Thread

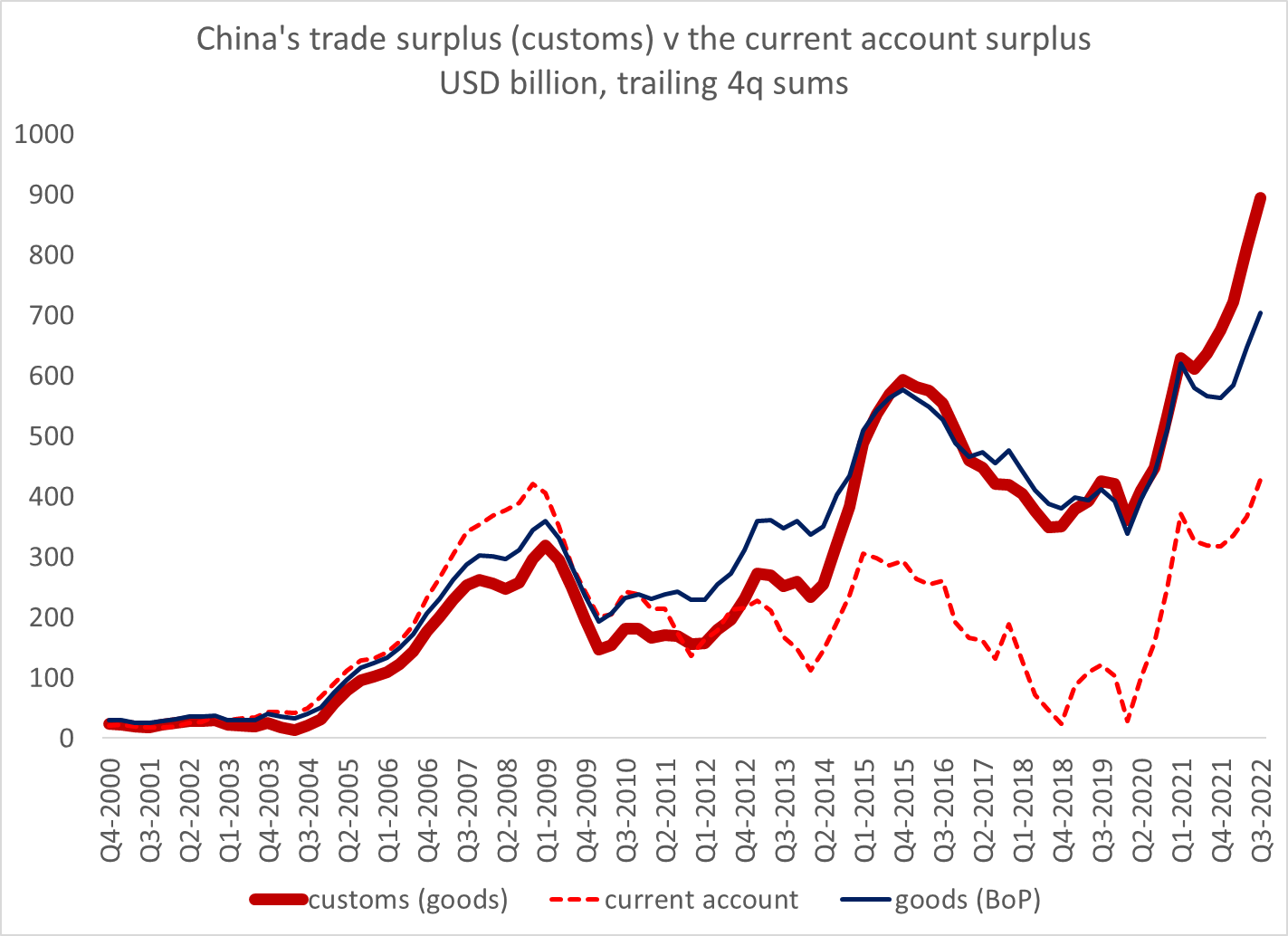

Chinas current account surplus rose, as expected, in the third quarter. The surplus now tops $400b/ is close to 2.5% of GDP.

It also differentiates China from most of Asia -- China's surplus is up while its currency has clearly joined the general sell off v. the USD.

1/

It also differentiates China from most of Asia -- China's surplus is up while its currency has clearly joined the general sell off v. the USD.

