Thread by Brad Setser

- Tweet

- Feb 27, 2023

- #Globalization #Economics

Thread

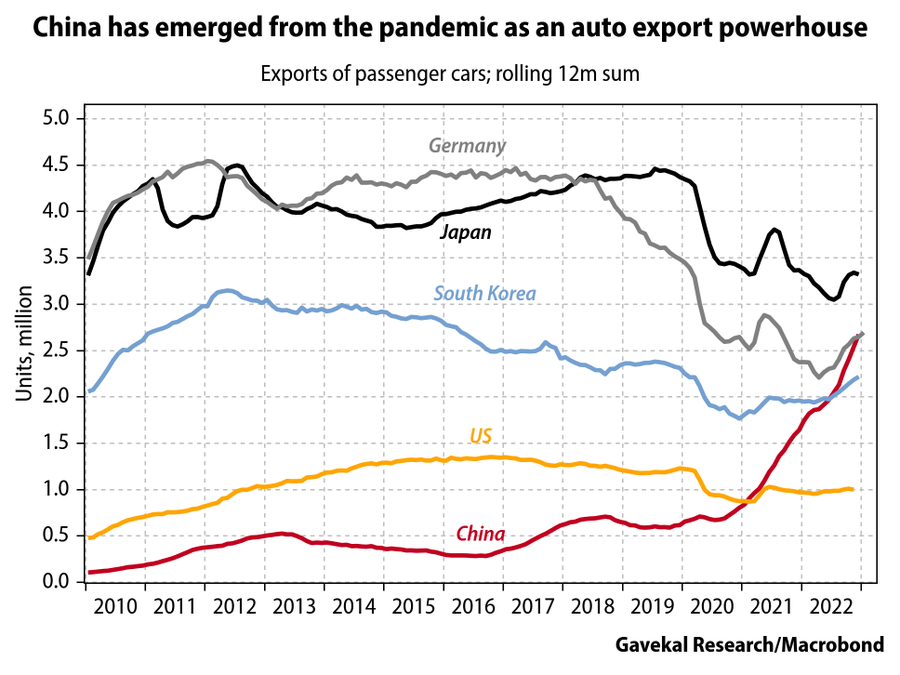

While the advanced economies talked about deglobalization, China's auto industry ... globalized.

And in a big way.

Amazing chart from Gavekal

1/

And in a big way.

Amazing chart from Gavekal

1/

Two additional observations --

One. It would be interesting to know if China's EV manufacturers got preferential access to "made in China" automotive chips (as has been rumored).

German, Japanese & US auto exports/ production have all been impacted by the chip shortage.

2/

One. It would be interesting to know if China's EV manufacturers got preferential access to "made in China" automotive chips (as has been rumored).

German, Japanese & US auto exports/ production have all been impacted by the chip shortage.

2/

Two. I really hope that the world's political scientists study how the EU responded to a surge in Chinese EV imports, and can eventually can explain why the EU responded to the immediate threat China posed to the EU auto sector by going wild over the United States IRA!

3/

3/

I can think of a couple of possible explanations --

The most obvious is that VW in particular but other German auto manufacturers have large businesses making autos in China for the Chinese market, and that tempered the EU response.

The most obvious is that VW in particular but other German auto manufacturers have large businesses making autos in China for the Chinese market, and that tempered the EU response.

The other is that a lot of trade debates are not actually driven by actual trade flows, but rather by perceptions of unfairness and, well, trade law. China's EV support was massive but opaque; the WTO case against the US IRA is clearer!

And the German auto makers I think responded to China's EV subsidies by seeking the support of their governments in qualifying their made in China production for China's subsidies -- not in rolling back China's local content requirements.

The EU's response is getting better, but the initial response to the IRA (and the non-response to China's export surge) is an interesting case in how the politics of trade can be quite divorced from actual trade flows

(on both sides of the Atlantic ...)

(on both sides of the Atlantic ...)

