Thread

I have never been a particularly big fan of Solana.

I have been skeptical of the design tradeoffs being made in the past and the instability of the chain has coloured my opinion.

I have been skeptical of the design tradeoffs being made in the past and the instability of the chain has coloured my opinion.

That being said, I’m a huge believer in constantly reassessing bias.

There have been a number of recent developments that have forced me to look again at Solana.

This is a high-level look at what’s going on and I’ve definitely missed a ton of stuff happening.

There have been a number of recent developments that have forced me to look again at Solana.

This is a high-level look at what’s going on and I’ve definitely missed a ton of stuff happening.

You can read the long version here or just continue to with the thread.

alphapls.substack.com/p/reassessing-solana

alphapls.substack.com/p/reassessing-solana

What’s to come?

• Solana update 1.10

• Solana adoption

• Solana DeFi

• NFTs

• Decentralisation

• Solana and Ethereum philosophies

• Neon

• Saga Phone and SMS

• Anatoly

• Concluding thoughts ($SOL)

• Solana update 1.10

• Solana adoption

• Solana DeFi

• NFTs

• Decentralisation

• Solana and Ethereum philosophies

• Neon

• Saga Phone and SMS

• Anatoly

• Concluding thoughts ($SOL)

Solana update 1.10

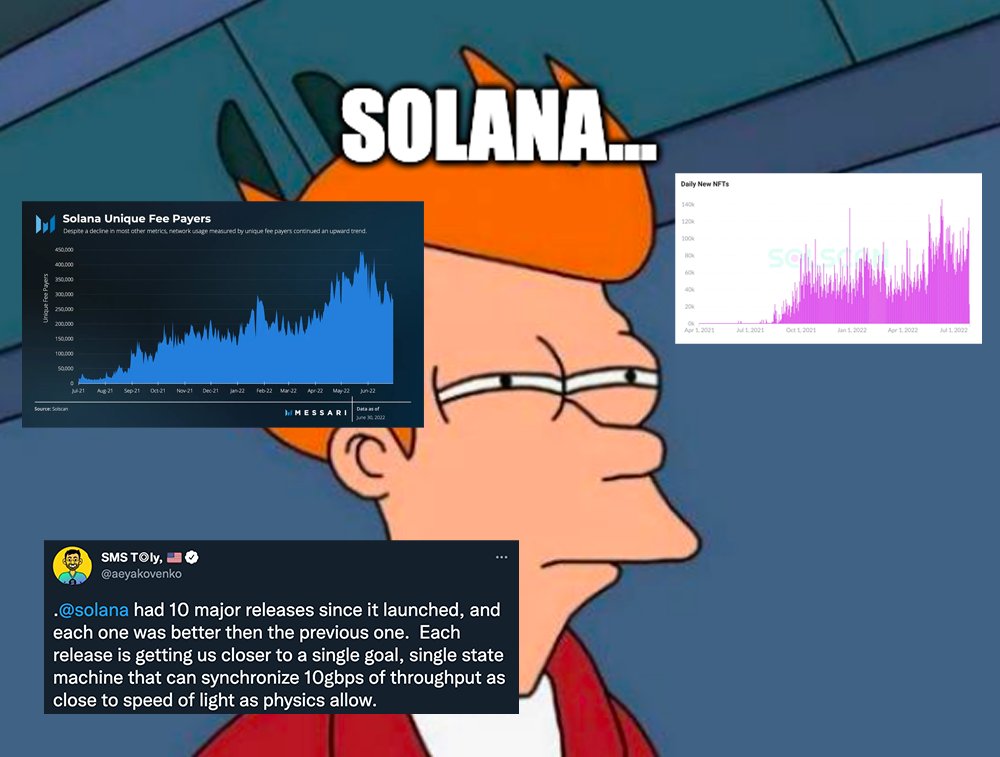

We’ve all become accustomed to enjoying the memes when Solana goes down.

The chain has gone down four times in its history. There are obviously serious knock on effects when a blockchain halts.

This is obviously bad.

We’ve all become accustomed to enjoying the memes when Solana goes down.

The chain has gone down four times in its history. There are obviously serious knock on effects when a blockchain halts.

This is obviously bad.

But, we can now see that Solana’s 1.10 has helped performance significantly.

You can see the impact on performance here. TPS is consistently back above 2.4k and there have been no chain incidents since the update.

You can see the impact on performance here. TPS is consistently back above 2.4k and there have been no chain incidents since the update.

The series introduced QUIC and Quality of Service (Qos) packets by stake weight and fee prioritization. You can read a great summary of these technical updates here:

medium.com/chorus-one/how-will-solana-improve-its-stability-6d4b0ba41866

medium.com/chorus-one/how-will-solana-improve-its-stability-6d4b0ba41866

The v1.10 series continues to roll out slowly, and the subsequent release series, v1.11, will focus on making QUIC default and optimizing the other features included in the v1.10 series.

The longer term vision is summed up here:

The longer term vision is summed up here:

