Thread

US Treasury yield curves are inverted--really inverted--right now.

But what exactly does that mean, and more importantly, does it truly signal an incoming recession?

Time for a Treasury 🧵👇

But what exactly does that mean, and more importantly, does it truly signal an incoming recession?

Time for a Treasury 🧵👇

👐 What is an inverted yield curve?

We’ve talked about yield curves on 🧠The Informationist before

If you haven’t read that article yet or just want a refresher, you can find it here:

jameslavish.substack.com/p/yield-curve-inversions-and-signals

We’ve talked about yield curves on 🧠The Informationist before

If you haven’t read that article yet or just want a refresher, you can find it here:

jameslavish.substack.com/p/yield-curve-inversions-and-signals

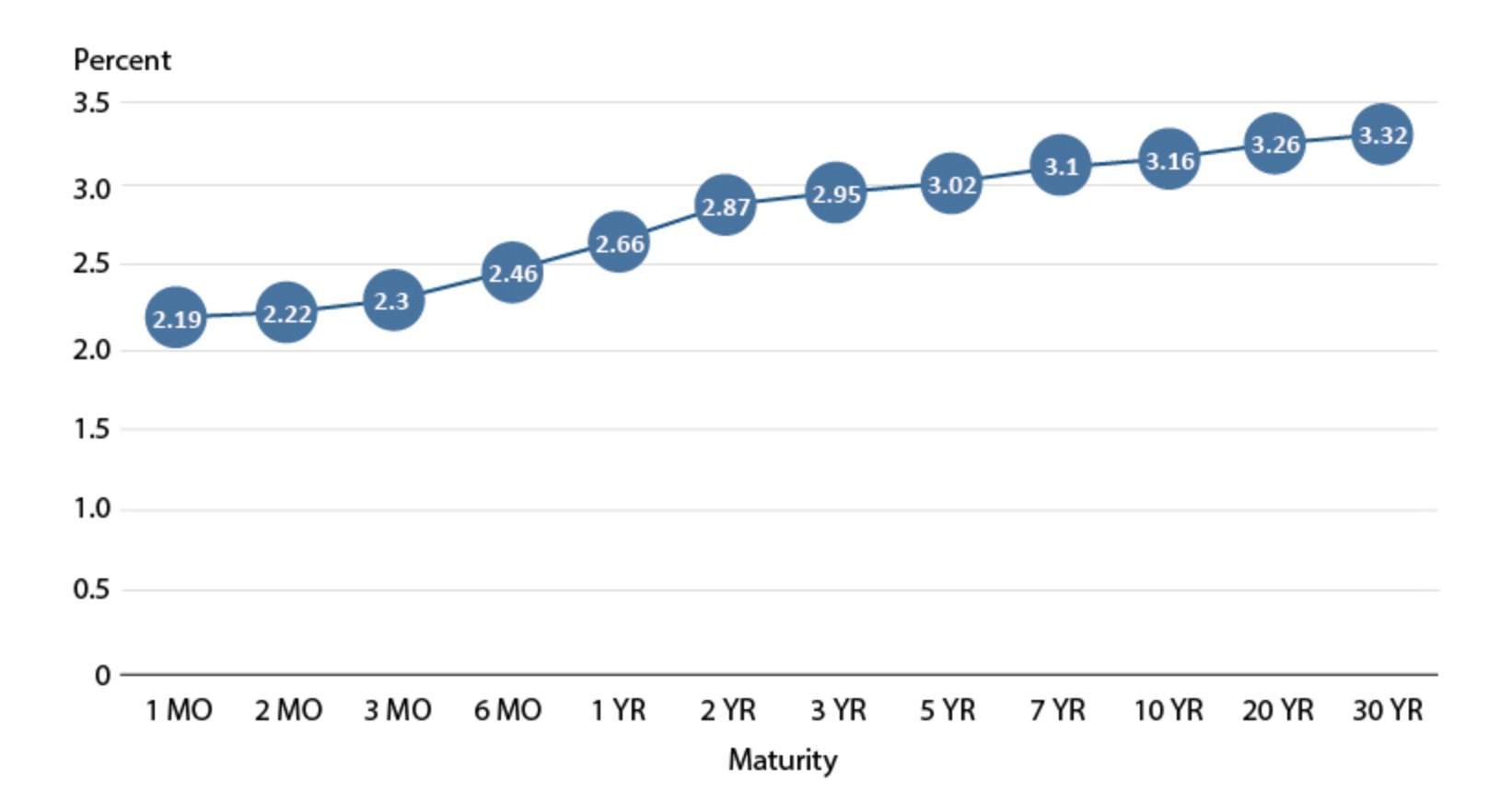

TL;DR: The US Treasury yield curve is just taking all the yields of the various maturities of US Treasuries and plotting them on a chart

