Thread

Hubspot, @stripe and JP Morgan Chase all acquired similar companies recently

Really?!

Yup - Tech and financial services are looking to buy media companies and communities

And this type of M&A is going to accelerate

Why?

In 6 letters, the answer is LTVCAC

🧵

Really?!

Yup - Tech and financial services are looking to buy media companies and communities

And this type of M&A is going to accelerate

Why?

In 6 letters, the answer is LTVCAC

🧵

2/ @Chase bought 2 content assets in the last 4 months

In Sept ‘21, JPM acq’d The Infatuation, a publisher with reviews & recs on restaurants in 50 cities.

They also acq’d Frank, an online portal w/ content to help students research and apply for financial aid

What?!

In Sept ‘21, JPM acq’d The Infatuation, a publisher with reviews & recs on restaurants in 50 cities.

They also acq’d Frank, an online portal w/ content to help students research and apply for financial aid

What?!

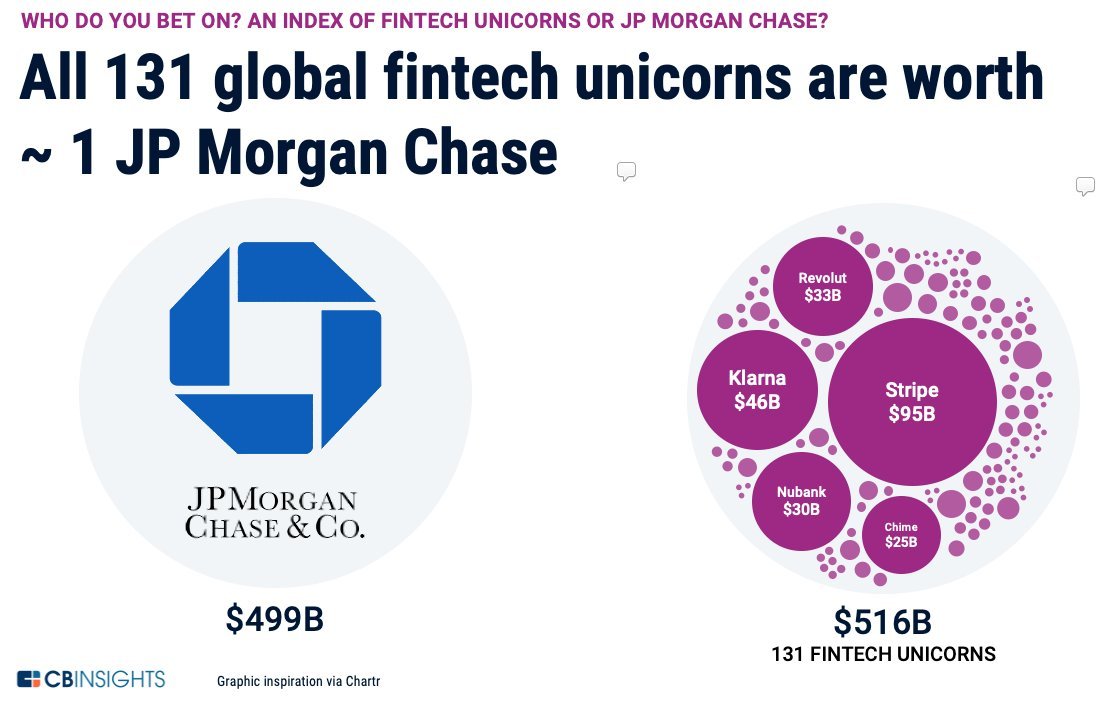

3/ Yes - that JPM Chase that is single handedly worth almost as much all the fintech unicorns combined is buying media assets.

Why?!

Why?!