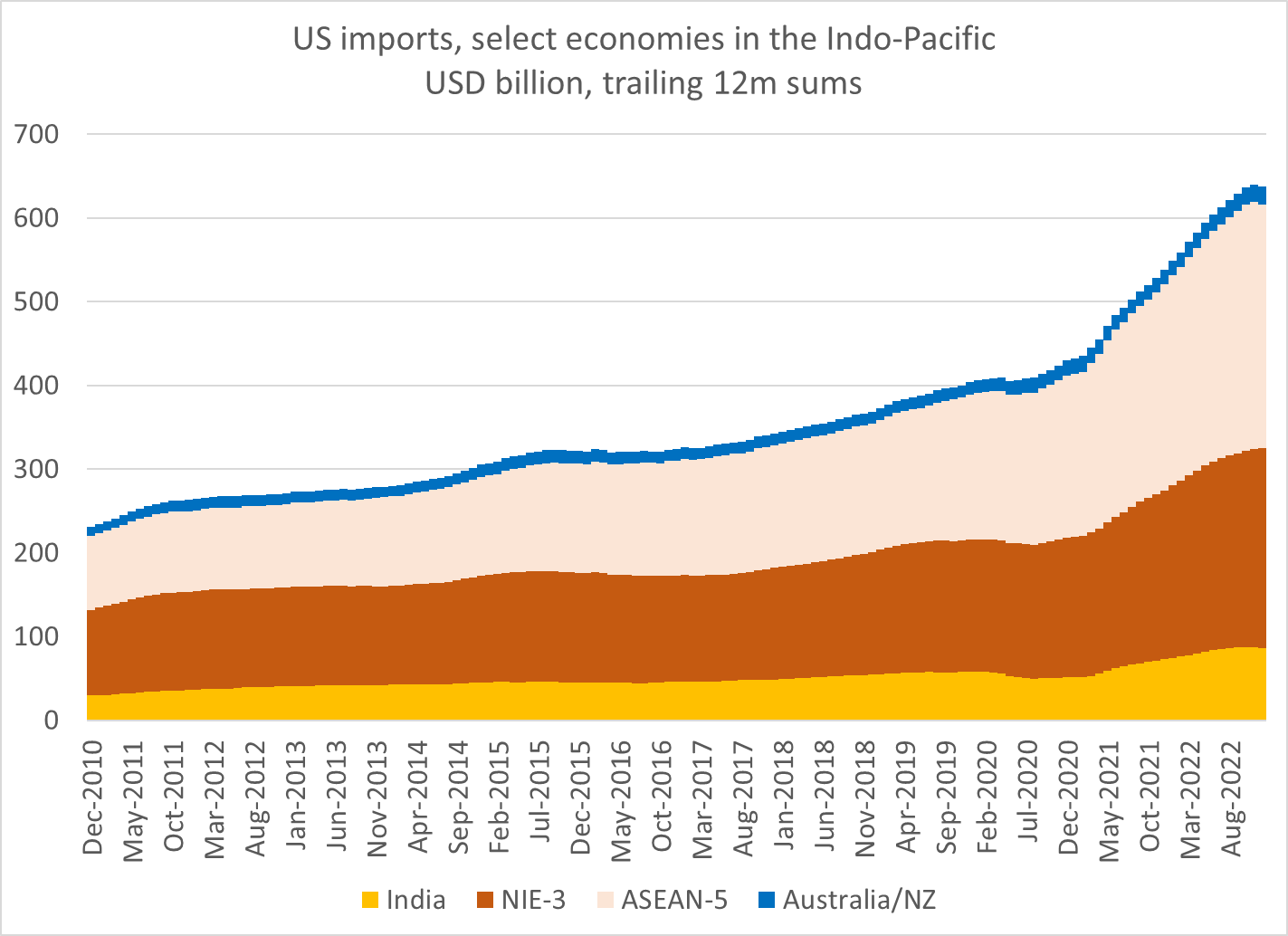

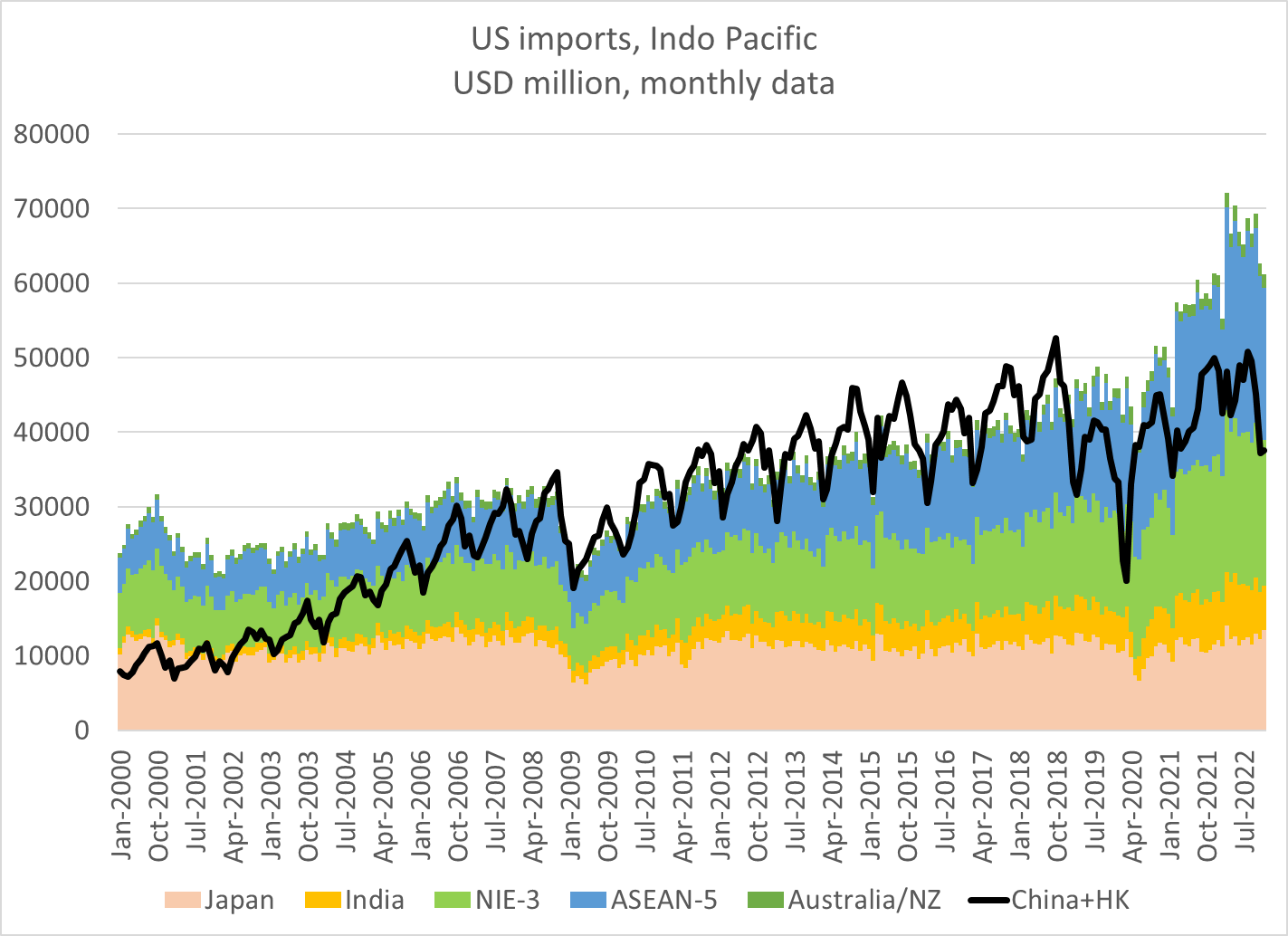

Another example: from US oped pages, you would never know that Trump's decision to withdraw from the TPP led to ... drumroll ... a surge in US imports from the Indo-Pacific.

So when I see various folks opine that the US isn't offering market access to the Indo-Pacific I sort of think, hmmm, $700b a year in imports (and, unlike China, lots of net demand for manufactures) isn't exactly nothing.

(I understand that the debate is over increases in market access at the margin, but the fact that the US market is basically open in most products -- even small cars -- is often lost in the discussion; economies in Asia haven't had trouble exporting a ton under WTO rules)

so to me the EU debate over the IRA (and its fairly marginal impact on EU EV exports given the price cap on the subsidies and BMW/ Mercedes market position) even as China emerges as a real global threat is another example of a trade policy debate divorced from actual trade flows.