Thread

Morning team call had two questions - which made me pull together some loose thoughts on Climate Tech VC. 🧵

1) Has the growth/presence of VC impacted your sector over the last 3-5 years?

2) If so, what are the implications of a severe slowdown/reduction in funding from VC?

1) Has the growth/presence of VC impacted your sector over the last 3-5 years?

2) If so, what are the implications of a severe slowdown/reduction in funding from VC?

Caveat: Hard to get consistent/reliable figures for 'Climate Tech' VC funding b/c of i) broad array of sectors included & ii) most universes bundle together VC/Growth/PE/IPO/SPAC. Makes #s noisy, but interesting to track the aggregate figures regardless to see directional trends.

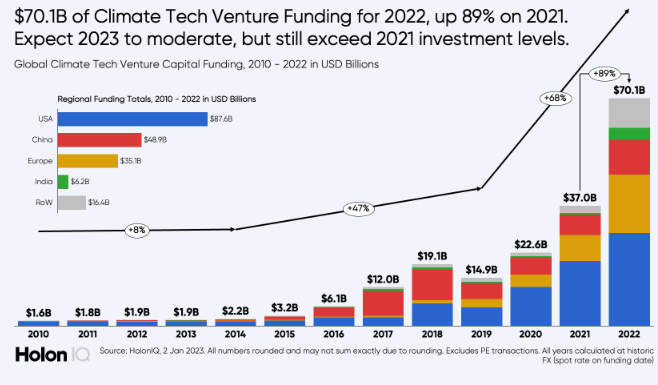

2022 VC funding, totaled ~$60-$70BN across two sources.

1) Global funding is $70.1BN per @holoniq, up >10x over the past 6 years. Holon uses their propiertary platform with data directly sourced from public disclosures + private submissions.

www.holoniq.com/notes/2022-climate-tech-vc-funding-totals-70-1b-up-89-from-37-0b-in-2021

1) Global funding is $70.1BN per @holoniq, up >10x over the past 6 years. Holon uses their propiertary platform with data directly sourced from public disclosures + private submissions.

www.holoniq.com/notes/2022-climate-tech-vc-funding-totals-70-1b-up-89-from-37-0b-in-2021

2) If you run-rate $52BN thru 3Q22 figure from PWC's State of Climate Tech 2022 report, you get to ~$70BN. Includes SPACs so excl. that = ~$65BN.

PwC has a team analyze/pore over Pitchbook data. They claim Climate Tech represents >25% of global VC in TTM period thru 3Q22.

PwC has a team analyze/pore over Pitchbook data. They claim Climate Tech represents >25% of global VC in TTM period thru 3Q22.

Impacts to public/later stage markets? Velocity of $ inflated the value of companies and gave too much aggressive forward credit. Look no further than the SPAC mania in climate tech land.

Since start of 2022, nearly ~70 climate tech SPACs are flat to below initial share price.

Since start of 2022, nearly ~70 climate tech SPACs are flat to below initial share price.

What could it mean moving forward? Ideally, you have more price/deal discipline in the early stages and slower overall momentum so that businesses can grow into their valuation and demonstrate real momentum and evidence a path to profitability.

Why might that not happen...?

Why might that not happen...?

$35-$40BN dry powder as of 11/22. Everyone raised into momentum around climate - bull markets, public enthusiasm, flood of talent into the space, regulatory tailwinds, investors piling into secular theme.

3 new Climate PE funds in 2 months alone: GSAM $1.6BN, GA $3.5, MS $1BN.

3 new Climate PE funds in 2 months alone: GSAM $1.6BN, GA $3.5, MS $1BN.

Not saying all these businesses are overvalued and not building substantial value, quite the opposite. But does not appear to be a scarcity/slowing of pace you're seeing in other early stage markets. Companies might be more selective about rounds and may 2nd guess quick exits tho

This opens up opportunities for incumbents who have been seeking to be acquisitive in the space but have had price/market activity be too aggressive for their tastes. Expect this becomes the preferred exit method while IPO/SPACs are slow to recover as the prior cycle shakes out.