Thread

As CFO, what is my favourite KPI?

Easy...Maintainable Free Cash Flow

"Oooooo, what's that?"

Pull up a chair, let me tell you...👇

Easy...Maintainable Free Cash Flow

"Oooooo, what's that?"

Pull up a chair, let me tell you...👇

1/ Let me start with why I love cashflow.

Cashflow doesn't lie like profit does.

Cashflow is that honest friend that tells me when I've got something in my teeth.

Cashflow is real.

Profit hides away in spreadsheets whispering secrets and telling stories.

Cashflow doesn't lie like profit does.

Cashflow is that honest friend that tells me when I've got something in my teeth.

Cashflow is real.

Profit hides away in spreadsheets whispering secrets and telling stories.

2/ OK, but why Maintainable Free Cash Flow?

Maintainable Free Cash Flow or MFCF😍 for short, is a measure of the cashflow generated by the business, that can be used for things that make shareholders happy.

Sounds boring. But it isn't.

MFCF is f*cking awesome.

Maintainable Free Cash Flow or MFCF😍 for short, is a measure of the cashflow generated by the business, that can be used for things that make shareholders happy.

Sounds boring. But it isn't.

MFCF is f*cking awesome.

3/ Where did MFCF come from?

Me...

It's a measure I use internally which is developed as a derivative of Free Cash Flow (FCF).

It's different to FCF in that it clearly separates cash generation activities, from capital allocation decisions.

It works wonders inside a BigCo.

Me...

It's a measure I use internally which is developed as a derivative of Free Cash Flow (FCF).

It's different to FCF in that it clearly separates cash generation activities, from capital allocation decisions.

It works wonders inside a BigCo.

4/ OK then, where did FCF come from?

FCF was invented by Joel M Stern in 1972. Stern was a significant voice in development of finance theory.

Stern said FCF was a purer measure of shareholder value creation than any profit measure

Joel (J-Dog to his friends) was right.

FCF was invented by Joel M Stern in 1972. Stern was a significant voice in development of finance theory.

Stern said FCF was a purer measure of shareholder value creation than any profit measure

Joel (J-Dog to his friends) was right.

5/ Of course he was, look at that vest. Beautiful.

He also went on to develop another great metric; Economic Value Added.

He is going straight in the @secretCFO hall of fame with the EBITDADDY.

Sadly it will have to be a posthumous award for the J-Dog 😞

Anyway, I digress...

He also went on to develop another great metric; Economic Value Added.

He is going straight in the @secretCFO hall of fame with the EBITDADDY.

Sadly it will have to be a posthumous award for the J-Dog 😞

Anyway, I digress...

6/ So what is wrong with FCF then?

Nothing is wrong with it. It's a great measure for the right purpose.

As CFO though, it's all about how do I drive the BEHAVIOUR I need to see from the organisation.

So I design a measure that does exactly that

*MFCF has entered the chat*

Nothing is wrong with it. It's a great measure for the right purpose.

As CFO though, it's all about how do I drive the BEHAVIOUR I need to see from the organisation.

So I design a measure that does exactly that

*MFCF has entered the chat*

7/ What is the behaviour I want to see?

At it's most fundamental level, I want 2 things;

a) To drive cashflow from core operations as hard as possible

b) To make correct capital allocation decisions with that cashflow

At it's most fundamental level, I want 2 things;

a) To drive cashflow from core operations as hard as possible

b) To make correct capital allocation decisions with that cashflow

8/ The problem is that the 2 things happen in completely different places in the business.

Cash generation happens on the ground in the business. It's decentralised. It's delivered in business operations not corporate HQ.

It's delivered by real people who make and sell stuff

Cash generation happens on the ground in the business. It's decentralised. It's delivered in business operations not corporate HQ.

It's delivered by real people who make and sell stuff

9/ It's delivered in factories, retail stores, oil rigs, bagel shops, car dealerships, design studios...etc etc

This is different to capital allocation decisions which should be taken in a very centralised way.

Karen on checkout 3 doesn't get to decide our dividend policy.

This is different to capital allocation decisions which should be taken in a very centralised way.

