Thread by Kailash Concepts

- Tweet

- Feb 28, 2023

- #EconomicInequality

Thread

1/19 @ttmygh of the wonderful Things That Make You Go HMMMM newsletter just wrote a scathing piece on the emerging #pension fund disaster in lagged marks from private #equity.

loom.ly/YyomXW4

loom.ly/YyomXW4

2/19 As he explains:

#PrivateEquity is taking down Pension Funds as they struggle to keep the game of hot-potato going. “Hot potato” being the business practice of selling slices of companies back and forth to one another at ever higher #valuations.

#PrivateEquity is taking down Pension Funds as they struggle to keep the game of hot-potato going. “Hot potato” being the business practice of selling slices of companies back and forth to one another at ever higher #valuations.

3/19 The “solution” appears to be PE firms building funds to buy #assets from themselves at possibly fraudulent valuations set by themselves.

4/19 What’s remarkable about Grant’s piece is that it highlights just how quickly comically overstated high rates of reported #returns can be wiped out by big negative marks.

5/19 We have written at length about this arithmetic folly. This was us at the end of 2018, highlighting that the stuffed pipeline of #IPOs scheduled to go public in 2019 would likely be overvalued by 50%+...

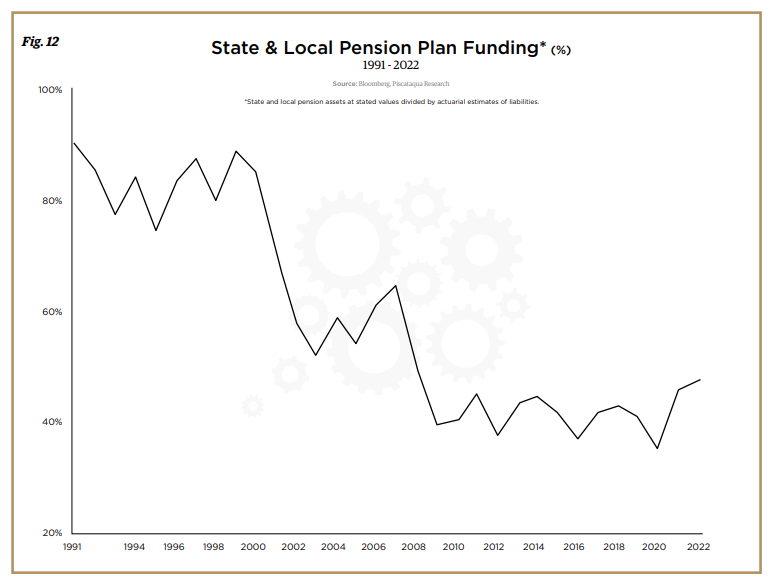

6/19 ...how the consensus BUY of PE by #Pension #Funds made no sense and it lead out with a discussion of how these forces would conspire to demolish pension funds.

7/19 Get the #whitepaper Private vs. Public Markets – Identifying Potential Sources of Risk and Reward 👇🏼

kailashconcepts.com/white-papers/private-vs-public-markets-identifying-potential-sources-of-risk-and-...

kailashconcepts.com/white-papers/private-vs-public-markets-identifying-potential-sources-of-risk-and-...

8/19 Excerpts from news reports highlighted by Grant’s recent report are posted below. They make for an incredible read.

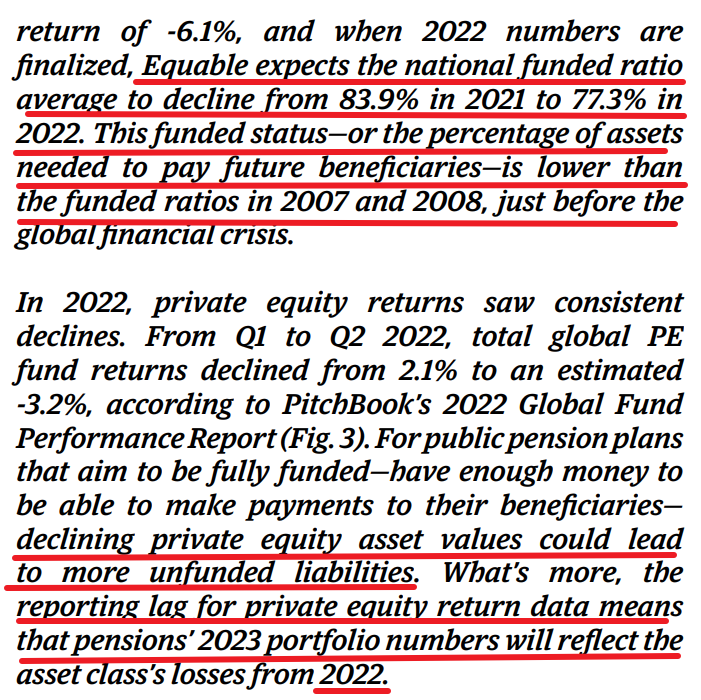

9/19 "Equable expects the national funded ration avg to decline from 83.9% in 2021 to 77.3% in 2022"