1/

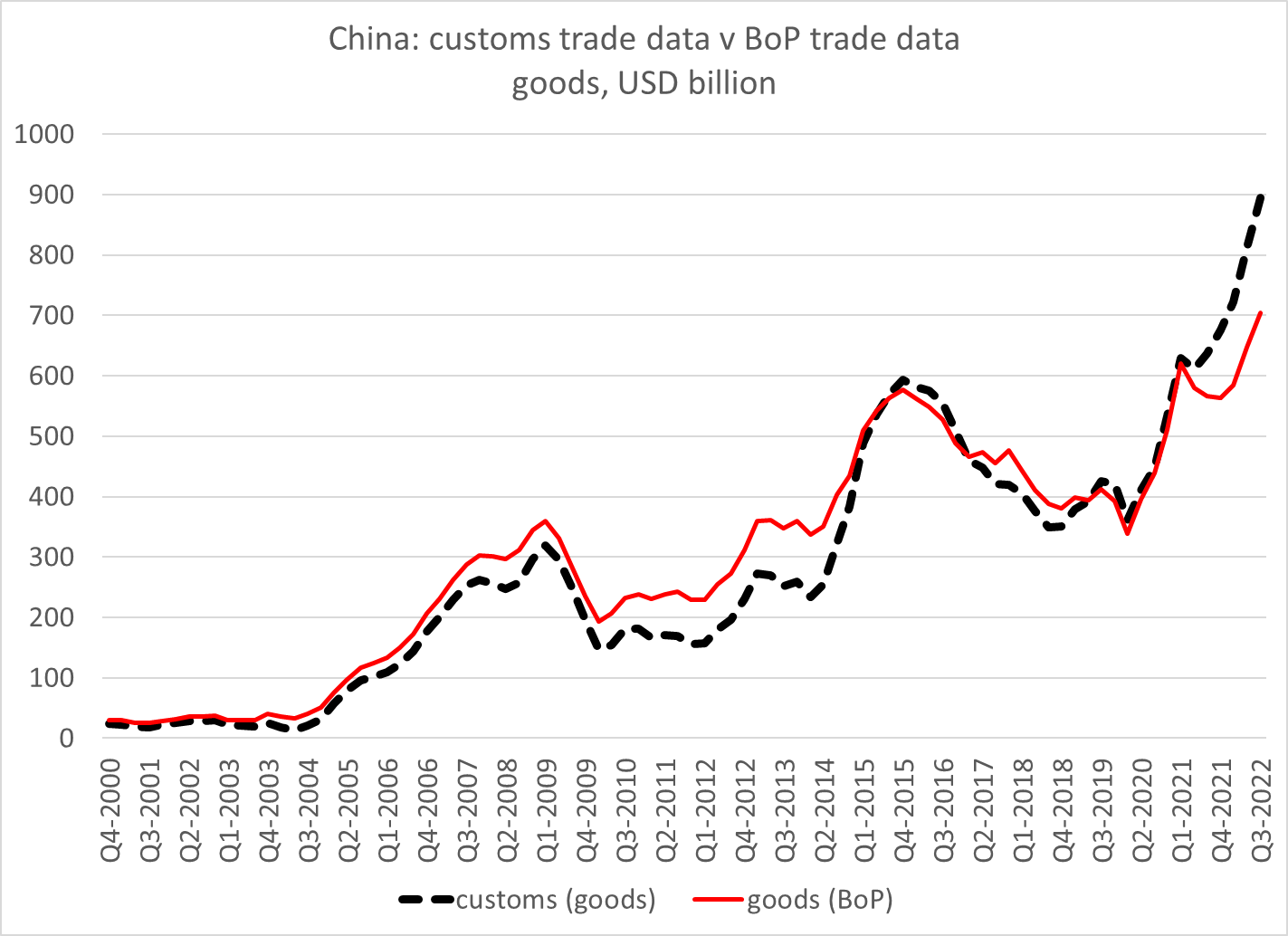

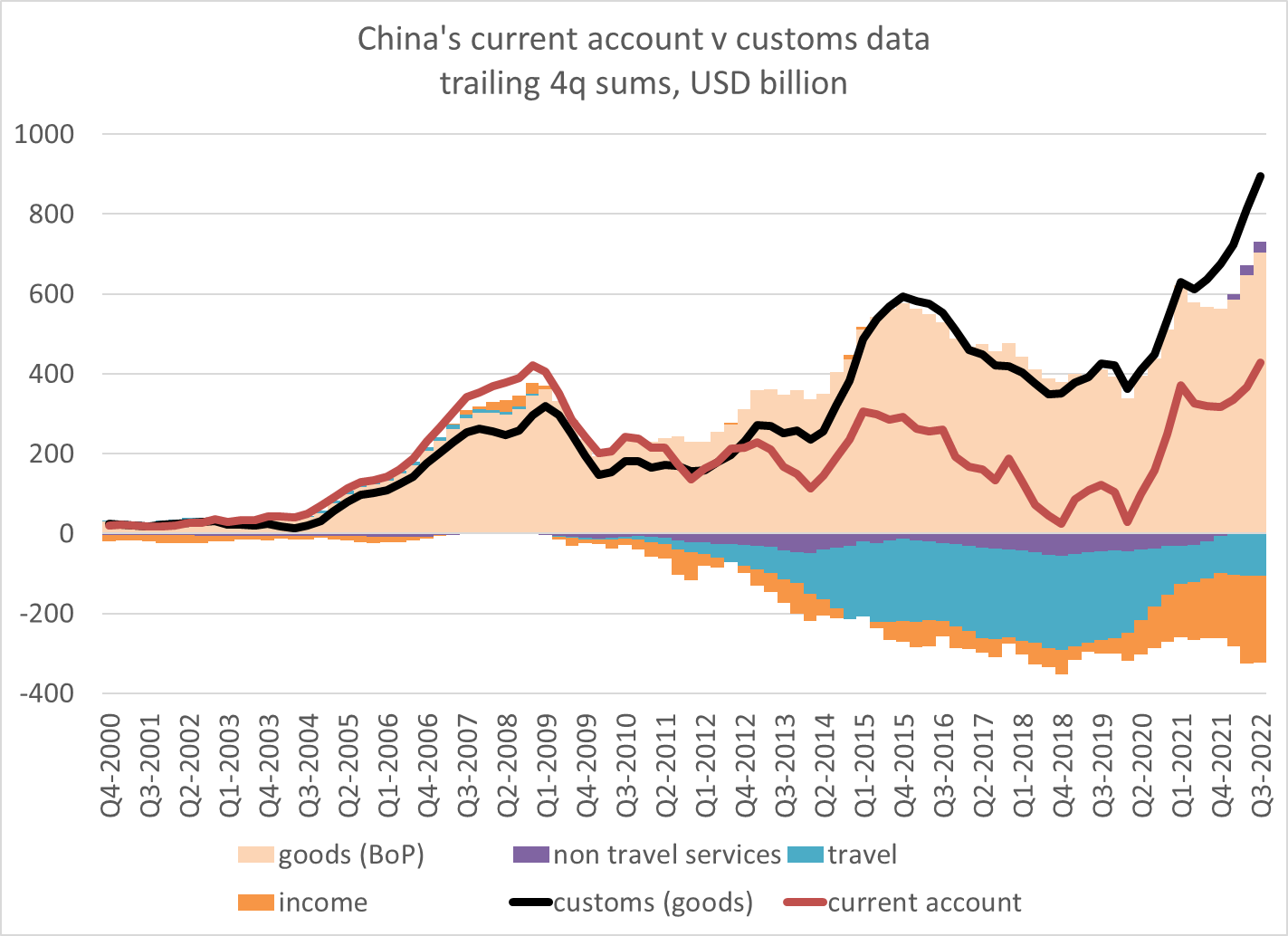

There is if anything a bit of evidence that China's current account surplus could be a bit bigger than officially reported -- the goods balance in the BoP is about $200b smaller than the customs goods surplus.

Paging @adamkwolfe for detailed analysis -- it is a bit strange

2/

Paging @adamkwolfe for detailed analysis -- it is a bit strange

2/

China's large income deficit (more payments out on FDI and foreign holdings of bonds than incoming payments) is the other main reason for the gap between the goods balance and the current account.

That gap remained unusually wide, but didn't get wider.

3/

That gap remained unusually wide, but didn't get wider.

