Thread

Time for a systemic risk update thread from the Cloudbear…

US stocks just don’t seem to release, so only a matter of time until all those puts result in dealers doing their gamma jam higher right? Not so fast…

US stocks just don’t seem to release, so only a matter of time until all those puts result in dealers doing their gamma jam higher right? Not so fast…

Morgan Stanley’s CDS seems like it wants to keep going higher. This is weird, because why should MS have a problem, especially since the Fed will never let a failure happen again right?

Let’s look in on the US financial plumbing - near term funding continues to flash yellow with signs of stress. Here is 3M SOFR ie UST collateralized lending:

So near-dated funding markets are tightening noticeably, and the Fed just stopped buying bonds yesterday.

Then there is credit - a rupture is bound to happen here as growth slows and margins collapse due to COGS and wage inflation. US corp junk yields continue to move higher:

Then there is credit - a rupture is bound to happen here as growth slows and margins collapse due to COGS and wage inflation. US corp junk yields continue to move higher:

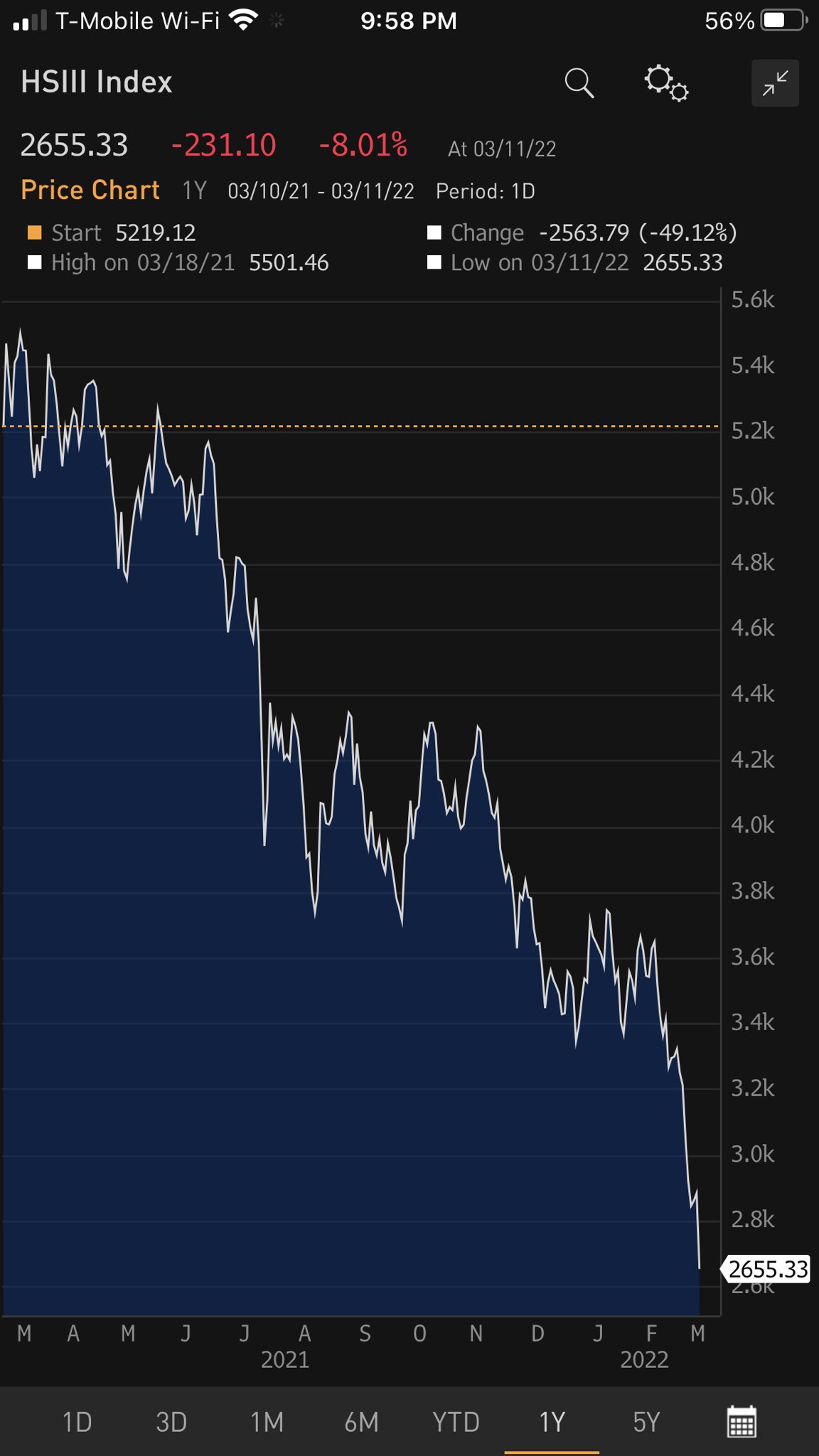

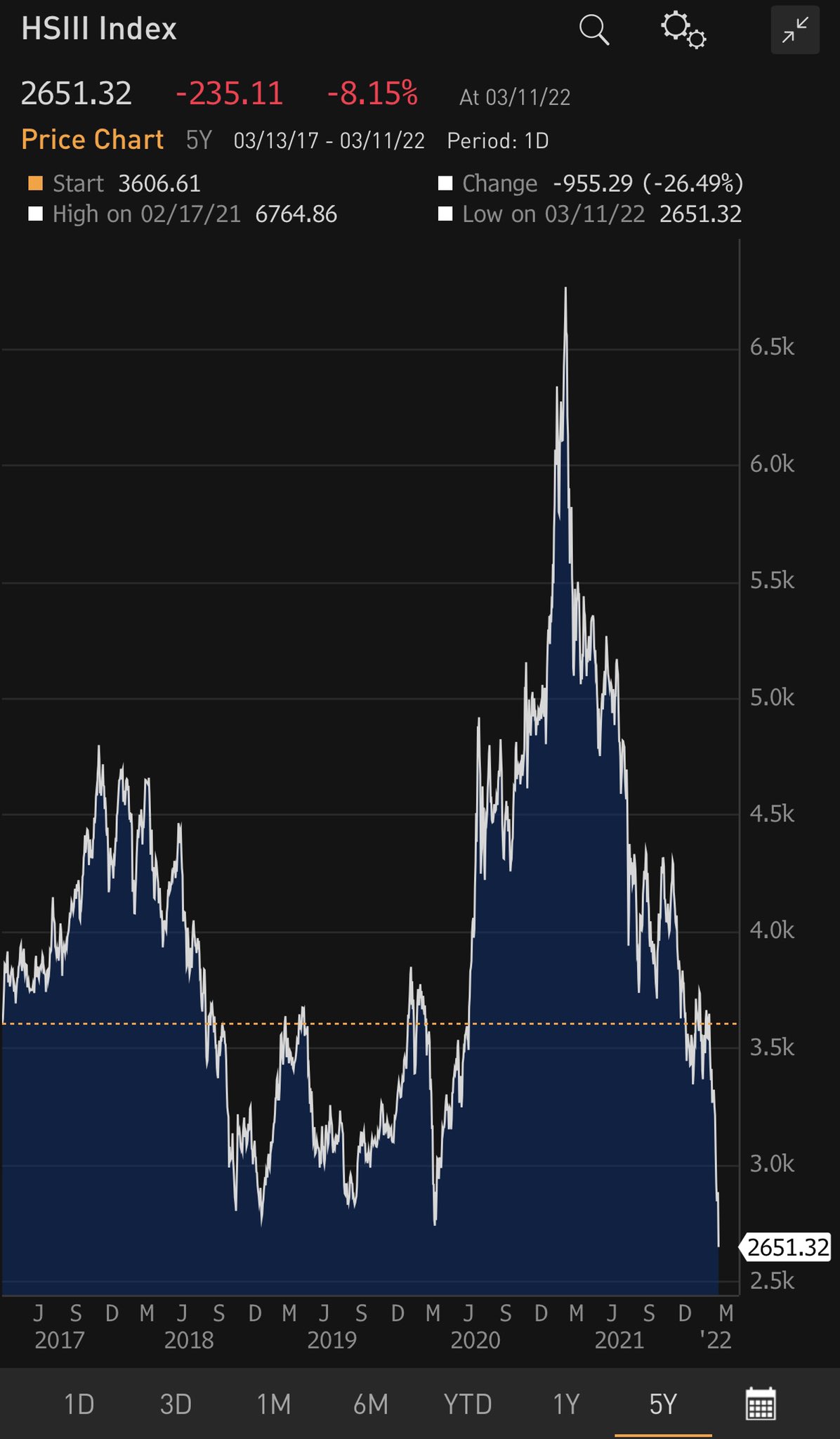

And the crackups are not just in the US - many are aware of Hang Seng Tech Index falling apart, down another -8% tonight and accelerating (1y and 5y charts for context):