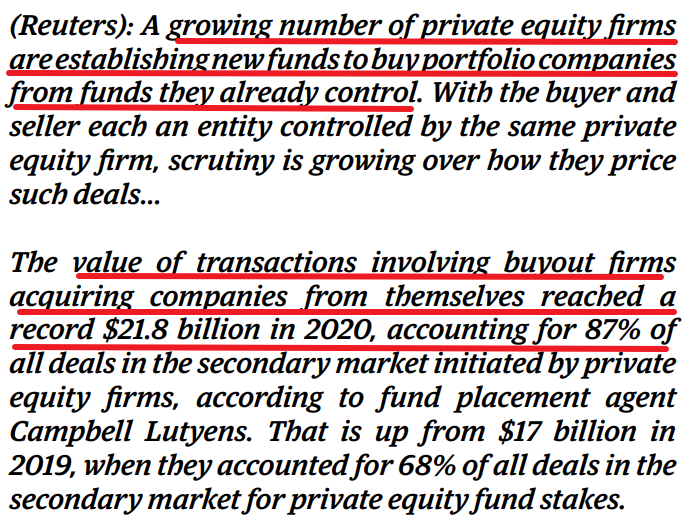

10/19 "A growing number of PE firms are establishing new funds to buy #portfolio #companies from funds they already control."

12/19 Building funds to buy assets from themselves so they can set marks are now 87% of all secondary deal transactions. In the search for suckers* more $ for these funds, the industry is trying to stuff “continuation funds” in ‘40Act wrappers & PE is racing for 401k inclusion.

13/19 This is an issue we questioned in #PrivateEquity Returns: Are Private Markets “Safe”?

Get it here 👇🏼

kailashconcepts.com/private-equity-returns-are-private-markets-safe/

Get it here 👇🏼

kailashconcepts.com/private-equity-returns-are-private-markets-safe/

14/19 We also highlighted the dubious methods PE was using to keep debt-to-EBITDA ratios under the Office of the Comptroller of the Currency’s high-risk flag of 6x as they made the most expensive acquisitions in the #industry’s history in 2021.

kailashconcepts.com/debt-to-ebitda-ratios-the-spiral-higher-continues/

kailashconcepts.com/debt-to-ebitda-ratios-the-spiral-higher-continues/

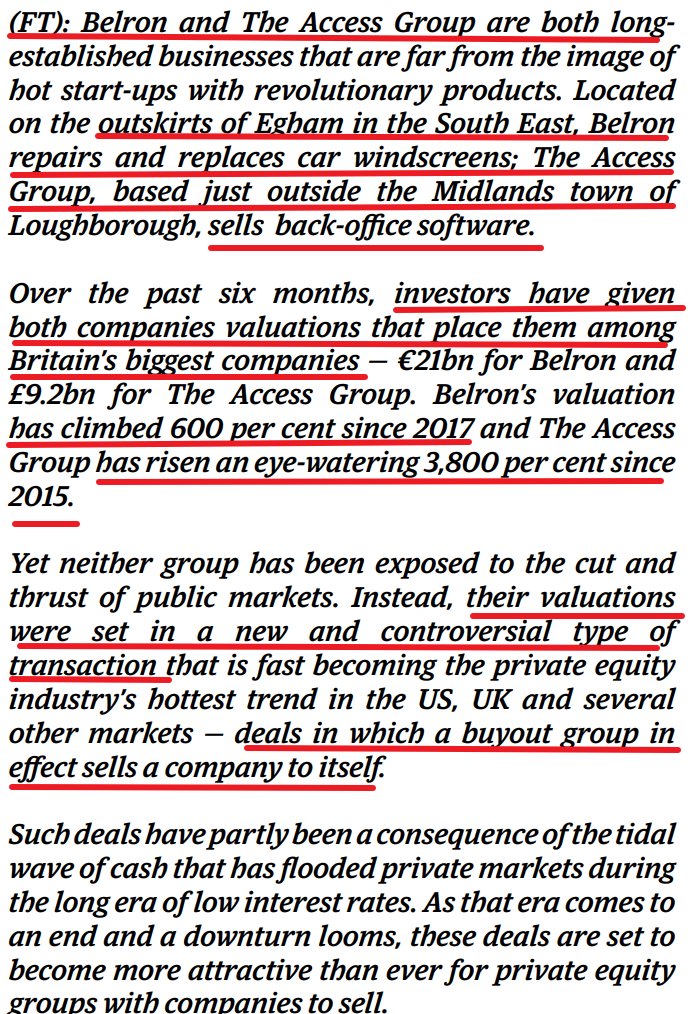

15/19 Excerpt from @FT article reporting how these private continuation fund marks have been used to value a couple obscure companies in the UK at valuations that make them among the largest companies in the country – with reported returns of 600% and 3,800%, respectively.

16/19 Who knew a British windshield repair company could be worth so much?!

17/19 As the excerpts from the @FT show, some are now publicly calling these practices #pyramidschemes with insiders at pension funds privately confirming the possibly criminal nature of these transactions.