3/

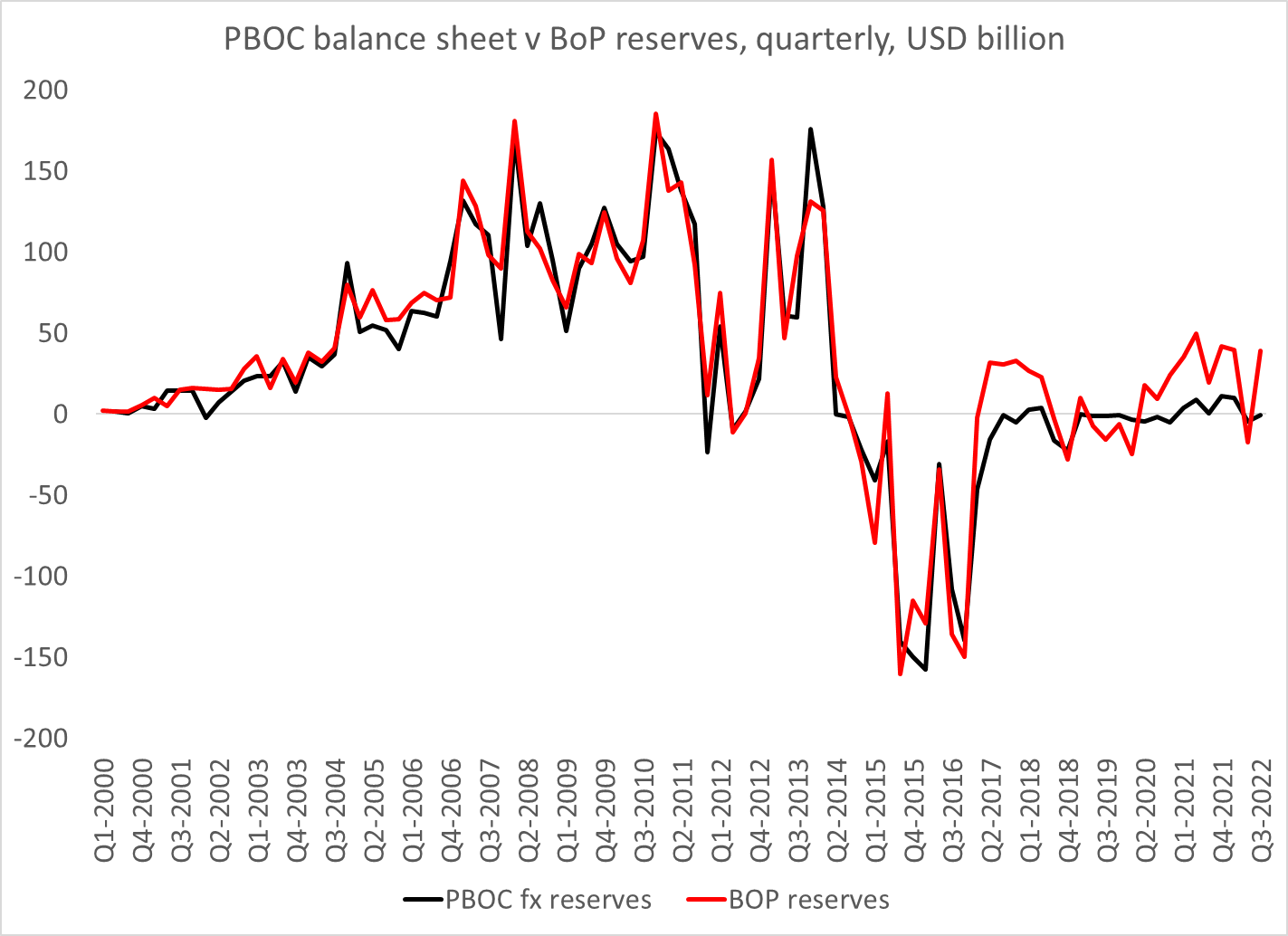

The strangest bit of the China's initial q3 BoP numbers, though, was the almost $40b increase - yes, increase - in China's foreign exchange reserves.

Amid the CNY's depreciation, and a general market view that China was pushing back at times against the CNY's move.

hmm.

4/

Amid the CNY's depreciation, and a general market view that China was pushing back at times against the CNY's move.

hmm.