Solana adoption

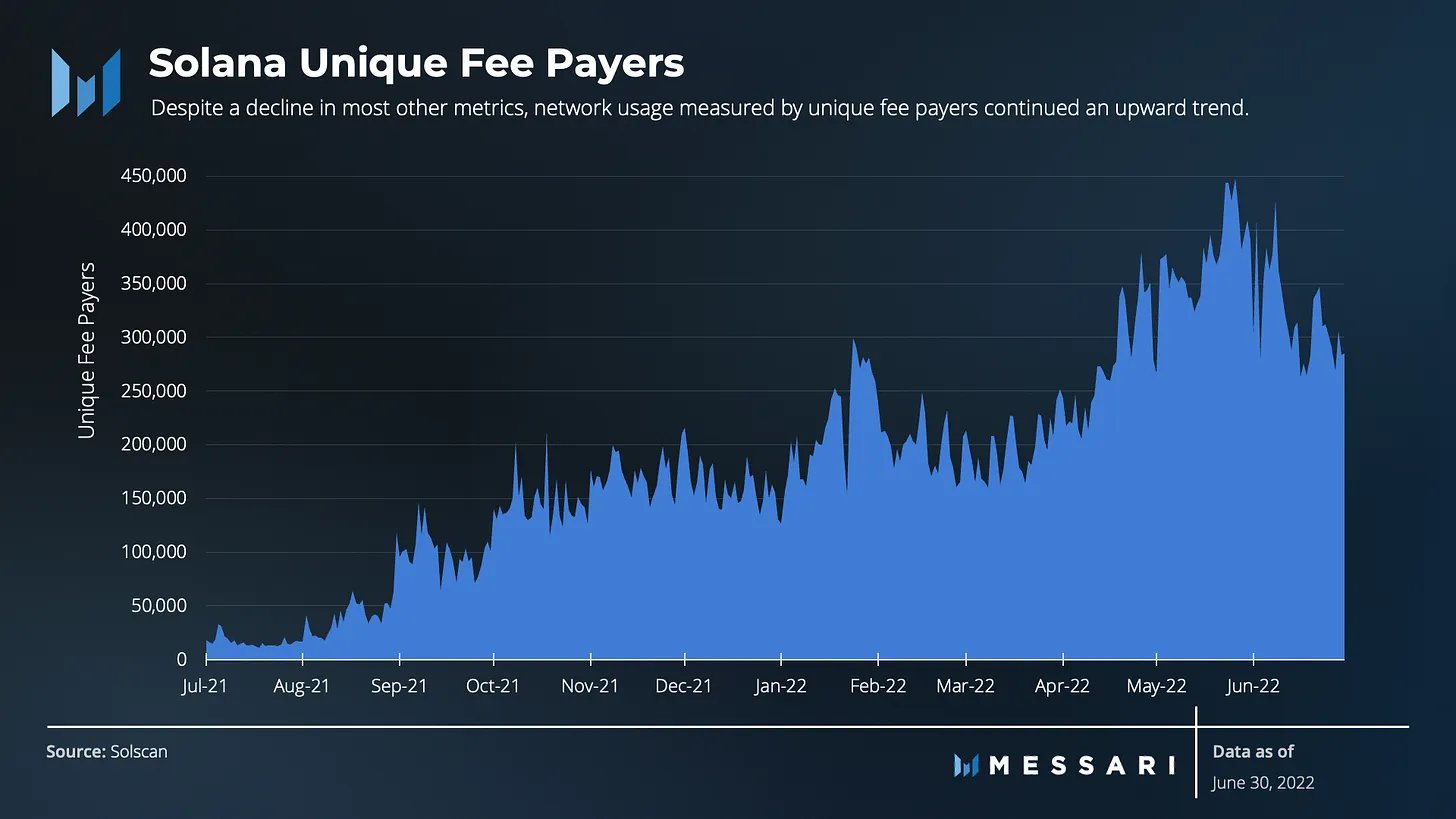

Solana is the only non-EVM chain, which has seen meaningful adoption. That is some achievement when you take into account the network effects of the EVM.

Solana is the only non-EVM chain, which has seen meaningful adoption. That is some achievement when you take into account the network effects of the EVM.