4/ Will come back to the math

First, worth noting that this idea and its implementation is not new

Folks in tech have been discussing for a while

Co-founder of @hubspot @dharmesh said it a while ago

He eventually put his $ behind this as you'll see

First, worth noting that this idea and its implementation is not new

Folks in tech have been discussing for a while

Co-founder of @hubspot @dharmesh said it a while ago

He eventually put his $ behind this as you'll see

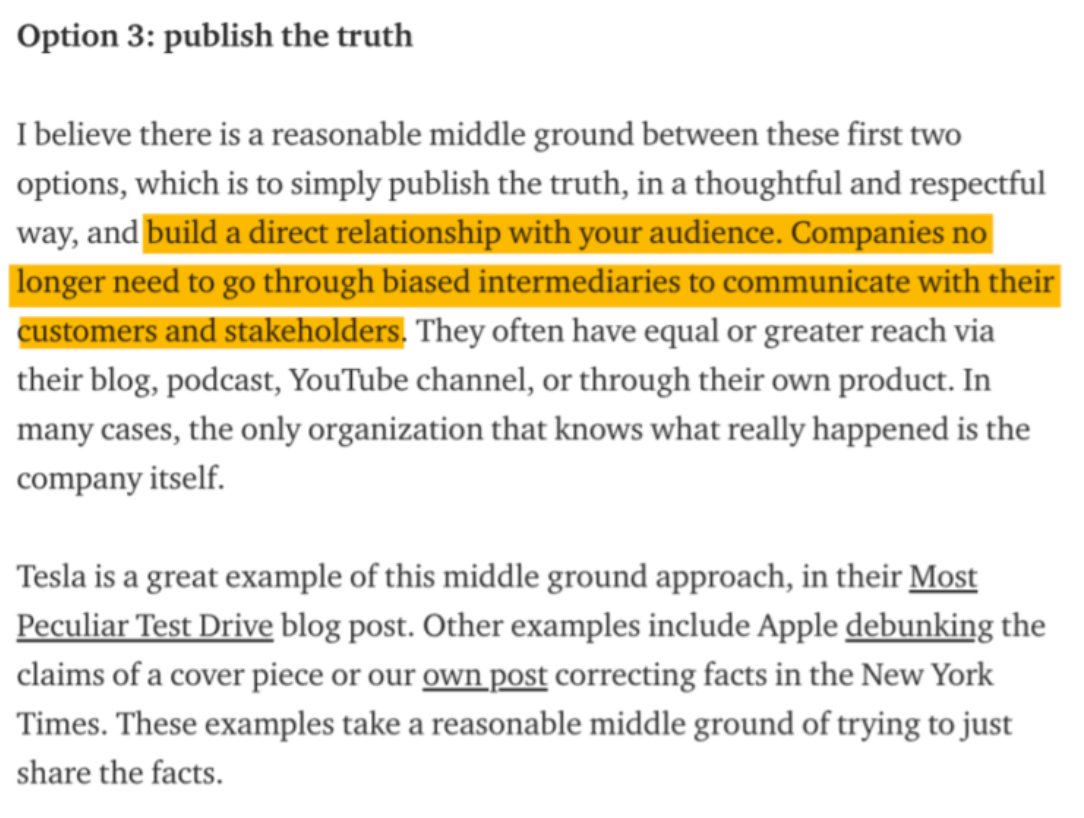

6/ @brian_armstrong ceo & co-founder of @coinbase has also said

“every tech company should go direct to their audience and become a media company”

He wrote

“every tech company should go direct to their audience and become a media company”

He wrote

7/ Beyond the 2 JPM deals, here’s a list of media & audience M&A transactions

* Hubspot acq’d The Hustle - rumored valuation of $27M and price/revenue valuation multiple of 2.25x-2.7x

* Penn National Gaming acq’d Barstool Sports - $450M valuation and multiple of 4.5-5.0x

* Hubspot acq’d The Hustle - rumored valuation of $27M and price/revenue valuation multiple of 2.25x-2.7x

* Penn National Gaming acq’d Barstool Sports - $450M valuation and multiple of 4.5-5.0x

8/ There’s also

* Robinhood acquired MarketSnacks

* Stripe bought IndieHackers (and also owns/operates Stripe Press

* DraftKings bought VSiN

* Zapier bought Makerpad

* DigitalOcean acquired Scotch(dot)io

* Robinhood acquired MarketSnacks

* Stripe bought IndieHackers (and also owns/operates Stripe Press

* DraftKings bought VSiN

* Zapier bought Makerpad

* DigitalOcean acquired Scotch(dot)io

9/ So why acquire media cos?

Easy answers:

* go direct to its audience/remove gatekeepers.

* build ongoing relationship w/ audience aka “owning” vs “renting”

Certainly true & important but not the primary reason for tech & fin services

The real answer is LTV/CAC arbitrage

Easy answers:

* go direct to its audience/remove gatekeepers.

* build ongoing relationship w/ audience aka “owning” vs “renting”

Certainly true & important but not the primary reason for tech & fin services

The real answer is LTV/CAC arbitrage

10/ First, some definitions for those unfamiliar

LTV refers to lifetime value of a customer

And CAC refers to customer acquisition cost

The sweetspot is high LTV products and low CACs

LTV refers to lifetime value of a customer

And CAC refers to customer acquisition cost

The sweetspot is high LTV products and low CACs

11/ If you’re selling SaaS, fantasy sports/gambling, or fin svcs products, you have:

High LTVs

But acquiring customers is also intensely competitive

So you also have

High CAC

High LTVs

But acquiring customers is also intensely competitive

So you also have

High CAC

12/ What about media companies?