In a strong economy, yields of shorter paper (like 1mo T-Bills to 2yr Notes) are lower than longer paper (say the 10yr to 30yr Treasuries)

In a strong economy, yields of shorter paper (like 1mo T-Bills to 2yr Notes) are lower than longer paper (say the 10yr to 30yr Treasuries)

This is simply because of time value of money and lenders demanding higher rates for committing to parting with their money for longer periods

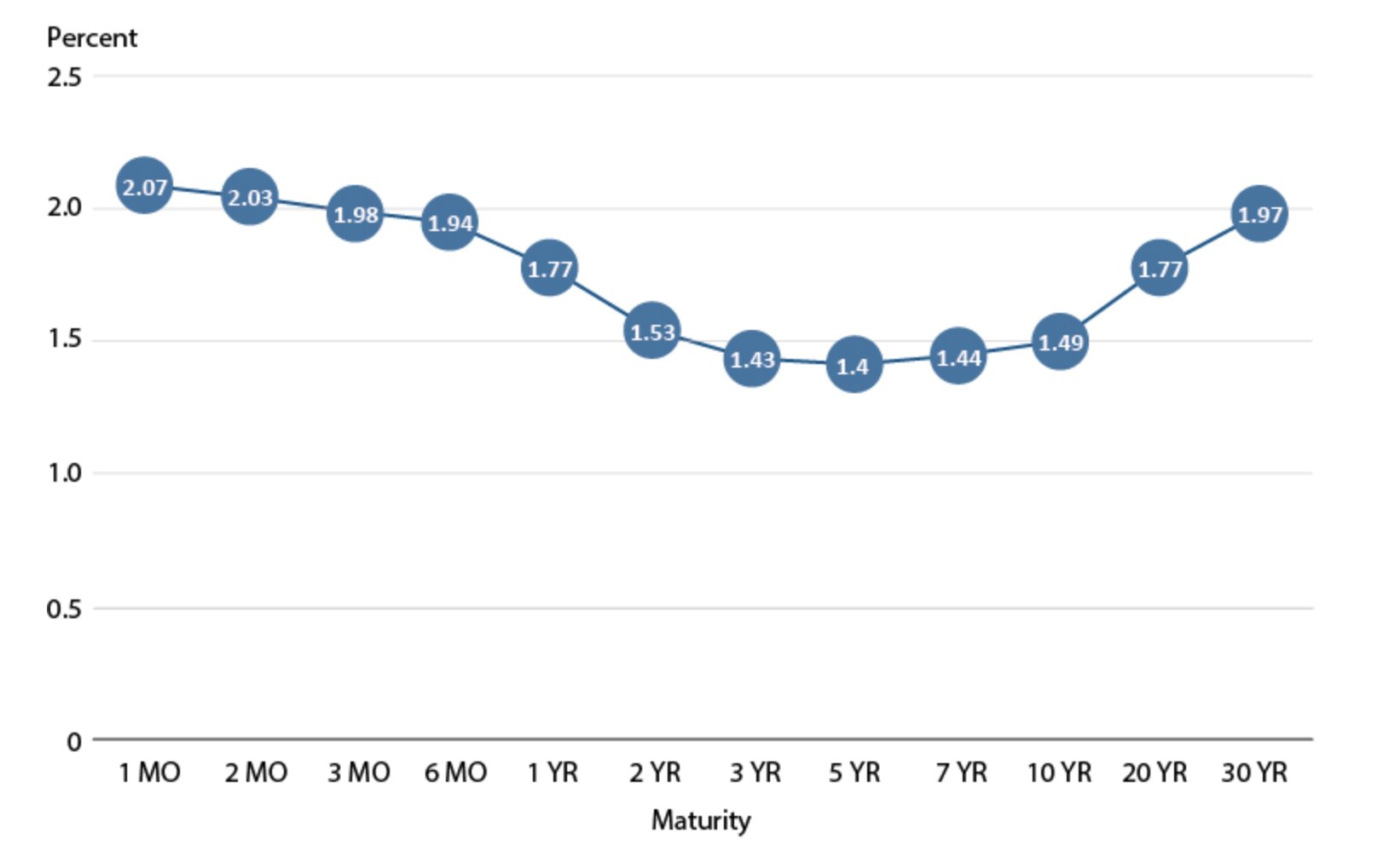

But in challenging economic times, the curve may become inverted. I.e., longer maturities yield less than shorter paper

Why?

