Thread by Bob Elliott

- Tweet

- Mar 13, 2023

- #CentralBank #Economics

Thread

Pricing switched from hikes to cuts in 72hrs, signaling small bank stress is enough to derail the macro strength.

JP must be considering lessons of '98 right now when a financial panic drove Fed cuts and extended the tech bubble. Except this time the costs are higher. Thread.

JP must be considering lessons of '98 right now when a financial panic drove Fed cuts and extended the tech bubble. Except this time the costs are higher. Thread.

What we are seeing right now with the small banks is pretty normal in any traditional macro tightening cycle. The rise in rates not only has an impact on the macro economy through higher cost of credit, etc, but it also exposes those most sensitive to rates and liquidity.

This time we are seeing the tech sector but in the past its been housing, or tech actually, or S&Ls or commodity producers, etc. Each time has a different flavor but the story is largely the same.

When this happens, the central bank has to make a call about whether it is enough of a tightening of the private financial sector to derail the strength of the macro economy.

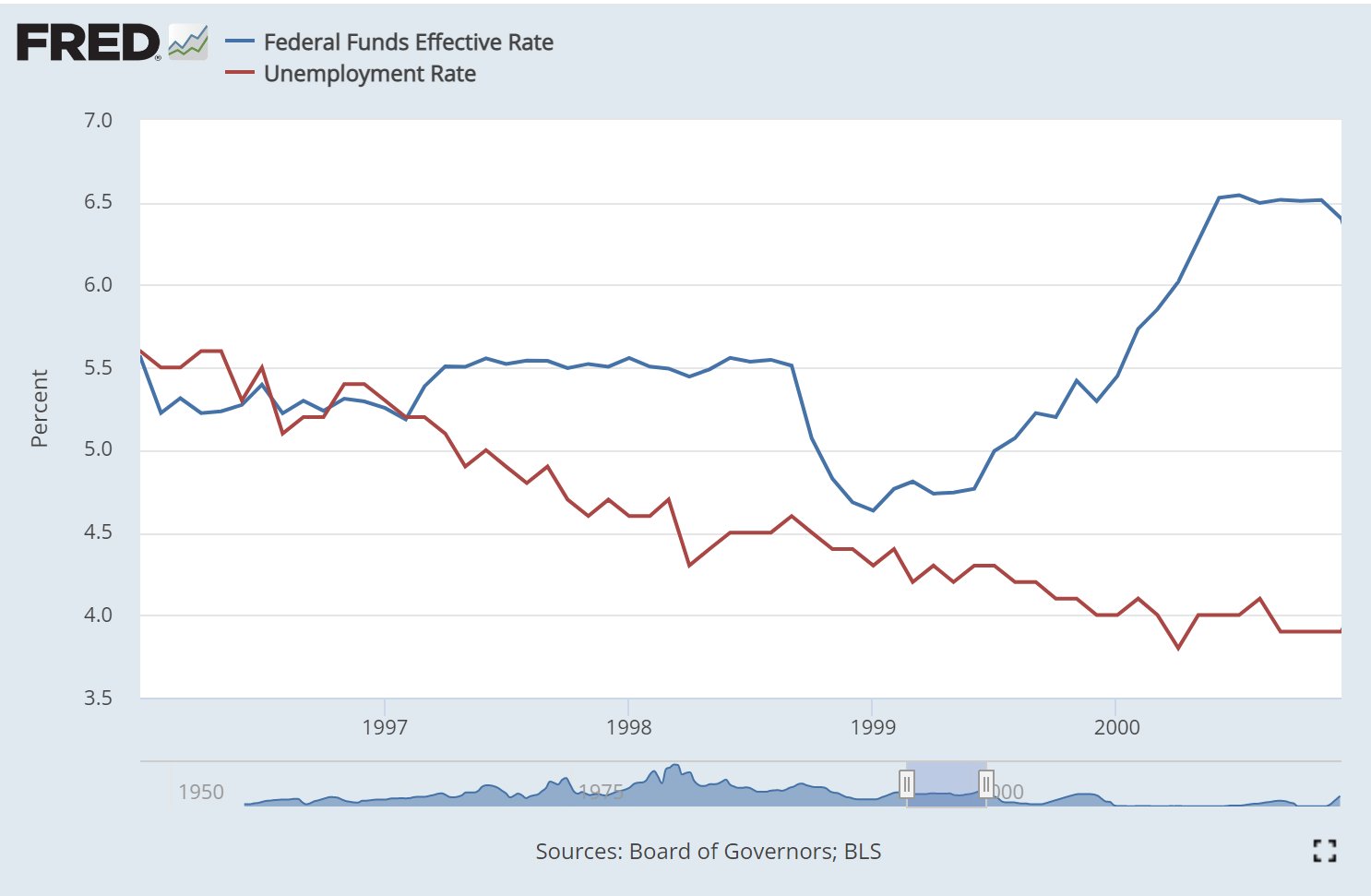

Back in 98 the tradeoffs were a little easier for the Fed. Despite the economy being pretty late cycle and UE being low, reported inflation was pretty contained. When LTCM broke, the Fed's there wasn't much immediate cost to respond with liquidity.

But LTCM wasn't big enough to derail the macro economy strength. It looked like it could be an existential threat but it wasn't. Heck, most people outside of the financial system had no idea that it was going on.

