Thread

Liability Driven Investments or LDIs for short.

What are they, and how did they almost take down the entire UK pension fund system?

Time for a debt 🧵👇

What are they, and how did they almost take down the entire UK pension fund system?

Time for a debt 🧵👇

🤑 Pension funds

First, a pension fund or scheme, as known in the UK, is an investment vehicle that pays income to members upon retirement

The total amount to be paid is set up as a long series of future payments

Put simply, these future payments are liabilities to the fund

First, a pension fund or scheme, as known in the UK, is an investment vehicle that pays income to members upon retirement

The total amount to be paid is set up as a long series of future payments

Put simply, these future payments are liabilities to the fund

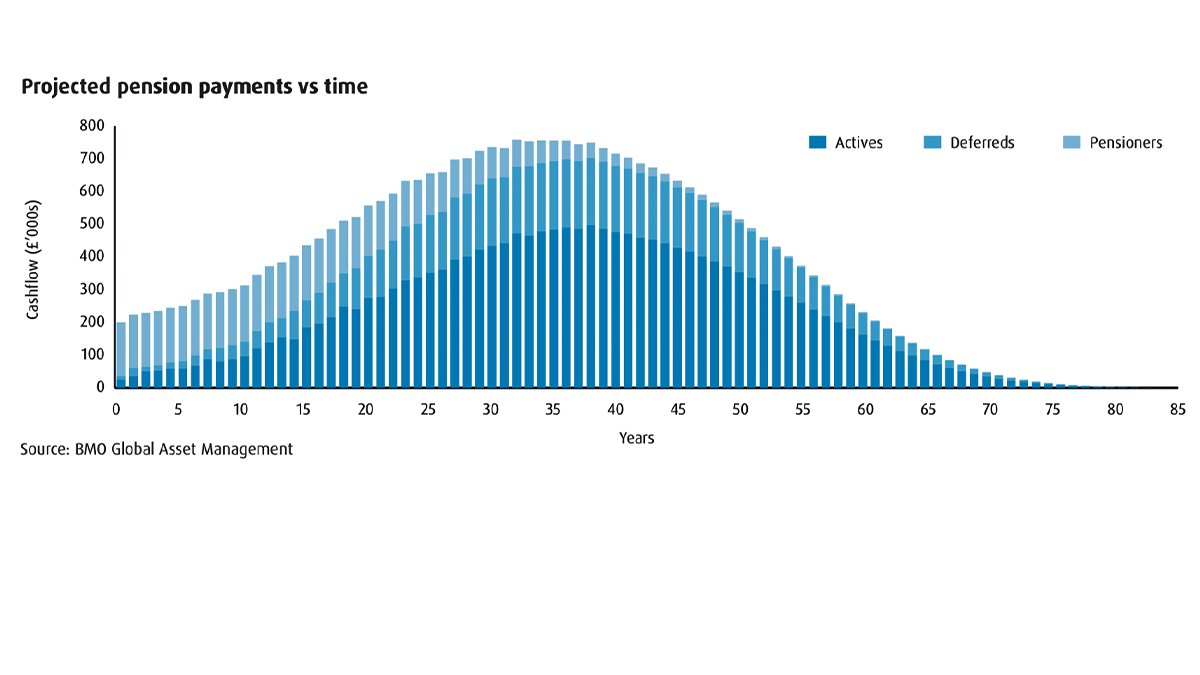

The fund projects aggregated monthly or annual payments it expects to make over its life

By assembling necessary member data, such as years worked, average salary, rate of accrual and age, the fund’s actuary calculates estimated cashflow projections for the life of the fund.

By assembling necessary member data, such as years worked, average salary, rate of accrual and age, the fund’s actuary calculates estimated cashflow projections for the life of the fund.

In the example created by BMO below, each bar represents how much must be paid for every year over the life of the fund

You can see liabilities peak in about 30 and 35 years, when the fund will need to provide the highest amount of annual payments.

You can see liabilities peak in about 30 and 35 years, when the fund will need to provide the highest amount of annual payments.

