Thread

1/8 So I have been thinking quite a bit about Japan and the JPY / JGB 10y YCC setup here a lot in recent weeks, particularly in the context of how SNB bungled EURCHF years ago.

I have an old expression I call “testing the fence.” This is now highly relevant for CBs in 2022.

I have an old expression I call “testing the fence.” This is now highly relevant for CBs in 2022.

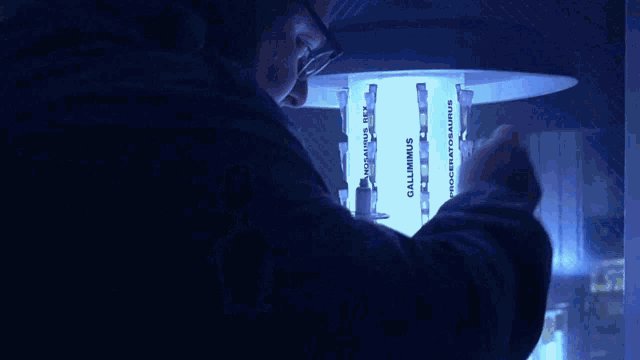

2/8 In the classic Jurassic Park, there is a scene where they have to feed the grown velociraptors in a giant pen by lowering a cow because the raptors would attack the electrified fences when the feeders showed up.

3/8 The raptors were highly intelligent - they never attacked the same place twice and would test the fence systematically for weakness. So they had to be contained in a pit.

4/8 The 10yr JBG 25bps YCC barrier is a conventional electrified fence run by economists. Macro traders are raptors. But instead of caging them in a pit of “whatever it takes” vague language and surprise rate hikes, the JCB insists on blowing yen on a classic vulnerable fence.

5/8 Unfortunately now there’s Dennis Nedry’s black swan inflation - who would have thought an energy net importer/global high tech manufacturing floor would have an inflation problem despite terrible demographics and public debt?

6/8 And so begins raptors’ test of the fences. A “lose lose” setup of “either 25bps YCC gives, or 126 USDJPY gives, and it’s a long way down either way” is now in play, and it is the sort of “break the pound” ERM trade that every Soros wannabe has been dreaming about for 30yrs.

Mentions

See All

Doomberg @DoombergT

·

Apr 17, 2022

Great thread