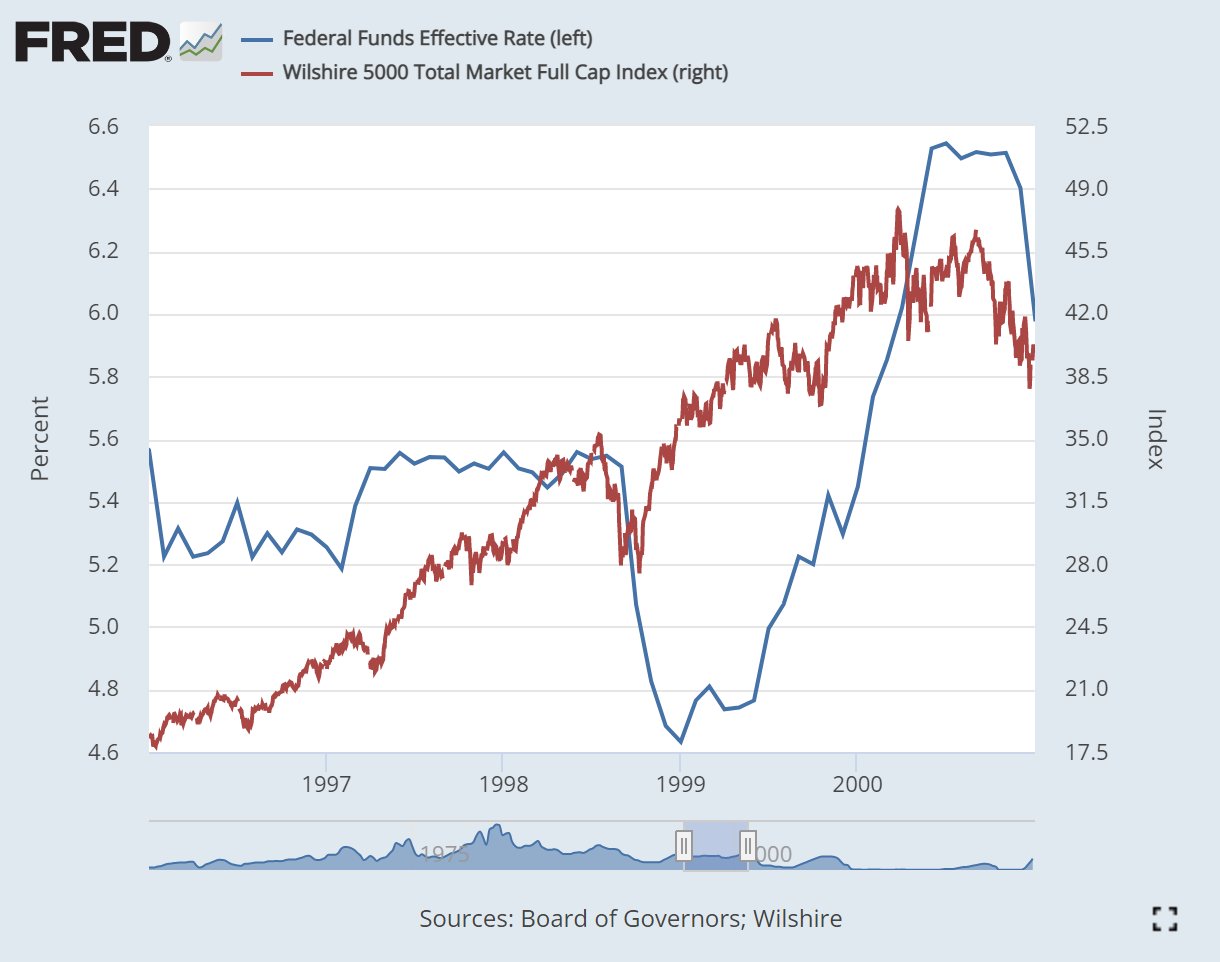

But what did impact pretty much everyone was the cut in rates and the easing of liquidity. In all sorts of ways the liquidity that was injected helped support the last 18m leg in the bubble and another 50pct rise in stocks.

Today the Fed faces a similar late cycle financial problem. One that needs to be addressed otherwise it could create a systemic risk, but not one that on its own is systemic in size. The steps done so far have likely curtailed the panic risk, though a few more banks may fail.

But the bigger battle remains on inflation. Assuming this doesnt leak into a broad set of lenders, then the macro economy looks not much different today than it did a few days ago.

Yet a halt to hikes and cuts are being rapidly priced in:

Yet a halt to hikes and cuts are being rapidly priced in:

The abruptness of the move plus the fact that funds were significantly short bonds and short rates coming in to this period suggests that we may be seeing a pretty big de-risking short squeeze rather than a careful repricing of expected path of policy.

Just like the bond rally in Jan, these types of moves in many ways sow the seeds of their own reversal. The lower the mortgage rate, the more stimulation and the more work the Fed has to do to get the macro economy to slow down to beat undesirably persist inflation.

While we aren't sure exactly how this will all play out, I'm sure JP is thinking hard about '98 and the consequences of running easy policy in a late cycle environment.

The best path is pretty clear. Keep tightening to slow the real economy while providing the necessary liquidity and capital to make sure the financial system can withstand the shifts in policy.

The stakes are pretty high and the right path for policy is pretty clear. What JP does will reveal a lot about how policy will be run in months ahead.

Until now the trade-offs were modest. Today they are not. We will soon see whether JP really is an inflation fighter.

Until now the trade-offs were modest. Today they are not. We will soon see whether JP really is an inflation fighter.