $94B to spend.

How common is this?

32 billionaires in the Forbes 400 have this type of line of credit.

Of all Fortune 500 - 560 executive officers & 5%+ shareholders currently pledge.

The average pledge is $427M. NBD.

Total is $239B, according to a report from Audit Analytics.

32 billionaires in the Forbes 400 have this type of line of credit.

Of all Fortune 500 - 560 executive officers & 5%+ shareholders currently pledge.

The average pledge is $427M. NBD.

Total is $239B, according to a report from Audit Analytics.

Why do this? #1 Taxes

It far cheaper to borrow against the value of your shares than to sell and pay taxes on the gains.

Federal capital gains tax can be 37% at high end.

States also tax aka CA 13.3%

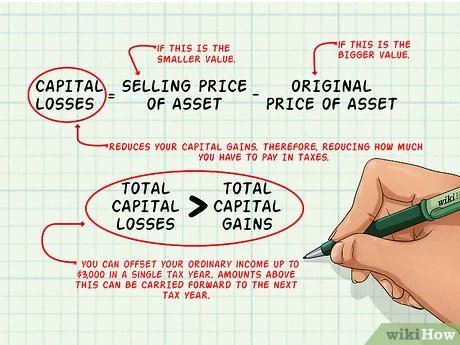

Tax = Price of stock sold - Original purchase price

It far cheaper to borrow against the value of your shares than to sell and pay taxes on the gains.

Federal capital gains tax can be 37% at high end.

States also tax aka CA 13.3%

Tax = Price of stock sold - Original purchase price

How does this cost compare?

Stock loan interest expense is much less than the capital gain tax.

I've had loans as low as 1.5% and I'm certainly no Elon Musk.

Right now they vary around 3-7%.

Stock loan interest expense is much less than the capital gain tax.

I've had loans as low as 1.5% and I'm certainly no Elon Musk.

Right now they vary around 3-7%.

#2 No Limitation on Loan Purpose

Mortgage loan -> you have to buy a property.

Stock margin -> you need to buy stock.

Stock collateral loan -> you can do pretty much whatever you want.

Banks usually do not request loan purpose.

You can use it invest, buy a home, travel...

Mortgage loan -> you have to buy a property.

Stock margin -> you need to buy stock.

Stock collateral loan -> you can do pretty much whatever you want.

Banks usually do not request loan purpose.

You can use it invest, buy a home, travel...

#3 Simple Process

Have you gotten a mortgage lately?

Colonoscopy much?

Stock loan model is generally easy and fast.

You don't need a credit score, or to submit proof of income.

You just have to hold the asset.

Have you gotten a mortgage lately?

Colonoscopy much?

Stock loan model is generally easy and fast.

You don't need a credit score, or to submit proof of income.

You just have to hold the asset.

#4 Invest More Long-Term Align with Your Long-Term Investment Strategy

A stock collateral loan allows you to increase liquidity w/o selling stock,

For founders it helps avoid equity dilution and retain control.

A way to monetize their shares w/o selling & losing control.

A stock collateral loan allows you to increase liquidity w/o selling stock,

For founders it helps avoid equity dilution and retain control.

A way to monetize their shares w/o selling & losing control.

This trend is normalizing.

I have a loan out on shares in one of my brokerage accounts.

Most of my friends with higher networths do as well.

I have a loan out on shares in one of my brokerage accounts.

Most of my friends with higher networths do as well.

Downsides?

The stock goes down, you need more stock or more cash to compensate.

You get over your skis you can lose everything.

Your stock could be locked up unable to sell until your loan is repaid.

This is why firms are thoughtful on who is allowed to do this.

The stock goes down, you need more stock or more cash to compensate.

You get over your skis you can lose everything.

Your stock could be locked up unable to sell until your loan is repaid.

This is why firms are thoughtful on who is allowed to do this.

In Sum:

Debt is neither good or bad.

It is simply a tool.

A tool that the wealthy (largely) truly understand and wield intelligently.

A tool that most of us do not use well.

Debt is neither good or bad.

It is simply a tool.

A tool that the wealthy (largely) truly understand and wield intelligently.

A tool that most of us do not use well.

10,000 of you people wanted more…

SO we’re writing up a deep dive on how the rich use debt… Part 1 & 2

Grab here and it’ll be in your inbox in the next week for Free. ;)

contrarian-thinking.ck.page/debt-guide

SO we’re writing up a deep dive on how the rich use debt… Part 1 & 2

Grab here and it’ll be in your inbox in the next week for Free. ;)

contrarian-thinking.ck.page/debt-guide