They make $ through non-recurring advertising, events, educational courses, brand partnerships, native advertising (sponsored content), or e-commerce

Hence

Low LTVs

At same time, they’re good at acquiring audience, so

Low CAC

They make $ through non-recurring advertising, events, educational courses, brand partnerships, native advertising (sponsored content), or e-commerce

Hence

Low LTVs

At same time, they’re good at acquiring audience, so

Low CAC

13/ So the big simple opportunity is the arbitrage that exists on both sides

Let’s use JPM Chase’s acquisition of The Infatuation as a high-level case study

The principles are the same for Hubspot, Draftkings, Robinhood, etc.

Let’s use JPM Chase’s acquisition of The Infatuation as a high-level case study

The principles are the same for Hubspot, Draftkings, Robinhood, etc.

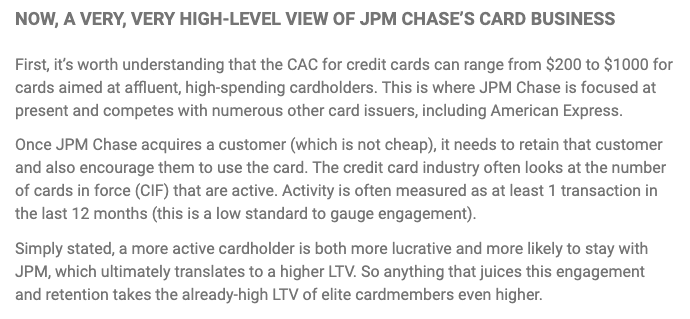

14/ What’s the CAC of a JPM credit card?

Between $200-$1000 for affluent, high spending cardholders

Once acquired, they also need to get that customer to use the card

Else they’ll churn

So JPM wants them spending more cuz that is more lucrative today and also increases LTV

Between $200-$1000 for affluent, high spending cardholders

Once acquired, they also need to get that customer to use the card

Else they’ll churn

So JPM wants them spending more cuz that is more lucrative today and also increases LTV

15/ So how does The Infatuation lower CAC/increase LTV?

* Gives cardholders access to food festivals, invite-only events, exclusive content

* 1.5-2M visits/mo who care abt key spend category

Result: attract new cardmembers, build brand affinity & retain existing existing CMs

* Gives cardholders access to food festivals, invite-only events, exclusive content

* 1.5-2M visits/mo who care abt key spend category

Result: attract new cardmembers, build brand affinity & retain existing existing CMs

17/ The playbook works - whether in SaaS, financial services, online gambling, etc

If you look at what @hubspot has done with @theSamParr and @TheHustle and the MFM podcast (also with @ShaanVP), you see them getting rid of ads and making them all ‘house ads’ for Hubspot

Smart

If you look at what @hubspot has done with @theSamParr and @TheHustle and the MFM podcast (also with @ShaanVP), you see them getting rid of ads and making them all ‘house ads’ for Hubspot

Smart

18/ There's a ton of niche media / community companies being built

If you’re in corp dev, you should be scouting this world

If you enjoyed nerding out to this, a more detailed view along w/ some predictions on who Airbnb, Citi, eBay should acquire >>

www.cbinsights.com/research/media-acquisitions-technology-financial-services/

If you’re in corp dev, you should be scouting this world

If you enjoyed nerding out to this, a more detailed view along w/ some predictions on who Airbnb, Citi, eBay should acquire >>

www.cbinsights.com/research/media-acquisitions-technology-financial-services/

19/ In financial services, the growth imperative is more acute than ever

While the old guard has seen their market caps stagnate, new entrants have been on 🔥🔥

We break down the "Gradually, Then Suddenly" disruption of financial services here >>

While the old guard has seen their market caps stagnate, new entrants have been on 🔥🔥

We break down the "Gradually, Then Suddenly" disruption of financial services here >>

20/ Today, another software company acquired a media asset

@zalando picked up streetwear media company @highsnobiety

They join JPM Chase, Hubspot, Stripe, Draftkings and others who see the math on buying audiences is just too damn compelling

www.cbinsights.com/research/media-acquisitions-technology-financial-services/

@zalando picked up streetwear media company @highsnobiety

They join JPM Chase, Hubspot, Stripe, Draftkings and others who see the math on buying audiences is just too damn compelling

www.cbinsights.com/research/media-acquisitions-technology-financial-services/

Mentions

See All

Balaji Srinivasan @balajis

·

Dec 28, 2021

Good thread on why tech companies (and companies in general) are buying media arms. There is for sure an economic argument to be made in terms of LTV/CAC. But I think it's worth doing even if it doesn't show up in the numbers. Can't let a disaligned media company speak for you.

Jesse Pujji @jspujji

·

Dec 29, 2021

Must read.