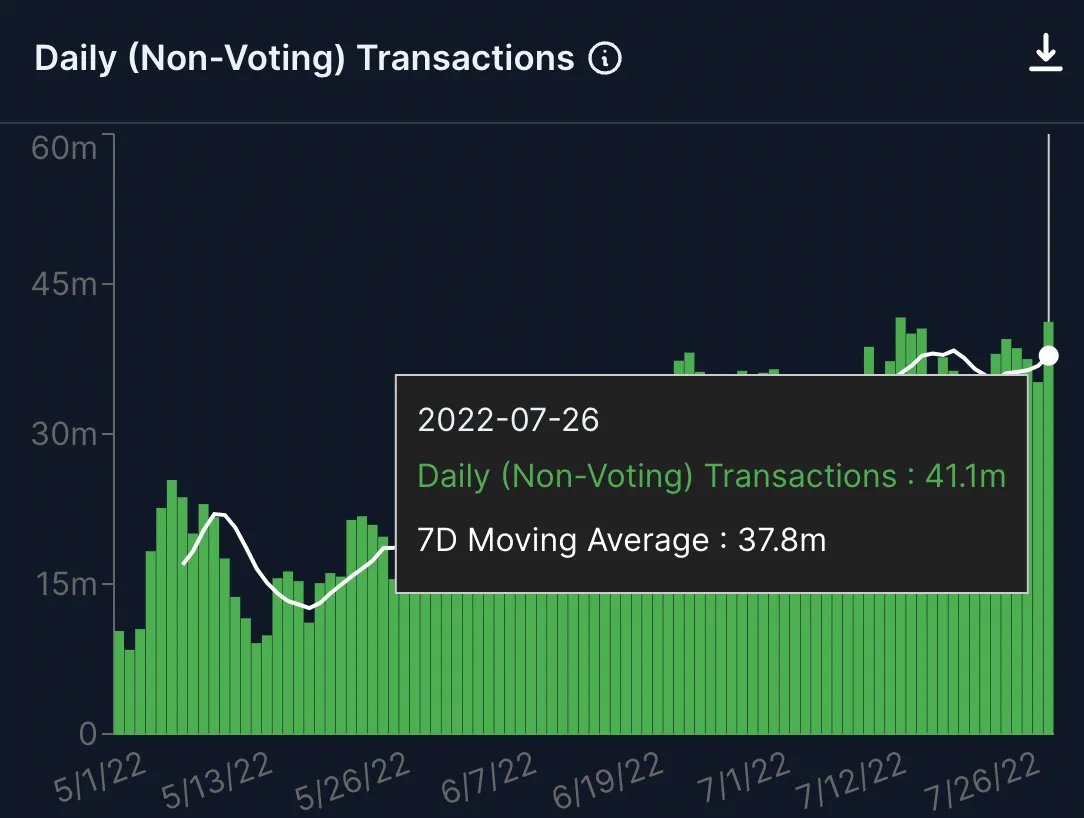

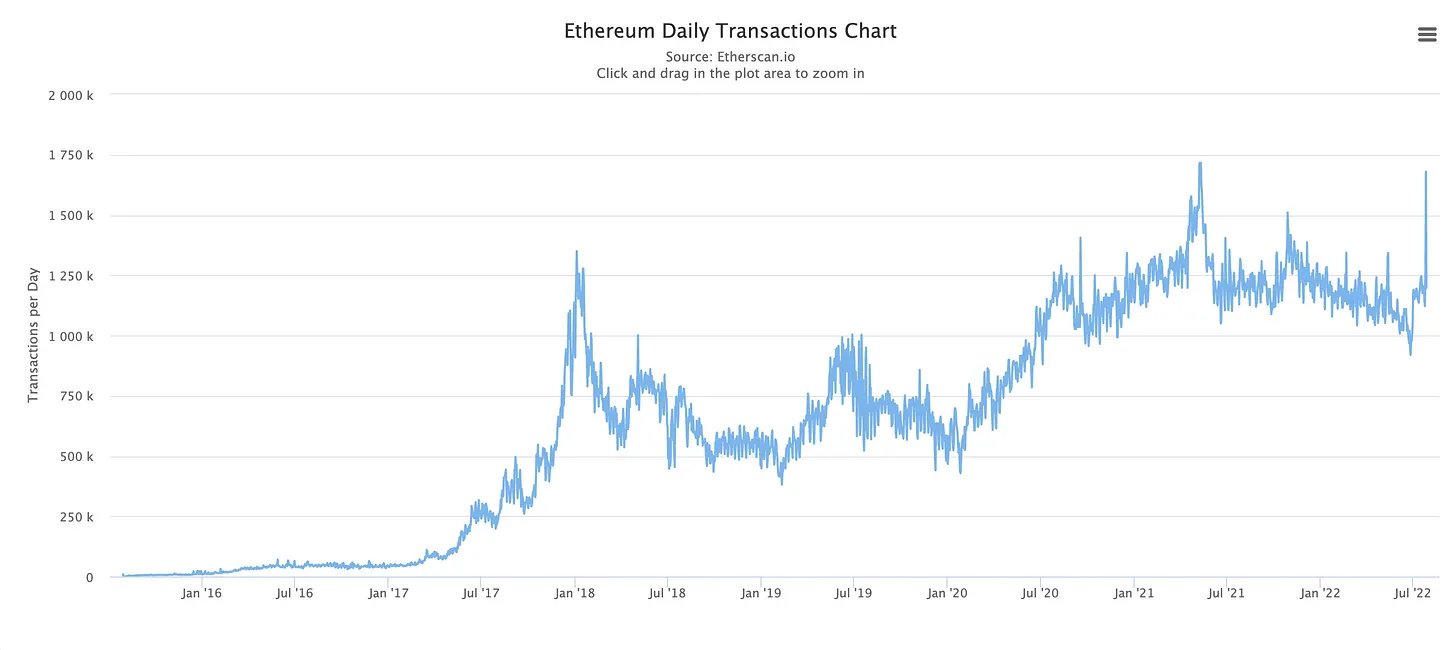

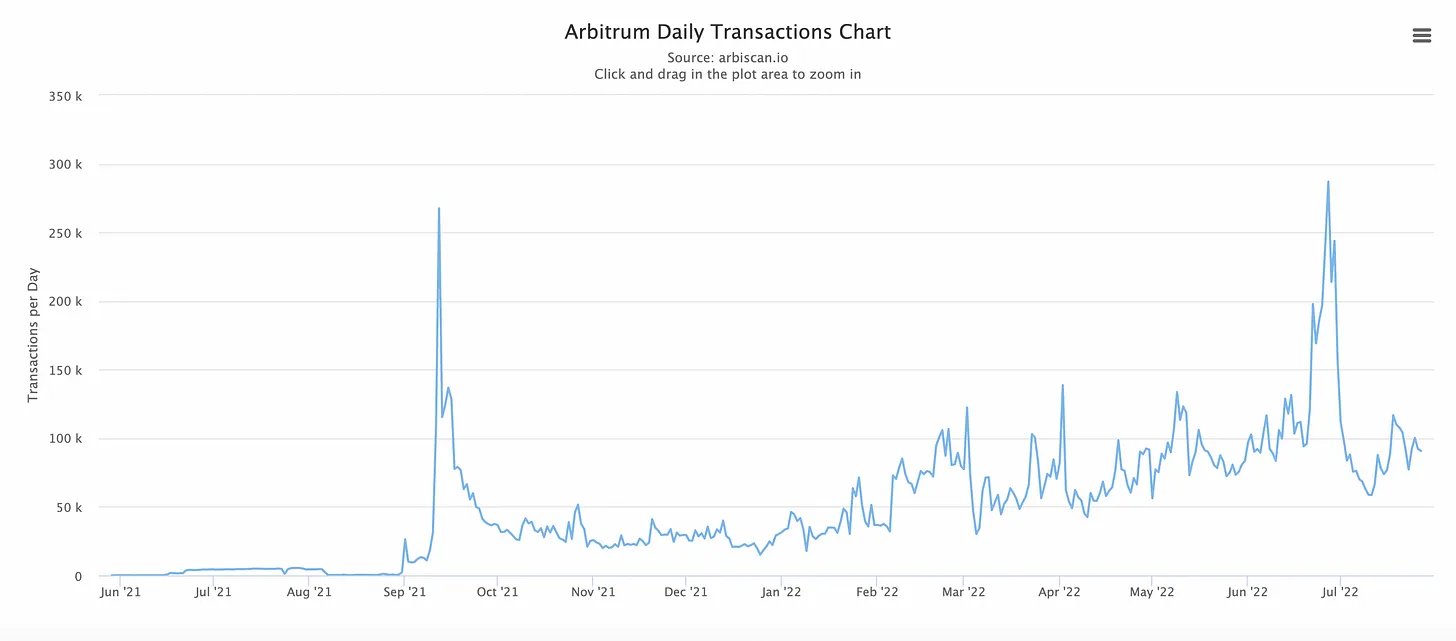

Daily transactions have been steadily rising in 2022. This chart doesn’t include the voting transactions that are used for consensus.

Obviously, Solana transactions are much cheaper than ETH L1 or L2 transactions right now, so you would expect the volume of transactions to be higher.

There is also a steady uptrend on L2 transactions over the last year.

There is also a steady uptrend on L2 transactions over the last year.

