Thread

1) Actor @ben_mckenzie's written testimony to @SenateBanking said “#Bitcoin cannot work as a medium of exchange because it cannot scale. The Bitcoin network can only process 5 to 7 transactions a second. By comparison Visa can handle tens of thousands.” Here's why he's wrong. 🧵

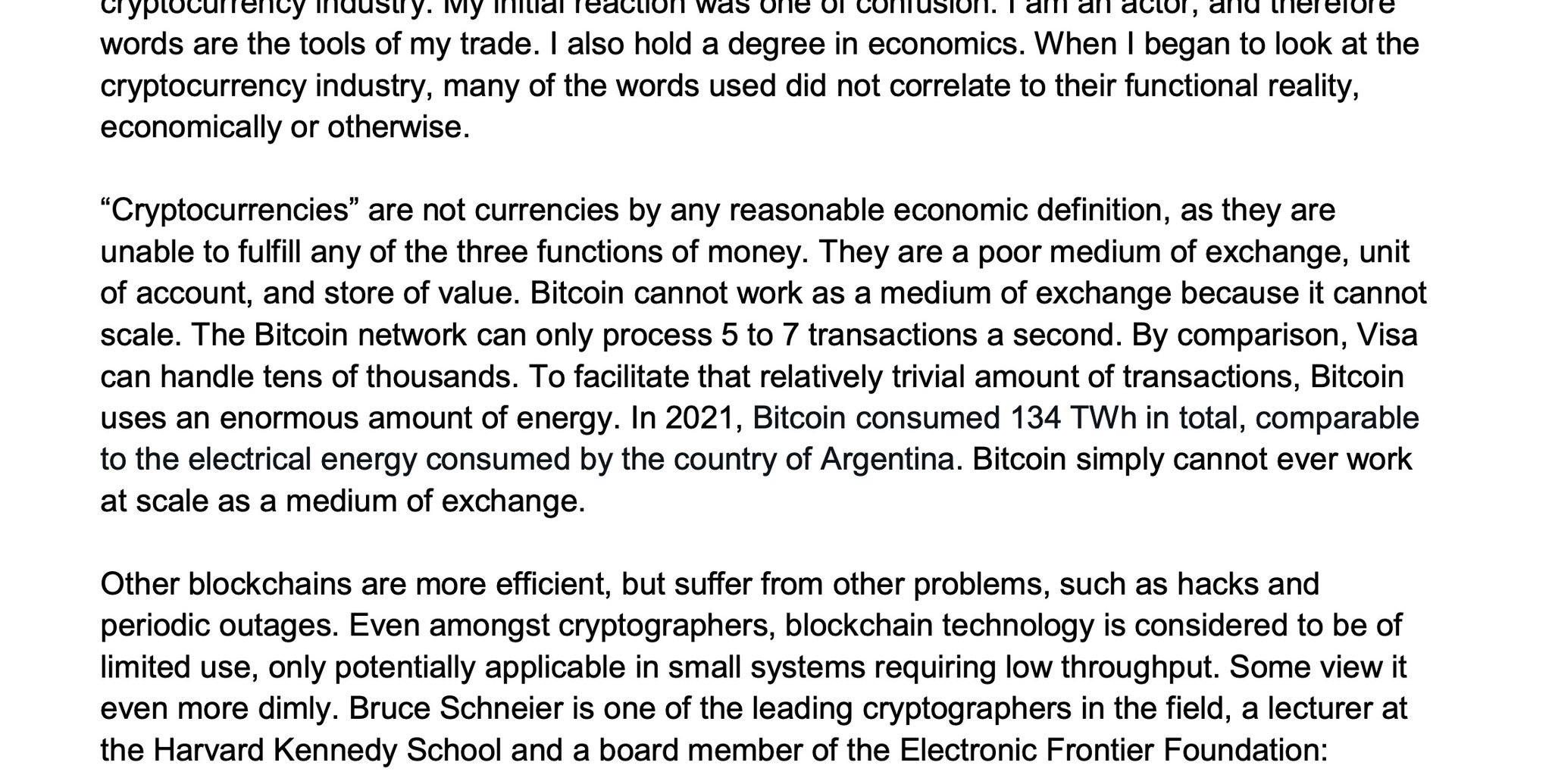

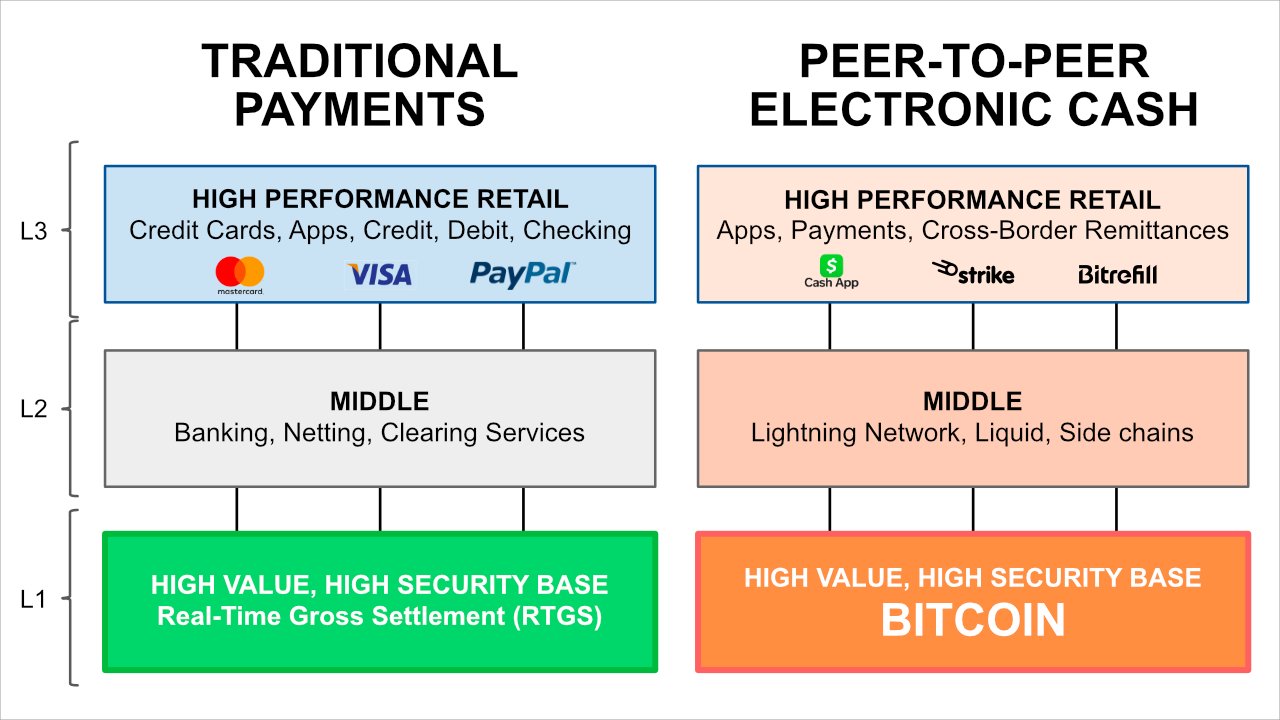

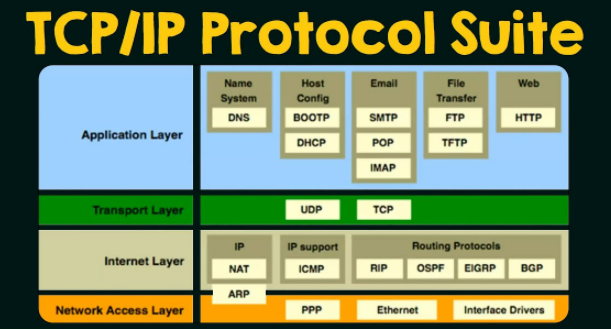

2) @ben_mckenzie made a novice mistake. Visa is a "credit" payments network that just informs banks where to send money, later, through "final settlement" networks such as Fedwire, CHIPS, SWIFT. #Bitcoin's blockchain competes with these low-volume final settlement networks.

3) Accounting for batching, #Bitcoin and Fedwire do about the same number transactions per year. With layered solutions #Bitcoin can indeed scale to millions of transactions per second—meaning @ben_mckenzie's written testimony is factually incorrect.

4) "While it would require time and investment, Visa’s payment network could sit on top of the bitcoin network to fulfill payments much the same way it sits on top of the existing banking system." — @parkeralewis unchained.com/blog/bitcoin-is-not-too-slow/