Bottom line, the fund must project these payments and then find a way to create enough growth and income with investments to meet these expected obligations

Two major factors that contribute to this estimate are:

Interest rates and inflation.

Two major factors that contribute to this estimate are:

Interest rates and inflation.

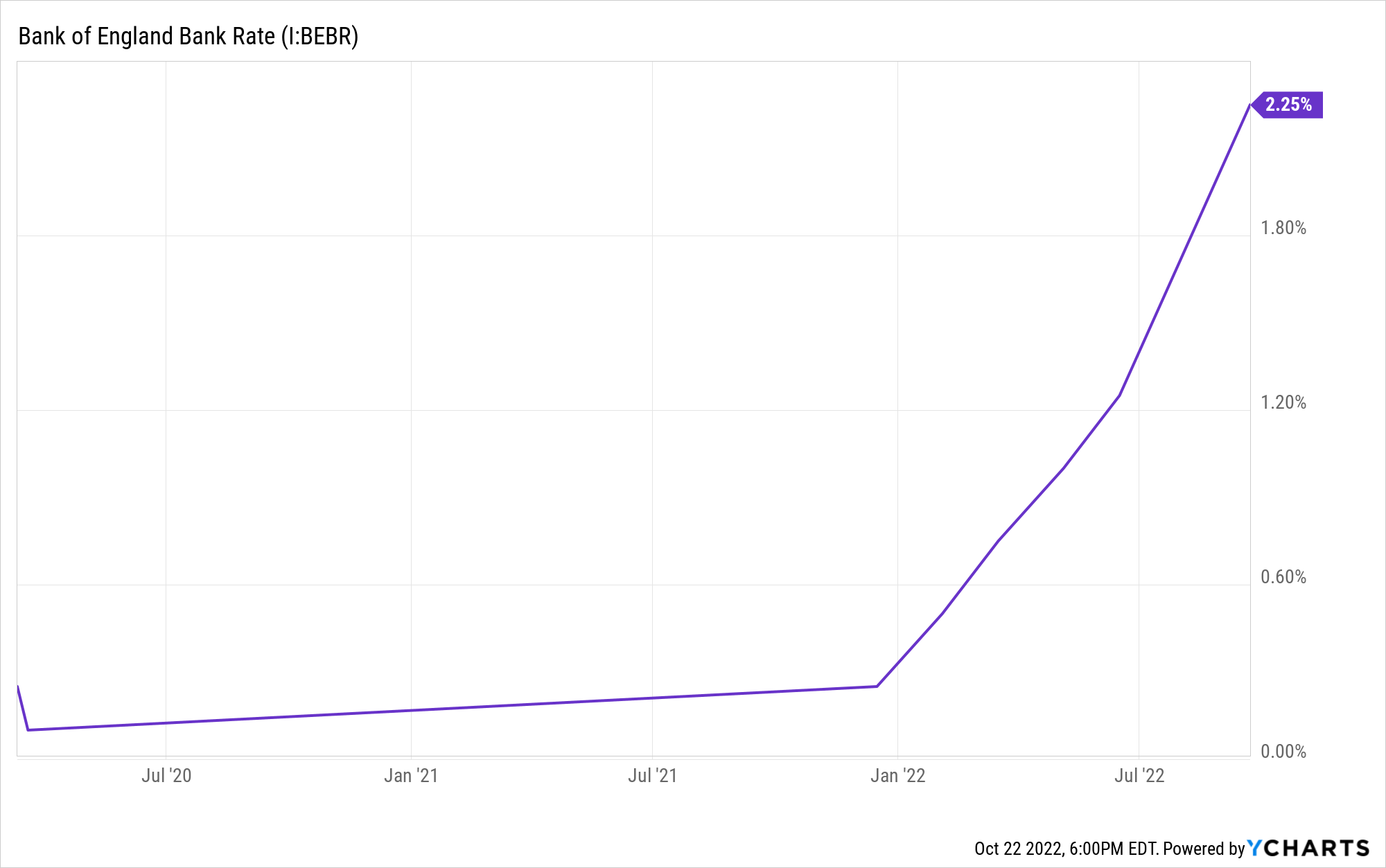

Higher interest rates means the fund can assume a higher rate of return on investments to meet these obligations, and lower rates mean they must assume a lower rate of return

They call this factor the *discount rate*

They call this factor the *discount rate*

However, the discount rate is adjusted by inflation to create a *real* discount rate

And higher inflation means a lower real discount rate (or a lower assumed return on their investments)

You see where we are going with all this, right?