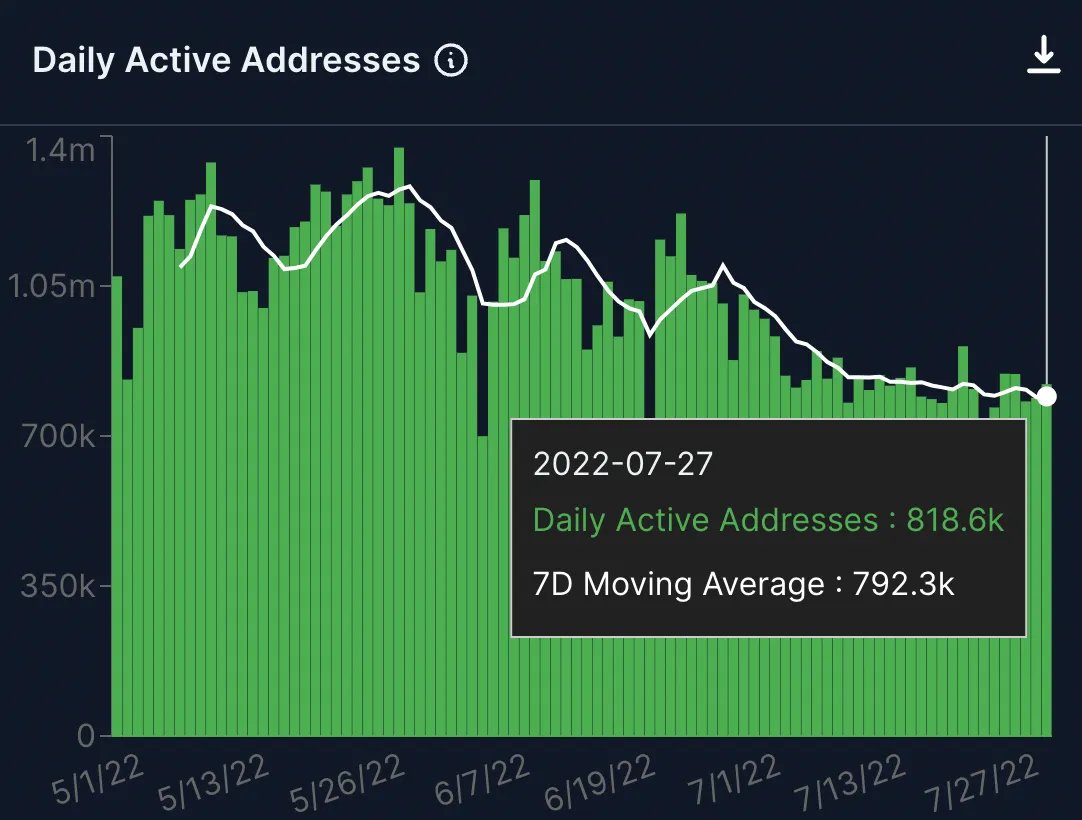

Daily active addresses are sitting just under 800k currently. The 7D moving average is actually the highest of any chain when this snapshot was taken.

Very impressive. Of course, unique addresses doesn’t necessarily mean unique users.

Very impressive. Of course, unique addresses doesn’t necessarily mean unique users.

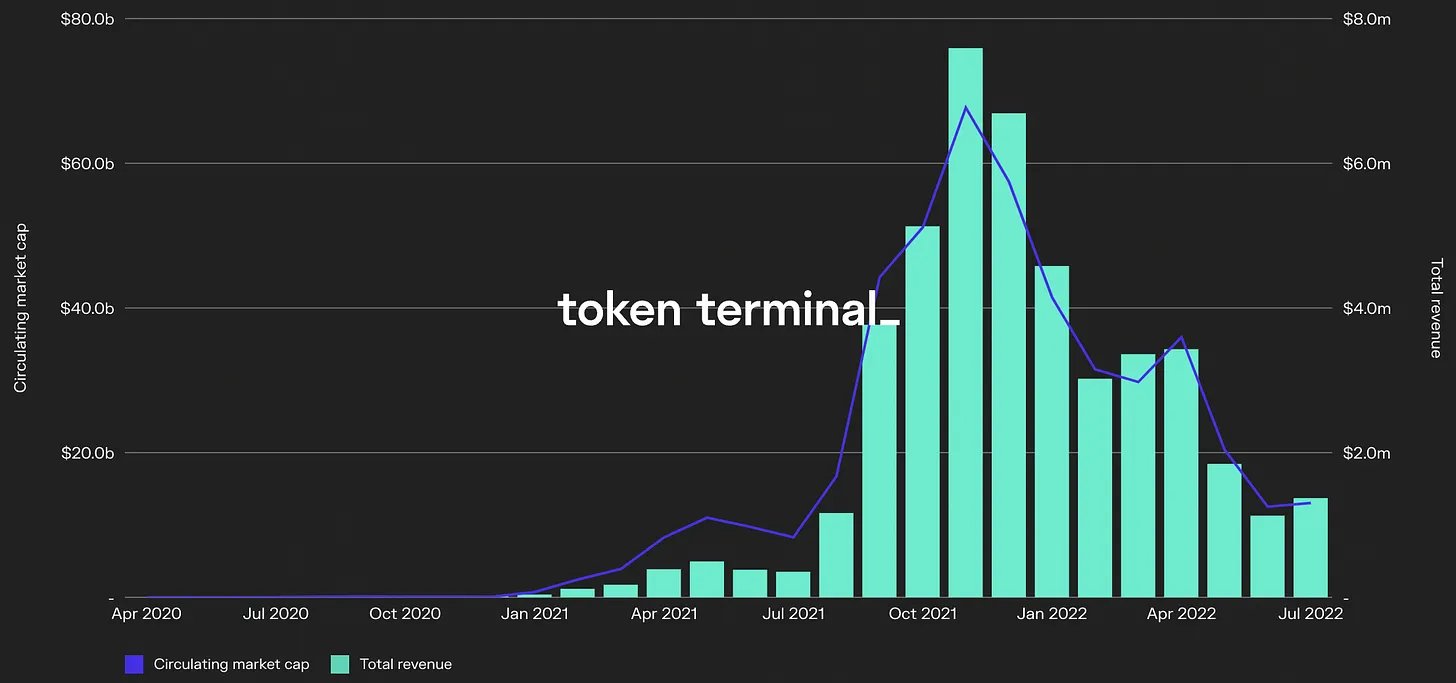

The annualised total revenue based on the last 30 days is just over $17.72 million, which is obviously significantly less than Ethereum’s $1.37B.

This is where most people, me included, start to stratch our heads and ask how does this make sense?

The SOL price so far has been determined by future speculation that Solana will get a tremendous amount of adoption and then the cheap fees will rack up to something meaningful.

The introduction of fee markets is a major change for Solana and this should see an increase in fees generated.

A user is able to attach an optional fee to their transaction to get it prioritized, with 50% of the fee going to the validator and 50% being burned.

