Thread

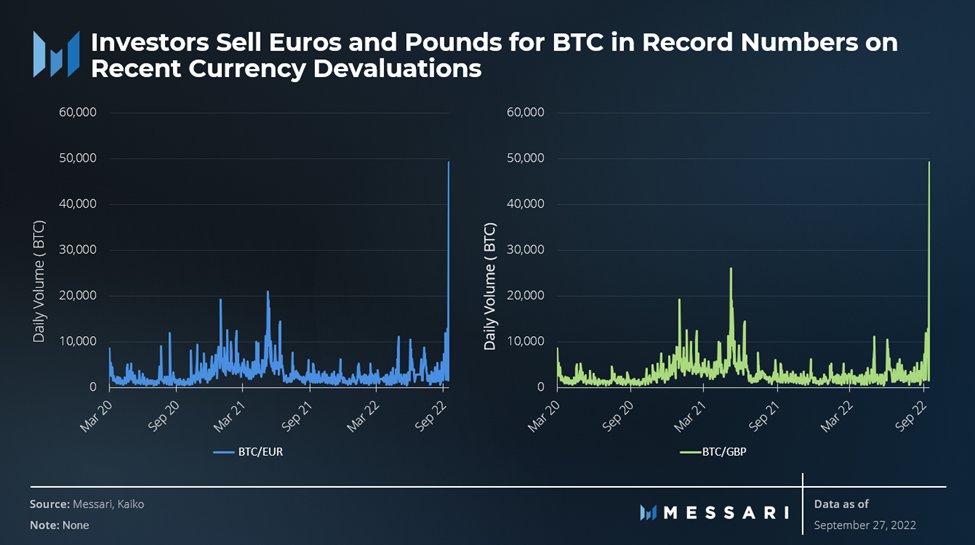

(1/6) If your currency was rapidly depreciating what would you buy to protect your purchasing power?

The answer for Euro and Pound holders has overwhelmingly been #Bitcoin

This is notable because we did not see the same trend in previous crises in 2020 or 2021

A brief 🧵

The answer for Euro and Pound holders has overwhelmingly been #Bitcoin

This is notable because we did not see the same trend in previous crises in 2020 or 2021

A brief 🧵

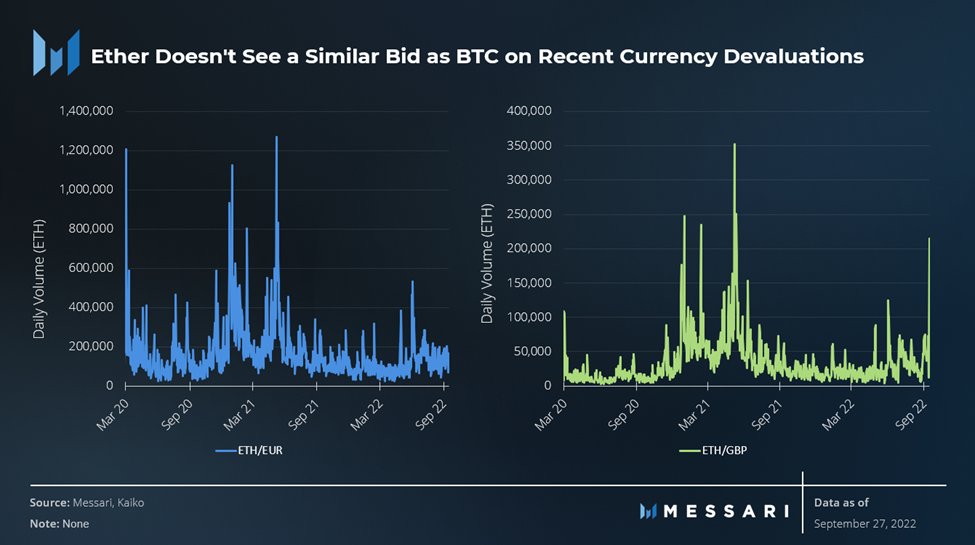

(2/6) What about other major crypto assets? Interestingly we haven't seen the same trend with Ether. Recent volumes are fairly unremarkable compared to the last 2 years. Hard money vs the world computer?

(3/6) "Real hard money" in Gold actually DEPRECIATED during the Sept 13th Euro sell-off and Sept 26th Pound drop off

(4/6) Is the hard money thesis of Bitcoin playing out before our eyes? Probably not. But this flight to Bitcoin is an interesting development and could be one stepping stone towards BTC being considered hard money.

(5/6) We’ve seen emerging countries choose to purchase Bitcoin at much higher rates than developed nations for years primarily due to local currency weakness. The top 20 countries in crypto adoption are ripe with countries with currency problems: Turkey, Brazil, Russia, Nigeria.

(6/6) The story of Bitcoin being hard money won’t play out overnight but over years. This could be the first real domino to fall.

messari.io/article/analyst-note-currency-crisises-in-a-crypto-context?utm_source=twitter_tomdunleavy&...

messari.io/article/analyst-note-currency-crisises-in-a-crypto-context?utm_source=twitter_tomdunleavy&...

I'll add to this that almost all of this volume is through Bitfinex .... and I have no idea why.