And higher inflation means a lower real discount rate (or a lower assumed return on their investments)

You see where we are going with all this, right?

Exactly

With perpetually low interest rates this past decade, pension funds have struggled to generate enough return on investments to meet the expected future payments to pension members

Enter Liability Driven Investments or LDIs for short.

With perpetually low interest rates this past decade, pension funds have struggled to generate enough return on investments to meet the expected future payments to pension members

Enter Liability Driven Investments or LDIs for short.

🤫 LDIs and leverage

Liability Driven Investments are not necessarily problematic in and of themselves

As stated above, pension fund managers have estimated future liabilities

They must find a way to meet these.

Liability Driven Investments are not necessarily problematic in and of themselves

As stated above, pension fund managers have estimated future liabilities

They must find a way to meet these.

In essence, an LDI has two basic objectives:

First, to generate returns from opportunities available in the market, such as equity or debt

Second, to minimize investments risks

These can be changes to interest rates or fluctuations is currencies, if investments are global, etc

First, to generate returns from opportunities available in the market, such as equity or debt

Second, to minimize investments risks

These can be changes to interest rates or fluctuations is currencies, if investments are global, etc

To minimize risks like these, an LDI will have a hedging component to neutralize that effect on the portfolio

How do they do this?

Swaps and derivatives.

How do they do this?

Swaps and derivatives.

I.e., the fund swaps a variable interest rate for a fixed interest rate or exposure to a foreign currency to a denomination in the fund’s native currency

Simple, right?

Simple, right?

Well, that is unless interest rates and expected returns from bonds remain ultra low, and risk management only allows a maximum allocation to higher return (higher risk) securities for the fund.

See, with ultra low or falling interest rates the past decade, many funds struggled to keep up with necessary returns to fund their future obligations (liabilities)

Bond investments, while super consistent and stable during those years, offered anemic returns for funds

Bond investments, while super consistent and stable during those years, offered anemic returns for funds

This meant funds had to either raise allocations to higher-risk equities or other risky assets, or employ other tactics to solve this liability math problem

Enter leverage.

Enter leverage.

By employing leverage on the lowest perceived risk assets of their portfolio, bond investments, funds were able to generate multiples of returns that they would normally receive from those bond investments

How?

How?

Buy bonds using swaps and derivatives → post a fraction of underlying investment as collateral → receive return that is multiples of a non-leveraged investment

A fantastic strategy, up until it isn’t.

A fantastic strategy, up until it isn’t.

😱 London, we have a problem

All seemed to be going fine for UK pension funds using leveraged LDI strategies

They estimated liabilities and expected returns on available assets, and they used LDIs to hedge out risks and leverage up those investments to generate enough returns.

All seemed to be going fine for UK pension funds using leveraged LDI strategies

They estimated liabilities and expected returns on available assets, and they used LDIs to hedge out risks and leverage up those investments to generate enough returns.