Karen on checkout 3 doesn't get to decide our dividend policy.

10/ So, I use MFCF to ringfence the cashflow between cash generation and capital allocation.

If it's above MFCF, it's cash generation.

If it's below MFCF it's capital allocation.

If it's above MFCF, it's cash generation.

If it's below MFCF it's capital allocation.

11/ MFCF allows me to hold each part of the business to account to deliver their cashflow in their part of the operation.

What if they don't?

Well, everything goes to sh*t.

We don't have the cash we need to invest, repay debt or pay dividends.

No-one is happy.

What if they don't?

Well, everything goes to sh*t.

We don't have the cash we need to invest, repay debt or pay dividends.

No-one is happy.

12/ One of the limitations of Free Cash Flow, is that it is calculated using only what is publicly available.

It's why investors like it, it's the best they've got...

It's why investors like it, it's the best they've got...

13/ But I'm going to share with you how I look at MFCF as CFO from inside a business.

In other words, this is pure 🔥

You're welcome

In other words, this is pure 🔥

You're welcome

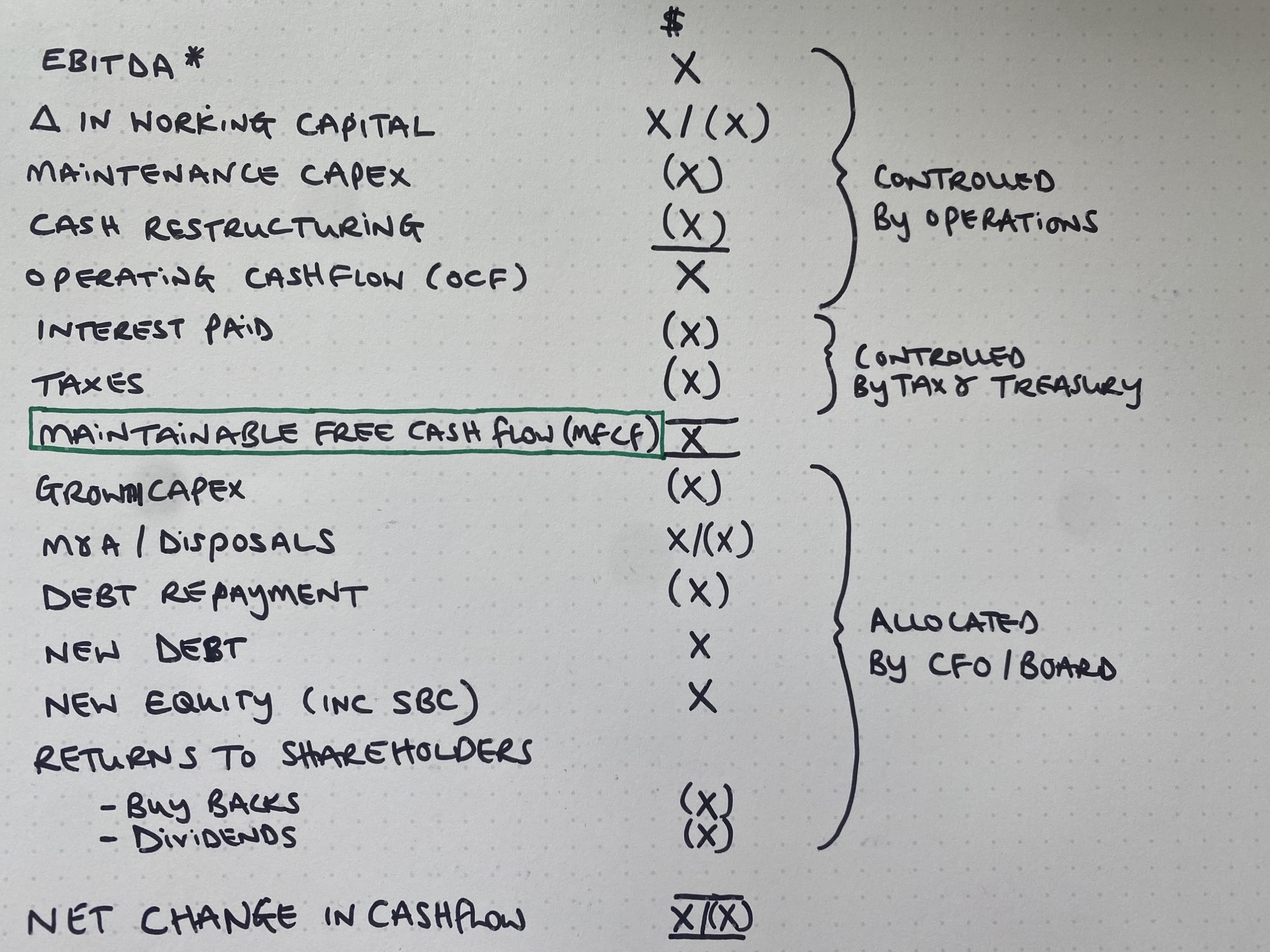

14/ So how exactly do I calculate MFCF

*EBITDA is before any restructuring costs, but after stock based compensation expenses

*EBITDA is before any restructuring costs, but after stock based compensation expenses

15/ Some of you will tell me, that this cuts across the school books a bit.

And that my calculation is a Frankenstein of FCFE

Maybe ...

But I don't care.

Why?

And that my calculation is a Frankenstein of FCFE

Maybe ...

But I don't care.

Why?

16/ Because what I care about... ALL I care about... is this:.