4/

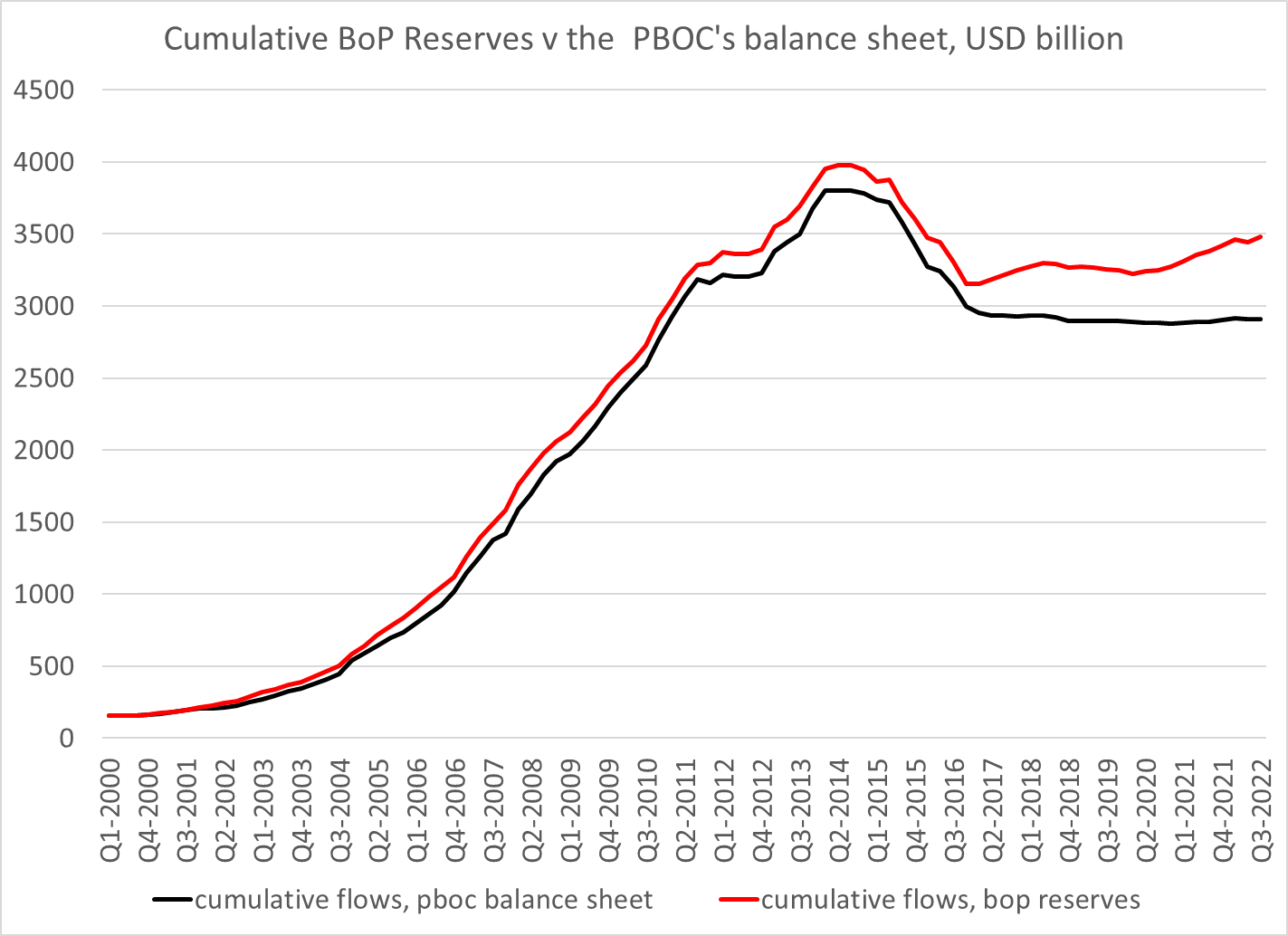

There are innocent explanations for why BoP reserves were up $39b in q3. Interest income on $3 trillion in reserves for example.

But the rise doesn't line up with the PBOC's balance sheet ... and points to a broader problem with the transparency of China's fx policies.

5/

But the rise doesn't line up with the PBOC's balance sheet ... and points to a broader problem with the transparency of China's fx policies.

5/