But in challenging economic times, the curve may become inverted. I.e., longer maturities yield less than shorter paper

Why?

Because investors are expecting financial conditions and the economy to worsen

They expect the yields to drop in the future, reflecting this falloff in economic conditions

And as a result, they demand higher prices (and lower yields) when selling those maturities in the market.

They expect the yields to drop in the future, reflecting this falloff in economic conditions

And as a result, they demand higher prices (and lower yields) when selling those maturities in the market.

As you’ve likely heard recently, UST yields are pretty inverted these days, indicating expectations of an economic slowdown, or worse, a recession

In fact, it's looking downright dismal, with an inversion as steep as the El Capitan cliff face:

In fact, it's looking downright dismal, with an inversion as steep as the El Capitan cliff face:

🧐 So what does this mean, and how do inversions affect the economy?

First and foremost, the reality of inverted yield curves is that they can create difficult lending environments for banks, and hence, difficult borrowing periods for consumers.

First and foremost, the reality of inverted yield curves is that they can create difficult lending environments for banks, and hence, difficult borrowing periods for consumers.

Think of it this way

Banks typically borrow at shorter maturities (i.e., overnight rates) and lend at longer ones (think mortgages)

And so, when rates are higher on the short end and lower on the long end, bank margins are squeezed and they face challenges to make money.

Banks typically borrow at shorter maturities (i.e., overnight rates) and lend at longer ones (think mortgages)

And so, when rates are higher on the short end and lower on the long end, bank margins are squeezed and they face challenges to make money.

As for consumers, adjustable rate mortgages, home equity lines of credit, personal loans or lines of credit, and credit card interest rates are all keyed to short-term interest rates

All these rates are pushed higher with an inverted yield curve

Payments rise for consumers.

All these rates are pushed higher with an inverted yield curve

Payments rise for consumers.

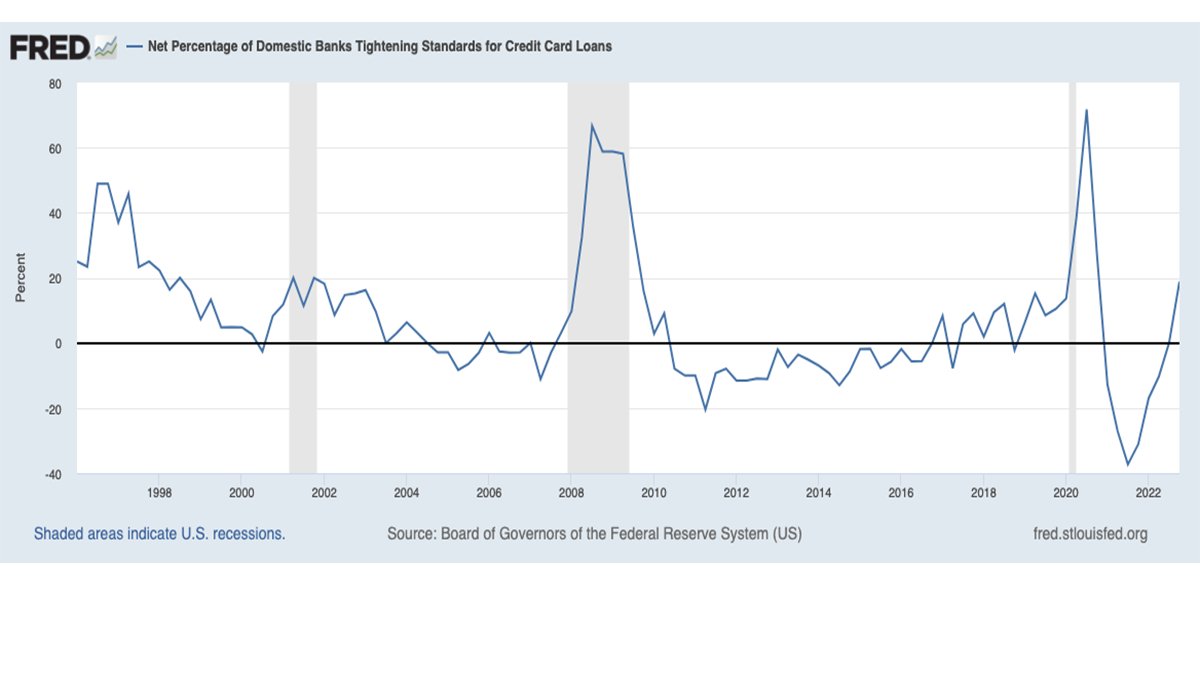

And banks become less willing to lend with the reduced spreads, only perpetuating the borrowing problem for many consumers

Like so…

Like so…

🤔 Do inversions signal recessions?