How do I present the cashflow to the business in a way that;

Cash performance is maximised (important for shareholders)

Capital allocation decisions are correct (important for shareholders)

More later on this

How do I present the cashflow to the business in a way that;

Cash performance is maximised (important for shareholders)

Capital allocation decisions are correct (important for shareholders)

More later on this

17/ A word on capex.

Traditionally FCF is calculated after deducting all capex.

In MFCF I deduct only MAINTENANCE capex.

And I treat GROWTH capex below the line

Why?

Traditionally FCF is calculated after deducting all capex.

In MFCF I deduct only MAINTENANCE capex.

And I treat GROWTH capex below the line

Why?

18/ Because they are completely different financial decisions.

Maintenance capex is any capex required for the operation to continue at its current level of operating performance.

I.e. It's necessary to support continuing the current level of EBITDA generation.

Maintenance capex is any capex required for the operation to continue at its current level of operating performance.

I.e. It's necessary to support continuing the current level of EBITDA generation.

19/ Growth capex on the other hand is different.

This is capex with the objective of increasing future EBITDA for an investment today.

That is a capital allocation decision with different opportunity costs

It shouldn't be evaluated alongside maintenance capex decisions...

This is capex with the objective of increasing future EBITDA for an investment today.

That is a capital allocation decision with different opportunity costs

It shouldn't be evaluated alongside maintenance capex decisions...