A user is able to attach an optional fee to their transaction to get it prioritized, with 50% of the fee going to the validator and 50% being burned.

Rather than creating a global fee market, where transactions compete globally to be included in the next block, like on Ethereum, Solana will have a local fee market which will result in spiking transaction fees solely for local states.

In reality, competition for blockspace will likely cause a net-increase fees globally.

This is a fantastic write-up on Solana in general, but also explains how Solana’s fee markets will work in much more detail:

sanny.substack.com/p/solana-is-dead-long-live-solana?utm_source=substack&utm_medium=web%2Creader2&utm...

This is a fantastic write-up on Solana in general, but also explains how Solana’s fee markets will work in much more detail:

sanny.substack.com/p/solana-is-dead-long-live-solana?utm_source=substack&utm_medium=web%2Creader2&utm...

This is also a great recent thread analysing fee markets on Solana:

Solana DeFi

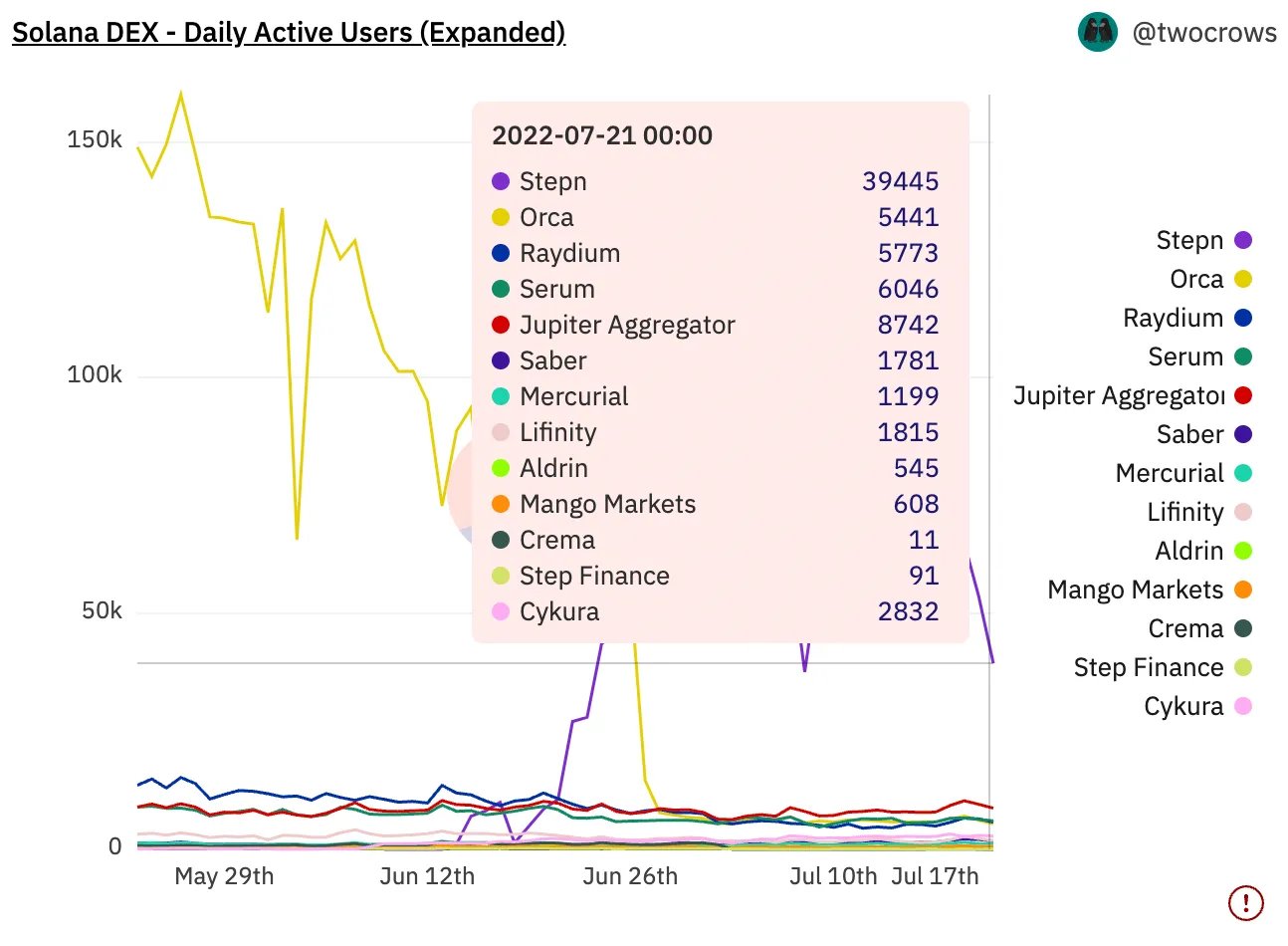

I’m looking at a surface level here, but what looked like promising DeFi useage, actually turned out to be Stepn using Orca as their integrated DEX.

After Stepn moved away from Orca this happened:

I’m looking at a surface level here, but what looked like promising DeFi useage, actually turned out to be Stepn using Orca as their integrated DEX.

After Stepn moved away from Orca this happened:

Here is a recent pull from Dune.

We can see Stepn is still dominating daily DEX useage (presumably people are having to run marathons every day in order to make their money back).

We can see Stepn is still dominating daily DEX useage (presumably people are having to run marathons every day in order to make their money back).

But, if we ignore Stepn, we get a number of around 30k DEX users on Solana.

For comparison here are the average number of DEX users on Polygon and Ethereum L1.

For comparison here are the average number of DEX users on Polygon and Ethereum L1.

Solana’s number is higher than I would have guessed. Especially as Solana DeFi has had serious challenges and problems over the last six months. From mainnet downtime, oracle failures to a dapp threatening to take control of a major whale's account.