But a few developments began to negatively impact this strategy

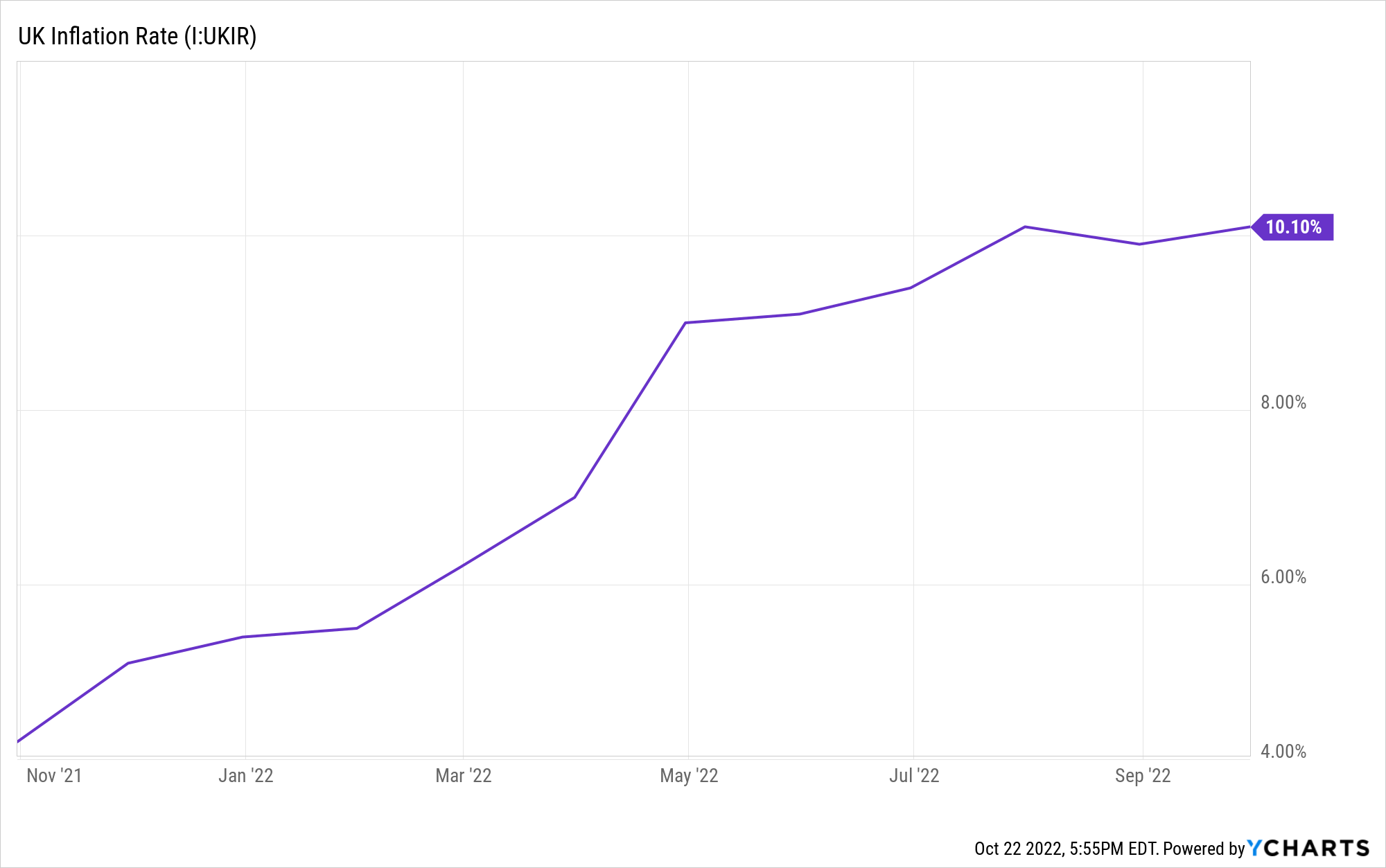

First, UK inflation has been white-hot at 10%+, significantly raising the bar on UK pension schemes to generate returns to match severely elevated obligations, while bonds only offered *negative* real returns

First, UK inflation has been white-hot at 10%+, significantly raising the bar on UK pension schemes to generate returns to match severely elevated obligations, while bonds only offered *negative* real returns

Then everything suddenly went sideways for the UK

First, newly appointed Finance Minister Kwasi Kwarteng announced a massive surprise to markets:

the biggest package of tax cuts in 50 years.

First, newly appointed Finance Minister Kwasi Kwarteng announced a massive surprise to markets:

the biggest package of tax cuts in 50 years.