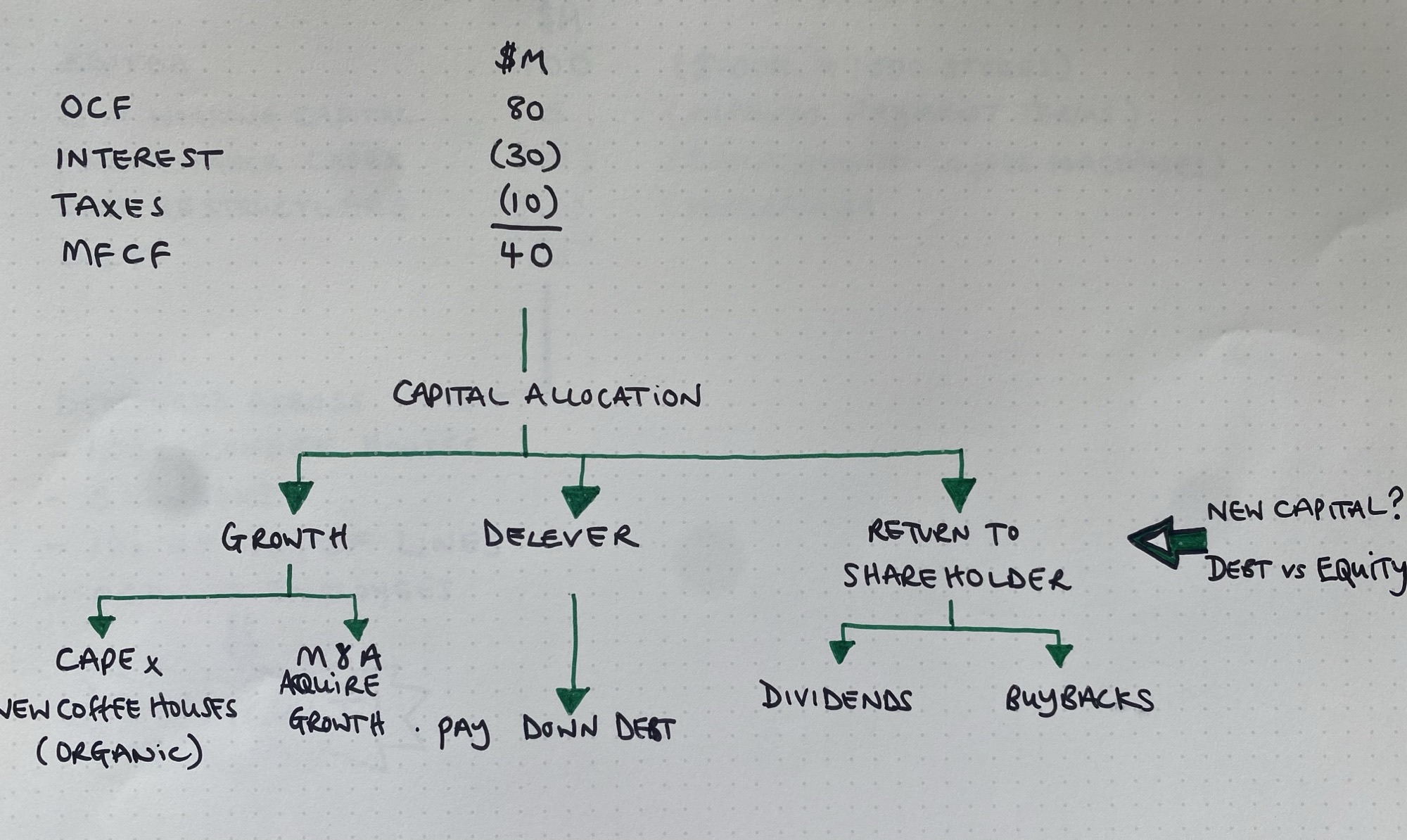

20/ It should be evaluated against other capital allocation options (dividends, debt pay down, M&A, etc)

Stock Based Compensation; this is a cash expense in EBITDA. This can be offset with an 'SBC add back' but BELOW MFCF.

That sh*t is an expense. Fight me.

Stock Based Compensation; this is a cash expense in EBITDA. This can be offset with an 'SBC add back' but BELOW MFCF.

That sh*t is an expense. Fight me.

21/ Interest & Tax. They are a consequence of the cashflow you have generated from the business. They go in MFCF.

You can get sophisticated here and take the tax shield on a capital allocation decision below the line but that's a bit 3D for my nice tidy thread.

You can get sophisticated here and take the tax shield on a capital allocation decision below the line but that's a bit 3D for my nice tidy thread.