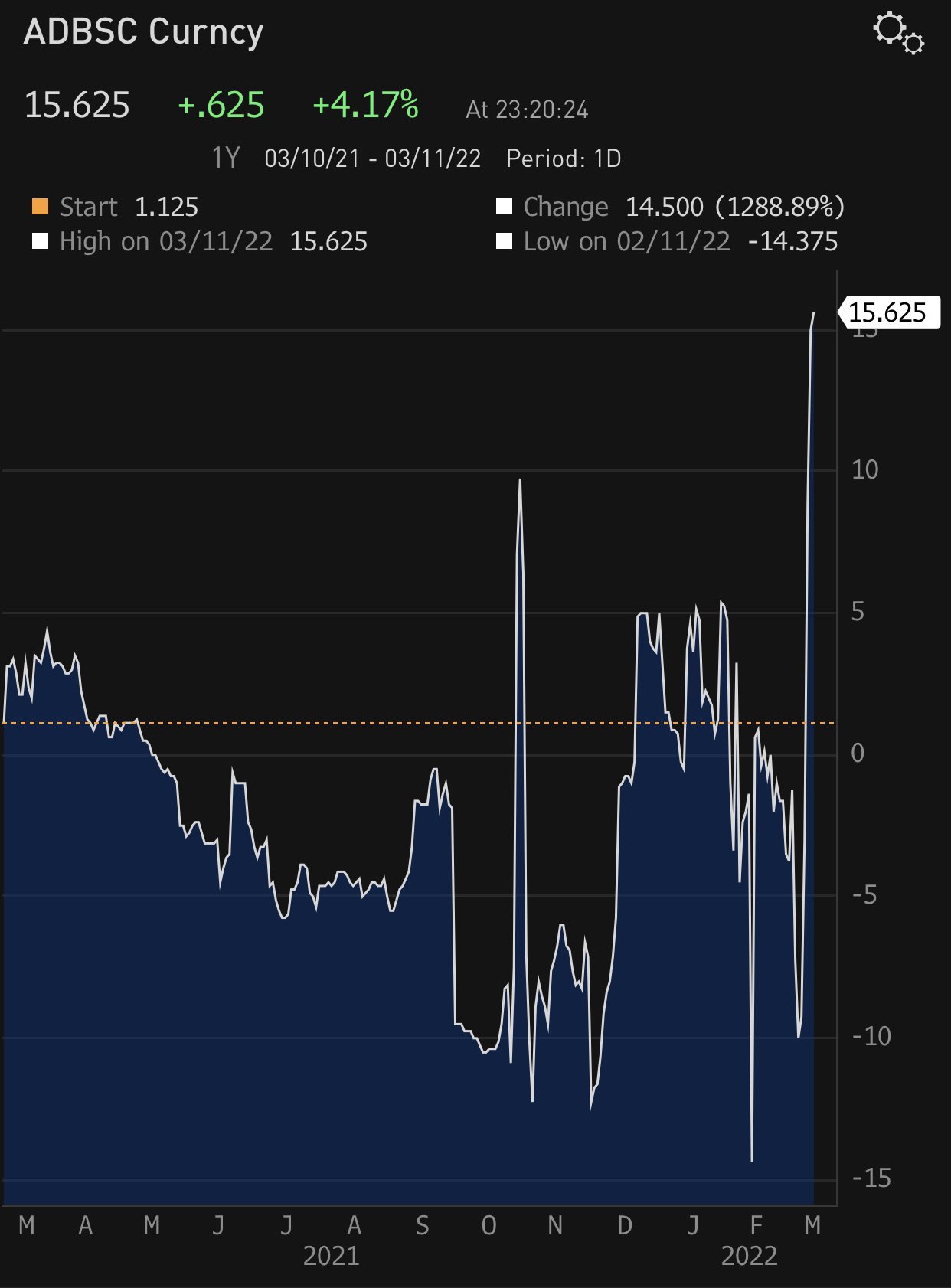

And cross currency basis swaps, remember when Aussie rates blew out on October 29th? The 1y AUD-USD basis swap is spiking again:

Worth monitoring these tremors as money is getting TIGHT and once confidence is shaken and credit runs into trouble, selling in equities becomes a near inevitability.

Mentions

See All

Dylan LeClair @BTCization

·

Mar 11, 2022

Great thread.