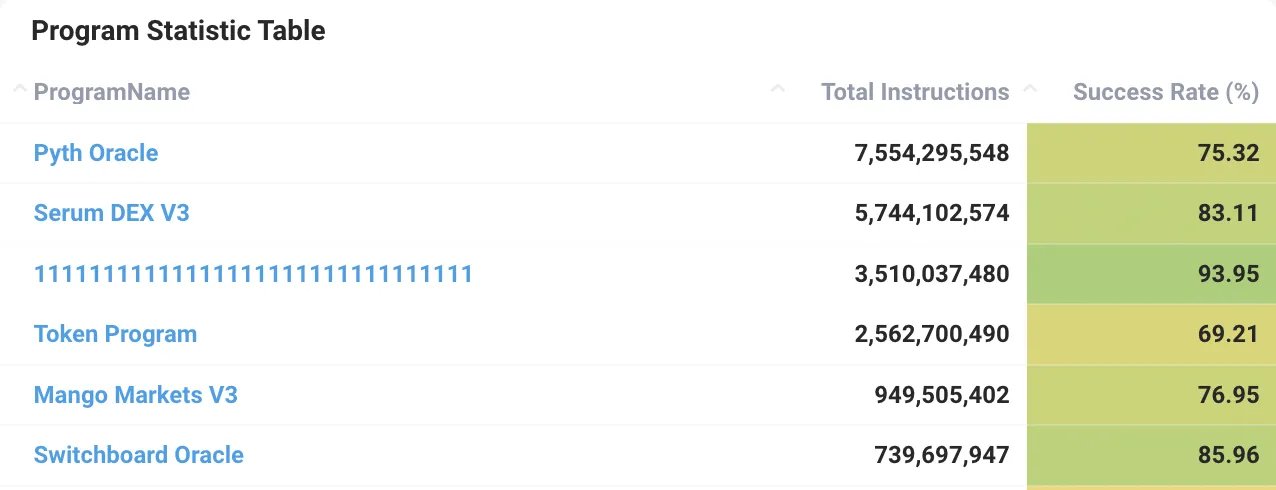

Pyth continues to be the most widely used oracle on Solana and the most used program in general. Chainlink is now available for developers to use, but there doesn’t seem to have been much of a shift yet.

Not sure why, as Pyth has shown itself to be unreliable in the past.

Not sure why, as Pyth has shown itself to be unreliable in the past.