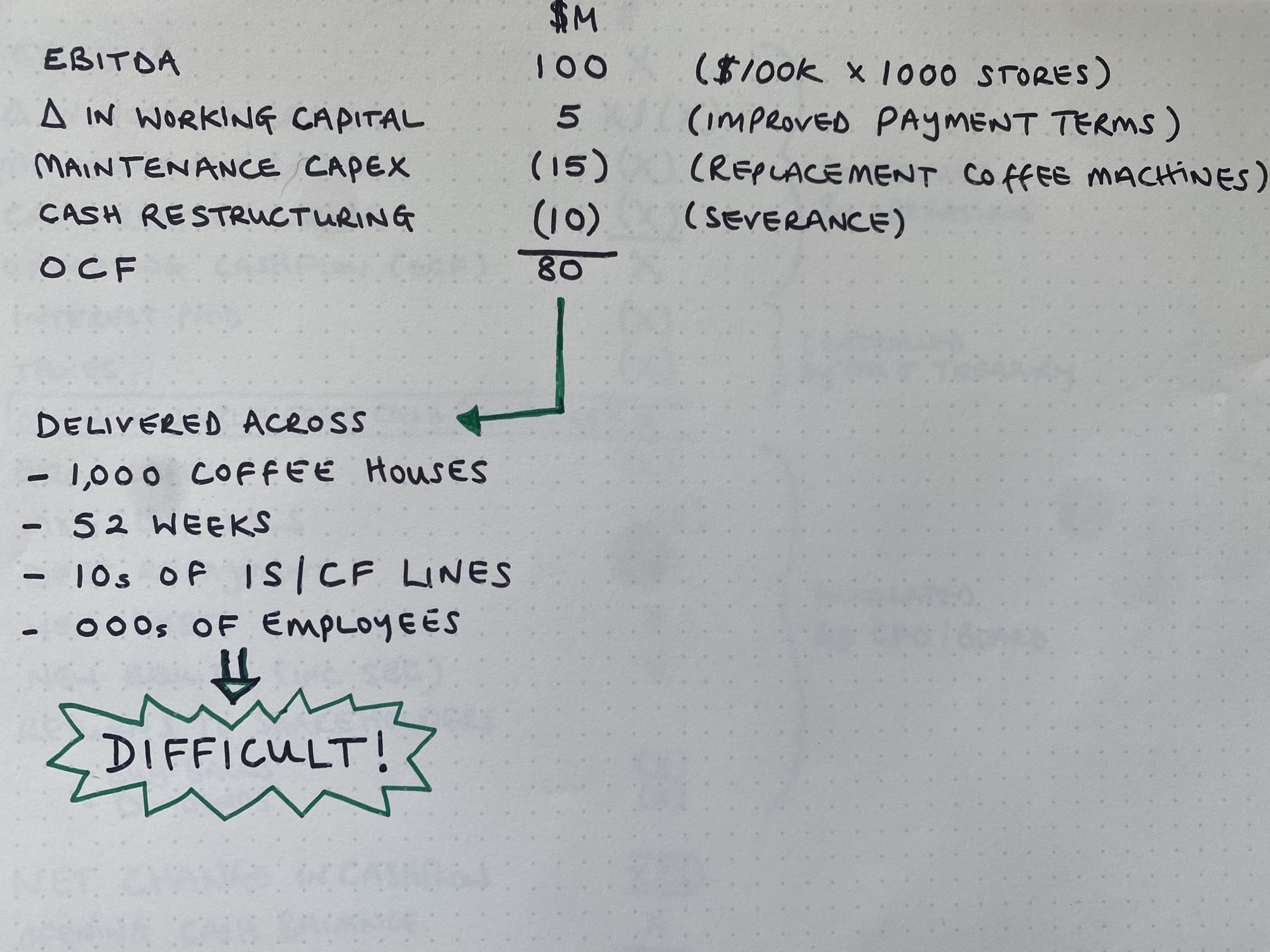

22/ Let's work an example year in a chain of 1,000 imaginary coffee houses.

- They generate $100k per store of EBITDA. That's $100m. Before restructuring but after SBC.

- I've improved payment terms with my coffee bean supplier, and it's worth a $5m inflow

- They generate $100k per store of EBITDA. That's $100m. Before restructuring but after SBC.

- I've improved payment terms with my coffee bean supplier, and it's worth a $5m inflow

23/

- I have to spend $15m replacing end of life fully amortized coffee machines. That's maintenance capex. My business can't operate without functioning coffee machines.

- I've also spent £10m on 'cash restructuring'. Severance pay after we changed management structure

- I have to spend $15m replacing end of life fully amortized coffee machines. That's maintenance capex. My business can't operate without functioning coffee machines.

- I've also spent £10m on 'cash restructuring'. Severance pay after we changed management structure

24/ Operating cashflow (OCF) = $80m (100 + 5 - 15 - 10).

