Thread

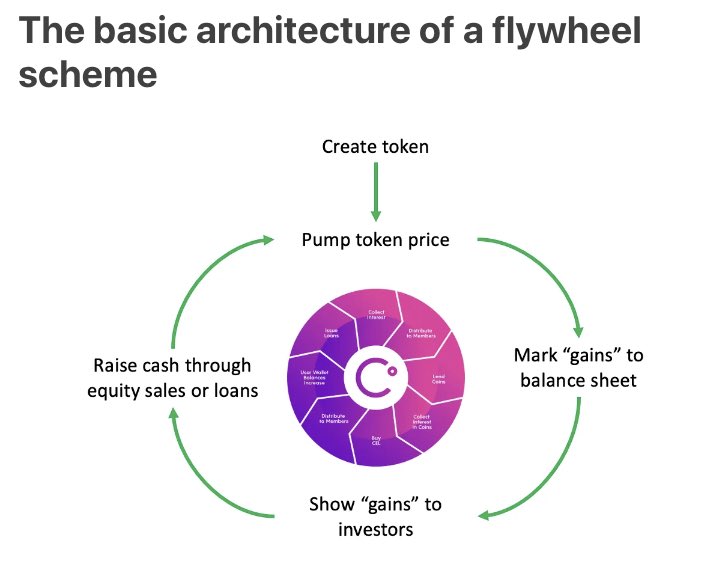

The FLYWHEEL SCHEME has been the dominant business model in “crypto” “cefi” from the past three years. It was as dirty as ICOs, maybe worse in wealth destruction and delay of Bitcoin adoption.

Major perpetrators:

FTX/Alameda

Celsius

Crypto dotcom

Nexo

Babel

Voyager

and more

Major perpetrators:

FTX/Alameda

Celsius

Crypto dotcom

Nexo

Babel

Voyager

and more

STEP 1

“Create a token: Tokens are literally just bits of code on a blockchain. Program that sucker up and get rolling. Make sure you retain the majority of those tokens on your balance sheet for maximum flywheeling.”

“Create a token: Tokens are literally just bits of code on a blockchain. Program that sucker up and get rolling. Make sure you retain the majority of those tokens on your balance sheet for maximum flywheeling.”

STEP 2

“Pump the token’s price: Retain a “market maker.” Buy tokens using your customer’s assets. Wash trade it to infinity. Do whatever it takes to drive that price sky-high! And since you kept most of the tokens for yourself, there’s that many fewer tokens out there to pump.”

“Pump the token’s price: Retain a “market maker.” Buy tokens using your customer’s assets. Wash trade it to infinity. Do whatever it takes to drive that price sky-high! And since you kept most of the tokens for yourself, there’s that many fewer tokens out there to pump.”

STEP 3

“Mark those babies to market: That’s right! Now you reap your rewards; at least, on paper. Now you can show billions of dollars in “assets” on your balance sheet.”

“Mark those babies to market: That’s right! Now you reap your rewards; at least, on paper. Now you can show billions of dollars in “assets” on your balance sheet.”

STEP 4

“Show off your success: Now’s the time to cash in. Hook some savvy investors (suckers), like pension funds, into massively overpaying for your equity or into making you big loans collateralized by your token.”

“Show off your success: Now’s the time to cash in. Hook some savvy investors (suckers), like pension funds, into massively overpaying for your equity or into making you big loans collateralized by your token.”