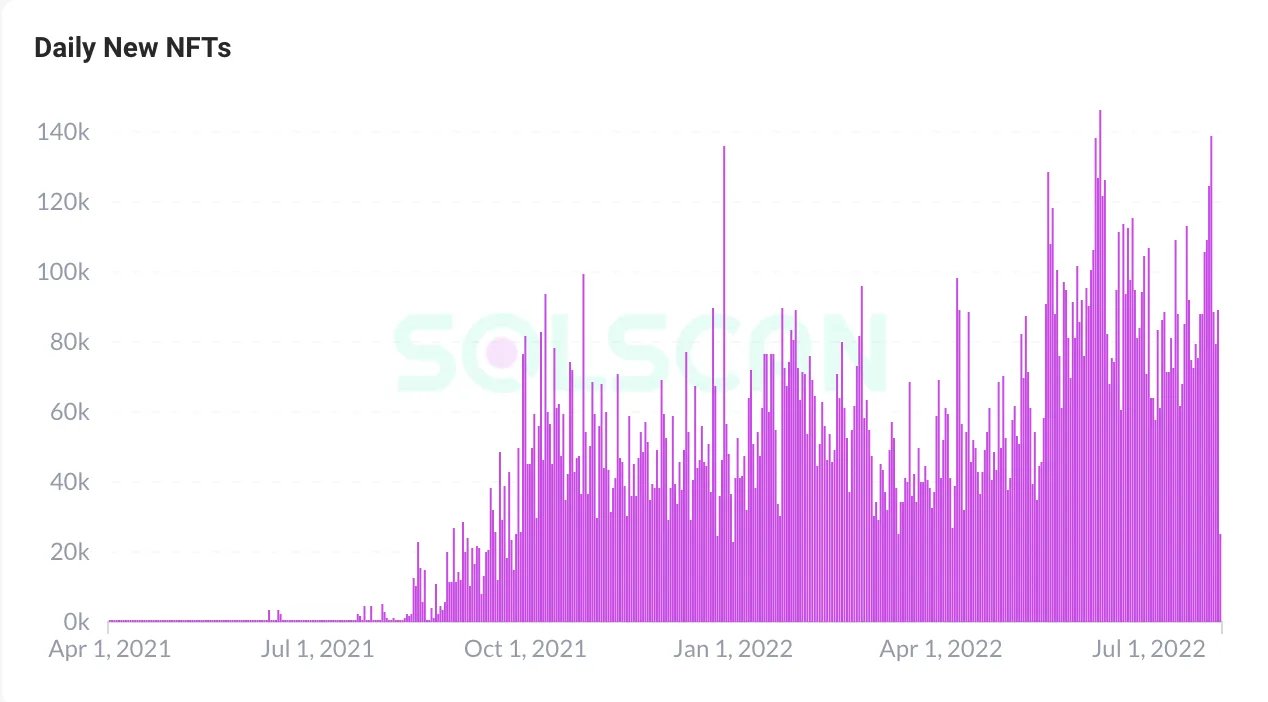

NFTs

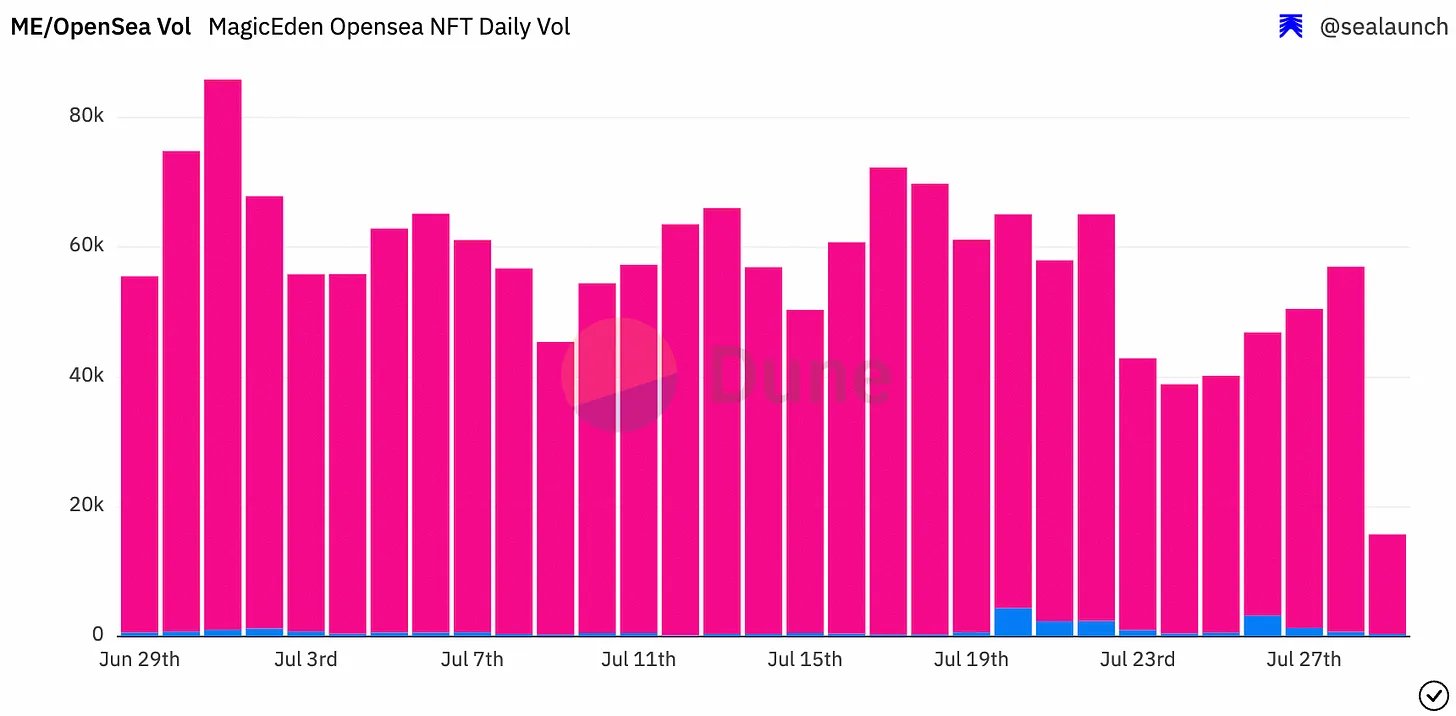

This is the category where Solana really shines and is posting some very impressive numbers.

This is the category where Solana really shines and is posting some very impressive numbers.

Despite OpenSea launching support for SOL NFTs they have taken away no marketshare from @MagicEden (Solana's most popular NFT marketplace).

June saw the biggest month for daily minted NFTs on Solana and July has been strong too.

June saw the biggest month for daily minted NFTs on Solana and July has been strong too.

Decentralisation

This is where most people (me previously) think Solana falls down. Expensive hardware and the amount of $SOL staked which is needed to be profitable makes it quite a large barrier for anyone wanting to become a validator.

This is where most people (me previously) think Solana falls down. Expensive hardware and the amount of $SOL staked which is needed to be profitable makes it quite a large barrier for anyone wanting to become a validator.

However, the validator number has been growing very steadily.

The above is well worth reading, but the TLDR is:

• Solana has the most active validators of almost any Proof of Stake blockchain after Ethereum.

• Nearly half of Solana’s validators are located in the US and Germany (geographic concentration is a problem for most chains).

• Solana has the most active validators of almost any Proof of Stake blockchain after Ethereum.

• Nearly half of Solana’s validators are located in the US and Germany (geographic concentration is a problem for most chains).

• Solana validators can begin staking with 1 SOL token, but a validator must constantly participate in voting transactions, with transaction fees costing about 1.1 SOL per day.

• For a validator to break even at a 10% commission, they need either 45k of SOL staked by 3rd parties (~$2m), or 5k of SOL self-staked.

• In order to help validators achieve profitability, the Solana Foundation has created the delegation program

medium.com/solana-labs/announcing-the-solana-foundation-delegation-strategy-5bcccf9104ab

• In order to help validators achieve profitability, the Solana Foundation has created the delegation program

medium.com/solana-labs/announcing-the-solana-foundation-delegation-strategy-5bcccf9104ab

Solana and Ethereum have different philosophies

Solana’s philosophy of move fast and sometimes break things is in contrast to Ethereum’s mantra of slow and steady wins the race.

Solana’s philosophy of move fast and sometimes break things is in contrast to Ethereum’s mantra of slow and steady wins the race.

Nathan wrote this interesting perspective on why Solana is genuine competition.

The TLDR is that everything happening on Solana is focused on making everything easy for regular users, like your grandma. Whilst arguably Ethereum devs have not prioritised focusing on the regular user.

Regular users = mass adoption

Regular users = mass adoption

I’m not criticising Ethereum here (its my biggest and highest conviction bag), but it would be ignorant to not recognise what Solana is doing well and learn from it.

I am just going to make the observation that this tweet suggests a shift in Ethereum dev attitude:

The clear focus on UI and easy onboarding for users (Phantom wallet) has also been a notable difference between Solana and ETH.

Neon

I expected this to roll out some time ago and am still unsure when it will launch.

Neon is a smart contract created using Rust on the Solana network that allows “Ethereum-like transactions” to be processed on Solana with Ethereum rulesets.

I expected this to roll out some time ago and am still unsure when it will launch.

Neon is a smart contract created using Rust on the Solana network that allows “Ethereum-like transactions” to be processed on Solana with Ethereum rulesets.

Neon allows Ethereum assets, transactions, and smart contracts to be executed in parallel, capitalising upon Solana’s parallelisation technologies such as Sealevel.

A few benefits:

• Smart contract interoperability

• Allows developers to port existing ETH dApps over to Solana

• Brings non-compatible coding languages to Solana

• No reconfiguration or alterations required to deploy smart contracts

• Increased network effects

• Smart contract interoperability

• Allows developers to port existing ETH dApps over to Solana

• Brings non-compatible coding languages to Solana

• No reconfiguration or alterations required to deploy smart contracts

• Increased network effects

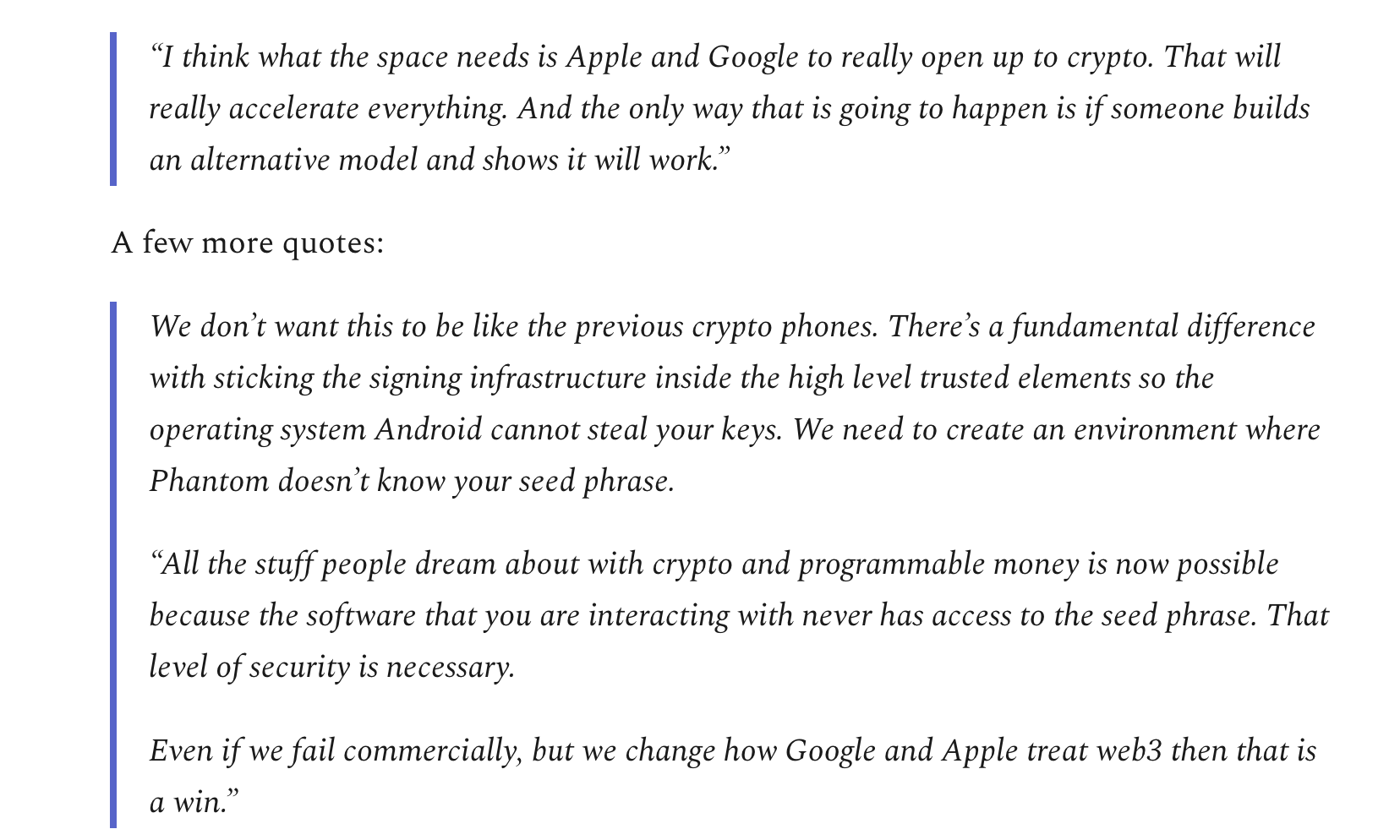

Saga Phone and SMS

This was a surprise for everyone judging by the reaction on CT.

Yes, developing a phone seems kind of mad when the chain still has problems to solve, but if Solana genuinely seeks mass adoption it could be the move that sparks the revolution.

This was a surprise for everyone judging by the reaction on CT.

Yes, developing a phone seems kind of mad when the chain still has problems to solve, but if Solana genuinely seeks mass adoption it could be the move that sparks the revolution.

The TLDR:

Another good take from Pickle. The r/r could be immense here. Making web3 work on mobile is the holy grail and it’s the surest path to adoption.

Java devs enter the room.

It’s obvious that the odds are still stacked against Solana pulling this off. However, I salute the bravery and effort in taking on this challenge and the beneficial effect it could have for the whole of web3.

Anatoly

If a crypto founder inspires a cult it usually means the chart is about to flip upside down.

Anatoly seems to inspire respect, but a cult hasn’t organised around him (I think).

If a crypto founder inspires a cult it usually means the chart is about to flip upside down.

Anatoly seems to inspire respect, but a cult hasn’t organised around him (I think).

I haven't seen him react negatively to a single piece of FUD, despite a fairly constant stream of Twitter attacks. I have seen many examples of him reacting rationally and logically to criticism. This is just my impression from following him casually on Twitter.

Here is an example of him responding to some recent criticism:

Concluding thoughts

I think Solana might be the most contentious blockchain out there today. I previously couldn’t see past their technical problems and figured Solana was just broken.

However, having dug through the data there is just too much happening to ignore it.

I think Solana might be the most contentious blockchain out there today. I previously couldn’t see past their technical problems and figured Solana was just broken.

However, having dug through the data there is just too much happening to ignore it.

Solana still has plenty of hurdles to overcome in regards to scaling, but this is no different to every other L1.

I agree with Polynya, I think Solana can adopt the tech they need overtime in order to keep scaling, but have a lot going for them right now.

Anatoly has said Solana’s goal is to improve Solana with each update. They are trying to solve problems that no other L1 is facing right now with the amount of activity happening on their chain.

But who knows, no blockchain has successfully scaled thus far and that’s why so many people are betting on multiple L1s and I think that's ok.

Avalanche, Cosmos & Polygon all have things going for them.

I don't pretend I'm technical enough to know how it all plays out.

Avalanche, Cosmos & Polygon all have things going for them.

I don't pretend I'm technical enough to know how it all plays out.

I also don’t know when the revenue generated by the network will start to catch up with the SOL market cap. I still think Solana will need tremendous adoption to start generating the revenue required for long term security and this is where I remain skeptical.

The question for investors is whether they value a blockchain and token led by a strong, well funded development foundation or whether they prefer more decentralized leadership with more even token distribution.

You can have a bit of both though.

You can have a bit of both though.

But, if you are looking for an alternative L1 bet alongside ETH in your portfolio, then I think Solana makes sense, as it is taking a different path to Ethereum. It’s still 84% off its ATH right now and that puts it in DCA territory for me.

The macro backdrop remains tough, but Solana has maintained a lot its momentum and I think there is a high probability that it will do well in the future once market conditions improve.

Plus, it can’t hurt to have Sam in your corner in the long run.

Plus, it can’t hurt to have Sam in your corner in the long run.

If you enjoyed the thread, please consider giving it an RT. This took me ages lol

Mentions

See All

Raoul Pal @RaoulPal

·

Aug 2, 2022

Great thread. Thanks.