This is the most complex line to manage, I have to deliver $80m of operating cashflow through a network of 1,000 coffee houses.

Each with it's own local challenges and some with good management and some with bad.

This is the most complex line to manage, I have to deliver $80m of operating cashflow through a network of 1,000 coffee houses.

Each with it's own local challenges and some with good management and some with bad.

25/ My most important job as CFO is building a reporting and performance management cycle that ensures I make it simple for the 000s of staff to deliver that $80m.

$80m delivered. One coffee cup at a time.

I've got another thread coming on how I do that.

But for now ....

$80m delivered. One coffee cup at a time.

I've got another thread coming on how I do that.

But for now ....

26/ What goes on in the cashflow below OCF to get down to MFCF?

Starting with $80m of OCF

- annual interest bill to pay of $30m. This is structural debt funding the business that generates my EBITDA. It's MFCF.

- taxes of $10m. Death & taxes and all that.

Starting with $80m of OCF

- annual interest bill to pay of $30m. This is structural debt funding the business that generates my EBITDA. It's MFCF.

- taxes of $10m. Death & taxes and all that.

27/ My MFCF is $40m; $80m of OCF - $30m - $10m)

That is the cash I have generated from my core business of operating 1,000 coffee shops.

I will measure the delivery of that $40m relentlessly.

Cash is like water, it will leak into gaps and cracks you don't even know are there

That is the cash I have generated from my core business of operating 1,000 coffee shops.

I will measure the delivery of that $40m relentlessly.

Cash is like water, it will leak into gaps and cracks you don't even know are there

28/ A buyer will give it away in payment terms to hit a rebate target.

An administrator will set the inventory MOQs at a level that makes their job easier and leaks cash to inventory.

An operator will waste capex for minimal payback in search of an EBITDA target.

An administrator will set the inventory MOQs at a level that makes their job easier and leaks cash to inventory.

An operator will waste capex for minimal payback in search of an EBITDA target.

29/ As CFO you design the performance control system to root this waste out.

It will be different in every business, but converting business performance into MFCF is one of your fundamental duties as CFO.

Remember who you work for.

Don't let your shareholders down

It will be different in every business, but converting business performance into MFCF is one of your fundamental duties as CFO.

Remember who you work for.

Don't let your shareholders down

30/ So, we've generated $40m of MFCF in our coffee houses.

It is new capital generated by the business, and everyone will want a piece.

Your next duty as CFO is to make sure that $40m MFCF is allocated in a way that is best for shareholders

But that's for next time ...

It is new capital generated by the business, and everyone will want a piece.

Your next duty as CFO is to make sure that $40m MFCF is allocated in a way that is best for shareholders

But that's for next time ...

31/ MFCF is my truest measure of business performance and shareholder value.

Shareholder value is simply the present value of future MFCF.

The business (including the CEO) will get distracted by vanity metrics. My job as CFO is to anchor them back to MFCF.

Every. F-ing. Day.

Shareholder value is simply the present value of future MFCF.

The business (including the CEO) will get distracted by vanity metrics. My job as CFO is to anchor them back to MFCF.

Every. F-ing. Day.

TLDR - Free Cash Flow

1. MFCF is a CFO's best friend

2. Purest measure of business performance

3. Separate cash generation, from capital allocation

4. MFCF doesn't manage itself. It needs hand to hand combat.

5. Driving MFCF = Driving shareholder value

1. MFCF is a CFO's best friend

2. Purest measure of business performance

3. Separate cash generation, from capital allocation

4. MFCF doesn't manage itself. It needs hand to hand combat.

5. Driving MFCF = Driving shareholder value

That's Maintainable Free Cash Flow...

If you enjoyed this thread:

1. Follow me @SecretCFO for more of these

2. RT the tweet below to share this thread with your audience

If you enjoyed this thread:

1. Follow me @SecretCFO for more of these

2. RT the tweet below to share this thread with your audience

Mentions

See All

Brian Feroldi @BrianFeroldi

·

Sep 16, 2022

Wonderful thread. I like the term!