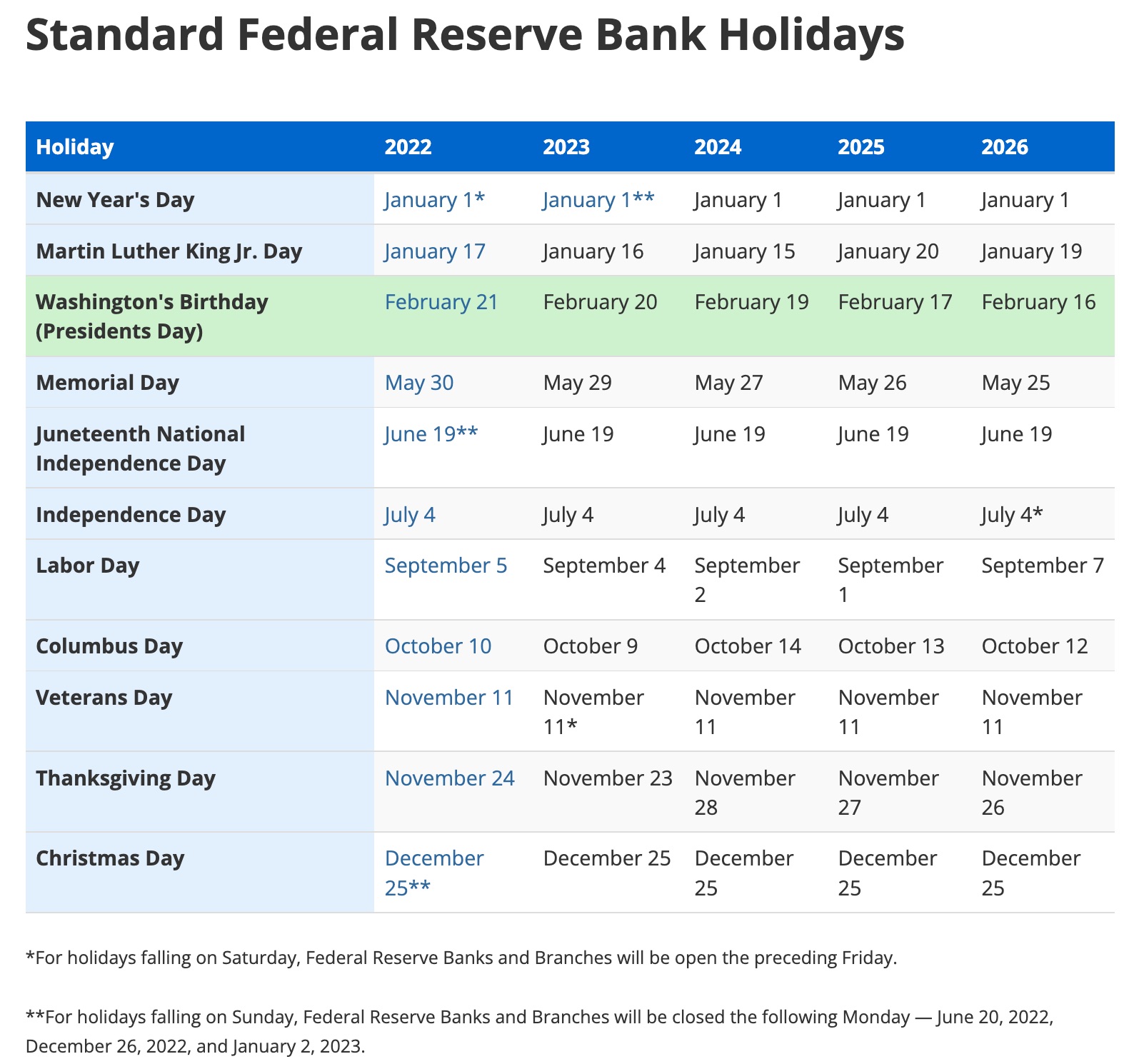

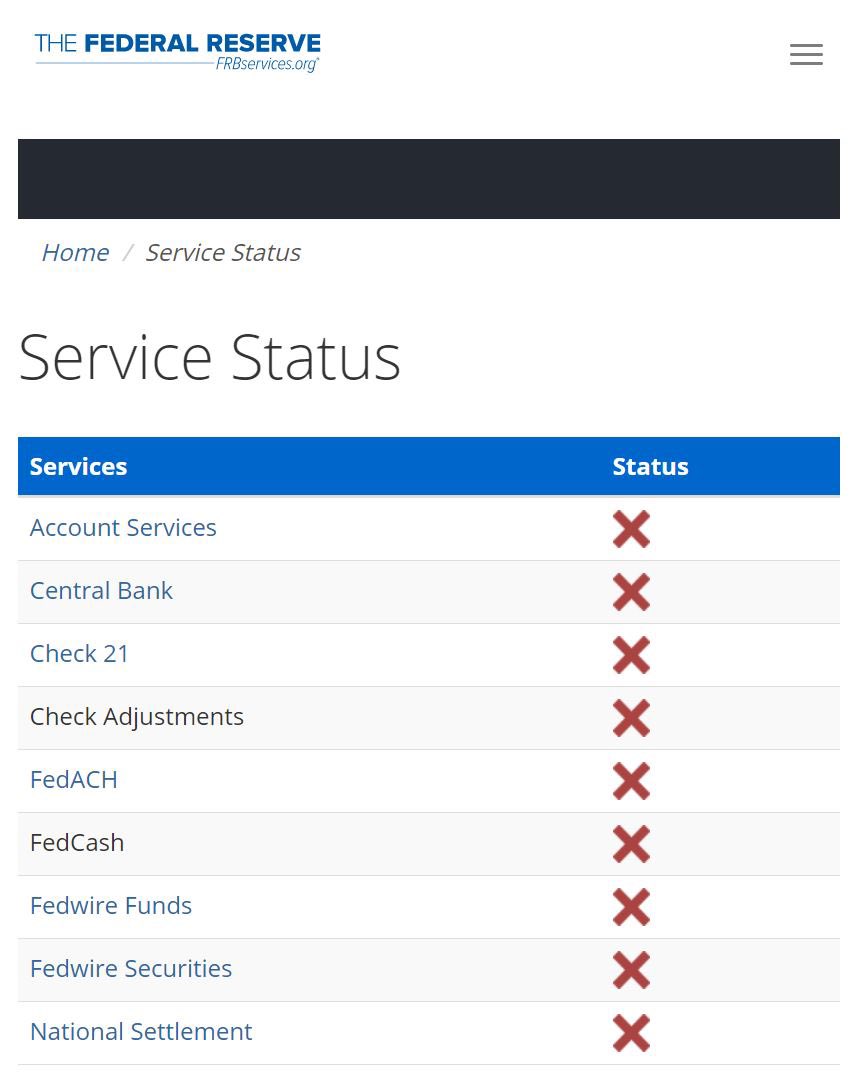

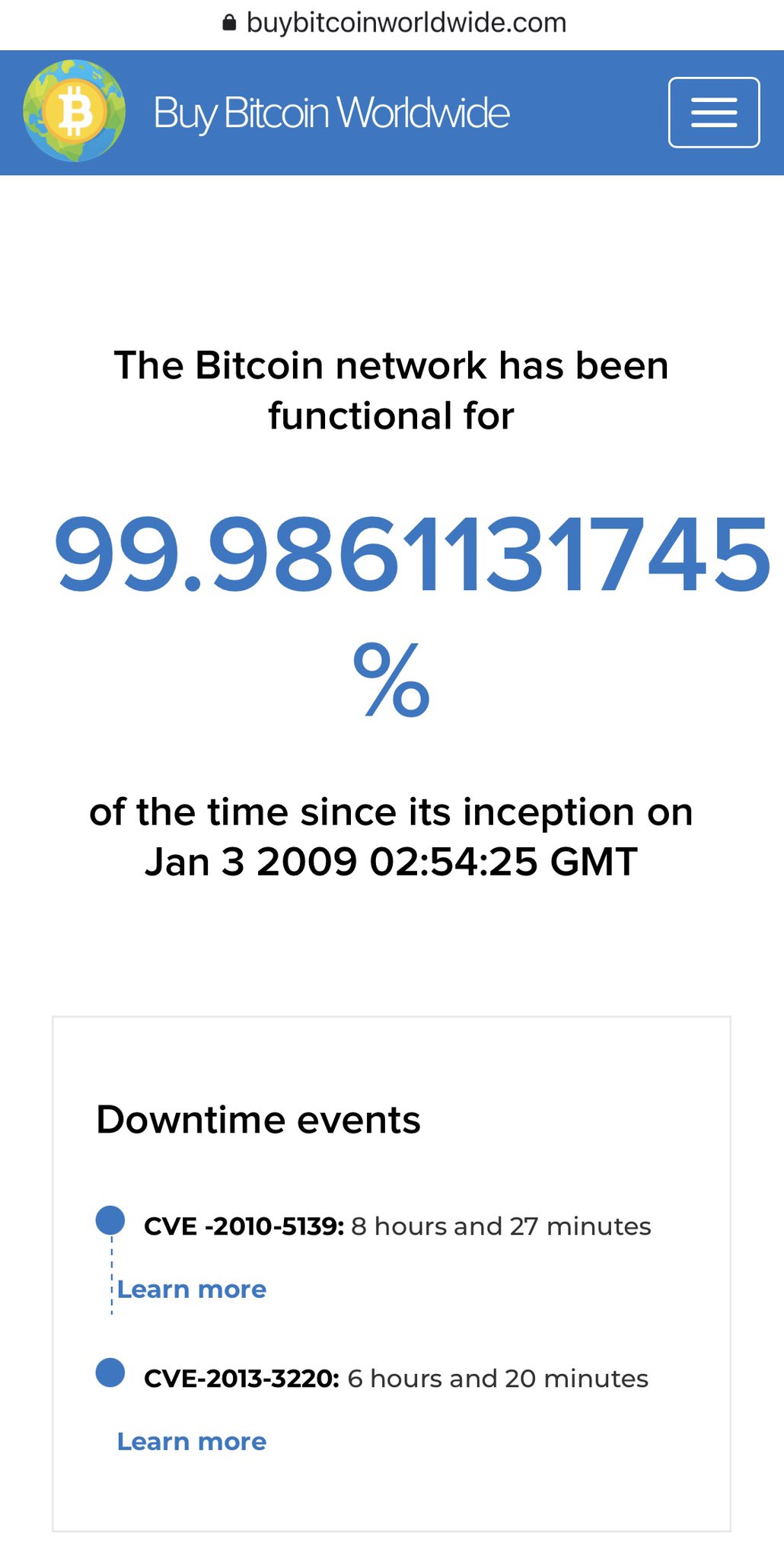

5) Unlike the final settlement systems run by central banks, #Bitcoin finalizes payments 24 hours a day, 7 days a week, 365 days a year and satisfies every customer. Central banks only settle payments during business hours and are closed on holidays.

6) Bitcoin not only never closes and never stops settling, it has a higher reliability and better uptime than the Federal Reserve, which is prone to outages and service issues.