Considering the above, it would make sense that inversions both induce and indicate incoming recessions

And so, the benchmark 10yr / 2yr UST spread clearly shows inversions occur before the onset of every recent recession (even 2020):

Considering the above, it would make sense that inversions both induce and indicate incoming recessions

And so, the benchmark 10yr / 2yr UST spread clearly shows inversions occur before the onset of every recent recession (even 2020):

The evidence appears indisputable, and looking at the 10yr / 3yr spread, in particular, the warnings become clear about one to two years before each onset:

🤨 Where does that leave us today?

Unfortunately, we have a number of negative indicators that suggest a deep recession looming ahead

First, while both of the above spreads are negative, the spread of the 10yr / 2y USTs was recently the widest negative reading since the 1980s:

Unfortunately, we have a number of negative indicators that suggest a deep recession looming ahead

First, while both of the above spreads are negative, the spread of the 10yr / 2y USTs was recently the widest negative reading since the 1980s:

Second, total US debt to GDP has ballooned to over 130%

Far worse than the 30% or so level that it sat at back in the 1980s

Why does this matter?

Far worse than the 30% or so level that it sat at back in the 1980s

Why does this matter?

Well, if you’ve been listening to me (and others) on Twitter lately, or if you’ve been reading 🧠The Informationist, you’ve undoubtedly heard me pointing out how the US now finds itself in what we call a debt spiral.

If you haven’t read that, or want more context, you can find a summary of the article in a recent Twitter thread, right here:

Bottom line, with US already borrowing over $1T per year, now facing a recession

This means GDP drops, hence tax revenues shrink, leading to even more borrowing, going further into debt, causing higher interest rate costs and deeper annual deficits

The debt spiral accelerates.

This means GDP drops, hence tax revenues shrink, leading to even more borrowing, going further into debt, causing higher interest rate costs and deeper annual deficits

The debt spiral accelerates.

Not good, my friends

But the Fed has made it clear that it will keep tightening, keep raising short-term rates

They are essentially trying to out-manipulate their past manipulations.

But the Fed has made it clear that it will keep tightening, keep raising short-term rates

They are essentially trying to out-manipulate their past manipulations.

I personally don’t believe it will work, though

There will be no soft landing. There will be no avoiding a recession

The market is telling you this, the inversions are telling you this.

There will be no soft landing. There will be no avoiding a recession

The market is telling you this, the inversions are telling you this.

So, at the worst, we will have a deep recession or even depression

At best, we will have a short-lived recession

Either way, the Fed will eventually reverse course.

At best, we will have a short-lived recession

Either way, the Fed will eventually reverse course.

They will lower rates

They will stop selling the USTs and MBS on their balance sheet

They will most likely be forced to step in and provide liquidity to the Treasury market, to keep it orderly, functioning properly.

They will stop selling the USTs and MBS on their balance sheet

They will most likely be forced to step in and provide liquidity to the Treasury market, to keep it orderly, functioning properly.

Manipulate more

Print more

Debase the USD more.

Print more

Debase the USD more.

So what can you do?

I'm being careful of my exposures, and I'm holding more cash than usual heading into this uncertainty

I'm also adding opportunistically to hard money assets, like gold, silver, and #Bitcoin, all for the long term.

I'm being careful of my exposures, and I'm holding more cash than usual heading into this uncertainty

I'm also adding opportunistically to hard money assets, like gold, silver, and #Bitcoin, all for the long term.

I expect these to perform well when the market eventually turns to the upside, especially when the Fed realizes it has no choice but to expand the money supply once again

Until then, I'm exercising caution and looking for defensive or deep value, truly asymmetric opportunities.

Until then, I'm exercising caution and looking for defensive or deep value, truly asymmetric opportunities.

This thread is a summary of a recent 🧠Informationist Newsletter. If you enjoyed it, make sure to:

1. Follow @jameslavish to see more investment related content

2. Subscribe to The Informationist to learn one simplified concept weekly: jameslavish.substack.com

1. Follow @jameslavish to see more investment related content

2. Subscribe to The Informationist to learn one simplified concept weekly: jameslavish.substack.com

Mentions

See All

Jeff Booth @JeffBooth

·

Dec 23, 2022

Good thread @jameslavish !