The British pound and UK gilts (gov't bonds), already under pressure, crashed almost instantly

The gilts became particularly problematic for UK pension schemes, as they collapsed through levels that generated margin calls by the banks who had extended all that leverage.

The gilts became particularly problematic for UK pension schemes, as they collapsed through levels that generated margin calls by the banks who had extended all that leverage.

Remember, when you make an investment using leverage and the investment falls enough in value, you're obligated to send more money (collateral) to keep the position

Otherwise, the lender will sell the position to protect their own invested capital in the swap

You got it.

Otherwise, the lender will sell the position to protect their own invested capital in the swap

You got it.

The over-levered pensions almost immediately received margin calls, some of them sold positions in the already depressed gilts to generate cash to meet those calls

And it all snowballed in a single day.

And it all snowballed in a single day.

With many funds selling at once, gilt prices fell, yields were pushed even higher, and this in turn increased the collateral payments they already needed to make

These dominoes started to cascade and threatened a meltdown of epic proportions.

These dominoes started to cascade and threatened a meltdown of epic proportions.

And so, while *raising* interest rates to tame inflation, the BOE stepped in to *buy* gilts to save the UK pensions

This put more cash into the system, and emergency or not, it's a form of QE

Meanwhile, the situation also forced the BOE to delay their own planned bond sales

This put more cash into the system, and emergency or not, it's a form of QE

Meanwhile, the situation also forced the BOE to delay their own planned bond sales

So much for QT and tightening to fight inflation

The result?

Prime Minister Liz Truss fired Finance Minister Kwasi Kwarteng, and then, amidst the turmoil and just six days later, resigned herself

*Note: markets truly dislike surprises.

The result?

Prime Minister Liz Truss fired Finance Minister Kwasi Kwarteng, and then, amidst the turmoil and just six days later, resigned herself

*Note: markets truly dislike surprises.

🤭 Where does this leave the UK?

As you can see, the UK sits in a tenuous position

First, the BOE is in a battle against rising and stubborn inflation

At over 10%, this threatens serious negative impacts to the economy.

As you can see, the UK sits in a tenuous position

First, the BOE is in a battle against rising and stubborn inflation

At over 10%, this threatens serious negative impacts to the economy.

If the BOE can’t tame inflation, it could spiral out of control

Meanwhile, the pound and gilts, while stabilized, still show signs of weakness, particularly in gilt liquidity

And this all demonstrates just how fragile our entire system built upon mountains of debt has become.

Meanwhile, the pound and gilts, while stabilized, still show signs of weakness, particularly in gilt liquidity

And this all demonstrates just how fragile our entire system built upon mountains of debt has become.

With massive amounts of sovereign debt and central banks raising rates to tame inflation, we're seeing results of relentless over-manipulation

Cracks are beginning to show

And like UK pension schemes, Europe has its own imbalance of debt and revenues

I.e., Germany and Italy.

Cracks are beginning to show

And like UK pension schemes, Europe has its own imbalance of debt and revenues

I.e., Germany and Italy.

I’ve written about this issue recently, and if you want a bit more detail of what may be ahead, you can find much more in this recent 🧠Informationist article jameslavish.substack.com/p/target2-and-is-this-the-end-of-europe

For the TL;DR crowd, I believe Europe has deep structural financial problems, and will ultimately break up over them within the decade.

Final thought: the global financial system is built upon a mountain of sovereign debt

The system has been bound to bend from the weight of all this debt

and the cracks are now beginning to show.

The system has been bound to bend from the weight of all this debt

and the cracks are now beginning to show.

This thread was a summary of a recent 🧠Informationist Newsletter. If you enjoyed it, make sure to:

1. Follow @jameslavish to see more investment related content

2. Subscribe to The Informationist to learn one simplified concept weekly:jameslavish.substack.com

1. Follow @jameslavish to see more investment related content

2. Subscribe to The Informationist to learn one simplified concept weekly:jameslavish.substack.com