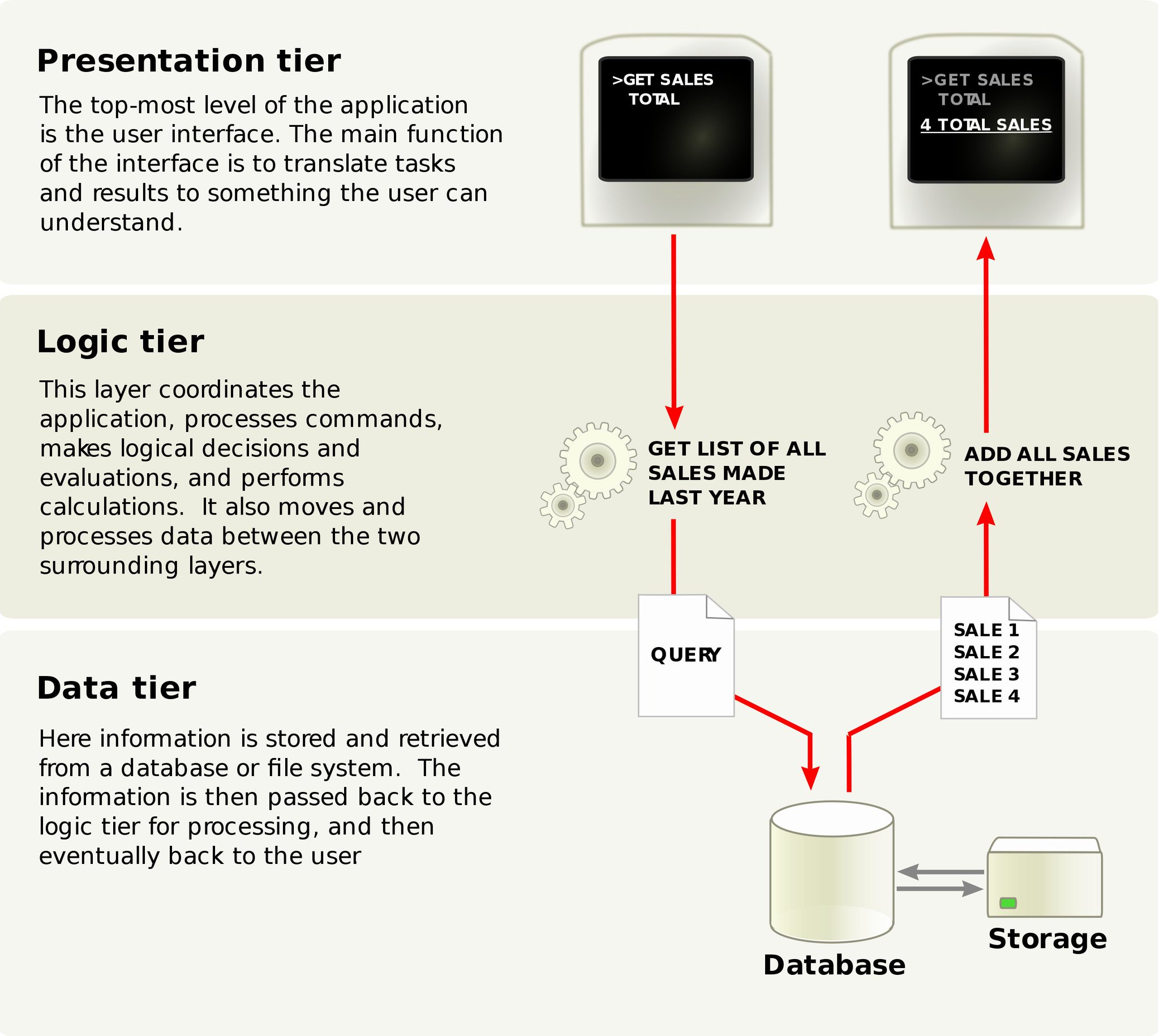

7) It is unfortunate that @ben_mckenzie (and his colleague @SilvermanJacob) failed to engage with the Bitcoin community, in good faith, and learn the basic structure and design intent of Bitcoin. Layered architecture is an essential part of good software design.

8) Not only that, the entire Internet is built on a multi-layer architecture that took many decades to build and evolve. That evolution continues to this day. In the 1990s, some economists thought the Internet would have no useful purpose beyond the fax machine.

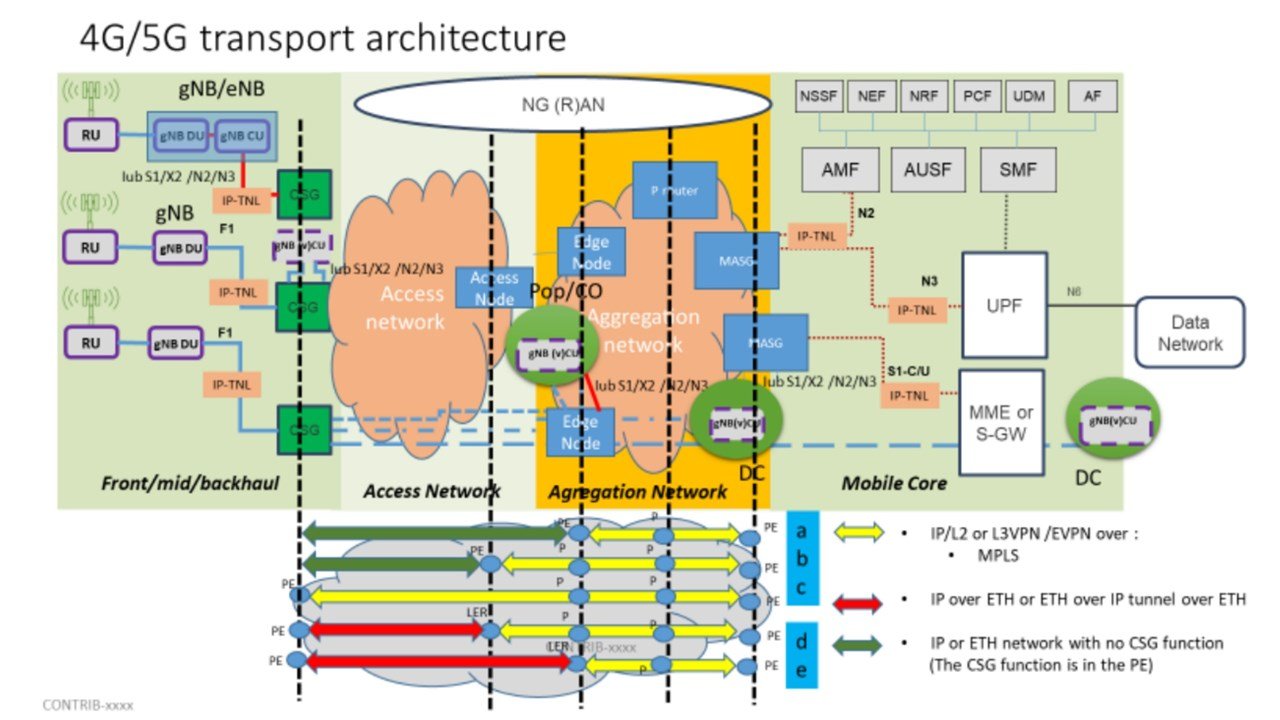

9) Even wireless cellular networks use a complex set of layered architecture. To an untrained eye, these systems seem inefficient and clunky. Yet, they allow us to communicate instantly and efficiently.

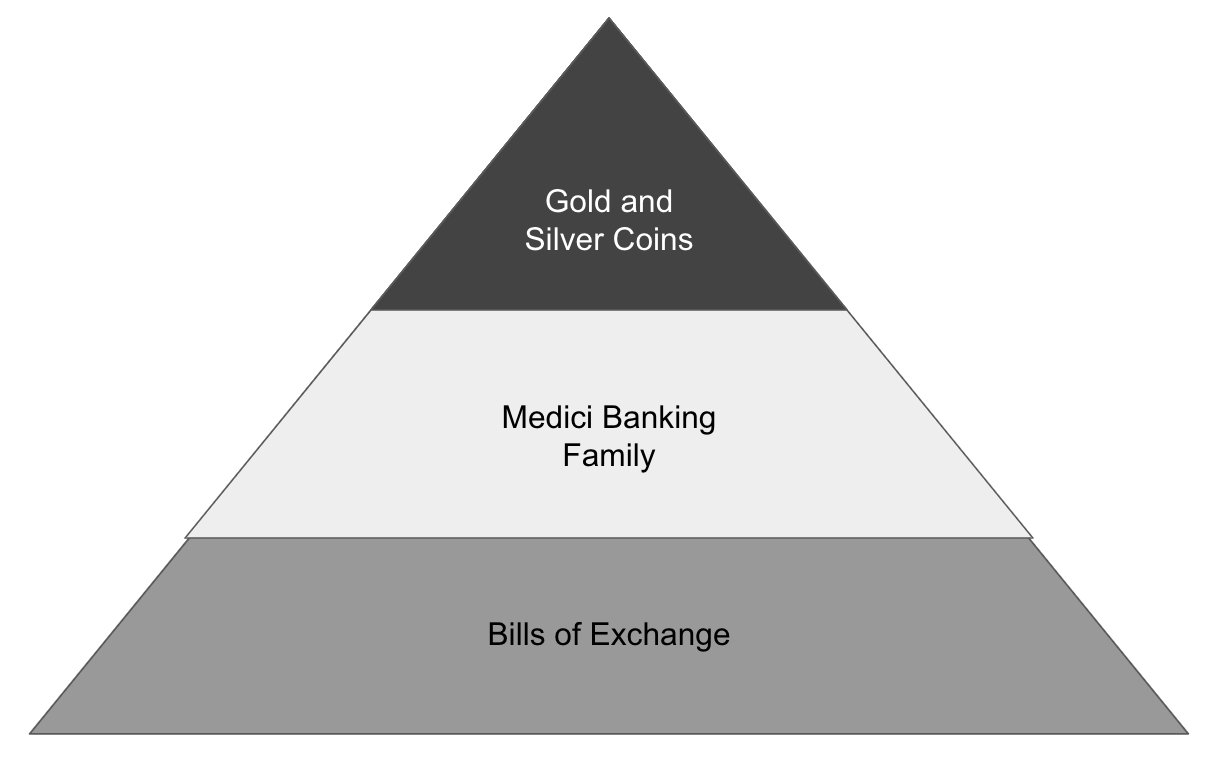

10) As Nik Bhatia @timevalueofbtc explains in his book, "Layered Money," monetary layers are not unique to Bitcoin, nor are they a new thing. The House of Medici banking family operated on a layered system in the 15th century.

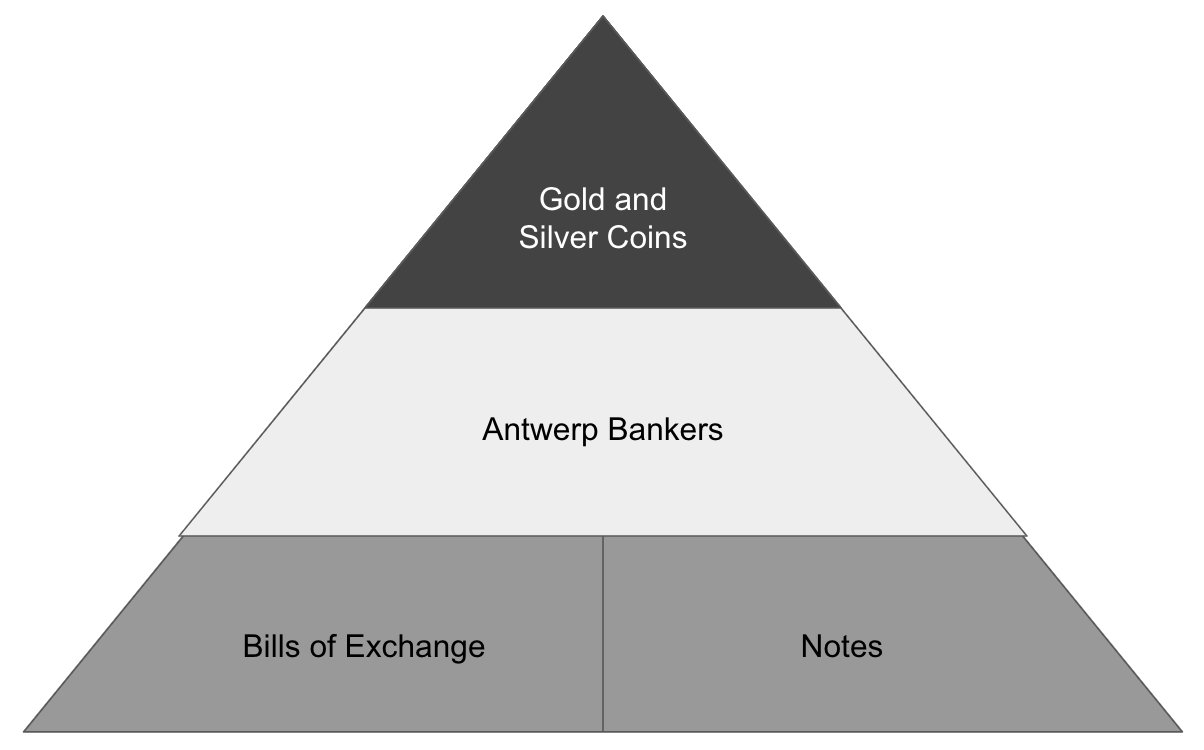

11) In the 16th century, Antwerp bankers created a new form of secondary money called promissory notes. Unlike previous versions of second layer money that had a person's name on it, these notes did not and were freely traded, similar to currency notes or what we call cash today.

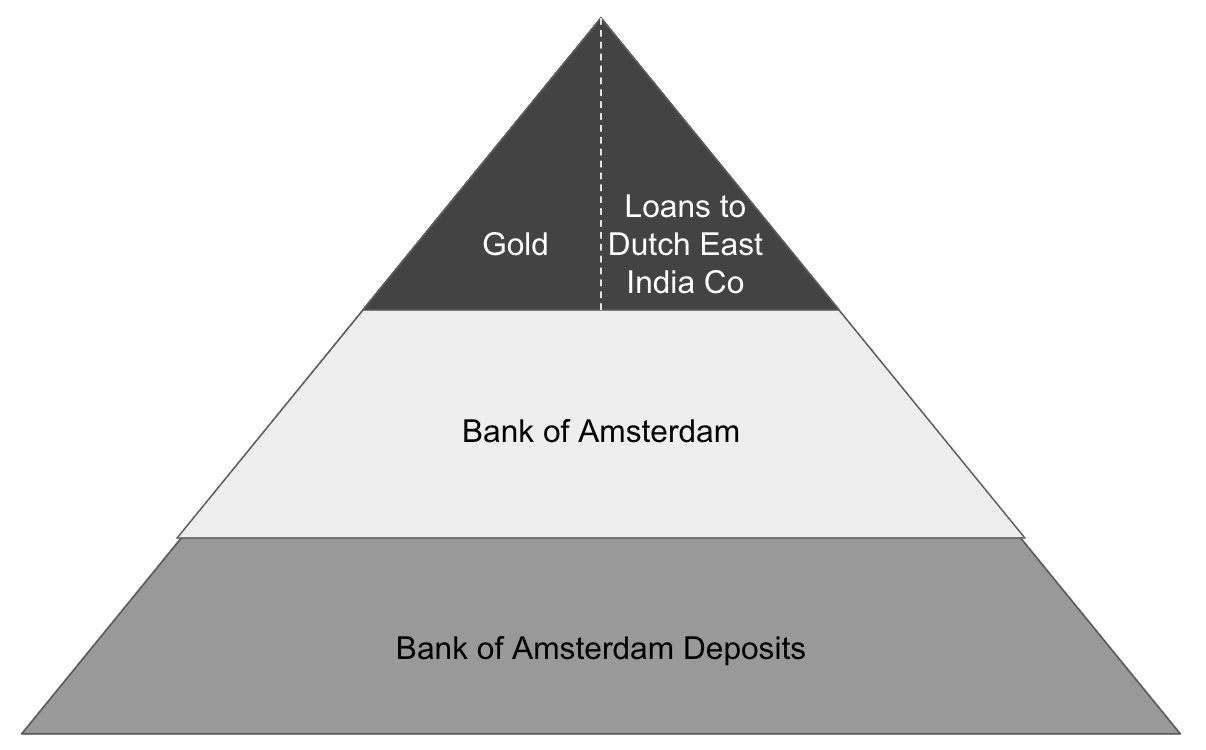

12) In 1609, the Bank of Amsterdam emerged as a kind of central bank. It outlawed private cashiers and their notes and required all gold/silver coins to be deposited with the bank. Depositors could instantly transfer Dutch guilders between accounts with no fee.

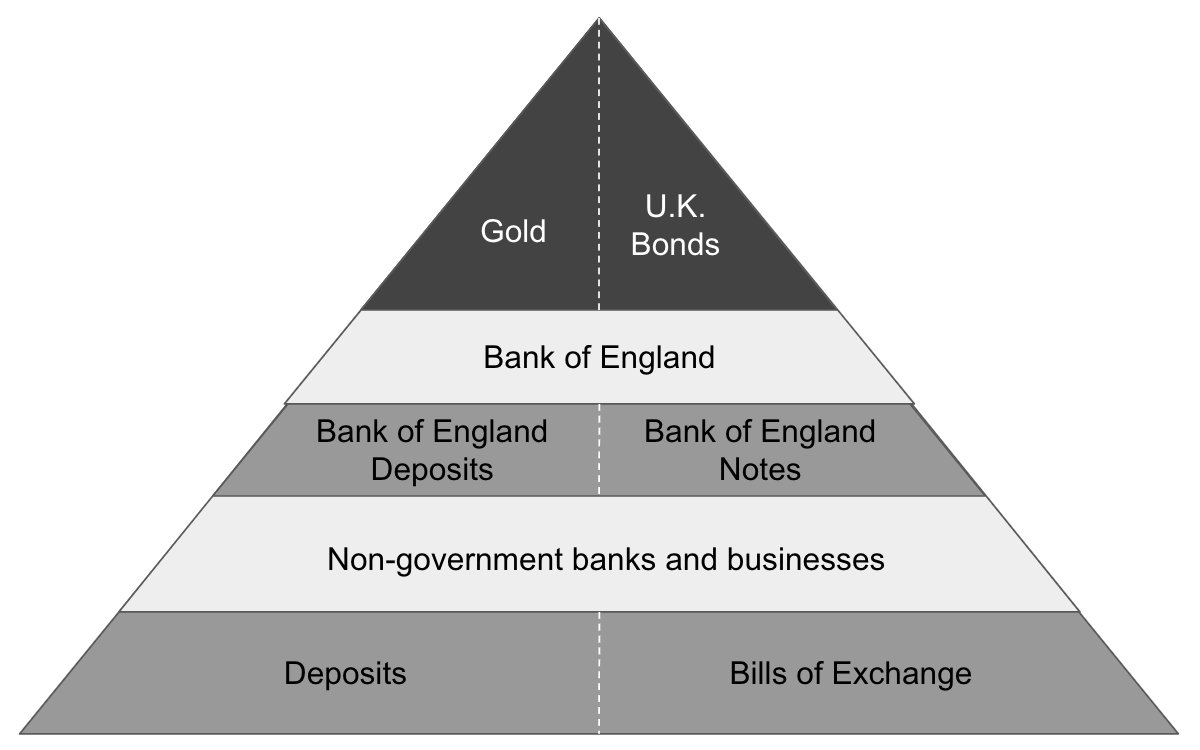

13) The Bank of England's first charter was granted in 1694. Bills of exchange were promises to pay pounds. Non-government banks and businesses issued promises to pay second layer money in the form of bills of exchange or deposits, and thus these liabilities existed on L3s.

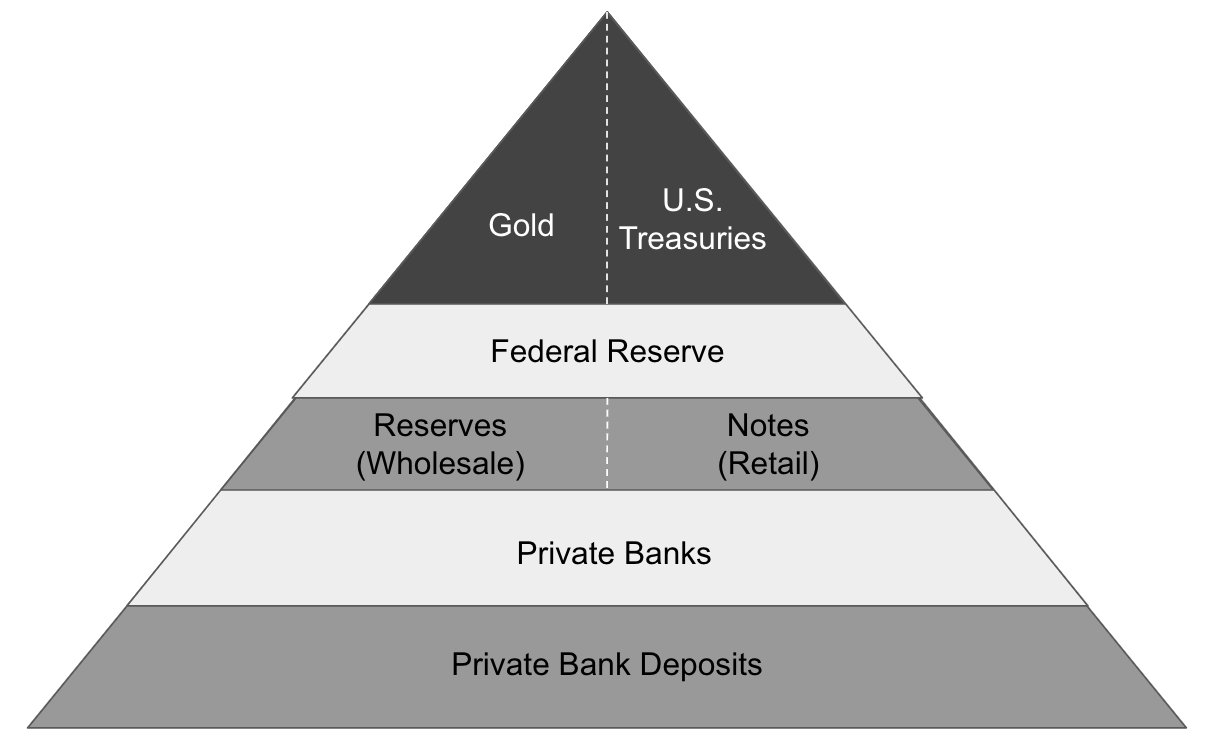

14) In 1913 the US Federal Reserve was established. Gold and US Treasuries were L1 money, wholesale reserves and retail bank notes were L2 money, and private bank deposits were L3 money.

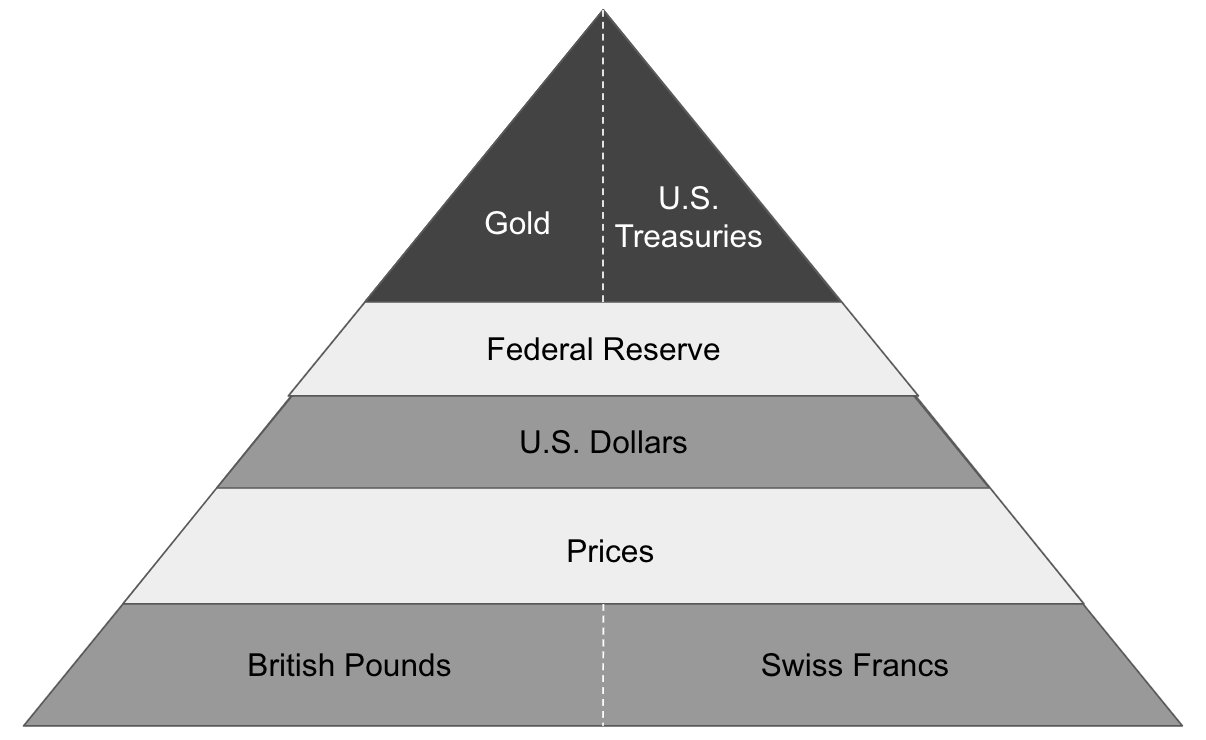

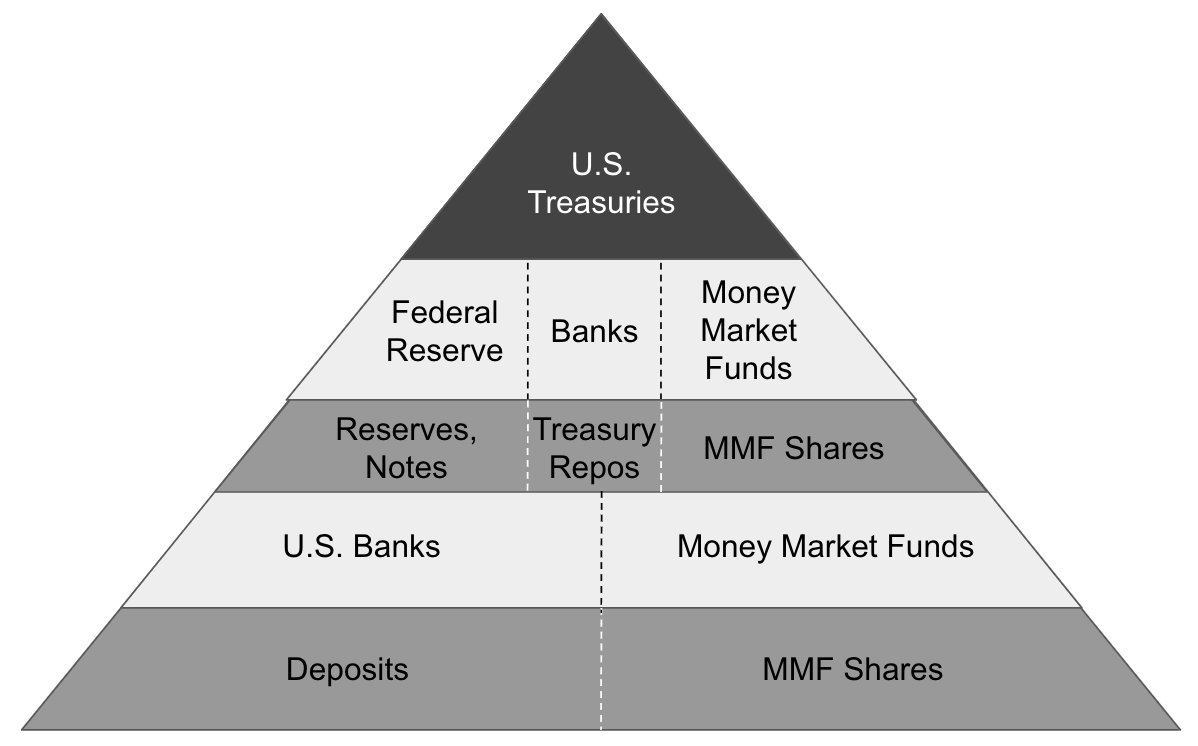

15) In 1931, the pound sterling left the gold standard, ending its status as world reserve currency. At Bretton Woods in 1944, world leaders agreed that all currencies beside the dollar were L3 money in the dollar pyramid.

16) Foreign nations were depleting the US gold stock, making it impossible to maintain a fixed price. Foreign demand for dollars caused trade imbalances and in 1971 the US ended gold convertibility for the dollar—creating the current set of monetary layers.

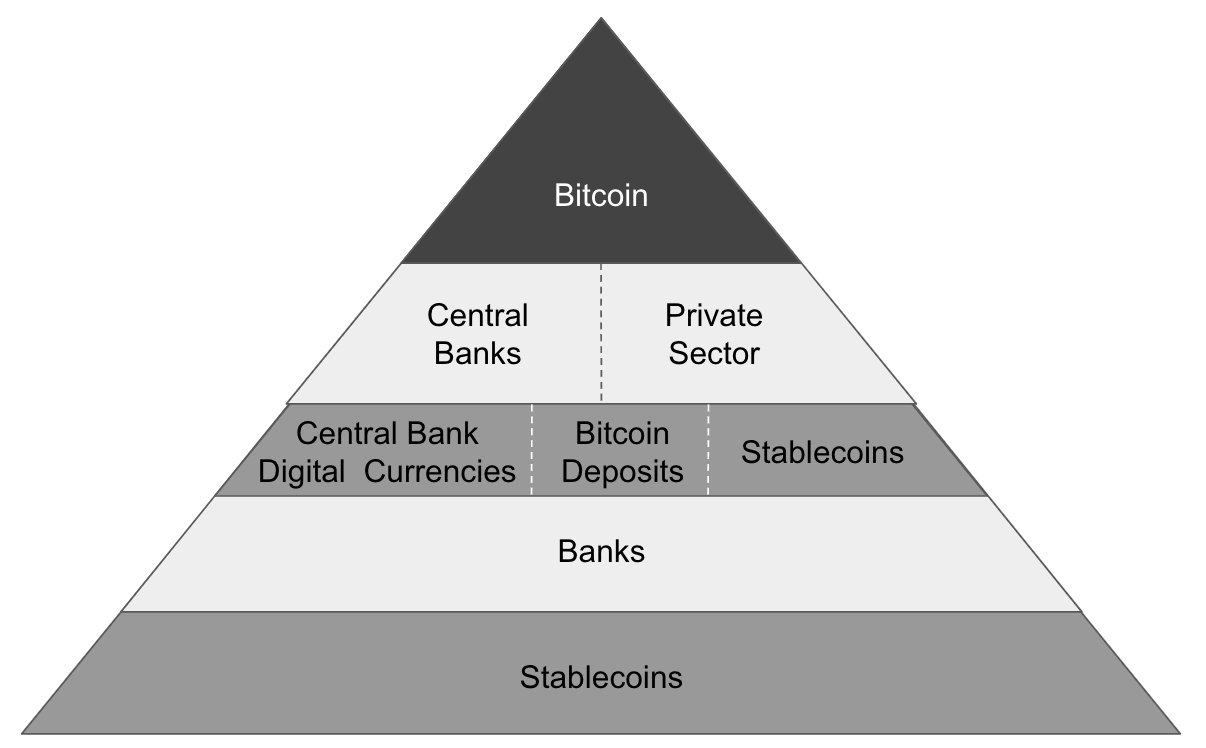

17) The goal of #Bitcoin's "slow" blockchain is not to compete with the fast L3 payment networks of the world. Rather it is to provide a sound, immutable, accessible and open digital alternative to the slow archaic global settlement of Treasuries, bonds, base money and gold.

18) These excellent diagrams come from Nik Bhatia's @timevalueofbtc book, "Layered Money." If you enjoyed them, order his book today. layeredmoney.com.

19) By comparing Visa's throughput to that of Bitcoin's, @ben_mckenzie made a novice error in his testimony and misled @SenateBanking into thinking that #Bitcoin cannot scale—something that could have been avoided if actual experts had been called upon.

20) If @SenateBanking has any desire to keep the United States from falling behind to other nations, they would do well to seek out *actual experts* in #Bitcoin mining, energy markets and payments application. Political theater will only cause the US to fall behind.

21) In fairness, @ben_mckenzie is right about 99.99% of the "crypto" market. Indeed it is nearly all scams. While calling out those scams is commendable, to blindly call Satoshi Nakamoto's invention a scam shows a lack of critical thinking and expertise.

22) @ben_mckenzie and @SilvermanJacob ought to make a sincere effort to understand #Bitcoin's architecture, and how it scales. If they are willing, the community is willing and open to engage in thoughtful and meaningful discussion. If not, it suggests they have an agenda.

23) Unfortunately, having an undergraduate degree in economics does not automatically qualify one to understand #Bitcoin. If only it were that easy. It requires an open multidisciplinary mind and hours upon hours of research just to begin scratching the surface.